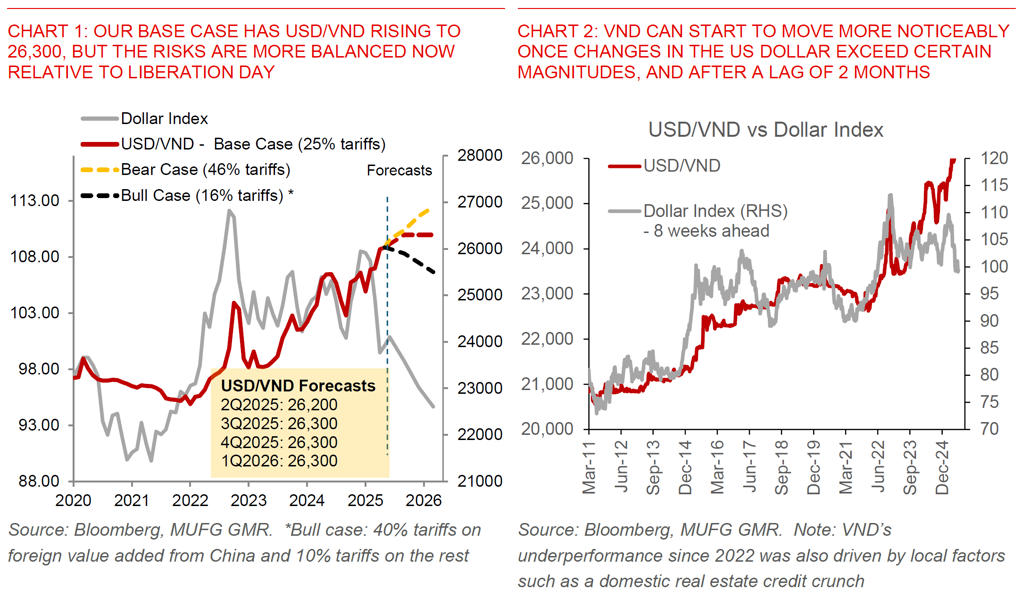

- While we continue to forecast USD/VND to rise, we think the risks are more balanced now certainly relative to the Liberation Day announcement when Vietnam received 46% reciprocal tariffs and the subsequent 90-day pause.

- Part of this is due to global factors such as the recent US-China tariff pause, which has lowered the left-tail risks on a possible US and global recession.

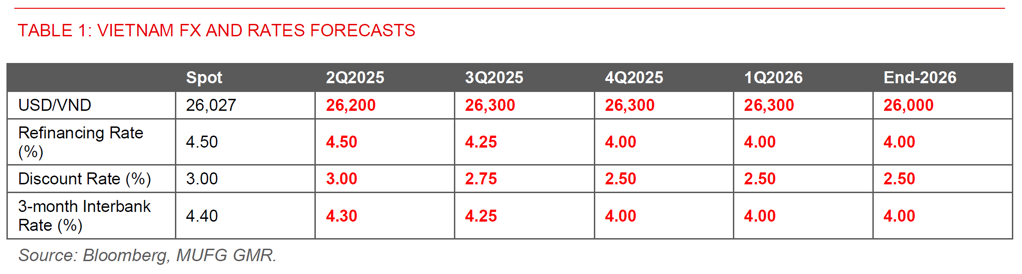

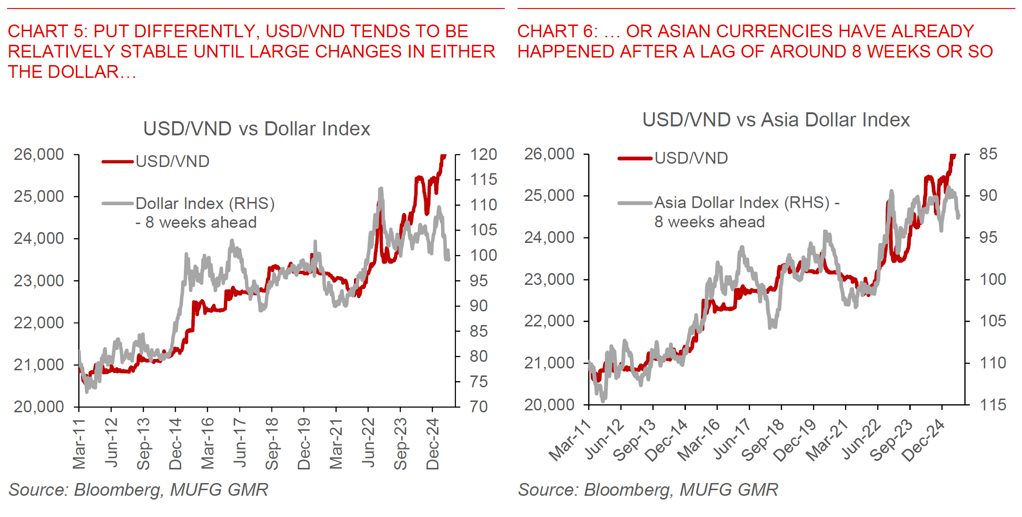

- In addition, our expectation for further US dollar weakness should cap upside risks to USD/VND. While VND’s sensitivity to the US dollar is historically small, our analysis shows VND starts to move more noticeably once changes in the dollar exceed certain magnitudes, and importantly after a lag of 2 months.

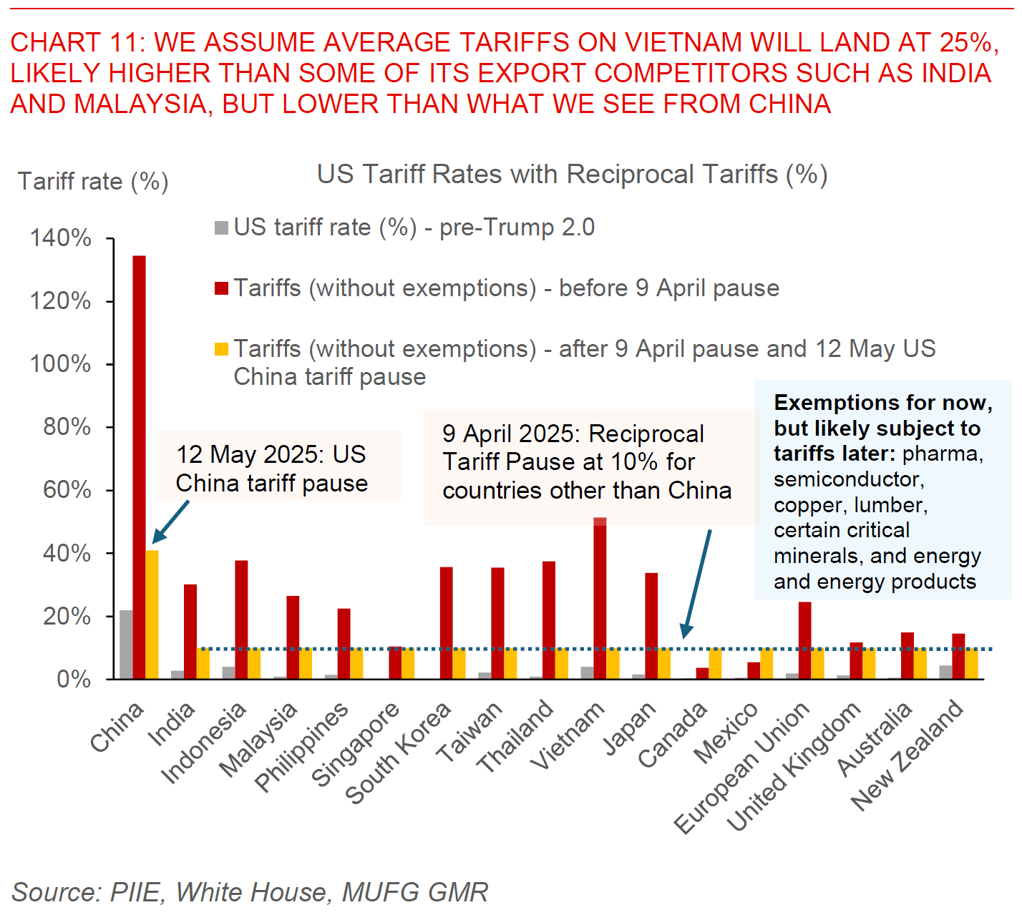

- Despite these positives, our base case profile has USD/VND rising gradually to 26,300 by 3Q2025 for several reasons. First, we assume Vietnam will receive an average tariff rate of around 25% come July 2025. While this is better relative to 46%, it will still be at a rate which dampens exports. Second, we expect interest rates to be lowered and some tolerance for FX weakness with the government’s focus on growth. Third, resident capital outflows remain quite sizeable. Fourth, Vietnam’s FX reserves are low.

- The biggest source of uncertainty is on our tariff assumptions in making our forecasts. We see a good chance for VND to strengthen if average tariffs eventually fall firmly below 20% with a possible trade deal reached.

US-China tariff pause, Dollar weakness and domestic recovery reduce VND depreciation risks

- VND has underperformed since President Trump’s tariff announcements on Liberation Day in April, declining 1.5% against the Dollar. This contrasts with G10 FX and also Vietnam’s trading partners such as Taiwan (+11%), South Korea (+6.5%), and Thailand (+3.9%) which have seen their FX strengthen.

- This FX underperformance for the Vietnam Dong makes sense and is something we have been highlighting in our research reports, given the high absolute level of tariffs proposed for Vietnam at 46%, and also meaningful uncertainty with regards to any potential trade deal for Vietnam (see Reciprocal tariffs imply pressure on Asia growth and FX and also Global FX Monthly).

- Moving forward, our key message is that the risks for USD/VND are more balanced and two-sided now, certainly relative to what we witnessed one month ago for several reasons.

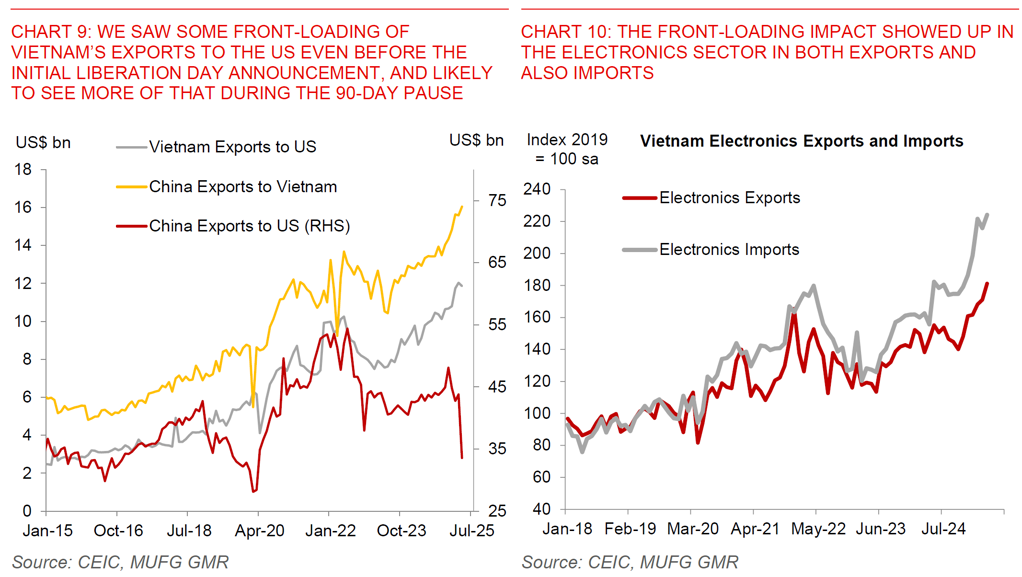

- For one, the recent US-China tariff pause has reduced the left-tail risks of a sharp US and global recession, and this correspondingly lowers the chance of a sharp export slowdown from Vietnam. Of course, we fully expect the negotiation between US and China to be fraught with difficulties, and we expect strategic competition and decoupling to continue between US and China over the medium-term. The net result is however still a lower chance of a global recession, coupled with a more modest pace of CNY depreciation (see US-China trade war: some ease of tension), both of which should cap VND weakness.

- Second, the weaker US dollar that we have already seen, and importantly which our G10 team continues to expect moving forward (~5% further Dollar weakness through 1Q2026), should cap upside risks to USD/VND.

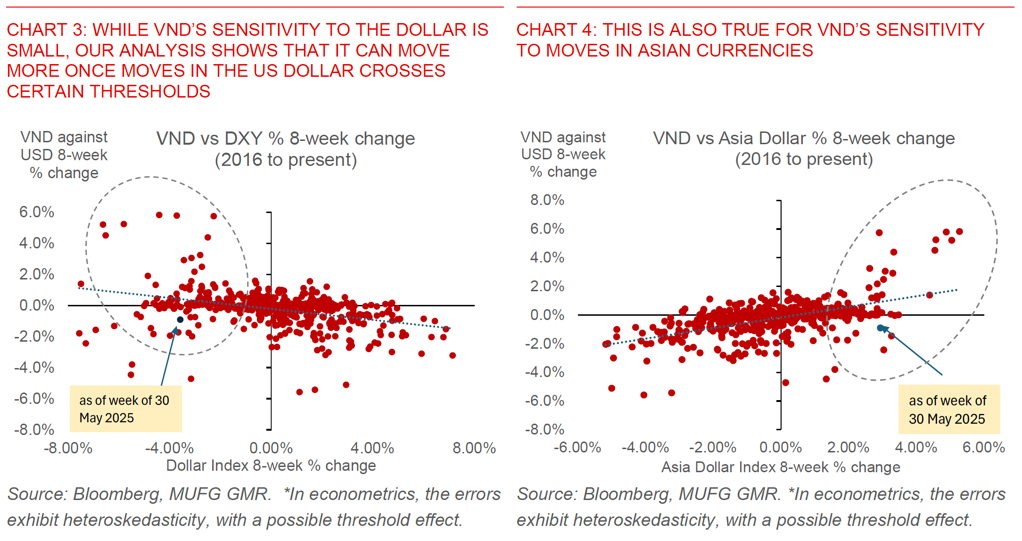

- Historically, VND’s sensitivity to the US Dollar, and for that matter Asian currencies, tends to be reasonably small. For instance, a simple regression of weekly changes of the Dollar Index on Vietnam Dong throws up a beta of just 0.02% for every 1% change in DXY, and 0.16% for a 1% change in the Asia Dollar Index. The sensitivity is higher when we include lags of up to 8 weeks, but ultimately the beta is small in absolute terms at 0.17% and 0.37% on VND for a 1% change in DXY and Asia Dollar respectively.

- Crucially, this ignores the property that USD/VND can tend to move more noticeably once changes in the USD and Asian FX exceed certain magnitudes, and much more evidently after a lag of ~2 months.

- Charts 3 and 4 below provide a visualisation of this relationship, by highlighting that changes in VND against the US Dollar and Asia FX tends to be much larger once movements in both factors cross certain thresholds.

- Put it differently, while USD/VND tends to be historically reasonably stable to global FX movements, sizeable changes in the Dollar or Asian currencies can engender a bigger move in the domestic currency (see Charts 5 and 6 above). This is likely partly a reflection of the more controlled nature of USD/VND, with the central bank tending to prefer smaller daily moves in the fixing rate but with a bias for moderate FX depreciation over time.

- With VND having already underperformed Dollar weakness and the strength already seen in several key Asia FX pairs such as TWD, KRW and THB, we therefore see the risk of another sharp spike in USD/VND as much less likely now, notwithstanding uncertainty on tariffs Vietnam will eventually receive (see Chart 5 and 6 above).

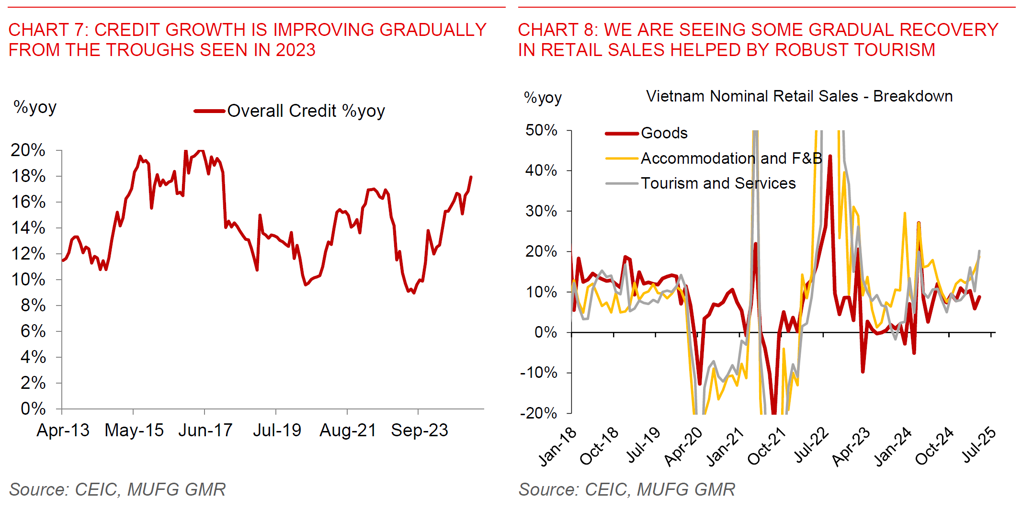

- Third and finally, Vietnam’s domestic economy also seems to be on a gradual recovery path, with credit growth picking up from the troughs seen in 2023, together with some improvement in domestic retail sales helped by a robust tourism recovery (see Charts 7 and 8 below).

We forecast USD/VND at 26,300 by 3Q2025 as our base case, with levels highly dependent on tariff assumptions

- Overall, we continue to forecast USD/VND rising towards the 26,300 levels by 3Q2025 in our base case forecasts, with the exact levels highly dependent and sensitive to tariffs that Vietnam will land up with. This is despite the positives mentioned above for several reasons.

- First, we assume Vietnam will receive an average tariff rate of around 25% come July 2025 with a trade deal likely to be reached eventually. While this is better relative to the initial 46% rate announced, we are assuming that this will be at a rate which dampens Vietnam’s exports over time through 2025-26. We think this 25% tariff rate will likely be higher relative to some of Vietnam’s key export competitors such as India and Malaysia, but still meaningfully lower compared with China’s tariff rate. As such, the net macro impact is still some slowing in Vietnam’s exports and FDI over the next 2 years, but with some offsets as Vietnam tries to diversify to new trading partners away from the US.

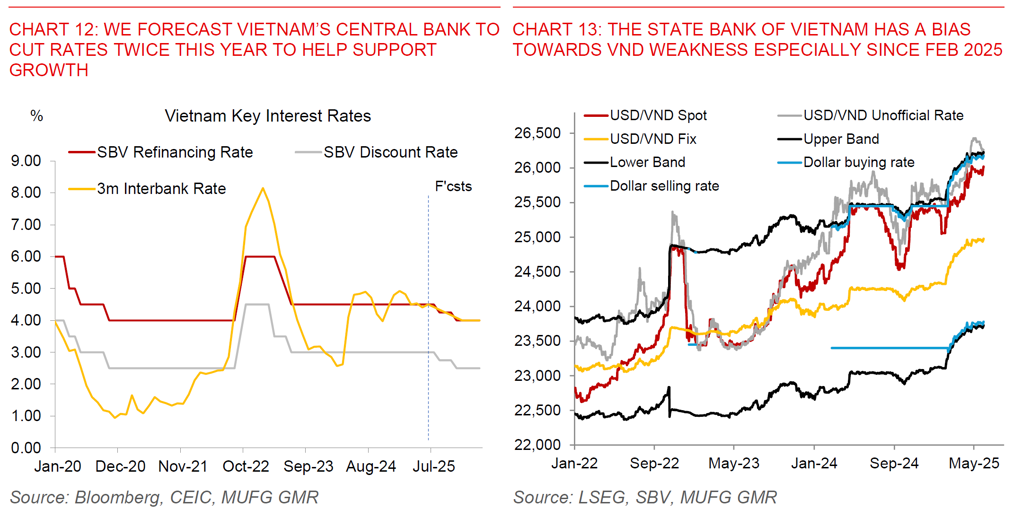

- Second, we expect interest rates to be lowered and some continued tolerance for FX weakness with the government’s focus on growth. The government is focusing on meeting an ambitious 8% GDP growth target for 2025, notwithstanding external risks including through tariffs. Correspondingly, the government also has a higher inflation ceiling of 5% (from 4% previously). Net-net, we think the central bank will be biased to cut interest rates this year to the extent that external conditions such as Fed rate cuts allow SBV to do so. We are forecasting two 25bps rate cuts by the SBV in both the refinancing and discount rates in 2025. Correspondingly, we think SBV will also allow some FX weakness within a reasonable pace to help support exports amidst global growth risks.

- Third, resident capital outflows remain quite sizeable, with rising domestic premium of gold prices, as possibly a symptom of rising outflows.

- Fourth, there are also some domestic risks including the significant restructuring and reorganisation of the government bureaucracy, which may ultimately affect up to 1 in 5 public sector jobs.

- Fifth, Vietnam’s FX reserves are relatively low at less than US$80bn and so the SBV lacks firepower to defend VND directly against sharp depreciation pressures.

Tariffs by rules of origin – will that actually be good for the Vietnam Dong?

- It goes without saying that our macro and FX forecasts are sensitive to the exact level of tariffs that will be pencilled in for Vietnam.

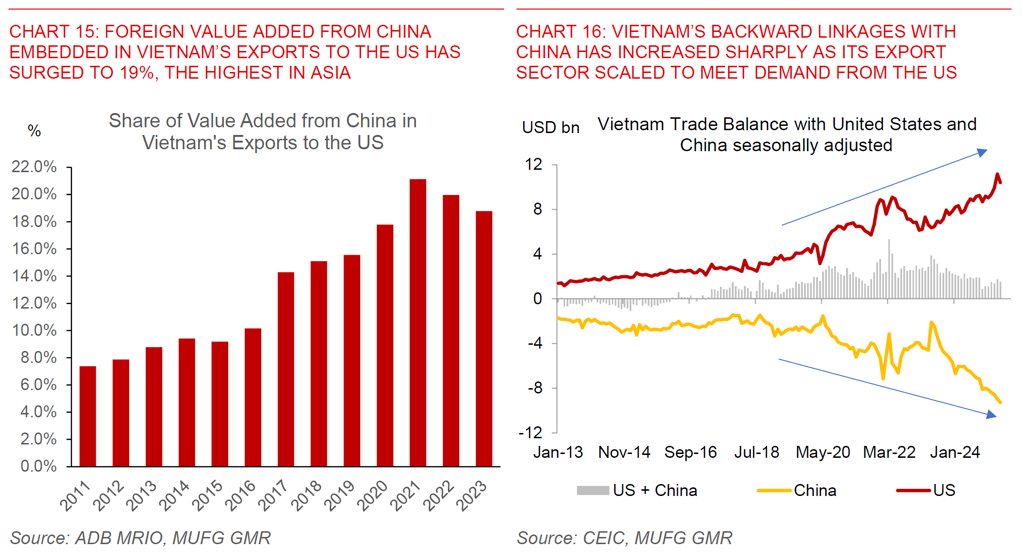

- We explore an alternative scenario where the US imposes tariffs on Vietnam by rules of origin, and to an extent this in line with our views that Vietnam’s Chinese-linked supply chains will be scrutinised (see Vietnam: Reasons to remain optimistic while factoring in Trump 2.0 tariff risks)

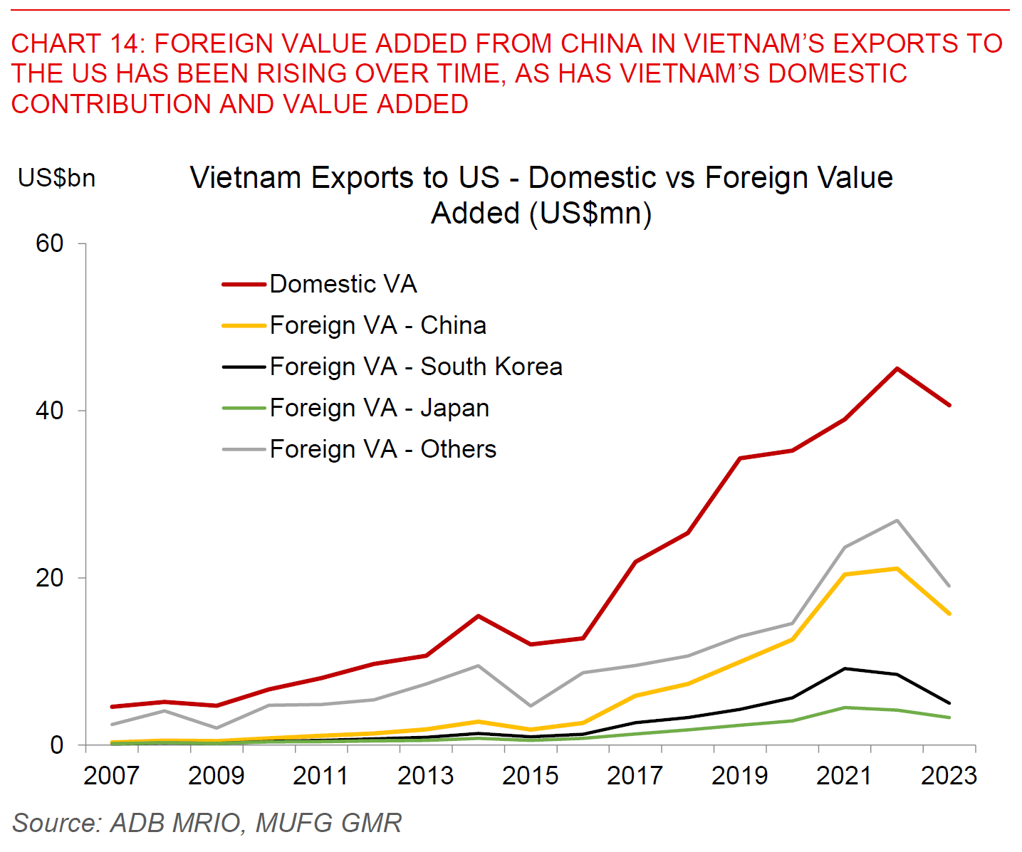

- If we assume that the US imposes 40% tariffs on Chinese-origin value added in Vietnam’s exports to the US, while the US imposes a 10% baseline tariff on the rest of Vietnam’s exports, this would work out to an average tariff rate of around 16% (much lower than the 25% we are currently assuming). We utilise data from the ADB’s Multi-Regional Input Output table, which shows that foreign value added from China in Vietnam’s exports to the US has risen sharply to around 19%, from just 8% in 10 years ago.

- In this scenario, we think the Vietnam Dong may have a good chance of strengthening against the US Dollar, given the negativity already priced in by markets, coupled with the FX underperformance that we have already seen. In addition, this can also further incentivise some Chinese-linked manufacturing companies to onshore their presence and FDI investments in Vietnam – something that was already happening to begin with.

- We would however stress this is just a scenario, and much will be dependent in practice on how these rules and tariffs are enforced and designed, and whether there will also be retaliation by other countries.

- Finally, it’s also important to continue to point out that the structural factors underpinning pinning strong Vietnam exports and manufacturing have not changed, even as the tariffs announced so far in Trump 2.0 have been higher than we anticipated for Vietnam (see Vietnam: Reasons to remain optimistic while factoring in Trump 2.0 tariff risks). These positive structural factors go well beyond tariffs and Trump, and include Vietnam’s multitude of Free Trade agreements, good STEM skills in the population, geographical location and proximity to supply chains, supportive government policies, among many others. Certainly tariffs play some role, but are far from the only factor driving supply chain shifts and diversification by companies.