Please download PDF using the link above for the full report

Key Points:

- The policy effects continued to show but the endogenous force of consumption lacked.

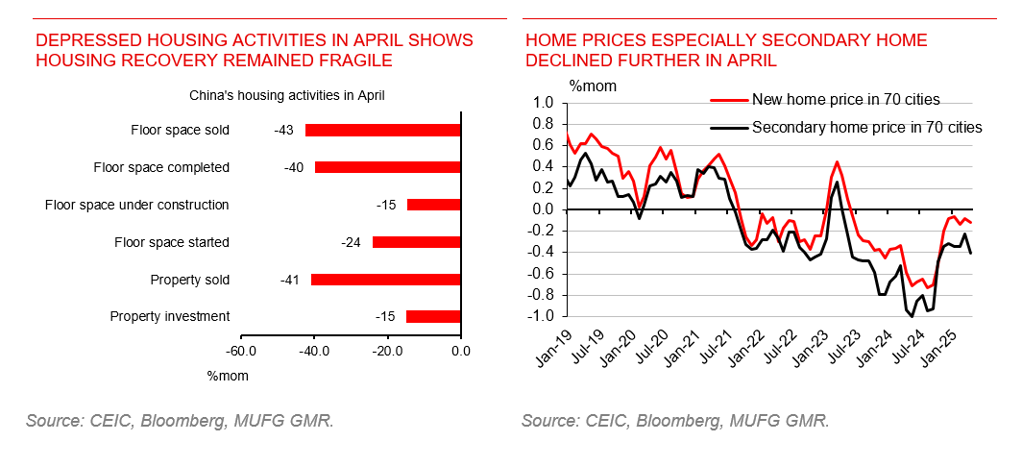

- Major indicators of the housing sector contracted significantly in April. Tariffs likely curtail housing demand ahead. More aid is needed.

- The 90-day US-China truce could mean resilient exports in near term, providing support for the CNY, however with a total 41% tariff rate in place, the uncertainly about the negotiations, we see more upside than downside on USD/CNY.

Data event:

China released its monthly April key macro economic data on 19 May. This April, retail sales growth declined by 0.8ppts to 5.1%yoy; IP growth declined by 1.6ppts to 6.1%yoy; FAI YTD growth edged lower by 0.2ppts to 4.0%yoy; Property YTD investment worsened to -10.3%yoy from prior -9.9%yoy, and home prices further declined by a larger degree compared with March.

Comments:

China’s April economic data released today presented little good news. The data was largely in line with the direction of market consensus forecasts, growth deceleration for retail sales and IP. But growths of FAI and property investment were worse-than-expected. The performance of property sector signalled the slump of the sector remains a challenge for policymakers to fend off the trade tensions with the U.S. Beyond the data released today, we have seen subdued inflation and credit demand (China: Endogenous financing demand still in a need to be restored), weaker official and Caixin PMI readings for April.

We expect more actions from governments. There is strong need for a stronger support to stabilize the property sector and overall sentiment. The easing of monetary policy and other supportive measures introduced on 7 May (China: Incremental financial policies announced) could be the first step of what is to come.

- For retail sales, a noticeable growth deceleration was reported for April’s retail sales. Retail sales grew 5.1%yoy, down from prior month’s 5.9%yoy, also below the 5.8%yoy market consensus expectation. And, the monthly sequential growth also declined to 0.24%mom this April, down from March’s 0.47%mom, and February’s 0.52%mom. The growth slowdown was seen in both commodity retail (-0.8ppts) and catering (-0.4ppts). The commodity retail for above designated size enterprise grew 6.6%yoy in April, 2ppts lower than March’s growth. Auto sales was a drag, with a 0.7%yoy in April (down from March’s 5.5%yoy), and retail sales of beverage, tobacco & liquor, and clothing all grew between 2.2~4.0%yoy.

The details of commodity retail sales number did show the positive impacts of consumption supportive policies. Despite some decline in growth rates, strong growth was seen in sales of furniture (26.9%yoy), communication appliance (19.9%yoy), household electric & video appliance (38.8%yoy), helped by consumer goods trade-in program. On 29 April, the NDRC announced dispatching the second batch of RMB 81bn funds raised from special ultra-long CGB to continue support the consumer goods trade-in program. The first batch RMB 81bn was dispatched on 9 January. We do not rule out the possibility of quicker dispatchment to ramp up growth going forward. There is still a big gap to catch up with the pre-Covid 2015-2019 goods retail sales growth of 9.7%yoy, from current 5.1%yoy.

Separately, we saw services retail sales YTD growth edging up slightly from 4.9%yoy in February to 5.1%yoy in April. Services consumption would be a key driver to stimulate domestic demand on the areas of childcare, education, elderly care and etc, as highlighted in government’s “30-point” plan on 16 March. One key initiative rolled out lately was the PBoC’s RMB 500bn relending quota for “service consumption and elderly care”, aiming to guide the commercial banks to expand lending to these areas.

- IP growth weakened in April, consistent with a weaker growth of exports and a weaker manufacturing PMI for the month. IP growth decelerated to 6.1%yoy from 7.7%yoy prior month. While the deceleration was largely expected, this April’s 6.1%yoy print was better than market expectations of 5.7%yoy, consistent with better-than-expected exports in April. Regardless, the growth slowdown happened across all types of enterprises (i.e., state/ privately owned) and industries (i.e., mining, manufacturing and utilities industries). The bright spot however, was that high-tech manufacturing still had a solid growth of 10.0%yoy though edging lower slightly from March’s 10.7%yoy, which shows the resilient demand for China’s high value-added goods. Sequentially, the overall IP growth slowed to 0.22%mom from 0.44%mom in March. Lastly, service production growth also slowed by 0.3ppts to 6.0%yoy in April.

- A weaker FAI growth was largely dragged by growth deceleration of transportation equipment. The 4.0% YTD FAI growth surprised the market to the downside as market was expecting a 4.2%yoy for April same as March’s growth. FAI only expanded by 0.10%mom this April, extending the recent sequential decline for the fourth month.

In year-over-year term, the growth slowdown was seen across primary (-2.8ppts), secondary (-0.2ppts) and tertiary industries (-0.3ppts). In particular, manufacturing IP growth decelerated by 0.3ppts to 8.8%yoy, within which the transport equipment sector (e.g., rail, ship, aircraft) experienced a significant growth declaration of 8.3ppts to 29.6%yoy. The sharp growth decline in the sector may be linked to Trump administration’s proposed tariffs targeting China’s maritime, logistics and shipbuilding sectors announced on 17 April (link). Lastly, we saw infrastructure sustaining its YTD growth of 5.8% from prior month, providing some support for overall FAI growth.

- No clear sign of stabilization for property sector yet in this April. There contraction of YTD property investment got even worse this April, to -10.3%yoy from prior month’s -9.9%yoy. Sequentially, all housing activities indicators showed contraction in April from March, including property investment (-15%mom), property sold (-41%mom), floor space start (-24%mom), floor space under construction (-15%mom), floor space completed (-40%mom) and floor space sold (-43%mom). And the broad negative year-over-year growths were also seen for levels of indicators and year-to-date levels of indicators. Additionally, in April, new home prices in 70 cities further declined by 0.12%mom, whereas the used home prices in 70 cities declined further by 0.41%mom. The paces of price decline were worse than what were in March respectively. Such poor readings would likely prompt the government to expedite the rollout of measures to support the property sector. On 7 May, the NFRA mentioned to expedite the development of series of financing system to support a new real estate development model.

- Though the surveyed urban unemployment rate edged lower from 5.2% to 5.1% in April, the drop may merely be caused by seasonality. The unemployment rate of 5.1% is still higher than last year’s April print of 5.0%.