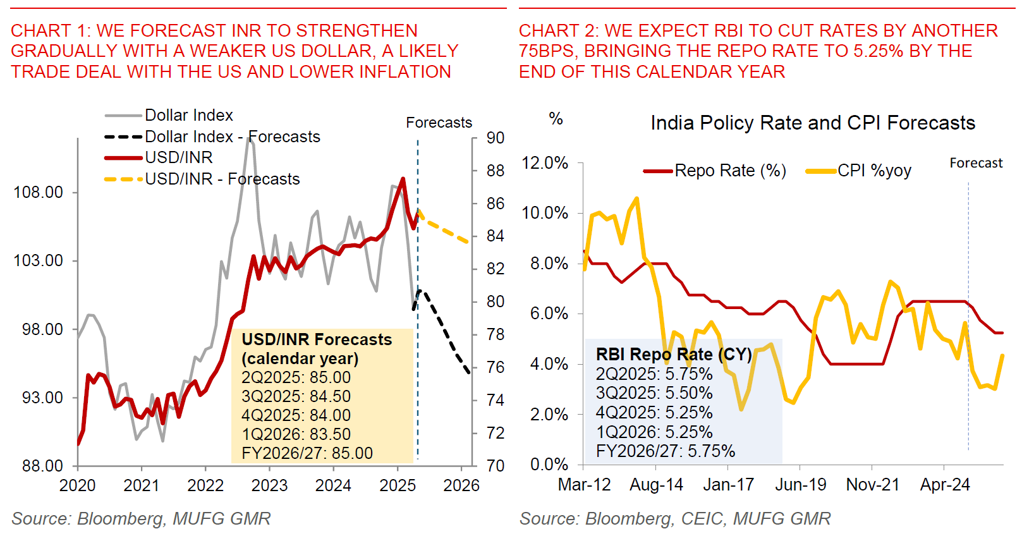

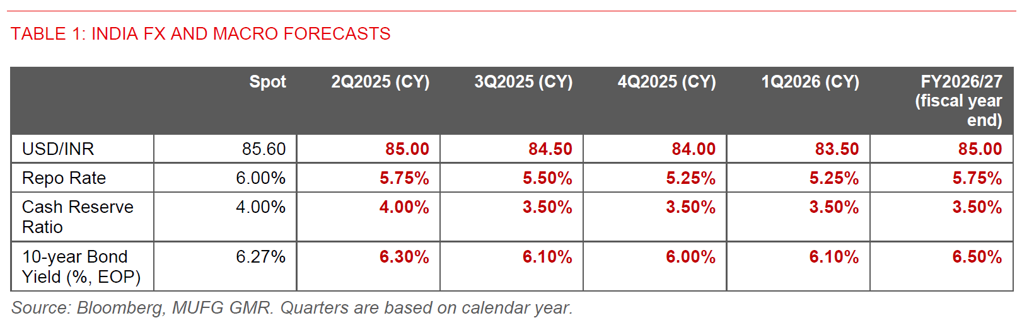

- We keep our USD/INR forecast at 85.00 by 2Q2025 (calendar year) and 83.50 by 1Q2026 (calendar year), a profile which we pencilled in the latest Global FX Monthly at the start of May 2025 (see link here).

- Our USD/INR forecast profile partly reflects our global team’s forecasts for US Dollar weakness over the medium-term (see USD Reserve currency status), with the Dollar Index expected to weaken further by around 5% by 1Q 2026.

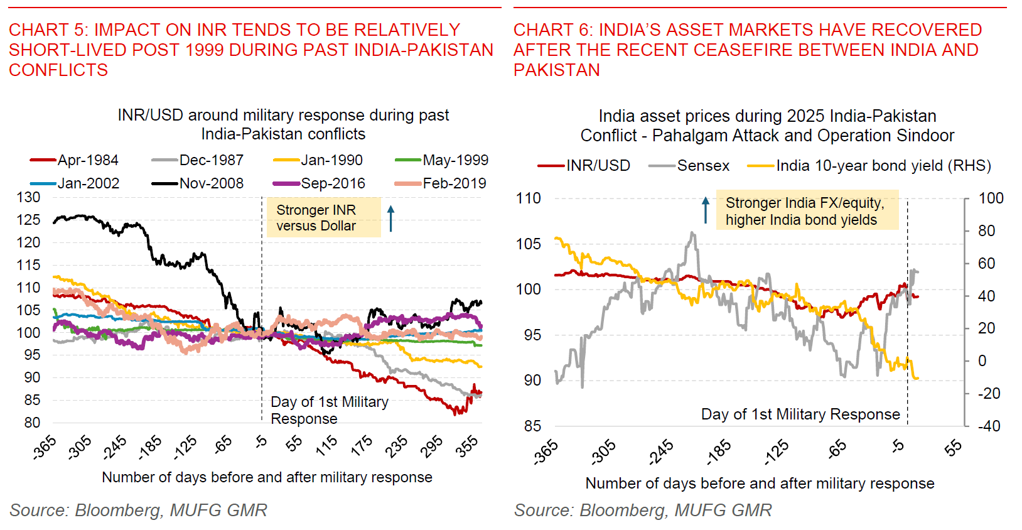

- From an FX perspective, several developments in May have nonetheless raised some downside risks for INR, in particular a possible re-escalation of the India-Pakistan conflict (see India and Pakistan conflict – is this time different), a lack of clarity on a US-India trade deal, coupled with other developments in US policies such as possible taxation on remittances and restrictions on immigration.

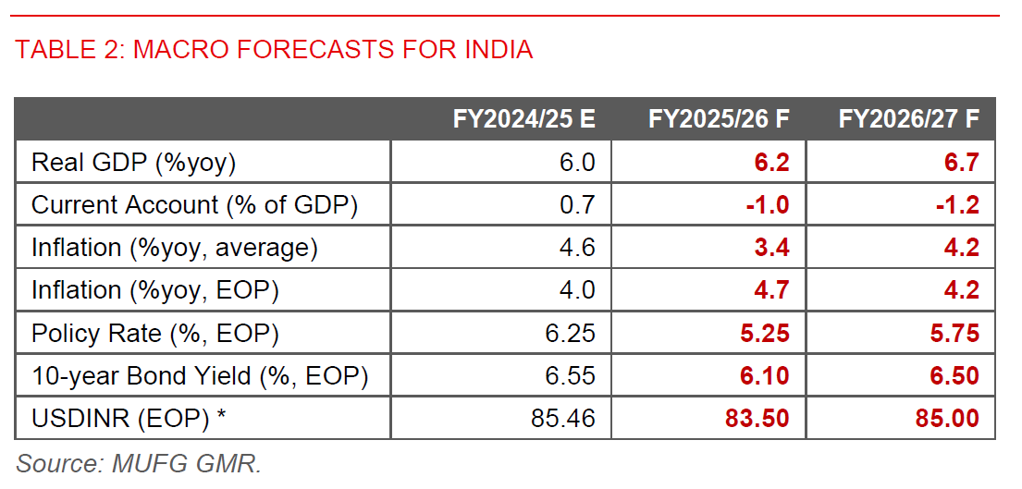

- Nonetheless, we think these downside risks are offset by an even more moderate profile for India’s inflation than we previously forecast, with CPI expected to remain below 4% over the next few quarters. With global commodity and oil prices generally soft, coupled with reduced left tail risks of a global and US recession from the recent US-China tariff pause, we are as such still comfortable with our USD/INR forecast profile for now.

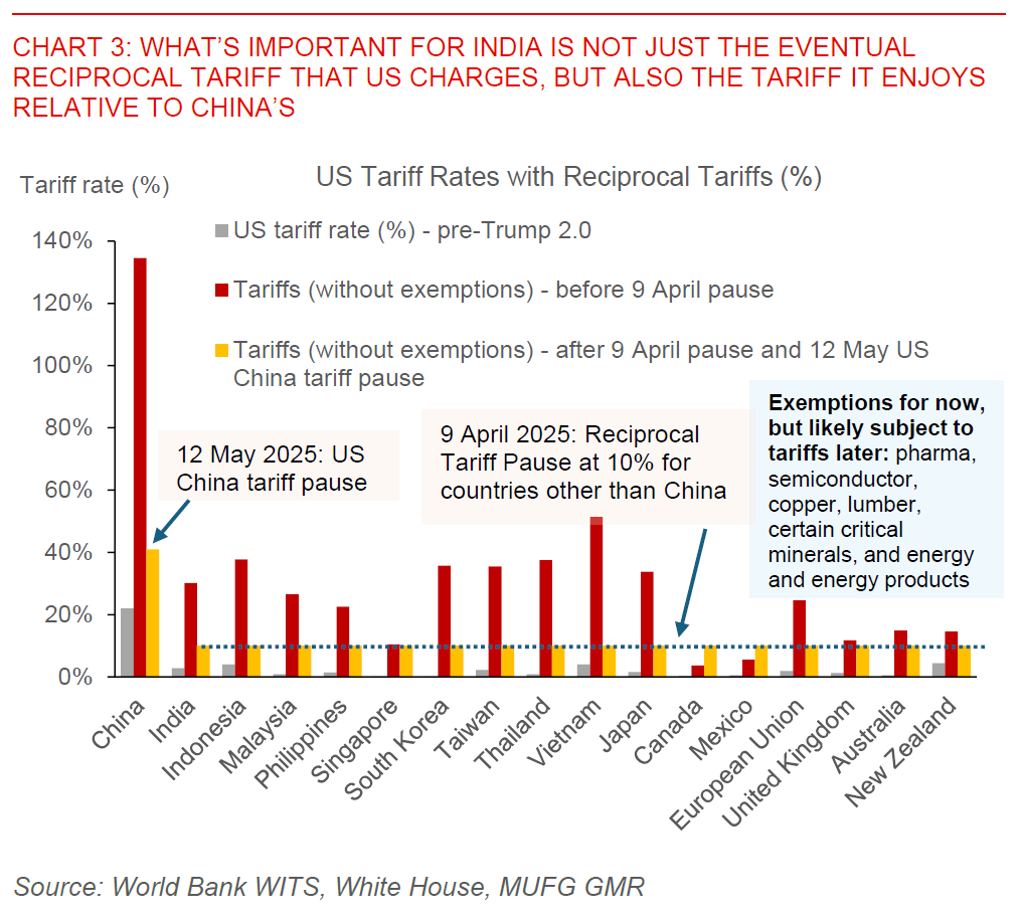

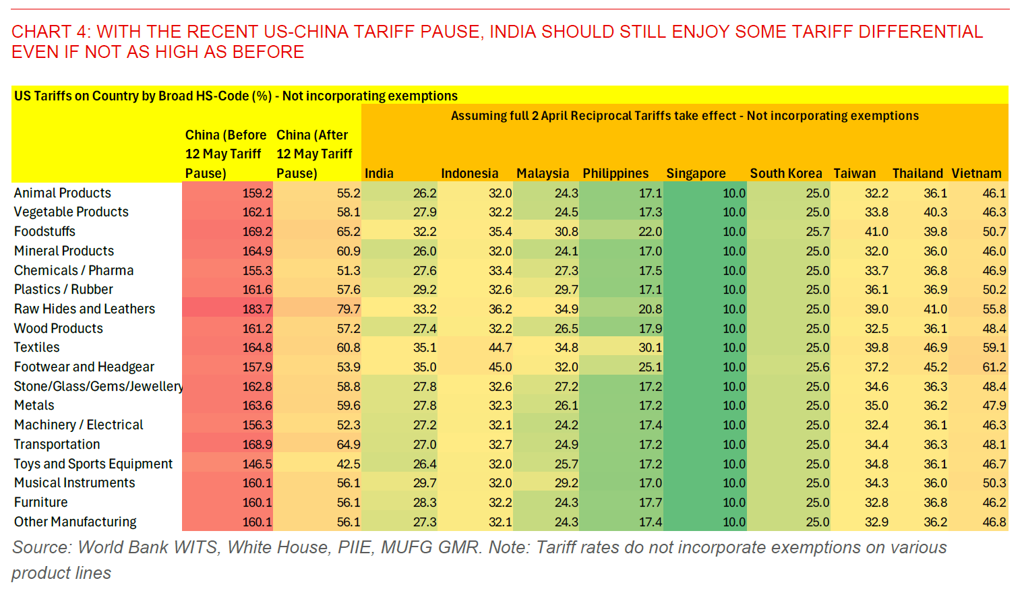

- An important implicit assumption is that a trade deal with the US will eventually be struck even if the exact timing is uncertain. This should help bring some certainty to tariff rates, and as such help India attract some additional manufacturing activity.

- We forecast RBI to cut rates by another 75bps, bringing the key repo rate to 5.25% by the end of this calendar year.

Art of the deal?

- The art of the deal? We continue to expect a trade deal to be struck between India and the US, even if the exact timing is uncertain. This will eventually help to bring some certainty to tariffs, and help cement India’s ability to substitute for China’s exports in some sectors.

- Recent developments have raised some doubts about how soon a trade deal between the US and India can be struck. For one, according to Trump, India offered US a trade deal which essentially lowered tariffs across the board. This was a claim which India came out to deny subsequently, with External Affairs Minister Jaishankar stating that trade talks are ongoing and nothing is finalised, with India seeking a mutually beneficial deal amidst complex negotiations. Second, Trump also mentioned that he was not happy that Apple was building more production in India, and claiming that Apple was going to increase production in the US. Third, India recently notified the WTO of its intention to impose import duties on the US in response to the US’ tariffs on steel and aluminium, which may result in some uncertainty in negotiations. Lastly, Trump’s latest move in taking credit publicly in negotiations between India and Pakistan, while also highlighting the use of trade as a key driver for a ceasefire agreement has likely not been seen well within India, as noted by many analysts and commentators. While strictly not related to trade, it remains to be seen how this the India-Pakistan conflict could feature in negotiations.

- Whether all these public comments are negotiating tactics by Trump is unclear (and for that matter moves on India’s end), but the good news at least in our view is that there are ongoing meaningful discussions on trade between the US and India, and hence we still think a trade deal between the 2 countries are more likely than not. The India trade team led by Minister of Industry and Supply Piyush Goyal is in the US now for trade talks to potentially finalise the contours of an interim trade agreement between India and the US, and it’ll be important to see if there is further progress on that end to gauge the path forward for INR.

- Apart from the US, we think it makes perfect sense for India (and for that matter Southeast Asia more broadly) to diversify its trading relationships further. On that front, we have seen many positive developments with the recent trade deal concluded between the UK and India, while India has also resumed talks with the EU on a possible Free Trade Agreement. News reports suggest that India and EU have concluded their 11th round of negotiations, with a phased two-stage approach to finalising the deal likely. Meanwhile, India and New Zealand are also racing to finalise a FTA potentially expanding trade in aerospace, renewable energy and perhaps also agriculture.

- Beyond trade deal(s), the recent ceasefire between India and Pakistan came as a relief to many, ourselves included. It’s always hard to predict geopolitical conflicts, and especially in light of recent long drawn wars between Russia and Ukraine and Israel and Gaza. For what it’s worth, we had highlighted that there is an incentive both on India and Pakistan to avoid significant conflict, and as such we were not building in an assumption of prolonged escalation into our forecasts (see India and Pakistan conflict – Is this time different for INR and the market?). For India, this is driven by the long-term prize of being an alternative manufacturing hub to China, and a longer-drawn conflict could reduce India’s attractiveness to manufacturers to relocate and increase capacity. For Pakistan, its macroeconomy is still relatively weak and has just recently recovered from a balance of payments crunch, and is as such still reliant on the IMF for upcoming tranches of external financing to shore up its FX reserves.

- While the ceasefire is a good development, and in line with our implicit assumptions, the shift by India to recognise future terror attacks as an act of war lowers the bar for future conflict between India and Pakistan. In addition, how India’s longer-term relationship with China and the US develops remains to be seen. Our base case is that rhetoric could remain high but escalation unlikely, while the nascent economic détente between India and China could slow somewhat and shift to the back of priorities.

Macro stability quite supportive for INR, with lower inflation, manageable current account deficit, and also resumption of portfolio inflows

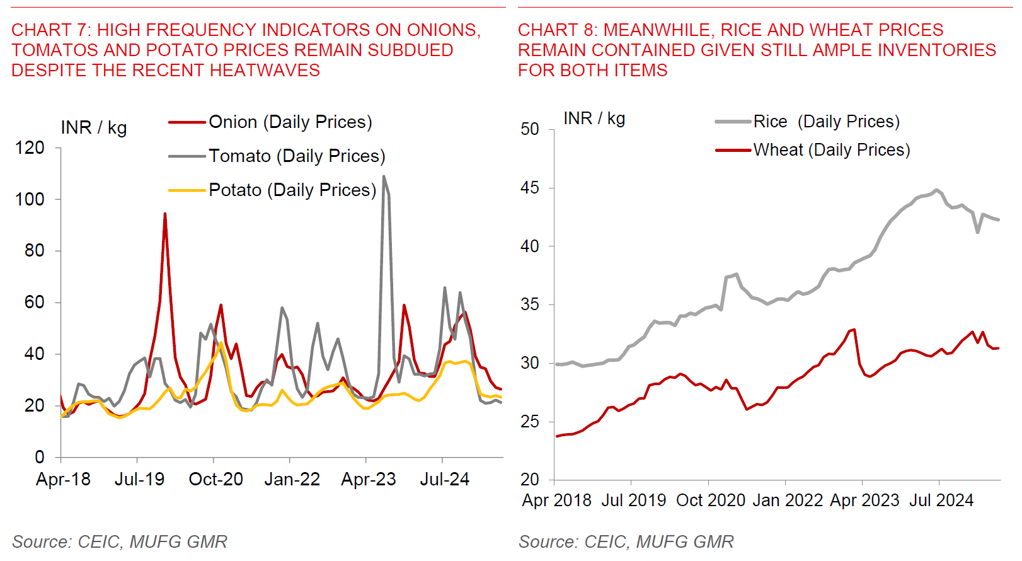

- Beyond the external factors which are to some extent uncontrollable, what’s positive for India is the softer than expected inflation profile thus far. While we had been expecting CPI inflation to soften due to a decent Kharif and Rabi harvests so far, we were building in some increases in food prices due to the recent heatwaves, which could help to push up vegetable prices and also create some risks for the upcoming Kharif crop during the Southwest Monsoon.

- The good news is that the food price increase we were expecting due to heatwaves has not happened, at least so far. On top of that, the somewhat earlier onset of the upcoming Southwest Monsoon, which is also forecasted right now to be above normal, coupled with subdued oil and global commodity prices should help cap tradeable inflation pressures. While this is not to say that vegetable prices will not spike from here due to heatwaves, these supportive factors do lower the upside risks in our view moving forward.

- Meanwhile, core inflation as measured by RBI while rising looks more subdued when we exclude the impact of gold and silver prices, rising just around 3%yoy. We see a similar picture in alterative measures of underlying inflation such as trimmed mean CPI.

- Overall, we are forecasting India’s inflation to likely remain below 4% through the course of this calendar year, barring a bad Southwest Monsoon and further global supply-side shocks.

- With the even more manageable inflation picture, the external flow picture also looks correspondingly better in a few ways.

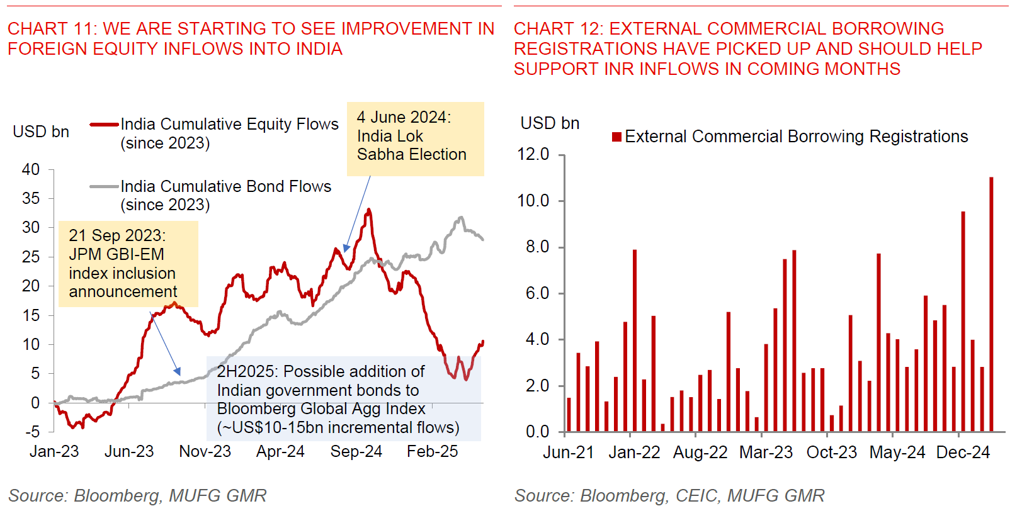

- For one, we are seeing some resumption of foreign equity inflows on the back of optimism around a US-India trade deal (as discussed above), coupled with expectations of more supportive monetary policy by the RBI to support growth through this fiscal year.

- Second, External Commercial Borrowing registrations have picked up to recent highs as of March 2025, and this should help support INR flows over time.

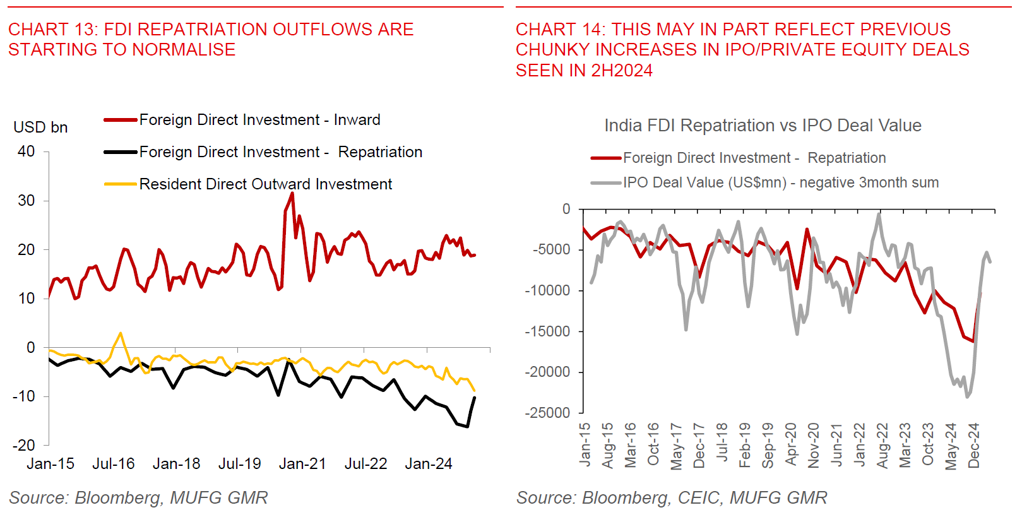

- Third, we are starting to see some normalisation in Foreign Direct Investment repatriation, and to some extent this may reflect some reversal of previous chunky increases in IPO/Private equity deals seen in 2H2024.

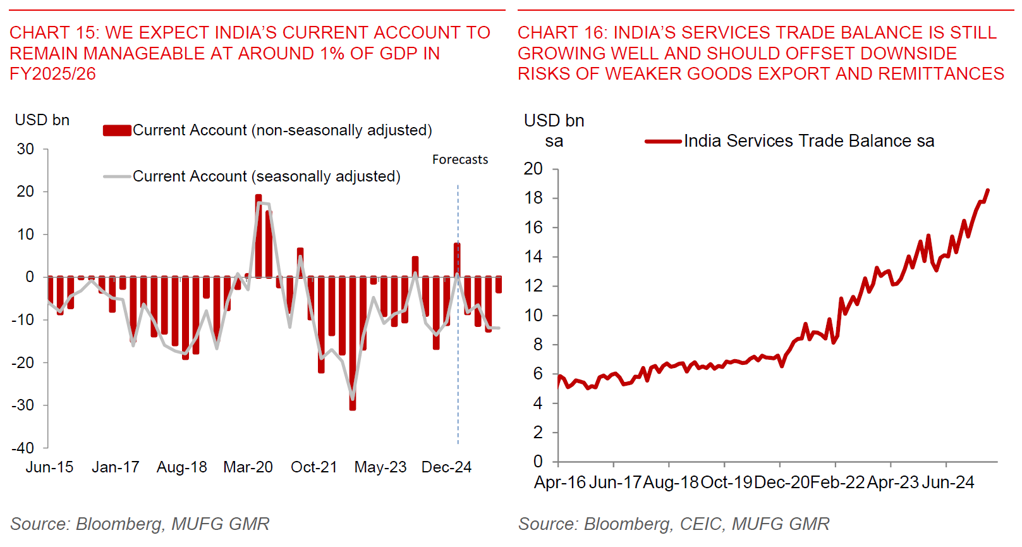

- Last but not least, India’s current account deficit is expected to remain manageable at around 1% of GDP in FY2025/26, and this is expected to be supported by India’s services trade balance, which has still been growing robustly. This is even as there are some downside risks to remittances from the Republican’s latest plans to tax remittances in its latest tax bill at least as drafted.

RBI – Still letting it go? USD/INR FX implied vol should remain at higher levels moving forward

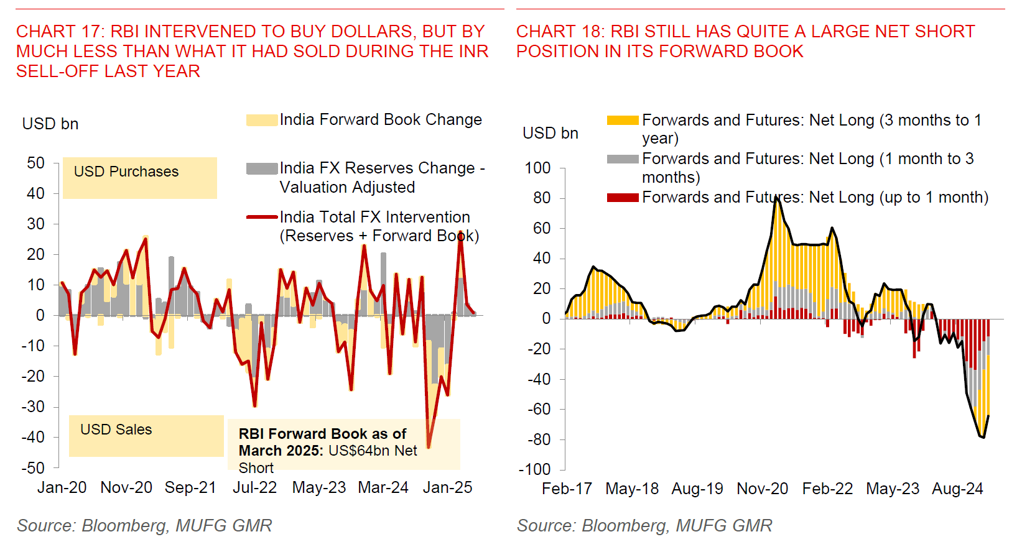

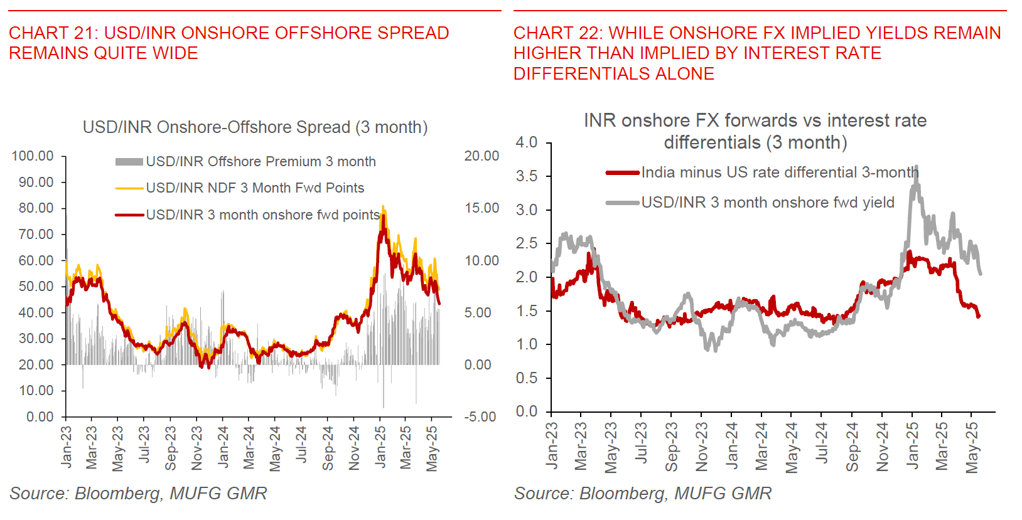

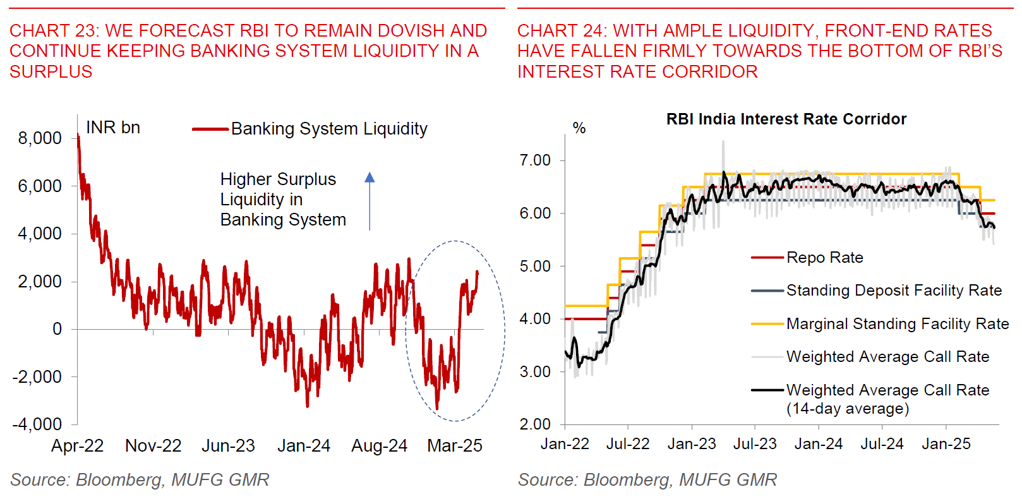

- Last but not least is RBI FX intervention. Our thesis heading into this year was that RBI is likely to intervene much less moving forward under new RBI Governor Sanjay Malhotra and this has played out to some extent. While RBI has bought Dollars to an extent as USD/INR fell (to cap INR strength), this has been much less than implied by the amount that the central bank sold previously during the sharp INR sell-off in the 2H of last year.

- We expect a more hands-off approach by RBI in FX intervention, and hence for FX implied vol to remain at higher levels moving forward. Moving forward, while we think it would still make sense for RBI to intervene to buy more Dollars if USD/INR falls further, and in part due to the central bank’s large net short forward book (US$64bn as of March 2025 and more concentrated in the 3 months to 1 year tenor), we think the magnitude will likely still be smaller relative to the previous RBI Governor. As such, we think that USD/INR FX volatility should remain at higher levels moving forward