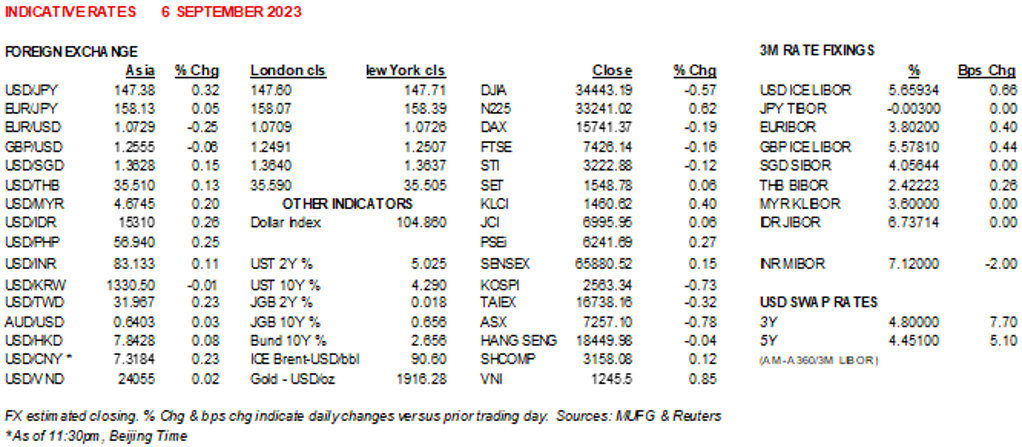

Market Highlights

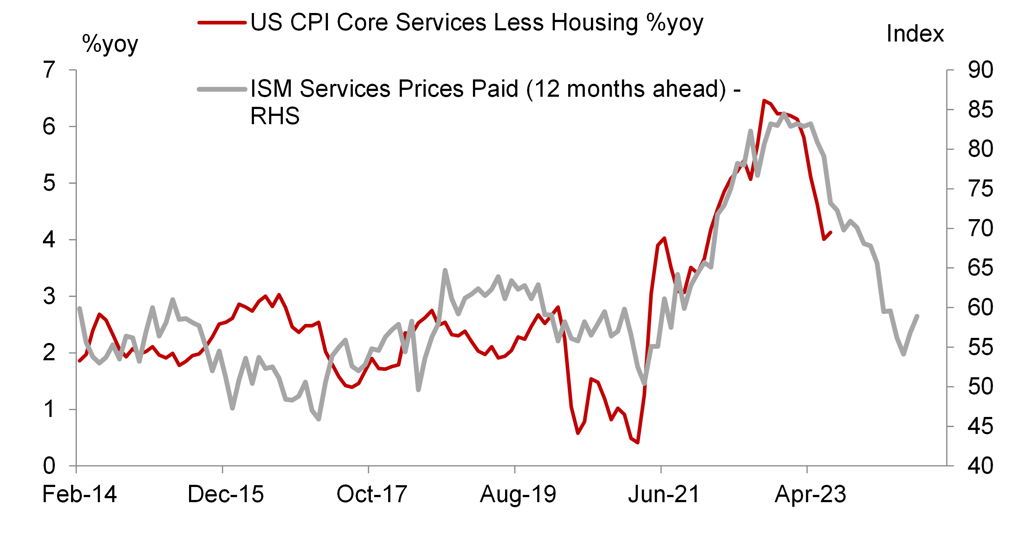

US ISM Services PMI came in stronger than expected, raising concerns that the Fed may need to hike more and keep rates higher for longer. The headline index rose to 54.5 from 52.7 previously. The Prices Paid component, which has a good leading relationship with services inflation picked up to 58.9 from 56.8. Whether this signals a trend higher in US inflation or is just noise in the data is yet to be seen, but it certainly comes at a time of increasing concerns around higher oil and food prices. Meanwhile Germany’s factory orders slumped by -10.5%yoy, highlighting the continued weakness of the European economy.

Overall, the Dollar strengthened slightly, while US yields rose across the board with the 2-year breaking above 5%. With USDJPY picking up to 147, we had some pickup in verbal intervention on the Yen by Japan’s vice finance minister for international affairs. Meanwhile Bank of Japan’s Board Member Takata said that Japan is seeing some early signs of a change in inflation expectations, but that BOJ must patiently maintain policy given the uncertain outlook.

THE PRICES PAID COMPONENT IN US ISM SERVICES PICKED UP, BUT IS STILL CONSISTENT WITH SOME SLOWDOWN IN US INFLATION

Source: Bloomberg

Regional FX

Asian currencies were more stable overnight, compared with the broader Dollar sell-off earlier in the week. Singapore’s COE premiums rose, raising some concerns about the possible impact to Singapore’s headline inflation down the road. Our base case is for MAS to keep its exchange rate on hold both in the October meeting and into next year. Looking ahead, China will release trade data, with the market expecting slower declines in both exports and imports. Meanwhile, Bank Negara Malaysia is expected to keep rates on hold at 3%, given manageable inflation and stable growth.