- Macro views: The BoE is set to continue its rate cut cycle with the fourth move at consecutive projection meetings – but a lot has changed since the last move in February. With increased market expectations that policymakers could step up the pace of easing this year the focus will be on changes to the forecasts, vote split and messaging.

- Lower energy pricing is set to see a significant downward shift in headline inflation projections, but there are various domestic factors which demand caution around underlying inflation. The growth figure for this year is likely to be upgraded after strong recent data. On messaging, policymakers are likely to indicate that more cuts are coming but will probably place heavy emphasis on the lack of clarity around the outlook. That could see tweaks to introduce more flexibility to act more urgently, if required, but with care to avoid signifying any pre-commitment to do so. We look for an 8-1 split with just one member voting for a larger cut.

- Looking ahead, we stick with our view that the established default path of quarterly cuts will be continued through the year, but we acknowledge that risks are tilted towards an acceleration in easing given heightened external risks. In particular, any clear signs of 1) a sharp US slowdown or 2) trade diversion effects starting to weigh meaningfully on UK inflation could be the trigger for more urgency.

- FX views: A more dovish policy update from the BoE could deliver a setback after the recent GBP rebound, although recent dovish repricing should help to dampen any GBP sell-off if there is a moderate change in guidance. Conversely, sterling will derive support if the BoE continues to signal that it is content with the current quarterly pace of rate cuts. This comes as financial market volatility continues to ease against a backdrop of stronger investor sentiment around the scope for post-‘Liberation Day’ trade deals.

Macro view: Sticking to the default path

The quarterly rate cut cycle is set to be extended

The Bank of England is set to cut rates again this week in a continuation of the quarterly easing cycle which has been established since last August. That would take rates to 4.25%, still in unambiguously restrictive territory. We expect all MPC members will vote for a cut in an 8-1 split with arch dove Dhingra voting for larger (50bp) move.

A lot has changed since the last meeting (20 March) and markets have now moved to price in more than three rate cuts this year – i.e. a departure from the apparent default path of quarterly moves.

Our view is that policymakers will want to continue to tread fairly carefully for now. Yes, it is clear that the post-‘Liberation Day’ shifts in energy pricing (and to a lesser extent the appreciation in trade-weighted sterling) will prompt a sizeable downgrade to the BoE’s headline inflation projections with a lower peak this year. The UK government also seems content to avoid retaliatory tariff measures, which could have had an almost-immediate upward effect on inflation.

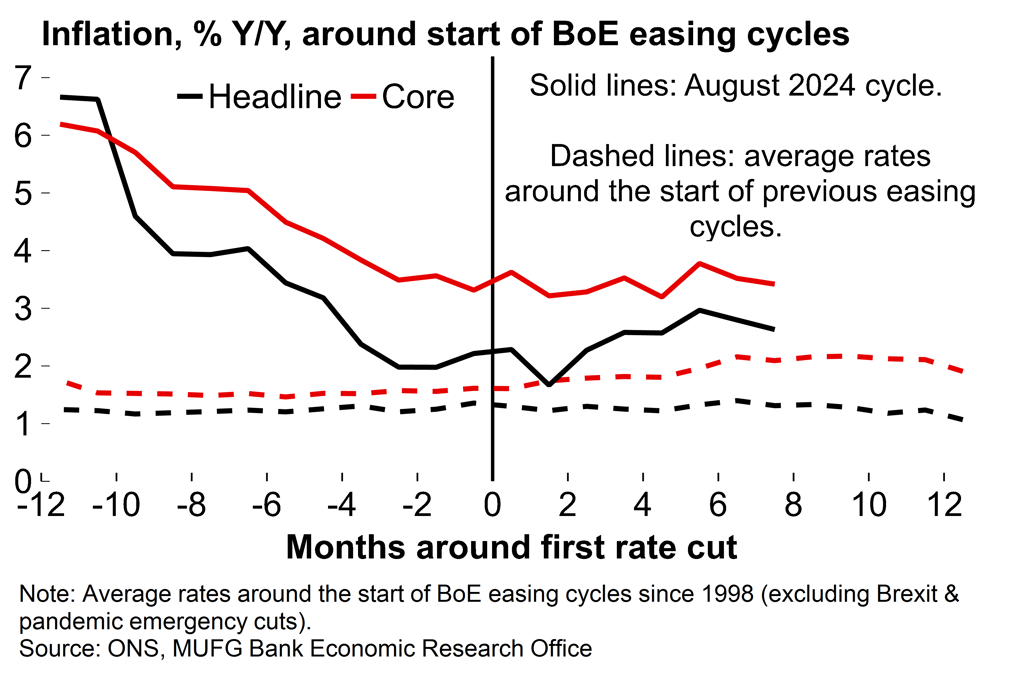

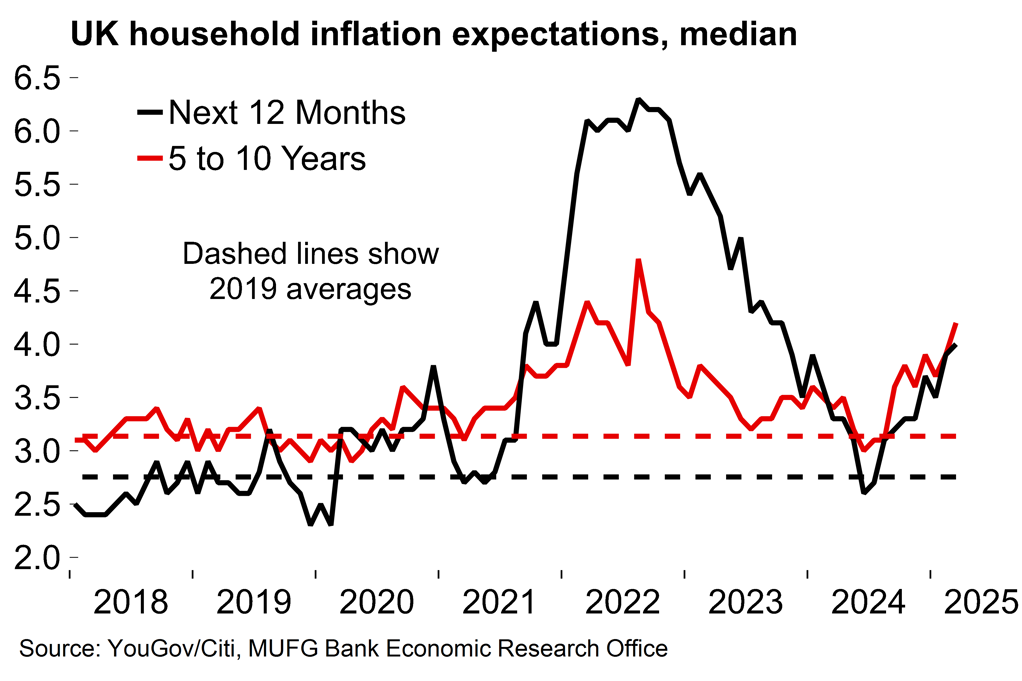

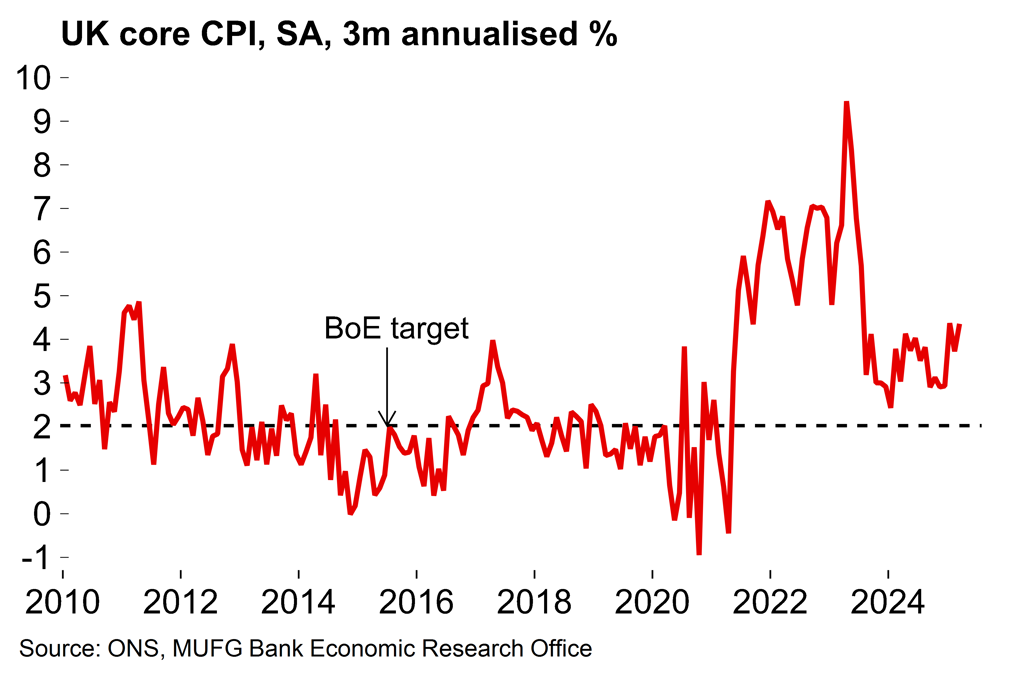

But the domestic situation suggests there’s still a need for caution on underlying price pressures. Services inflation came in at 4.7% in March. There will be a range of tailwinds to the key April print (released 21 May) – e.g. the 6.7% increase in the minimum wage and similar annual increase to many telecoms services contracts. Excluding the post-pandemic period, the services PMI input prices gauge is at a 17-year high, while household inflation expectations have also risen in recent months.

On earnings, nominal wage growth is still above 5%, well above rates that would be consistent with the inflation target. The impact on the labour market of the government’s increase in employer national insurance costs from April isn’t immediately apparent, either. Redundancy notification figures are only slightly higher than the 2023-24 average as the jobs market remains in reasonable shape.

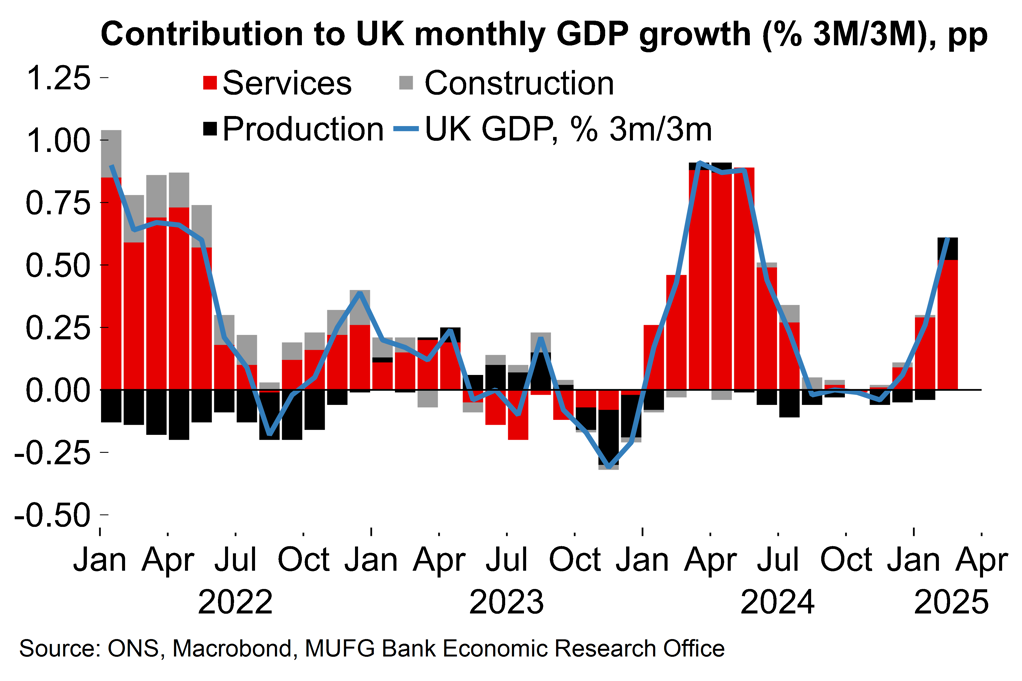

In terms of growth, it’s also clear now that the UK economy has started the year on a good footing. The BoE was expecting 0.1% Q/Q growth for Q1 in February (and 0.25% in March). After strong retail sales figures we are now tracking a figure of 0.6%. That is above potential and will support the BoE’s new annual average forecast for 2025. Remember, the UK government pared back its spending plans only slightly at the Spring Statement and new spending will provide a tailwind to activity this year.

Three cuts in, inflation remains elevated…

…and household expectations are increasing

Balancing domestic price pressures with heightened global uncertainty

Governor Bailey said that the BoE is focused on the potential “growth shock” from tariffs. The UK is less directly exposed to the US tariff shock than the euro area (see here), but a sharp US slowdown is a key risk for the UK with its large services surplus. Indeed, we see a US recession and/or significant trade diversion effects on inflation as two key factors which could prompt the BoE to step up the pace of easing this year.

For now, we think that policymakers will be content to indicate that more cuts are coming (e.g. through forecasts showing that unchanged rates would leave inflation undershooting the target), but will stop short of giving any clear indication of a shift to a faster pace of cuts.

Given heightened uncertainty there may be also some tweaks to the statement to provide flexibility to act if the outlook deteriorates, but policymakers may be concerned these would be overinterpreted as a commitment to move faster. At this stage we don’t expect that the stated intention to be “gradual” with rate cuts will be removed. Essentially, we think that a wait-and-see approach (with increased flexibility to act more forcefully if required) is appropriate given domestic price pressures and global uncertainty.

All told, our base scenario remains that the quarterly pace of rate cuts will continue through the year, but we acknowledge that risks are tilted towards an acceleration in easing given heightened external risks.

The UK economy has started the year on a firmer footing

Few signs of lower core momentum

Markets view: Downside risks for GBP if BoE signals faster cuts

BoE policy update could deliver setback for GBP after recent rebound

A more dovish policy update from the BoE this week poses downside risks for the GBP, and could deliver a setback after the recent rebound. The UK rate market has already moved to price in around 40bps of BoE cuts by the June MPC meeting highlighting that there is already a strong expectation that the BoE will signal a faster pace of easing going forward. The dovish repricing that has already taken place should help to dampen a GBP sell-off on the back of a change in guidance this week from the BoE unless those expectations are reinforced further by discussions over delivering a larger 50bps cut if needed. One can’t completely rule out a larger 50bps as early as this week either although that appears highly unlikely to us.

On the other hand, the GBP will derive support if the BoE continues to signal that they remain comfortable with the current quarterly pace of rate cuts, and financial market volatility continues to ease encouraged by building investor optimism over trade deals/agreements to reverse President Trump’s tariff plans especially involving China and the UK. The GBP has been hit harder recently by the sharp jump in financial market volatility triggered by the initial fallout from President Trump’s tariff plans. It has triggered an unwind of carry trades that reinforced the sell-off in higher yielding currencies such as the GBP. At the same time, unfavourable external conditions have made it more challenging for countries that rely more on external financing such as the UK whose current account deficit totalled just under 3% of GDP last year. Negative sentiment towards the GBP was reinforced as well last month by the renewed sell-off in the Gilt market which was hit by negative spill-overs from the sell-off in the US Treasury market. Please see our latest FX Weekly (click here) for more details.