Fed provides support for USD by dampening rate cut expectations

USD: Fed remains in wait & see mode to assess impact of tariffs

The US dollar has continued to trade at modestly stronger levels overnight following yesterday’s FOMC meeting. It has helped to lift the dollar index back up above the 100.00-level. The US dollar has derived support from the scaling back of Fed rate cut expectations as soon at the next FOMC meeting in June. The US rate market is now only pricing in around 5bps of Fed rate cuts by the June meeting and is no longer fully (around 20bps) pricing in a rate cut by the July FOMC meeting either. The policy update from the Fed overnight refrained from sending a stronger signal that they were moving closer to cutting rates. In the updated policy statement, the Fed acknowledged that uncertainty about the economic outlook had increased “further”, and “judged that the risks of higher unemployment and higher inflation have risen”. However, the description of the economy was left largely unchanged. The Fed continued to describe economic activity as expanding at a “solid” pace downplaying the negative Q1 GDP print, and labour market conditions as “solid”. Additionally, in the press conference Fed Chair Powell reiterated that the Fed sees “no need to hurry” to lower rates which argues against a rate cut as soon as the next FOMC meeting in June. He did emphasize though that the Fed “can respond in a timely way” to incoming economic data. He believes that the Fed is in the “right place t wait and see how things evolve”, and “feel like it’s appropriate to be patient”.

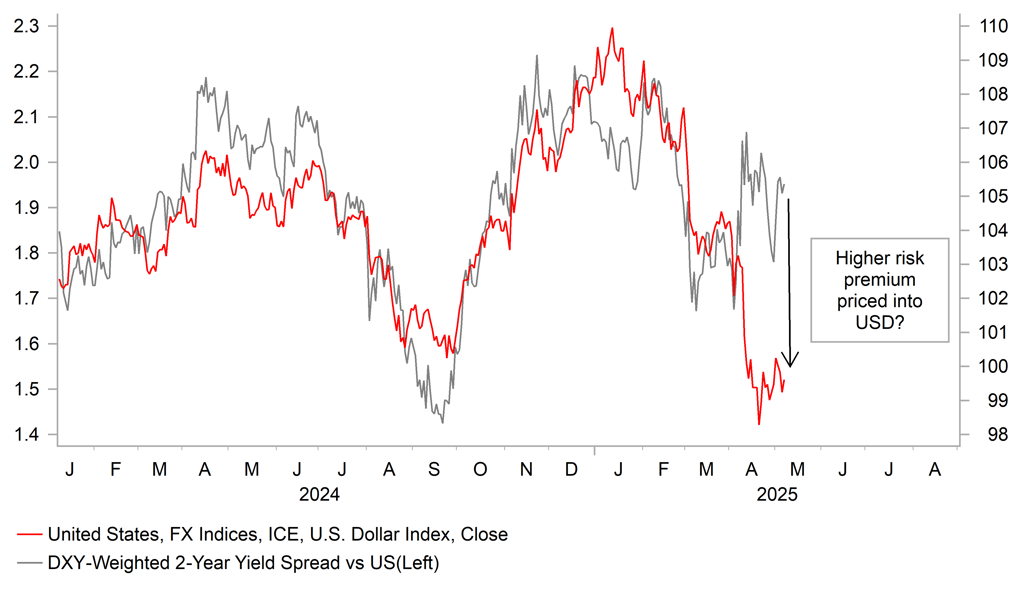

In response to recent criticism from President Trump that the Fed has been too slow to cut rates, Chair Powell stated that “it’s not a situation where we can be pre-emptive, because we actually don’t know what the right response to the data will be until we see more data”. It clearly highlights that the Fed is in data dependent mode right now when setting policy. We expect the Fed to resume rate cuts when evidence emerges that the US labour market is loosening in response to trade disruption and heightened policy uncertainty supporting our outlook for further US dollar weakness in the 2H of this year (click here). However, the bar is now higher for a rate cut as soon as at the 18th June FOMC meeting when there will have been just one more nonfarm payrolls report released for May and it is still unlikely to be clear what President Trump’s plans are for the higher “reciprocal tariff” rates when the 90-day delay comes to an end on 9th July. A delay to Fed rate cuts may help to offer some much needed support for the US dollar in the near-term although the link with short-term yield spreads has broken down recently.

LINK BETWEEN USD & YIELD SPREADS HAS BROKEN DOWN RECENTLY

Source: Bloomberg, Macrobond & MUFG GMR

GBP: US trade deal optimism lifts GBP ahead of BoE policy meeting

The other main announcement overnight was from President Trump who posted on social media that he would hold an Oval Office news conference today to discuss “a major trade deal with representatives of a big, and highly respected, country”. While President Trump did not specify which country was involved, it has since been reported by the media that it is the UK. The UK and US have been in intensive discussions about an economic agreement that would reduce the impact of some tariffs, with a team of British officials in Washington to negotiate terms this week. Earlier this week the UK announced a new major trade with the India as well. The British media are reporting that a “heads of terms” agreement has been reached which is a “substantive” step towards a full trade deal. The UK has been pushing to get a trade deal signed before the UK-EU Summit later this month. It has been reported that the trade agreement could lower sector specific tariffs applied to the UK on autos, steel and aluminium from the current rates of 25% although the 10% universal tariff rate could remain in place. Trade deal optimism has helped the pound to strengthen overnight although gains have been modest perhaps reflecting the close the proximity to today’s BoE policy meeting, and lack of details so far.

There is still a risk of a more dovish policy update from the BoE today posing downside risks for the pound, that could deliver a setback after the recent rebound. The UK rate market has already moved to price in around 39bps of BoE cuts by the June MPC meeting highlighting that there is already a strong expectation that the BoE will signal a faster pace of easing going forward. The dovish repricing that has already taken place should help to dampen any pound sell-off on the back of a change in guidance today from the BoE unless those expectations are reinforced further by discussions over delivering a larger 50bps cut if needed. One can’t completely rule out a larger 50bps as early as today either although that appears highly unlikely to us.

On the other hand, the pound will derive more support if the BoE continues to signal that they remain comfortable with the current quarterly pace of rate cuts, and financial market volatility continues to ease encouraged by building investor optimism over a trade deal between the US and US. A trade deal could ease pressure on the BoE to speed up the pace of rate cuts if the negative impact on the UK economy is dampened. The pound was hit hard last month by the sharp jump in financial market volatility triggered by the initial fallout from President Trump’s tariff plans. It has triggered an unwind of carry trades that reinforced the sell-off in higher yielding currencies such as the pound. At the same time, unfavourable external conditions have made it more challenging for countries that rely more on external financing such as the UK whose current account deficit totalled just under 3% of GDP last year. Please see our BoE Preview (click here) for more details.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.50% |

4.50% |

!! |

|

GE |

10:40 |

German Buba Balz Speaks |

-- |

-- |

-- |

!! |

|

UK |

12:00 |

BoE Interest Rate Decision |

May |

4.25% |

4.50% |

!!! |

|

UK |

12:00 |

BoE MPC Meeting Minutes |

-- |

-- |

-- |

!!! |

|

UK |

13:00 |

BOE Inflation Letter |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

231K |

241K |

!!! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q1 |

-0.4% |

1.5% |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q1 |

5.3% |

2.2% |

!! |

|

UK |

14:15 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

CA |

15:00 |

BoC Financial System Review |

-- |

-- |

-- |

! |

Source: Investing.com