Key Points

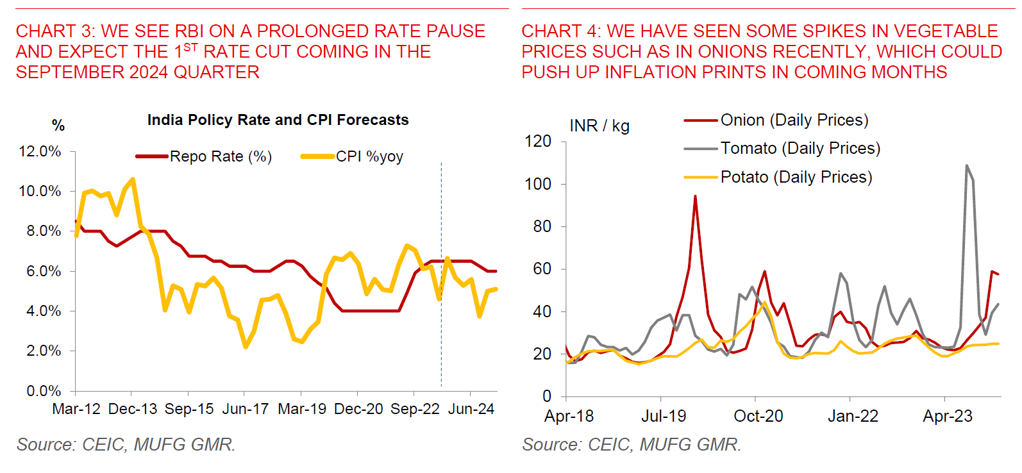

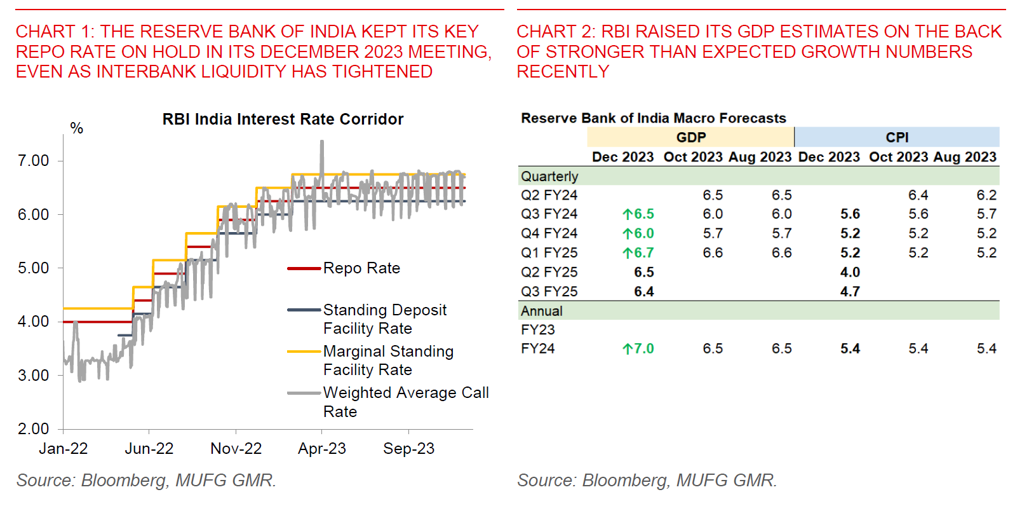

- The Reserve Bank of India kept its key repo rate on hold at 6.50% in its December 2023 meeting as expected, while keeping its policy stance unchanged. The voting patterns were unchanged, while the RBI raised its GDP estimates on the back of recent stronger than expected CY3Q GDP and kept its inflation estimates unchanged (see Chart 1 and 2).

- RBI maintained a similar tone, highlighting that its policy remains “actively disinflationary”, while also mentioning possible upside risks to inflation due to vegetable price spikes, even as core inflation trends have been quite positive.

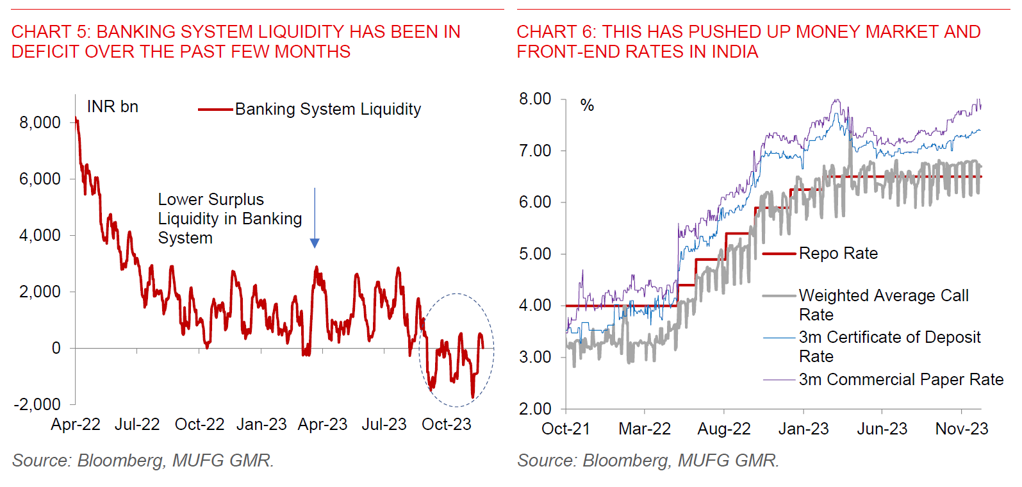

- There were no major hawkish surprises. This was unlike what we saw in the October policy meeting, when the central bank surprised markets by talking about potential Open Market Operation (OMO) sales of government bonds, and also prudential measures on fast-growing unsecured personal loans.

- If anything, RBI’s tone on liquidity in this meeting seems to have eased slightly, saying that India’s banking system liquidity has so far tightened significantly versus RBI’s expectations, albeit for factors outside of RBI’s control such as the festive season and government spending.

- In a bid to improve liquidity management by banks, the RBI is now allowing banks to allow withdrawal/payment of funds from its standing deposit and lending facility even during weekends and holidays from 30 December 2023. Previously, such transactions were only available the next working day.

- Overall, the read-through from RBI’s policy decision to INR is limited. We continue to see RBI on a prolonged rate pause, and the 1st rate cut happening in the September 2024 quarter.

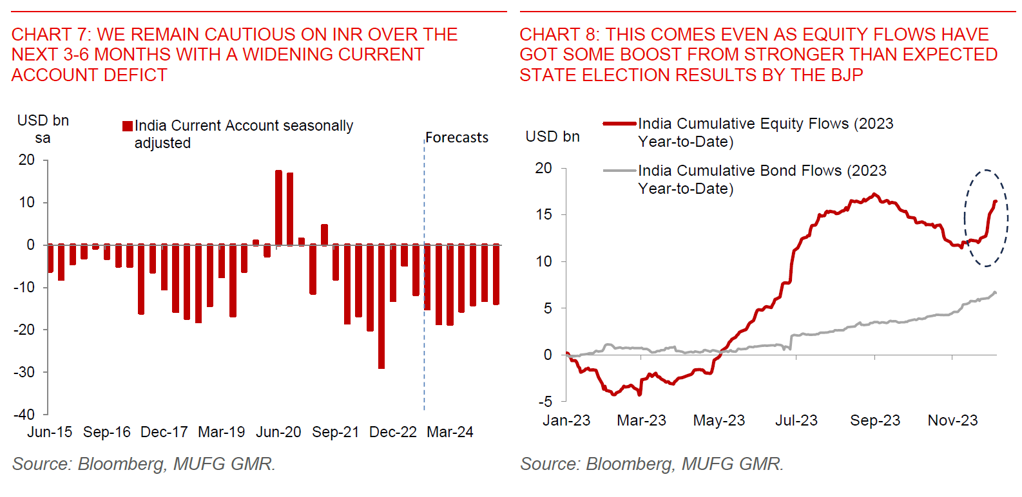

- We remain cautious over the next 3-6 months on INR, given a widening current account deficit, and slowing FDI inflows (see IndiaPulse: Turning More Cautious on INR). This comes even as equity portfolio flows are getting a boost from recent strong result in state assembly elections by the BJP – Prime Minister Modi’s Party (see India State Elections (Dec 2023): Likely Policy Continuity?).

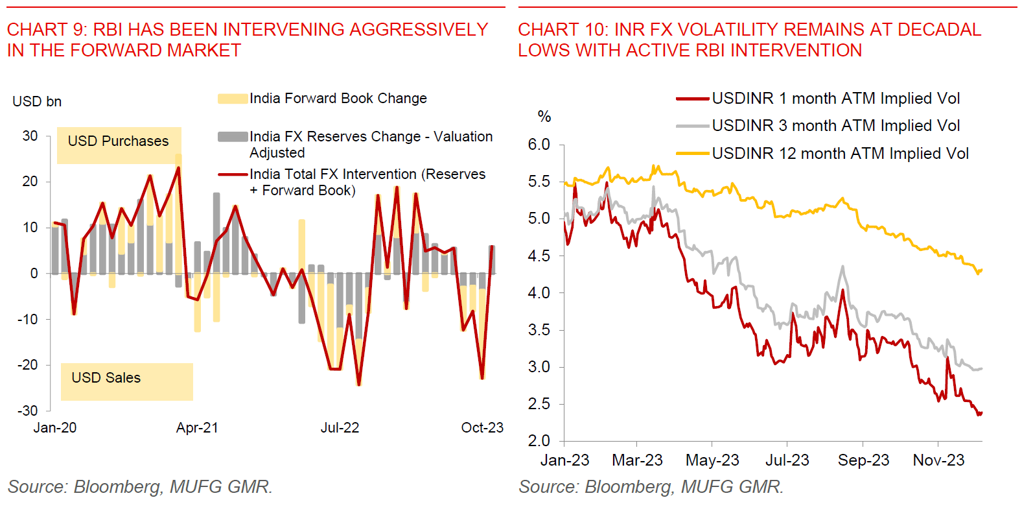

- As such, we forecast USDINR at 83.5 in 3 months, and 82.0 in 12 months once inflows from bond index inclusion come in more meaningfully from June 2024.

- We expect INR to trade in a higher range between 82 and 84, and for RBI to continue to intervene meaningfully to prevent sharp spikes in USDINR. Latest data shows that RBI’s net forward book fell sharply by US$19bn in October, even as it accumulated FX reserves on a spot basis in November by US$6bn.