- US President Trump announced through social media that the US and Vietnam reached a trade deal following a call between the leaders of both countries.

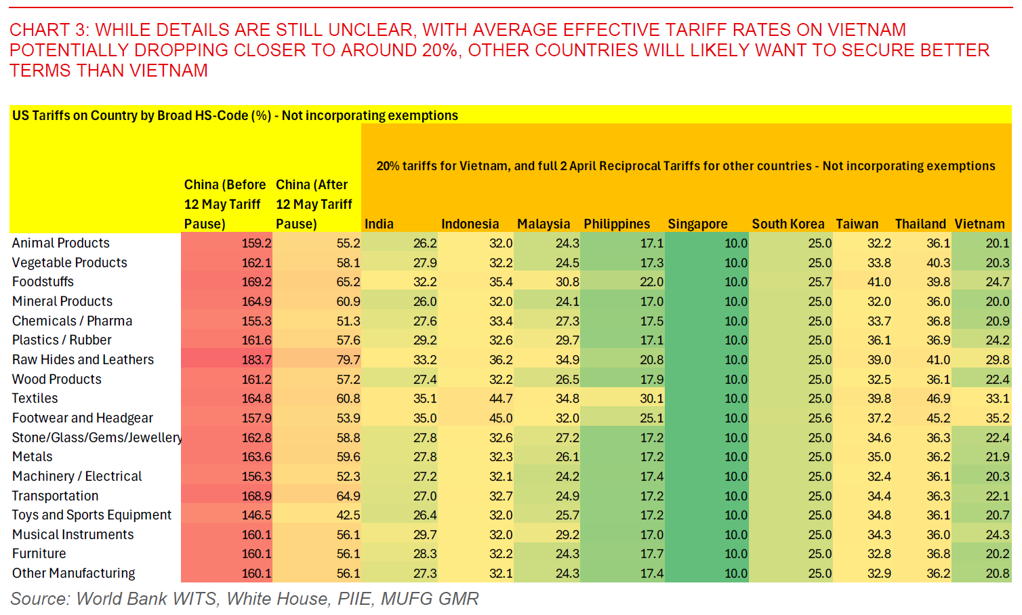

- According to Trump, a 20% tariff rate will be placed on “any and all goods” from Vietnam to the US, with a 40% tariff rate on “any Transshipping”. While this is lower than the 46% reciprocal tariff announced on Liberation Day, it is still as announced higher than tariffs imposed pre Trump 2.0.

- In return, Vietnam seems to have committed to opening up its markets to US imports, with Trump’s social media post saying that there will be “total access” and “zero tariffs” by Vietnam including on Large Engine Vehicles.

- We think the details will matter greatly in gauging the macro and market impact beyond the headlines, in at least a couple of ways.

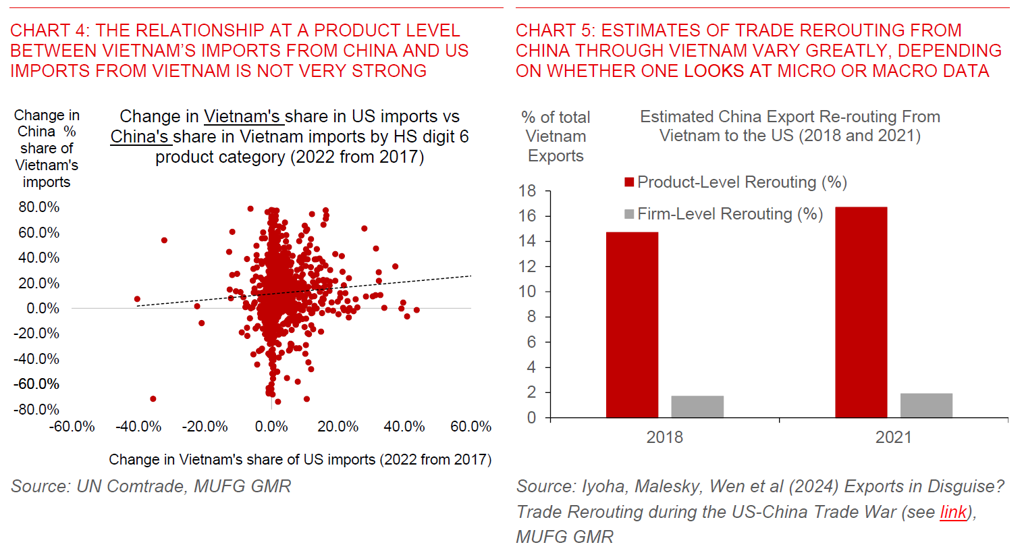

- First, how exactly “Transshipping” is defined and enforced for the stated 40% tariffs is a crucial question. We think the impact may be more limited if these 40% tariffs are enforced solely for the most egregious practices of plain diversion of trade to avoid US tariffs. In contrast, if there is a stricter determination of transshipment defined as a certain threshold of foreign value added, the impact of this 40% tariffs may be pronounced.

- Overall, we are inclined to think that plain diversion make up only a minority of Vietnam’s exports, as highlighted in our previous reports (see Vietnam: Reasons to remain optimistic). Our analysis showed only a relatively weak relationship at a product level between changes in Vietnam’s imports from China and US imports from Vietnam. Meanwhile, the academic literature estimating plain trade diversion from China through Vietnam is quite mixed, ranging anywhere from 2% to 16% of Vietnam’s total exports (and Iyoha, Malesky, Wen et al 2023 – Exports in Disguise link). The historical precedent on rules of origin including in a 2022 case regarding mountain bikes assembled in Vietnam also suggests that even a single component may suffice to determine origin in Vietnam, even when many inputs are foreign (see link here).

- The second key factor is whether there will be tariffs charged according to foreign content. This will be key to determining the average effective tariff rates for Vietnam, and as such the macro impact. Reporting by Bloomberg News just before Trump’s announcement suggested that tariffs will be scaled on Vietnam’s exports depending on the proportion of foreign content, with exports to the US containing the highest proportion of foreign components charged around 20% or above. Meanwhile, according to the news article, products containing a lower percentage of foreign components would face a slightly reduced rate, while those entirely from Vietnam would face the lowest rate potentially the universal 10% levy (for instance agriculture products).

- If this is true, the average effective rate imposed on Vietnam should fall below 20%, and is in line directionally with one scenario we envisioned in our recent report (see Vietnam: Risks to VND more balanced). To provide a sense, we estimated in our research that average tariffs on Vietnam would work out to around 16% assuming the US imposes 40% tariffs on Chinese-origin value added in aggregate while US imposes a 10% baseline tariffs on the rest of Vietnam’s exports. Of course again, how this works in practice and how to determine what is “Chinese” is also key here.

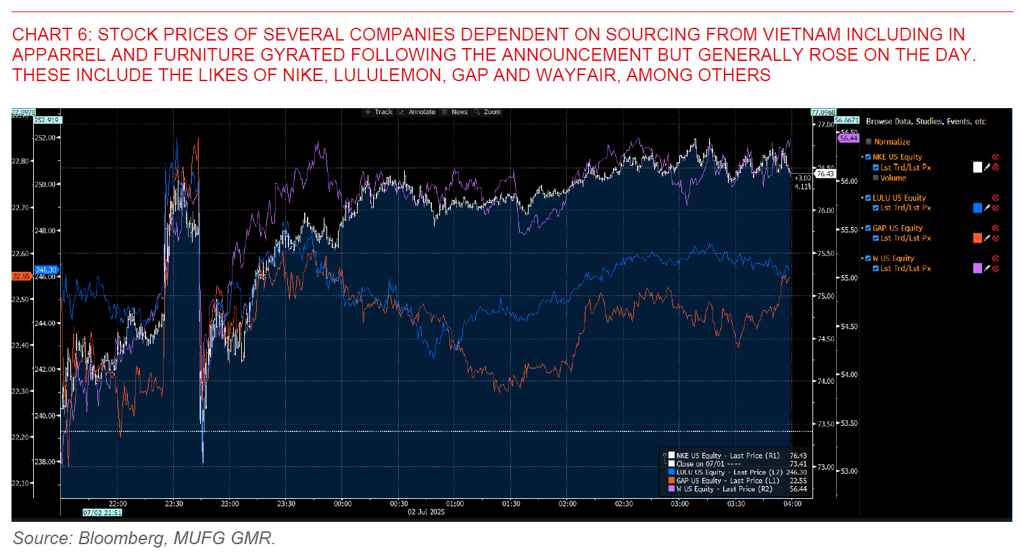

- The last important factor is whether tariffs will be determined based on products, and as such lower the effective tariff rates beyond the headline rate of 20%. News reports by Politico citing the draft statement said both the US and Vietnam will continue to work on a final deal that will result in a “substantial reduction” in US tariffs on Vietnam’s imports, with the tariff reductions applying to a wide range of Vietnamese imports including tech products, footwear, agricultural commodities, and consumer products including toys.

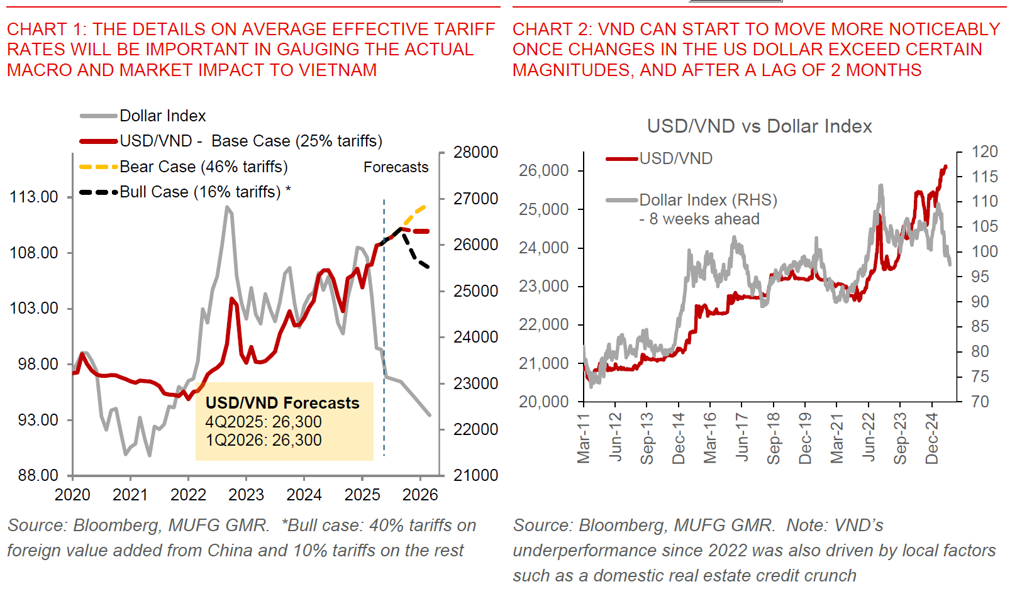

- Overall, while we continue to forecast USD/VND to rise, our key message to clients is that we think the risks are more balanced now certainly relative to the Liberation Day announcement when Vietnam received 46% reciprocal tariffs and the subsequent 90-day pause.

- We continue to forecast USD/VND rising to 26,300 by end-2025 (see Vietnam: Risks to VND more balanced), helped by our forecasts for further US dollar weakness and reduced left tail risks of a sharp global recession following the US-China tariff pause.

- A major uncertainty continues to be on our tariff assumptions in making our forecasts, even after the announcement by Trump. If the US-UK trade agreement is anything to go by, we may not get the full details for a while, with a framework agreement possibly only signed in a couple of weeks.

- We continue to see a good chance for VND to strengthen if average tariffs eventually fall firmly below 20% with a possible trade deal reached.

- There is also a related question on the read-through to trade deals and negotiations with other countries. We think that other countries would certainly want to get a lower rate than Vietnam if possible, while similarly we may only get sparse details come next week’s tariff deadline. Meanwhile, it is also important to gauge China’s response to these deals, and how China may perceive US’ targeting of Chinese value-added.