JPY selling resumes as timing of BoJ’s exit from negative rates in focus

JPY: BoJ Deputy Governor Uchida disappoints expectations for March hike

The yen has weakened during the Asian trading session resulting in USD/JPY moving back to within touching distance of the year to date high at 148.89 from 5th February. The main trigger for the renewed yen sell-off overnight was a speech by BoJ Deputy Governor Uchida to local business leaders in Nara, western Japan. Prior to the speech there had been some speculation amongst market participants that Deputy Governor Uchida could use the speech to send another signal that the BoJ is moving closer to raising rates potentially as early as at the next meeting in March. However, those expectations were disappointed as he failed to provide a clear signal over the timing of an exit from negative rates. He repeated the message from the last BoJ meeting at which they indicated that the “certainty for attaining their price goal is rising gradually”. He stated that the rate path will depend on the economy and inflation with spring wage talks a key factor to watch. While he did not give a clear indication over the timing of the first rate hike, he did provide more colour over the potential path for rates once the hiking cycle commences. He stated that it was “hard to imagine a path of continuous rate hikes”, and he attempted to provide reassurance that financial conditions will still be easy even after negative rates end.

In addition, he commented on the BoJ’s ongoing YCC policy settings. He noted that he sees “continuity between YCC and bond buying post YCC” indicating that the BoJ would continue to provide support for the JGB market through bond purchases even after YCC has formally been brought to end. He attempted to provide reassurance that the BoJ will be “careful” to avoid surges in government bond yields. Finally he added that it is “natural” to stop ETF and J-REITs purchases when their price goal is in sight. Overall, the comments from Deputy Governor Uchida highlight that the BoJ is preparing market participants for an exit from negative rates but there was no urgency expressed to indicate that the first hike will be delivered in March. It remains consistent with our base case outlook for the first hike to be delivered in April, but we acknowledge that the risk of earlier exit in March has increased recently in light of the change in BoJ communication since their last meeting January. In these circumstances, we remain unconvinced that the yen can weaken much further in the near-term and still expect the yen to rebound heading into Q2 as the BoJ finally moves to exit negative rates based on the assumption that the upcoming wage negotiations do not disappoint.

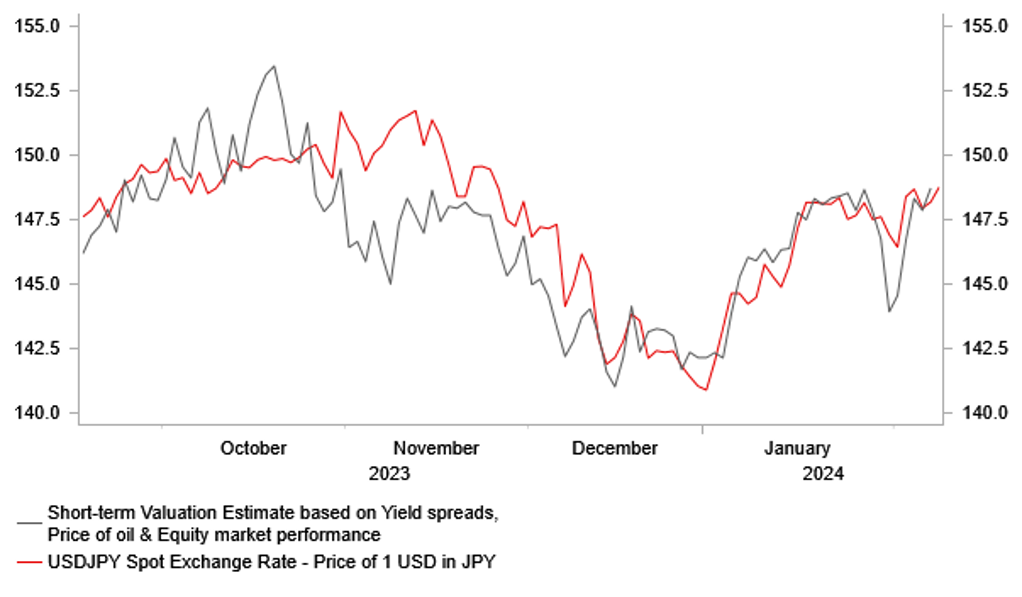

USD/JPY REBOUND SUPPORTED BY SHORT-TERM FUNDAMENTALS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Rising likelihood of ECB cutting ahead of Fed weighing on EUR/USD

The euro has rebounded against the US dollar in recent days after hitting a year to date low at the start of this week at 1.0723. So far this year the euro has been trending lower against the US dollar as it continues to move further below the high from the end of last year at 1.1139. The correction lower for EUR/USD which has brought it back in line with its average since the start of last year has been driven in part by market expectations that the ECB could now begin to cut rates ahead of the Fed. The recent run of stronger US economic data and pushback by Fed officials against a rate cut as soon as in March has prompted the US rate market to delay the expected timing of the Fed’s first cut until 1st May FOMC meeting. There are currently 21bps of cuts priced in by the May FOMC meeting and 43bps by the June FOMC meeting. In contrast, the euro-zone rate market has moved to price in a higher probability of the ECB delivering an earlier rate cut in April rather than June although the timing is still finely balanced. There are currently 15bps of cuts priced in by 11th April ECB policy meeting and 42bps by 6th June ECB policy meeting. Recent comments from ECB policymakers at the last policy meeting and since have indicated more flexibility over cutting rates before June if backed up by the incoming economic data. The release yesterday of the latest German industrial production data for December provided further evidence that the euro-zone economy was weak at the end of last year although data releases have started to beat expectations on the whole at the start of this year. Overall we continue to judge that risks are titled modestly to the downside for EUR/USD in the near-term.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Economic Bulletin |

-- |

-- |

-- |

!! |

|

US |

13:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

221K |

224K |

!!! |

|

UK |

14:00 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

! |

|

UK |

15:00 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

EC |

15:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg