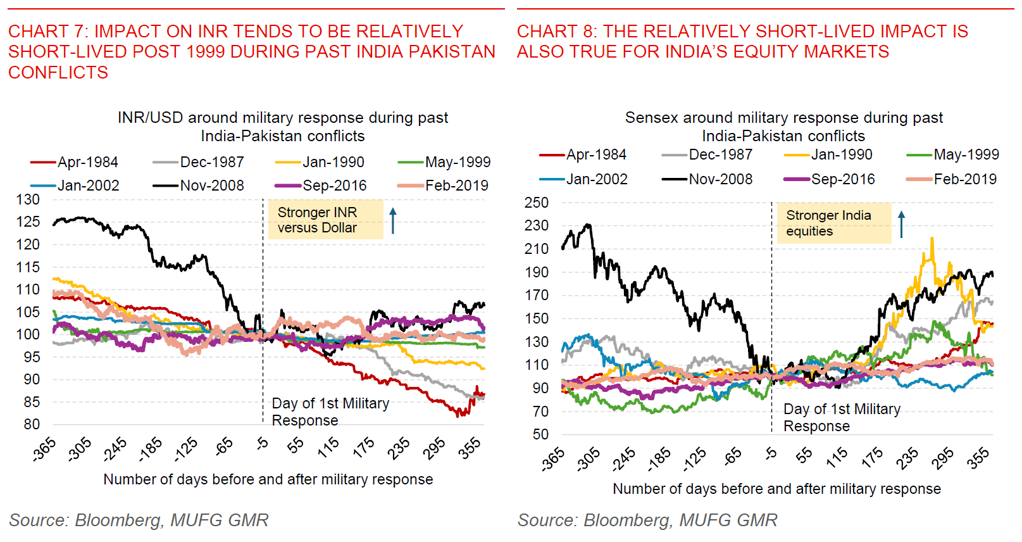

- Our analysis of the history of India-Pakistan conflicts suggest that the market impact (including on USD/INR) tends to be relatively short-lived especially in the post 1999 Kargil War episode. Nonetheless, we highlight that history is an imperfect proxy and this time could well be different.

- Our sense right now is that there is a fundamental incentive both on India and Pakistan to avoid substantial escalation over the medium-term.

- Our existing USD/INR forecast profiles of 85.00 by 2Q2025 (calendar year) and 83.50 by 1Q2026 (calendar year) as such do not build in an assumption of a prolonged escalation in conflict between India and Pakistan.

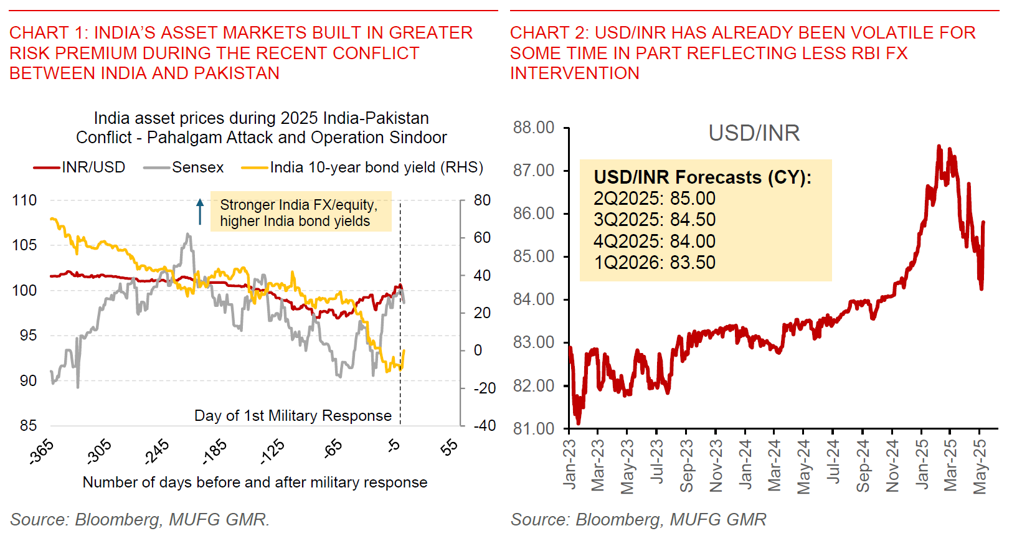

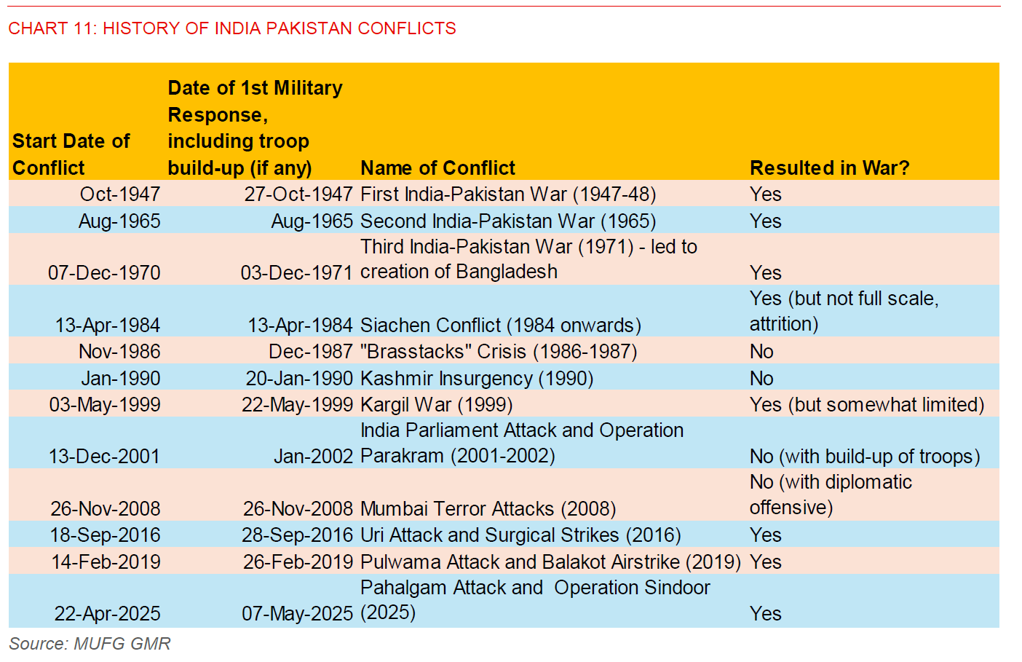

- As of the time of writing (9 May 2025), the current conflict between India and Pakistan is fluid and fast moving. India’s retaliatory strikes from 7 May 2025 thus far following the recent Pahalgam attack on 22 April 2025 mark a much stronger response from India compared to its recent history. This is certainly true relative to the 2016 Uri attack where surgical strikes by special forces were used, and the 2019 Pulwama attack where airstrikes were mainly used. Similarly during the 2008 Mumbai terror attacks, India mounted a significant diplomatic offensive with the military put on alert but not deployed across the border.

- This time around however, the strikes by India hit much deeper into Pakistan with a wider range of targets, while Pakistan’s response has thus far been stronger with also unverified reports of drone attacks from both sides.

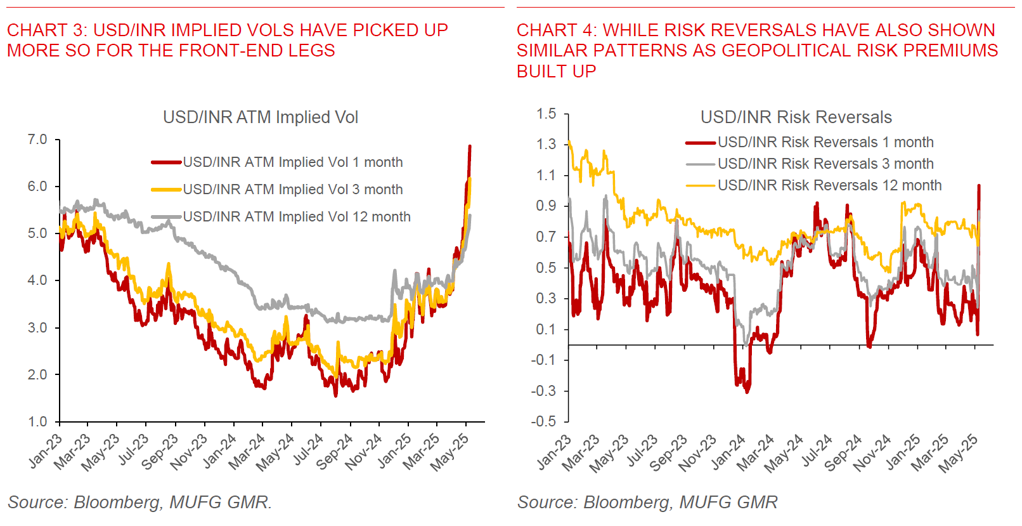

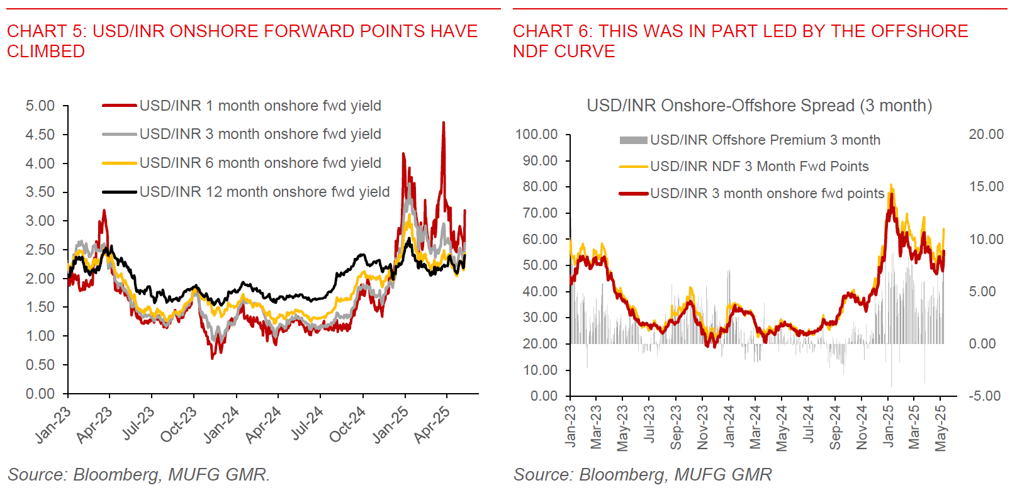

- From a FX market perspective, the India Pakistan conflict has resulted in INR weakening against the Dollar to 85.80 from recent local lows of 84.00 and underperforming Asian currencies to some extent as geopolitical risk premium was priced in. Meanwhile, USD/INR FX implied volatility picked up, much more so for the near legs, while risk reversals (ratio of calls to puts) also saw similar increases. Onshore forward implied yields also rose, with NDF points building in some greater risk premia with wider onshore-offshore spreads in USD/INR.

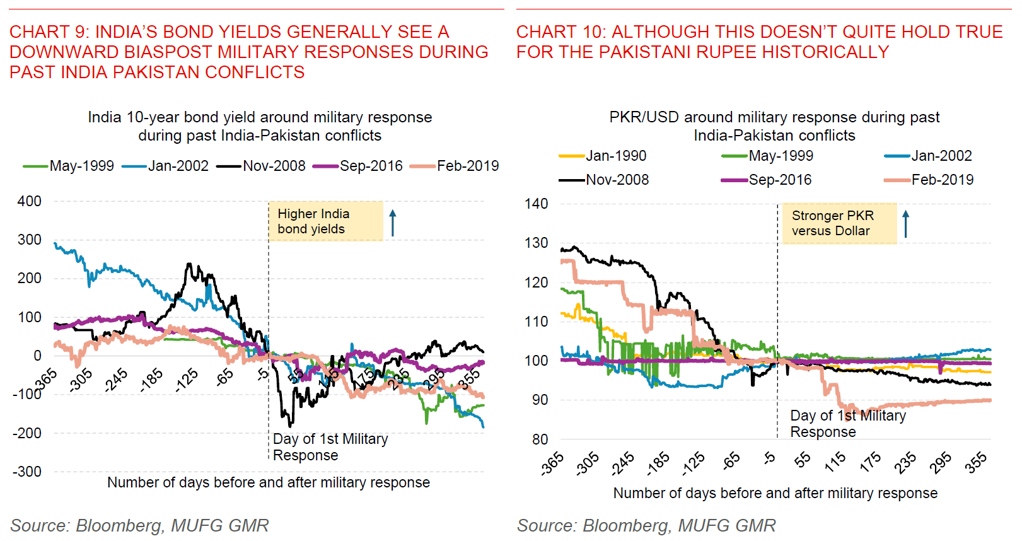

- Broader asset market moves have mirrored similar trends, with India’s equity markets declining around 1.4% while the fall in the Pakistan stock market was larger at 7% at one point. India’s 10-year bond yields also rose by around 10bps from 6.32% to 6.42% post Operation Sindoor.

- Our analysis of the history of India-Pakistan conflicts suggests that the market impact (including on USD/INR) tends to be relatively short-lived especially in the post 1999 Kargil War episodes (see Charts 7 to 10 below). From a cross-asset perspective, this is also true for India’s equity and bond markets, with equity markets generally recovering 12 months after the 1st military response and India’s bond yields generally on a downward trend.

- With geopolitical conflicts, it is also important to be humble and say that there is much we do not know, and recent history of conflicts between Russia and Ukraine, and Israel and Gaza suggest we have to be cognisant of regime shifts.

- Ultimately, history is an imperfect proxy and certainly this time could be different. In the post 1999 Kargil War episodes, there were generally off-ramps found relatively quickly between India and Pakistan, and the military responses have generally been more muted compared with the current 2025 episode.

- The longer-term history going back to the 1947 India-Pakistan war suggest that there can be more meaningful macro impact on both India and Pakistan especially if there is longer-drawn escalation, and as such with tensions currently high we cannot be dismissive of the tail risks.

- Our sense right now is that there is a fundamental incentive both on India and Pakistan to avoid escalation.

- For India, this is because it wants to cement its place as an alternative manufacturing hub to China and also strike trade deals with the US among other key trading partners. A longer-drawn conflict could significantly reduce India’s attractiveness to manufacturers to relocate and increase capacity there.

- For Pakistan, we think that it certainly also has an incentive to avoid escalation. This is because its macroeconomy is still relatively weak and has just recently recovered from a balance of payments crunch, and is also reliant still on the IMF for upcoming tranches of external financing to shore up its FX reserves.

- Our assumption as such is that there should be some incentives to de-escalate both from India and Pakistan’s side over the medium-term.

- Our existing USD/INR forecast profiles of 85.00 by 2Q2025 (calendar year) and 83.50 by 1Q2026 (calendar year) do not build in an implicit forecast of a meaningful and sustained escalation in conflict between India and Pakistan, even as we are cognisant of the left tail risks from the current conflict.

- Over time, we think the fundamentals of a weaker Dollar, gradual improvement in India’s growth, a more accommodative RBI, coupled with some likely trade deals struck in India’s favour should support INR over the medium-term.