Summary

Please download PDF version above for the full report

Special focus: Crude palm oil prices have swiftly retreated in recent months, due to oversupply and demand concerns. For Indonesia, the headwinds from the drop in crude palm oil prices is likely to be a secondary factor compared to the pickup in imports. In Malaysia, this is likely to be offset by an import growth slowdown and tourism recovery.

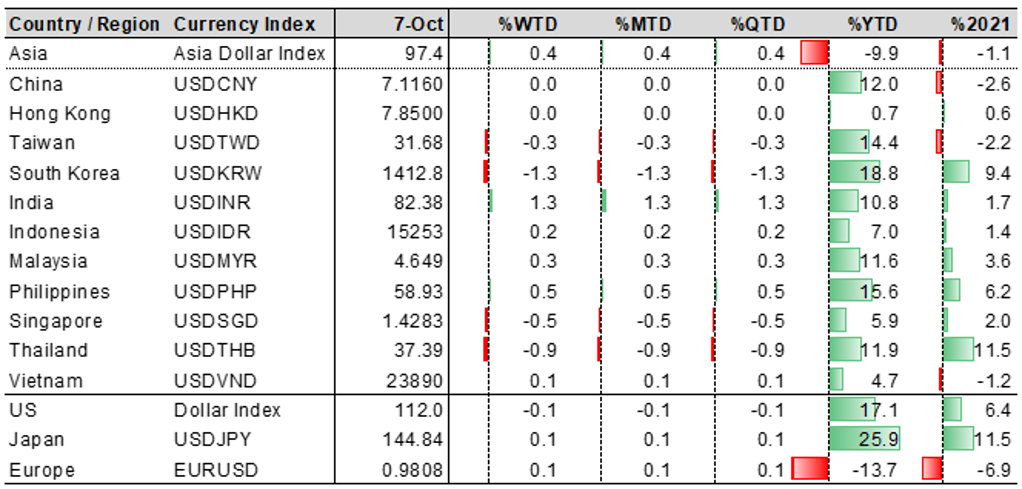

FX views: Asian currencies were mixed as the USD initially softened but rebounded thereafter. KRW and THB were the better performing currencies, while the PHP and INR underperformed. Forecasts in report.

Week in review: Indonesia inflation rose due to higher subsidized fuel prices. Thailand inflation retreated on base effects. Manufacturing PMIs expanded for Thailand, Vietnam Indonesia, Philippines and India but retreated for Taiwan, Malaysia and Singapore.

Central bank monitor: US ISMs retreated amid concerns of economic slowdown. Fedspeak stayed hawkish and geared markets towards higher interest rates to fight inflation. Bank of Korea announces its policy decision next week, alongside the Monetary Authority of Singapore.

Week ahead: Markets to watch CPI releases for the US, China and India. Singapore will announce monetary policy on 14 October and GDP growth advance estimates. Previews in report.

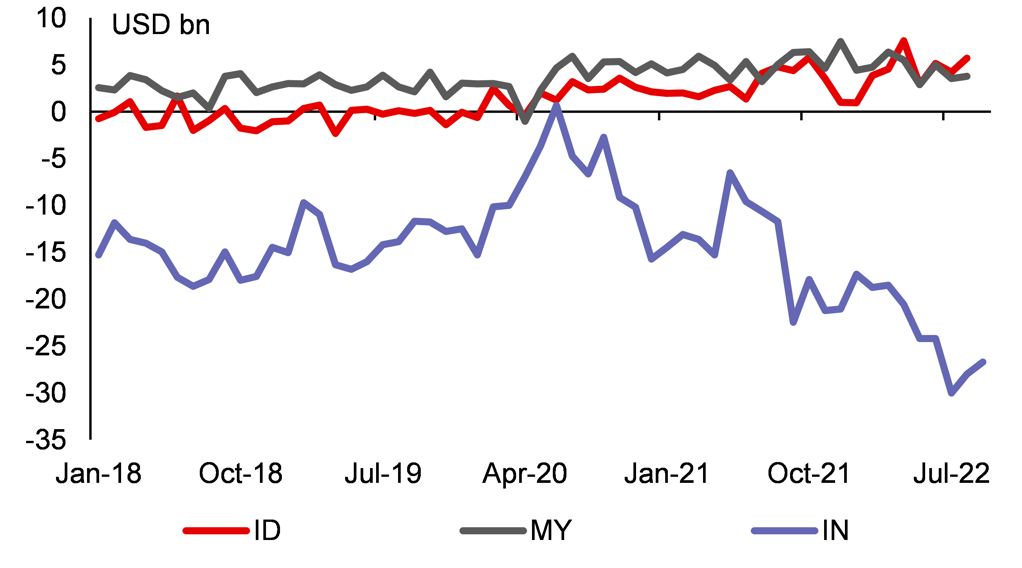

Chart of the week: Indonesia and Malaysia’s trade balance may face downside risks if crude palm oil prices continue to retreat

Source: Bloomberg, MUFG GMR

FX View

Asian currencies appreciated slightly overall with ADXY index rising 0.4% last week amid a 0.1% decline in dollar index. KRW (+1.3%) led the gains against the US dollar among EM Asian currencies, followed by THB (+0.9%), SGD (+0.5%) and TWD (+0.3%), benefiting from returning capital inflows into their local stock markets. While CNY was not traded as China’s financial markets were closed last week for Golden Week holidays, CNH rose against the US dollar. INR seemed an outlier with a 1.3% depreciation of INR due to the recent rise of crude oil prices.

This week, inflation will be the spotlight, with US, China and India reporting their CPI figures for September and Philippines releasing August numbers. On top of that, Asia calendar also features August trade data for Philippines, September trade reports for China and India, and September monetary data for China. For central bank, PBOC, BOK and MAS will have policy decision, and Fed will release minutes of September’s meeting. In near term, Asian currencies likely remain volatile and driven by potential shifting market sentiments, particularly due to these inflation readings.

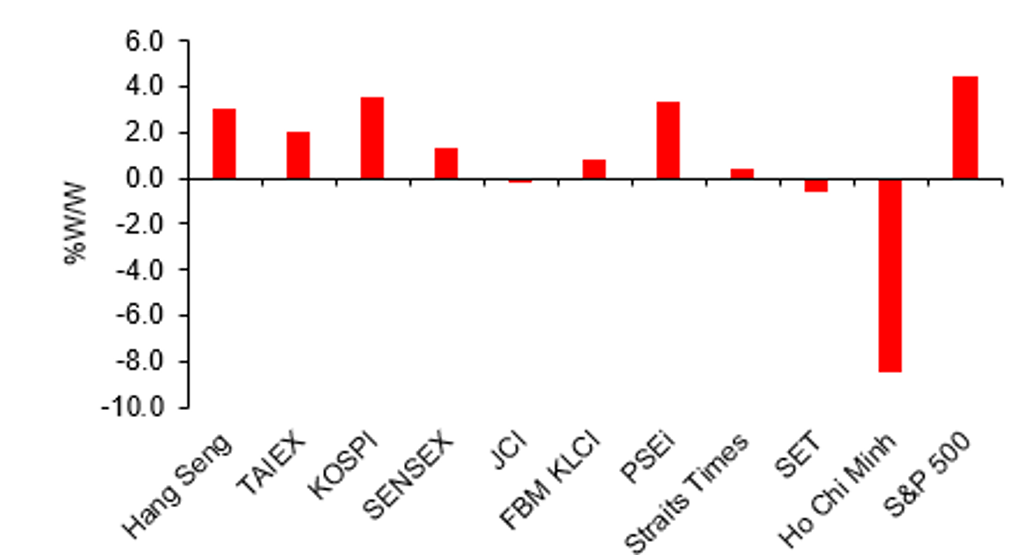

Overall global stock markets rebounded last week

Source: Bloomberg, MUFG GMR

FX Performance

Source: Bloomberg, MUFG GMR Note: Data retrieved at HKT5:30PM on 7 October 2022

|

LIN LI KARMAN LI |

USD/CNY: Watch Friday’s exports numbers for September

While the onshore yuan trading was paused last week due to China’s Golden Week holidays, offshore yuan recorded a slight appreciation against the dollar last week, the first weekly appreciation since the week starting August 15, on the back of a net zero change of the DXY index. USD/CNH decreased to 7.09 last Friday from 7.14 on September 30. It is likely that this Monday that domestic CNY market would catch up some of the strength that CNH showed last week.

CNY may catch up some of the strength that CNH showed last week.

China will release September credit date this week, we expect some increase in Bank’s new loan and overall aggregate financing to reflect the effect of government’s efforts in encouraging credit expansion. We expect no change on 1-year MLF rate this Month as China’s actually rates are quite low and rate cut would exaggerate the monetary policy divergence. One factor which could bring pressure on CNY is September trade numbers on Friday, judging by two key early indicator: 1) South Korea’s exports, a global trade barometer, grew at the slowest pace in about two years in September, 2) China’s Caixin manufacturing PMI that focuses on exporters and private companies dropped deeper into contractionary territory in September. The Dollar again this week may cause volatility due to its CPI release.

Last week’s improvement in sentiment unlikely to persist for long, as global economy slides into recession ahead

USD/KRW: KRW continue to be affected by sentiment in near term

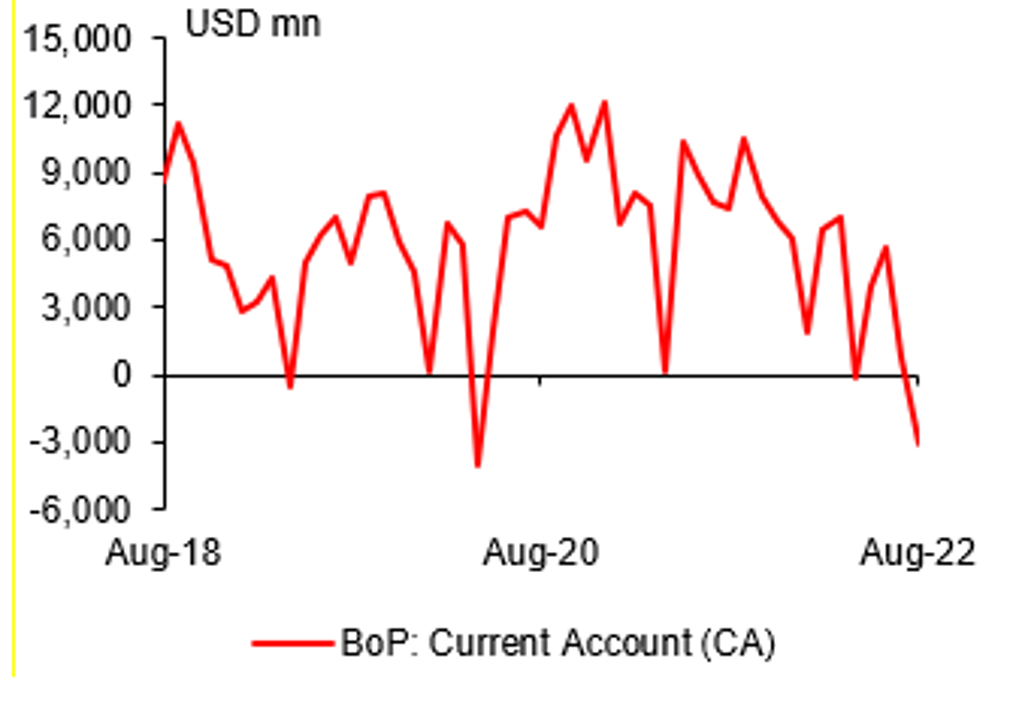

Korean won snapped an eight-week losing streak, rising 1.3% against the US dollar in the first week of October, amid a rebound in stock markets. The benchmark KOSPI index surged 3.6% and foreign investors were net buyers of Korea’s local equities last week. On the economic front, South Korea’s overall current account logged a deficit of USD3.05 billion in August, a sharp turnaround from a surplus of a revised USD0.79 billion in prior month due to the large shortfall in the goods balance in August. In addition, South Korea’s manufacturing PMI fell further from August’s 47.6 to 47.3 in September, marking the third month in a row under contractionary territory and the lowest reading since July 2020, with new orders sub-index both falling in the month, suggesting a weakening conditions in external markets. With expected slowing global demand, export is likely to keep falling, adding pressures to the trade-reliant Korean economy. Notably, the country's FX reserves shrank by USD19.66 billion to USD416.77 billion at the end of September, the second biggest monthly decline on record, as BOK stepped up dollar-selling intervention to shore up the won that has been under pressure from Fed’s policy tightening. Still, the KRW ended September with a monthly decline of 7% against the USD, as fundamental risks including the dollar strength, lingering concern over global growths and persisting geopolitical uncertainties continued to weigh on the won. We expect all these drivers will remain intact, we expect a weaker KRW by the end of Q4 this year.

China’s FX reserves fell to USD3.03 trillion at end-September, the lowest since 2017

Source: CEIC, MUFG GMR

South Korea’s Current Account Swung to Deficit in August

Source: CEIC, MUFG GMR

|

JEFF NG |

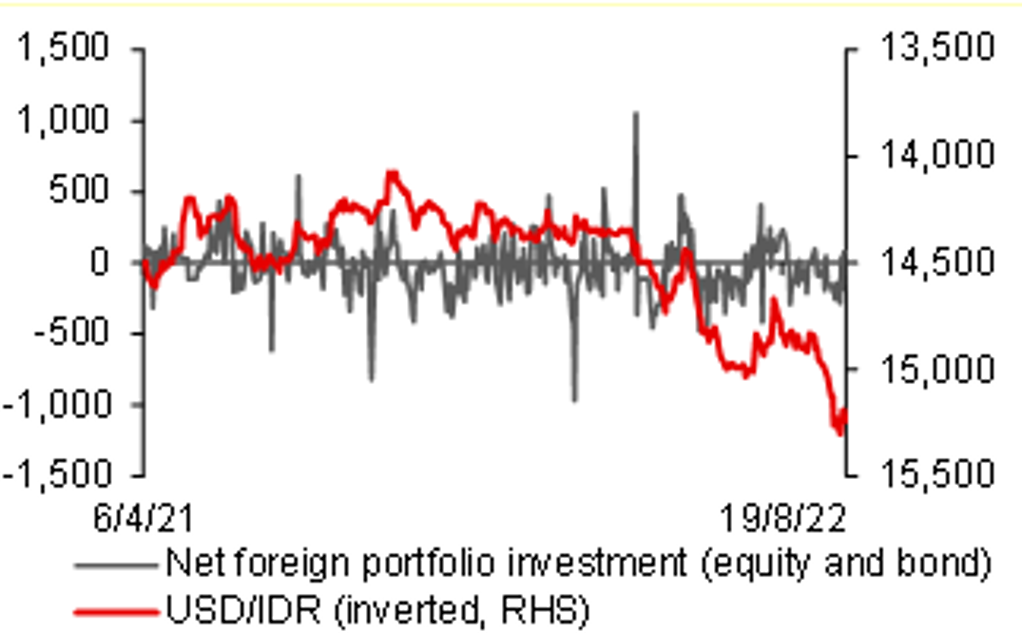

USD/IDR: USD driven for the coming week

After the high of 15,311 on 4 October, USD/IDR retreated lower to the 15,200 levels. However, the pair was last in a bid on Friday’s session. Net portfolio investment flows were negative between 23 September to 3 October but is now more balanced. We may see a test of the 15,311 high again in the coming week, especially if USD strength returns.

Indonesia’s headline inflation rose to the highest so far of 5.95% y/y in September, from 4.69% a month ago. This has been a consequence of higher prices for fuel that is subsidized. Inflation has been supported by food, beverage and tobacco (7.91%), transport (16%), household equipment (5%), and restaurants (4.5%). Core inflation also rose by 3.21% y/y from 3.04% a month ago. We forecast December inflation to be more than 6% y/y after being as low as 2.06% in February. Core inflation is also set to rise higher due to second-round impact from higher raw material prices.

Focus will shift next to trade numbers released on 17 October and BI decision on 20 October. However, in the absence of economic data, we see USD/IDR being driven by US developments. Upcoming releases on US CPI and PPI may provide some USD strength if inflation proves stickier than expected once again. At the same time, the recovery in commodity prices may provide some support for the IDR.

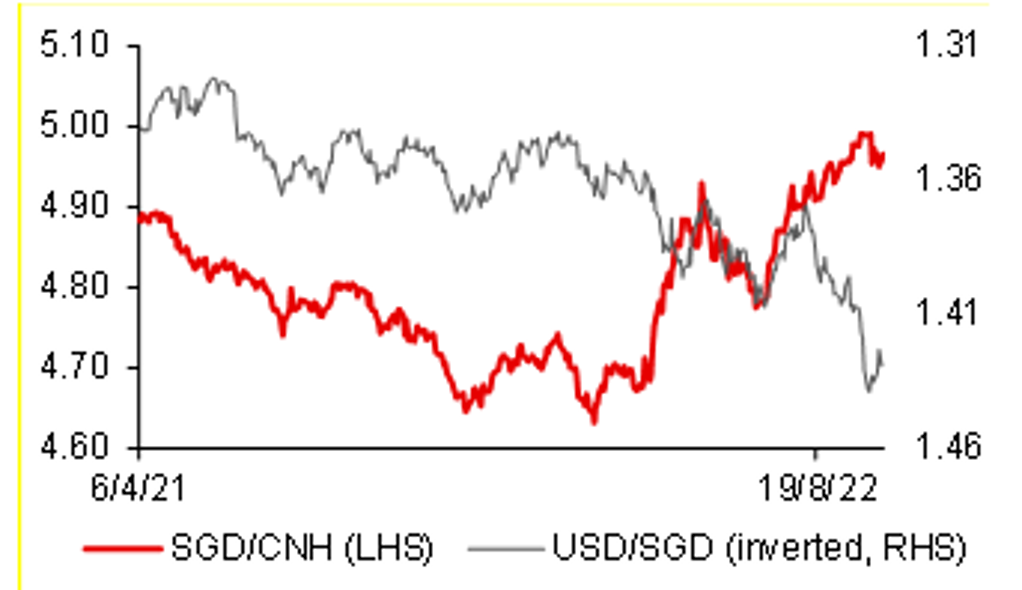

USD/SGD: Awaiting the MAS monetary policy decision

USD/SGD touched the 1.42 level over the past week from the 1.4492 high on 28 September but was rebounding by Friday’s session as dollar strength returned. This comes as Singapore prepares to announce advance estimates of Q3 GDP. We forecast a 3.7% y/y increase and a 0.6% q/q rebound after the 4.4% y/y growth and -0.2% q/q contraction in Q2. For the week ahead, we watch resistance of 1.44 and 1.4492 if dollar strength returns again.

Singapore will be announcing its monetary policy decision and providing the advance Q3 GDP figures over the coming week. Overall, we see that being slightly supportive of SGD resilience against dollar strength.

Our base case is for recentring to the prevailing level, with two alternate scenarios for a slight increase in the slope or for the MAS to do both simultaneously. This is due to our expectations of a slightly higher inflation expectation for 2022, with sticky inflation likely to only come off in H2-2023. We forecast headline inflation at 6.3% y/y in 2022 and 5.8% in 2023. We also believe that core inflation will be at 4.2% y/y in 2022 and 4.5% in 2023. Excluding the expected impact from the 1ppt increase in GST from 7% to 8%, headline and core inflation would have slowed to 5% y/y and 3.7% respectively.

More normalized foreign portfolio investment moves over the past week

Source: Bloomberg, MUFG GMR

Some reversion for USD/SGD

Source: Bloomberg, MUFG GMR

|

SOPHIA NG |

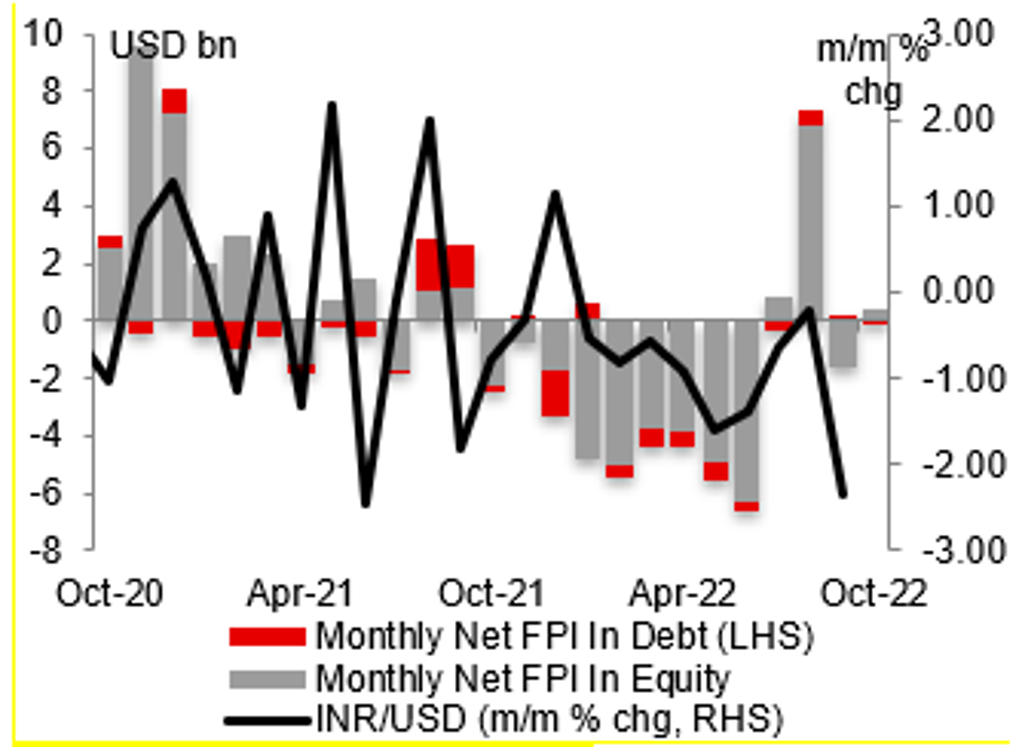

USD/INR: Bond index inclusion pushed back

USD/INR had been trying to test the 82.00 mark since touching the record high of 81.95 on 28 September and finally broke above that level last Friday to as high as 82.41. The INR’s 1.3% slide against the USD last week made it the worst performing AXJ currency, which contrasted with gains recorded across most AXJ currencies.

The INR’s underperformance was driven in part by USD strength, rebound in oil prices following the decision by OPEC+ to cut back daily oil production, greater onshore demand for the USD by importers, weaker manufacturing and services PMI numbers, and disappointment over JPMorgan’s decision to refrain from adding Indian government bonds (IGB) to its JPM GBI-EM index. FTSE Russell too decided to keep IGBs on index watch in its latest review two weeks ago. Prospects of higher oil prices in the near term following OPEC+’s decision means the value of India’s oil imports are likely to remain elevated compared to a year ago. Further, JPM’s decision means net foreign institutional investment flows into IGBs may result in net outflows and pressure IGB yields higher. This would be a reversal of net inflows into IGBs the past two months by USD0.7 bn cumulatively. Now that USD/INR has broken decisively above the 82.00 mark, the next topside resistance in the near term is 83.00.

BSP stepping up monitoring of FX trades

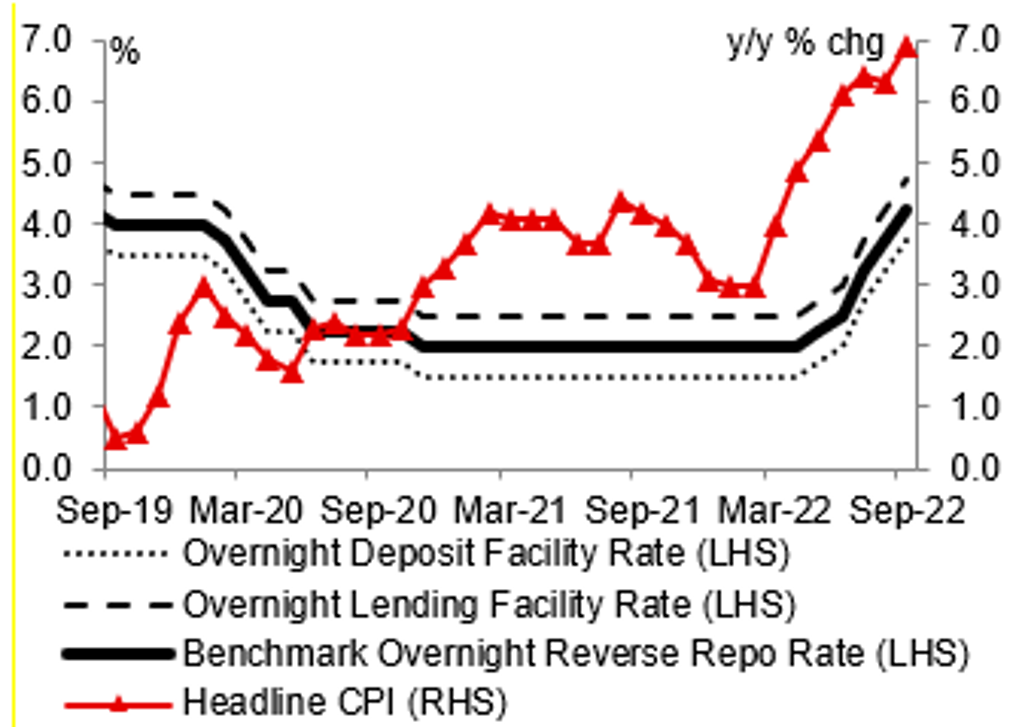

USD/PHP: Likely to break above 59.00 this week

The PHP was the second worst performing AXJ currency last week with a 0.5% loss against the USD. On 3 October, the PHP dropped to a new record low of 59.00 against the USD. But USD/PHP has yet to break decisively above that level since then, in part due to the BSP’s stepping up of monitoring FX trades onshore and “gentle” nudges to banks that speculation does no service to the country. During this period, there were no indications from newswires of suspected actual intervention by the BSP. But even with increased monitoring, it will be hard for the PHP to go against a strong USD, particularly with the Fed adamant on hiking rates to tame inflation. We see risks of USD/PHP breaking above 59.00 as soon as this week, with 59.50 to act as the next level of topside resistance.

The acceleration of the Philippines’ headline CPI to 6.9% y/y in September from August’s 6.3% y/y reinforced our expectations of another outsized 50bps hike by the BSP at the next policy meeting on 17 November. As expected, inflationary pressures were mainly driven by higher prices of food and housing, water, electricity, gas and fuels amid shortages of fish, pork and sugar and higher electricity tariffs. These factors are likely to drive inflation higher in the coming months which would bring headline CPI above 7% with the peak possibly in December instead of November. But given a more aggressive Fed policy tightening and deteriorating trade balances for the Philippines, policy tightening is insufficient to change the direction of the PHP.

Net FII into Indian equities & bonds

Sources: Bloomberg & MUFG GMR

The Philippines' headline CPI & benchmark rate

Sources: Bloomberg & MUFG GMR