USD/JPY stabilizes overnight after hitting fresh year to date highs

JPY: Fresh year to date low for the yen triggers concern from Finance Minister

The yen has stabilized overnight at weaker levels after yesterday’s sharp sell-off which resulted in USD/JPY hitting a fresh year to date high at 149.49. It brings the pair back closer to last year’s peak set from November at 151.91. Renewed weakness in the yen has drawn comments from Japan’s Finance Minister Suzuki who stated that we will watch FX markets closely while reiterating that it is important that FX moves stably and reflects fundamentals. The comments provide an early indication that recent yen weakness is becoming more of a concern again for domestic policymakers as they attempt to slowdown yen selling with USD/JPY moving closer to last year’s high. As we highlighted in yesterday’s FX Daily Snapshot (click here), the latest leg of yen weakness followed the speech from BoJ Deputy Governor Uchida. Overnight there were further comments from BoJ Governor Ueda. He told parliament that the BoJ is mulling whether negative rates should remain in place if the price goal is in insight. Similar to Deputy Governor Uchida he attempted to provide reassurance that financial conditions will remain easy even after negative rate policy is brought to an end.

At the same time, the IMF has released their staff concluding statement of their Article IV mission to Japan. The IMF concluded that the BoJ has been “appropriately cautious” given Japan’s history of deflation and mixed signals from recent data. That said, they note that upside risks to inflation have materialized in the past year with strengthening nominal wages and a closed output gap. The IMF noted that they expect this year’s wage hikes to be higher than last year’s. As a result, they recommend that the BoJ should consider exiting Yield Curve Control (YCC) and ending Quantitative and Qualitative Easing (QQE) while gradually raising short-term policy rates thereafter. They recommend that these policy shifts should take a “gradual and well-communicated” approach to anchor market expectations. Recent communication from the BoJ since the last policy meeting in January has clearly been setting the stage for the removal of negative rates either in March or April.

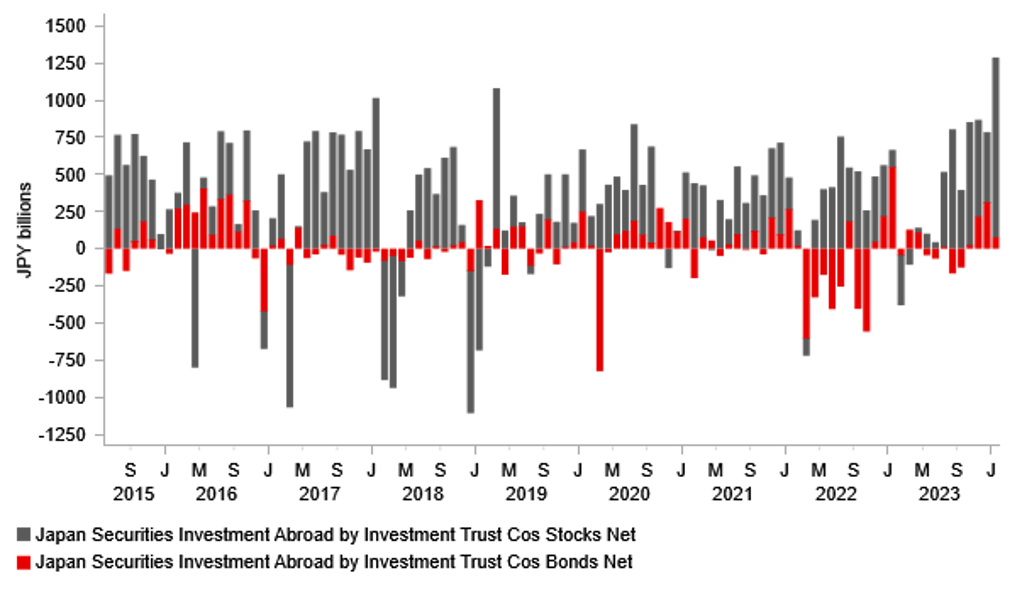

The Ministry of Finance in Japan has also released the breakdown of portfolio investment flows by investor type for the month of January. The report revealed a clear pick-up in demand for foreign securities by Japanese Investment Trusts. Net purchases of foreign equities by Japanese Investment Trusts totalled JPY1.21 trillion in January which was a record high for a single month. For comparison, net purchases of foreign equities averaged JPY292 billion/month in 2023. It provides evidence that the change in NISA tax-free savings regulations has had a significant impact on household savings behaviour in Japan at the start of this year. The pick-up in outflows into foreign equity markets could have contributed to yen weakness at the start of this year even if it has only further soured investor sentiment towards the yen.

The final external factor that has helped lift USD/JPY back towards last year’s highs has been the surprising resilience of the US economy which is casting doubts both on how quickly the Fed will begin to cut rates this year, and how quick and deep the rate cut cycle will be once underway. A slower and shallower Fed rate cut cycle would help to ease downside risks for USD/JPY in the year ahead. The next market focus for Fed rate cut expectations today will be the release of revisions to the US CPI data. Fed policymakers have indicated that they will be scrutinizing the report closely for confirmation that inflation pressures are slowing.

RECORD DEMAND FOR FOREIGN EQUITIES IN JANUARY

Source: Bloomberg, Macrobond & MUFG GMR

NZD: RBNZ is expected to buck trend and hike policy rate further

The best performing G10 currency overnight has been the New Zealand dollar which has strengthened by around +0.6% against the US dollar. Over the past week the NZD/USD rate has risen from a low of 0.6038 on 5th February up to a high overnight at 0.6135. Kiwi strength has been more notable against the Aussie over this period which has resulted in the AUD/NZD rate falling to its lowest level since May of last year at just below the 1.0600-level.

The New Zealand dollar has been benefitting from the sharp hawkish repricing of RBNZ rate hike expectations this month. The implied yield on the December 2024 New Zealand three-month interest rate futures contract has increased by around 60bps since the start of this month. The New Zealand rate market has moved to price in a much higher probability of the RBNZ delivering one final rate hike before reversing course and cutting rates later this year. There are now around 22bps of hikes priced in by the May RBNZ policy meeting, and then the amount of cuts priced in by end of this year has been scaled back to only around 36bps. In contrast, the Australian rate remains more confident that the RBA’s next policy move will be a rate cut with a gradual profile of around 41bps of cuts priced by the end of this year.

Market expectations for an RBNZ rate hike have been encouraged overnight by the reports that ANZ bank has changed their RBNZ call and is now forecasting two further 25bps hikes in February and April. It follows recent stronger than expected labour market and CPI reports from New Zealand for Q4.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Dec |

0.8% |

-1.5% |

! |

|

GE |

10:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Avg hourly wages Permanent employee |

Jan |

-- |

5.7% |

! |

|

CA |

13:30 |

Employment Change |

Jan |

16.0K |

0.1K |

!! |

|

US |

Tbc |

CPI Revisions |

!!! |

|||

|

CA |

15:30 |

BoC Senior Loan Officer Survey |

-- |

-- |

13.2 |

! |

|

US |

18:30 |

Fed Logan Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg