Key Points

- Deputy Prime Minister and Minister for Finance, Mr Lawrence Wong, delivered the FY2024 budget in parliament on 16 February. The budget provides support for households and businesses in tackling the immediate problem of rising costs, while also aiming to strengthen long-term economic competitiveness via boosting investment, innovation, productivity growth, and human capital.

- Notably, DPM Lawrence Wong said the budget is the first instalment of the Forward Singapore program – a roadmap for Singapore’s next bound of development -, signalling that the 4G leadership team under his helm has a vision and plans to secure Singapore’s future. We think this will be reassuring to the people and give confidence to foreign investors, considering that leadership transition within the ruling People’s Action Party (PAP) is set to take place this year.

- DPM Lawrence Wong revealed during the budget announcement that the government aims for average annual growth of 2%-3% over the coming decade. Against a backdrop of an increasingly competitive and volatile landscape, achieving this pace of growth would require a ramp-up of quality investment and total factor productivity growth. And if this pace of growth (2%-3%) is achieved over the coming decade, we believe this would bode well for the long-term appreciatory trajectory of the Singapore dollar.

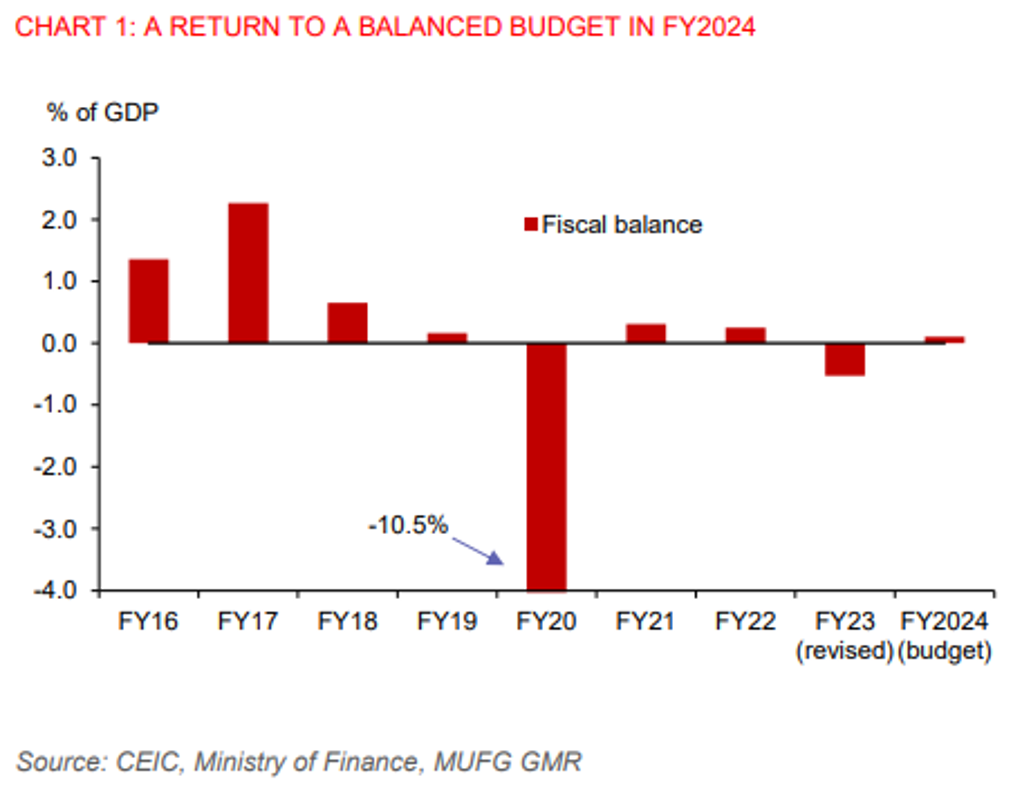

- While the budget provides cost of living support for households, the government is also mindful of the need to maintain fiscal discipline. As such, the government plans to run a balanced budget of 0.1% of GDP surplus in FY2024, which would be a fiscal tightening from the 0.5% deficit in FY2023. The fiscal impulse will only be slightly negative, implying a very modest fiscal drag on growth this year. This, coupled with emerging signs of a better outlook for regional and Singapore’s exports, lead us to maintain our forecast for Singapore’s GDP growth of 2.4% in 2024. Our 2024 growth projection sits at the upper end of the government’s 1%-3% outlook.

- Encouragingly, the FY2024 budget lays out the path that the government intends to take to sustain growth at 2%-3% over the longer term. Some of the measures include topping up the national productivity fund and R&D fund, investing $1bn in the national AI strategy 2.0 over next 5 years, launching a new refundable investment credit – a tax credit scheme with refundable cash feature - to support expansion of manufacturing facilities, innovation, and green transition, and topping up $4000 of Skills Future Credit for all Singaporeans aged 40 and above to support reskilling. This would help justify the high premium of operating in Singapore for multinational enterprises (MNE). The government also seeks to retain Singapore’s competitive edge in areas such as finance by topping up the financial sector development fund by SG$2bn.

- Half of the budgeted spending continues to be allocated for social development, such as healthcare and education. Notably, fiscal pressures on healthcare will continue to increase with an ageing population. And to meet future outlays in this area, DMP Lawrence Wong reiterated that GST rate hike is warranted today, rather than delaying it in the future, as this would impose a heavier burden on government finances. Meanwhile, the budget provides measures to strengthen retirement adequacy, as well as reduce inequality by raising the local qualifying salary to SG$1,600 from $1,400 and enhance the workfare income supplement scheme.

- DPM Lawrence Wong said that the government will implement Pillar Two of the International Base Erosion and Profit Shifting (BEPS) 2.0 initiative, which will introduce a global minimum effective tax rate of 15% for large MNE group with global revenue of at least 750 million euros annually from 2025. The government does not expect sustainable net revenue gains from this corporate tax adjustment, as any additional government revenues resulting from this move would be piled back towards supporting new investments and sustain economic competitiveness.