To read a full report, please download PDF

FOMC hike unlikely to deter USD weakness

FX View:

The US dollar has recovered modestly today after the DXY Index earlier hit an intra-day low, a level not seen in fact since April 2022. Retail sales data from the US revealed a decline in sales activity in March but the underlying measures fell by less than expected. At this moment, the OIS market implies close to a 90% probability of a rate hike on 3rd May. We do not believe a rate hike is necessary but based on the FOMC minutes, Fed official communications and the lack of any further top-tier data, we see the FOMC as more likely than not to hike. However, with that hike nearly fully priced, we do not expect a rate hike to lift the dollar notably. More likely perhaps will be a period of further modest depreciation or some consolidation at these weaker levels. With the US curve priced for nearly 60bps of easing by next January, the bias will remain for the dollar to weaken further

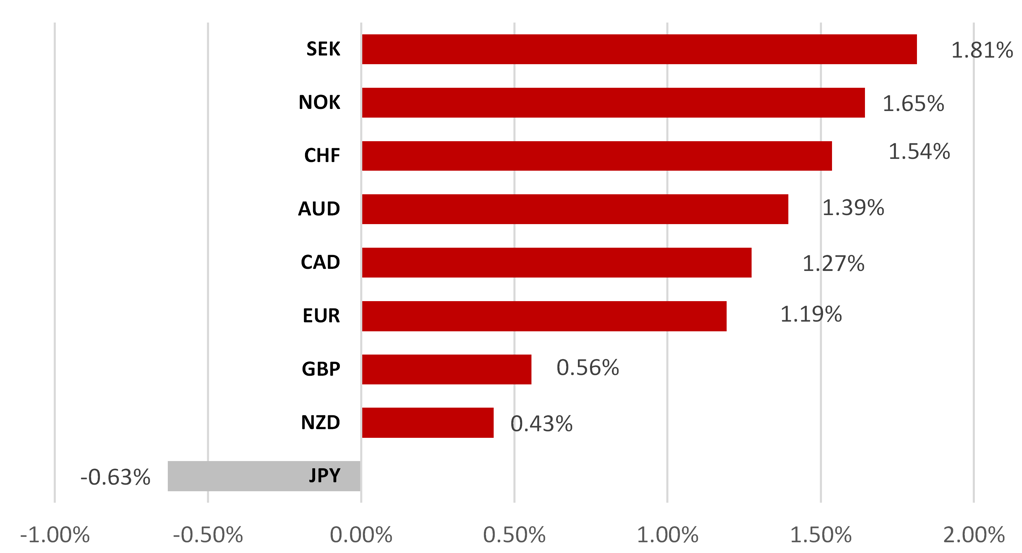

USD WEAKER ACROSS ALL OF G10 BAR JPY ONCE AGAIN

Source: Bloomberg, 14:00 GMT, 14th April 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a short USD/JPY trade idea, and adding a short USD/CAD trade idea based on recent developments we view as CAD supportive.

JPY Flows:

This week we analyse the monthly International Transactions in Securities for the month of March which revealed another large purchase of foreign bonds by Japanese investors. Most of the buying in February and March came from Japanese banks.

FOMC Sentiment:

Recent Fed minutes highlight a reduction in the net negative sentiment towards the macro environment in relation to previous months -39.19% (Feb 2023) to -24.16% (Mar 2023) from and a worsened sentiment towards US financial conditions following the US banking turmoil -7.063% (Feb 2023) to -2.439% (Mar 2023).

FX Views

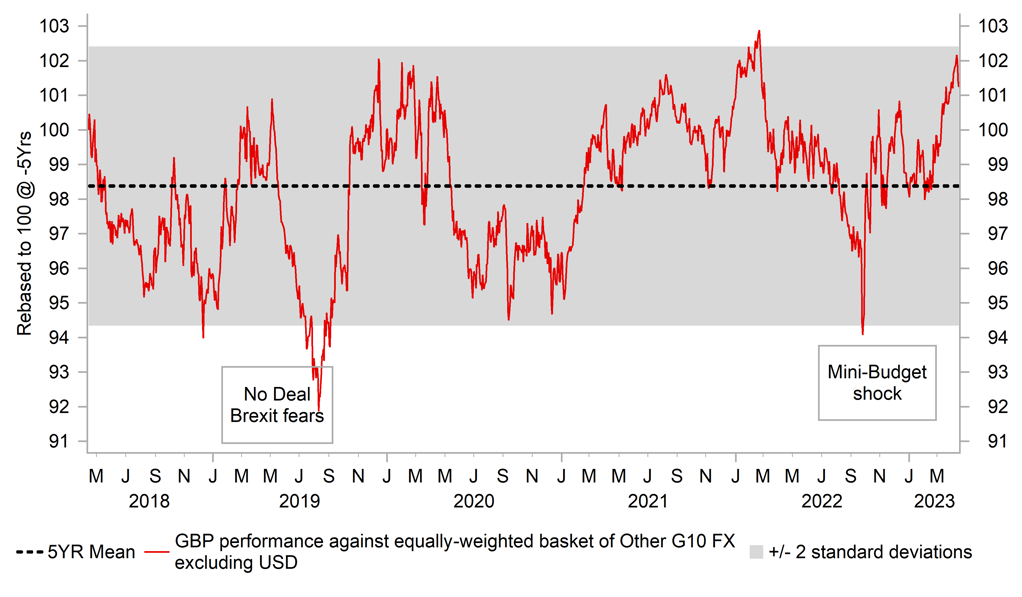

GBP: Can the pound continue to outperform?

We mentioned at the start of the year that we felt we had reached “peak pessimism” in relation to GBP sentiment and that is how we would explain the performance of the pound on a year-to-date basis. The pound is the second best performing G10 currency this year after just being surpassed by the Swiss franc. It is only marginally outperforming the euro though but is performing a lot better than the rest of G10. The gains feel to be a little more by default rather than for outright specific factors. The pound was the 3rd worst performing G10 currency in 2022 (-10.7% vs USD) and the mere fact that the political backdrop has improved from the turmoil in H2 last year is enough in itself to see some of the 2022 weakness reverse. But there are other factors that should help provide the pound with better support over the coming months although with the ECB set to hike for longer, gains will be more difficult versus EUR.

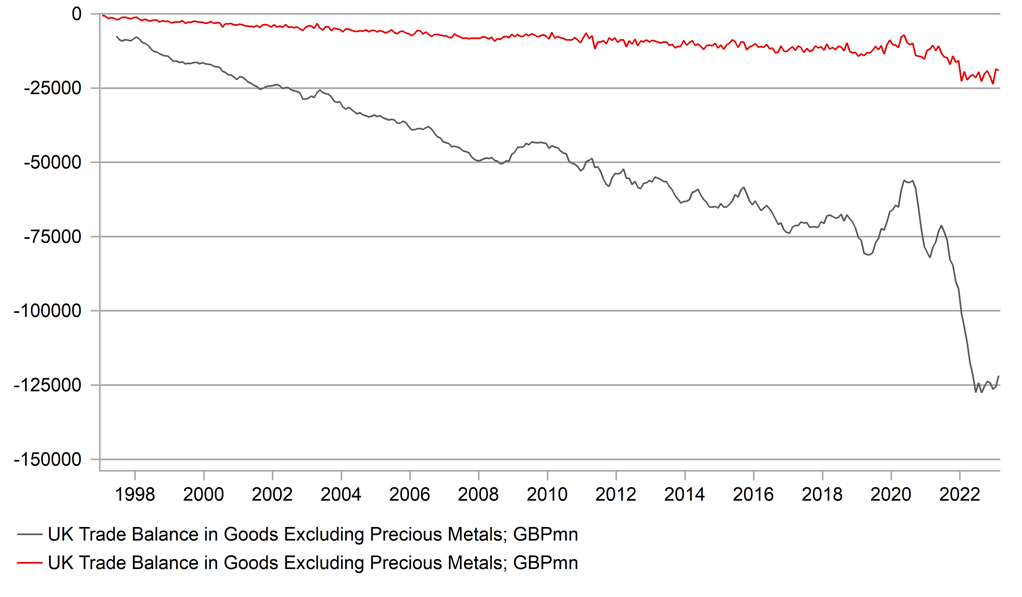

The UK’s external position has improved although the underlying trade balance remains problematic. The underlying trade balance (excluding precious metals) widened to GBP 63.9bn in Q4, which was only marginally smaller than the record deficit of GBP 64.4bn in Q1 2022. That was despite a notable improvement in the UK’s energy trade deficit due to a GBP 10bn decline in the value of imports, a 27% drop. The overall current account deficit in GDP terms fell from 4.2% in Q3 to 3.3% in Q4, the smallest deficit since Q4 2021. The problematic picture on the merchandise trade side of the current account is however being diluted by other areas. The UK recorded a record surplus in the trade of services of GBP 38.5bn and a record primary income surplus of GBP 9.8bn. The merchandise trade deficit should narrow further based on the movement of natural gas prices in Q1 2023.

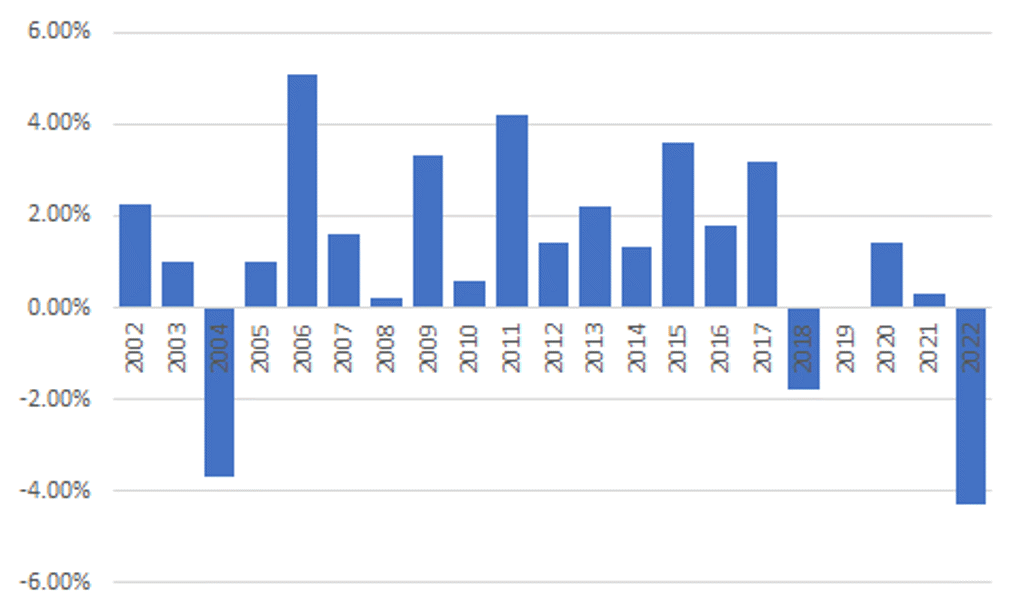

There are a number of known seasonal patterns that garner attention in the FX markets – the upward bias for EUR/USD in Dec followed by a clear downward bias in Jan-Feb is the best known. But in addition to that there has been a very clear upward bias for GBP/USD in the month of April. This was a very strong pattern between 2005 and 2017 when every year GBP/USD gained, sometimes significantly. The bias was in fact the same when analysed using the BoE GBP TWI highlighting the fact that this was GBP rather than USD specific. But as can be seen below, the bias has clearly faded since then. In the 5-year period from 2018, GBP/USD has fallen twice, significantly last year (-4.3%); was unchanged once and increased twice, once very modestly. The bias had been put down to a tendency for income payments to be made to UK shareholders at the start of the new tax year but the mixed performance in recent years means this is clearly not as reliable an indicator as before. The fact that GBP is already a top G10 performing currency could further undermine appetite for a ‘seasonal’ play in GBP.

UK GOODS DEFICIT REMAINS CLOSE TO RECORD

Source: Bloomberg, Macrobond & MUFG GMR

GBP/USD APRIL SEASONAL BIAS HAS DIMINISHED

Source: Bloomberg, Macrobond & MUFG GMR

It is clear that despite the performance of the pound, there remains an element of scepticism over the sustainability of this performance. Risk-Reversals indicate that the skew favouring puts is diminishing although puts remain favoured to calls. IMM positioning data also does not indicate confidence in the move. The Leveraged Funds sector has in fact been reducing net long GBP for four consecutive weeks to the smallest net long position since mid-December last year when positioning was marginally net short. However, there has been an overall bias favouring a reduction in longs of non-USD G10 over the last month perhaps reflecting the concerns over financial market conditions following the banking sector turmoil.

While the pound has performed well this year, data this week may have weighed on near-term performance. The pound is the 3rd worst performing G10 currency this week and the data yesterday looks to be weighing a little on GBP now, with EUR/GBP drifting higher. EUR/GBP is 0.7% higher this week with most of that gain coming since yesterday. The February GDP data was weaker than expected and growth is essentially flat-lining. That’s better than previously expected (back at the time of “peak pessimism”) but not good enough to fuel a market move. Next week will be crucial though for rates and FX. OIS pricing implies about an 80% probability of a 25bp hike in May. We see this, like with the Fed, as an unnecessary rate hike given the evidence of declining inflation pressures.

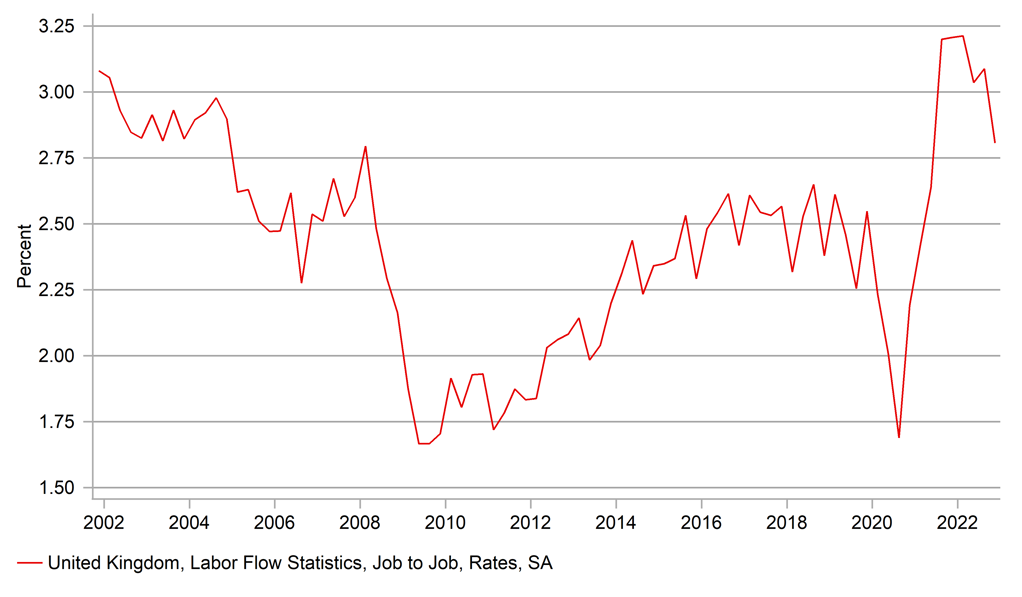

BoE Chief Economist Huw Pill gave a speech yesterday and it was clear listening to the speech that the May meeting decision will be a close call. The persistence of inflation is now the emphasis and hence the extent of decline in CPI in the data for March next week will be key. Pill did provide evidence that suggested better news lies ahead, but highlighted it as a hope more than expectation. He cited the declines in labour market churn, in the vacancy to unemployed ratio, in the REC pay survey data and in the 3mth/3mth annualised AWE data as suggesting wage pressures will ease.

The break in GBP/USD above the 1.2500 level which has coincided with the break higher in EUR/USD is significant technically and in circumstances of US dollar sentiment remaining unchanged, there is certainly scope for the move to extend higher, in particular given the lack of conviction behind the move evident in IMM positioning data. A weak set of data next week that changes expectations on a BoE rate hike on 11th May could well undermine GBP performance but that is more likely to be evident versus EUR than against the rest of G10 given many central banks have already moved to a pause and the curve in the US points to aggressive cuts by year-end.

UK LABOUR MARKEY “CHURN” IS RECEDING

Source: Bloomberg, Macrobond & MUFG GMR

GBP CLOSE TO MULTI-YEAR HIGH VS NON-USD G10

Source: Bloomberg, Macrobond & MUFG Research

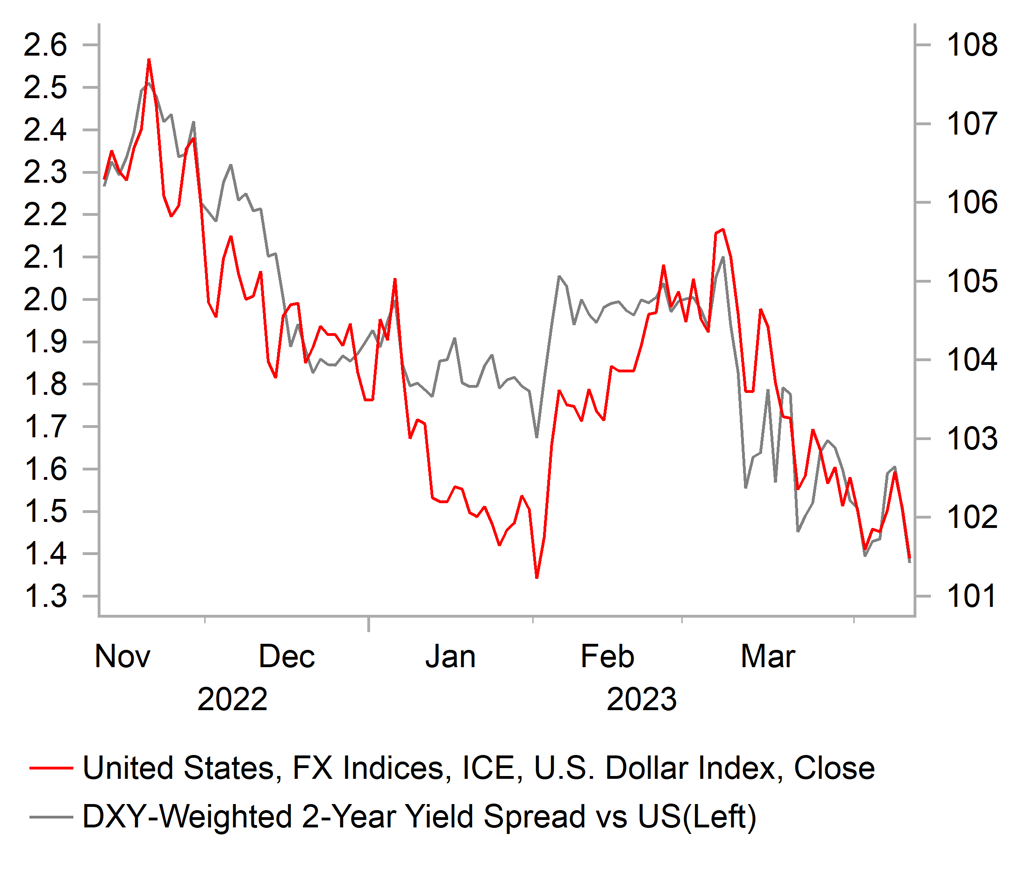

USD: Fears over impact of tighter credit conditions continue to weigh heavily

The USD weakened further this week and has resulted in the dollar index falling to a new intra-day low of the year, breaching the low from 2nd February to reach 100.78. It has brought the decline for the dollar index since the intra-day high on 8th March closer to 5%. The collapse of the Silicon Valley Bank and the subsequent loss of confidence in other US regional banks has proven to be an important bearish turning point for the USD. It is poised to extend its decline further with important support levels in the process of being challenged. In recent days there have been a number of bearish technical developments including: i) EUR/USD has broken above the year to date high from 2nd February at 1.1033 and has reached its highest level in just over a year, ii) USD/CHF has fallen even more sharply to its lowest level the start of 2021 after breaking below the 0.9000-level, and iii) USD/CAD has fallen below support for the 200-day moving average at around 1.3400 for the first time since the summer of last year. The only G10 currency that has failed to extend its rebound against the USD over the past week has been the JPY. The dovish communication (click here) from new Governor Ueda earlier this week has pushed back against expectations for the BoJ to adjust YCC settings as soon as this month delivering a temporary setback for the JPY.

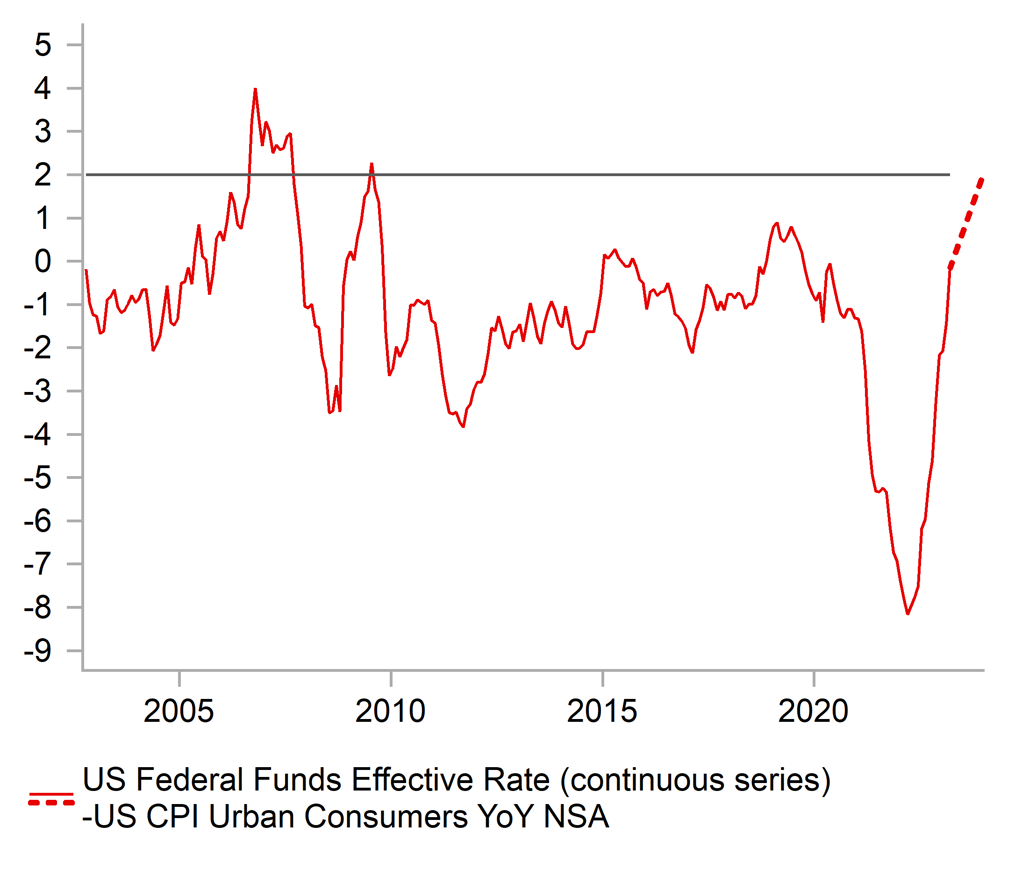

The USD’s bearish momentum has been reinforced in recent days by economic data releases that have supported expectations for a sharper slowdown in both US growth and inflation. The NFIB small business survey signalled that credit conditions are tightening with the sub-component for the availability of loans falling sharply to its lowest level since 2012. The release of the minutes from the last FOMC meeting on 22nd March revealed the Fed staff were already anticipating a mild US recession later this year triggered by the tightening in credit conditions. At the same there has been further encouragement that inflation pressures continue to ease (click here). Recent developments give us more confidence that inflation will fall back towards 3.0% by year end. With the Fed’s policy rate already close to 5.0%, a further sharp fall in inflation would lift the real policy rate into more restrictive territory just when the economy is expected to be slowing more sharply. The real policy rate has only been briefly above 2.0% over the last twenty years and that was just before the Global Financial Crisis. The developments should give the Fed more confidence that it has already delivered sufficient rate hikes and can now pause its hiking cycle.

In these circumstances, we believe that risks remain titled to the downside for the USD. In our latest monthly FX Outlook report, we doubled down on our bearish USD outlook for this year and now expect it to fall to deeper lows. A break above the 1.1000 level opens up the door for EUR/USD to move towards our updated forecast of 1.1500.

In these circumstances, we believe that risks remain titled to the downside for the USD. In our latest monthly FX Outlook report, we doubled down on our bearish USD outlook for this year and now expect it to fall to deeper lows. A break above the 1.1000 level opens up the door for EUR/USD to move towards our updated forecast of 1.1500.

YIELD SPREADS CONTINUE TO MOVE AGAINST USD

Source: Bloomberg, Macrobond & MUFG

FED REAL POLICY RATE SET TO BECOME RESTRICTIVE

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

04/17/2023 |

13:30 |

Empire Manufacturing |

Apr |

- 16.5 |

-24.6 |

!! |

|

US |

04/17/2023 |

15:00 |

NAHB Housing Market Index |

Apr |

44.0 |

44.0 |

!! |

|

AU |

04/18/2023 |

02:30 |

RBA Minutes of April Policy Meeting |

!!! |

|||

|

CH |

04/18/2023 |

03:00 |

GDP YoY |

1Q |

3.8% |

2.9% |

!!! |

|

UK |

04/18/2023 |

07:00 |

Employment Change 3M/3M |

Feb |

-- |

65k |

!!! |

|

GE |

04/18/2023 |

10:00 |

ZEW Survey Expectations |

Apr |

-- |

13.0 |

!! |

|

EC |

04/18/2023 |

10:00 |

Trade Balance SA |

Feb |

-- |

-11.3b |

!! |

|

US |

04/18/2023 |

13:30 |

Building Permits |

Mar |

1460k |

1524k |

!! |

|

CA |

04/18/2023 |

13:30 |

CPI YoY |

Mar |

-- |

5.2% |

!!! |

|

US |

04/18/2023 |

13:30 |

Housing Starts |

Mar |

1405k |

1450k |

!! |

|

UK |

04/19/2023 |

07:00 |

CPI YoY |

Mar |

-- |

10.4% |

!!! |

|

EC |

04/19/2023 |

09:00 |

ECB Current Account SA |

Feb |

-- |

17.1b |

!! |

|

EC |

04/19/2023 |

10:00 |

CPI YoY |

Mar F |

-- |

6.9% |

!!! |

|

EC |

04/19/2023 |

10:00 |

Construction Output MoM |

Feb |

-- |

3.9% |

!! |

|

EC |

04/19/2023 |

17:00 |

ECB's Schnabel Speaks |

!! |

|||

|

US |

04/19/2023 |

19:00 |

Federal Reserve Releases Beige Book |

!! |

|||

|

NZ |

04/19/2023 |

23:45 |

CPI YoY |

1Q |

-- |

7.2% |

!!! |

|

JN |

04/20/2023 |

00:50 |

Trade Balance |

Mar |

-¥1240.8b |

-¥897.7b |

!! |

|

EC |

04/20/2023 |

12:30 |

ECB March Meeting Account |

!! |

|||

|

US |

04/20/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

US |

04/20/2023 |

15:00 |

Existing Home Sales |

Mar |

4.50m |

4.58m |

!! |

|

JN |

04/21/2023 |

00:30 |

Natl CPI YoY |

Mar |

3.2% |

3.3% |

!!! |

|

UK |

04/21/2023 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Mar |

-- |

1.2% |

!!! |

|

EC |

04/21/2023 |

09:00 |

S&P Global Eurozone Manufacturing PMI |

Apr P |

-- |

47.3 |

!!! |

|

EC |

04/21/2023 |

09:00 |

S&P Global Eurozone Services PMI |

Apr P |

-- |

55.0 |

!!! |

|

UK |

04/21/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Apr P |

-- |

47.9 |

!!! |

|

UK |

04/21/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

Apr P |

-- |

52.9 |

!!! |

|

CA |

04/21/2023 |

13:30 |

Retail Sales MoM |

Feb |

-- |

1.4% |

!! |

|

US |

04/21/2023 |

14:45 |

S&P Global US Manufacturing PMI |

Apr P |

49.3 |

49.2 |

!! |

|

US |

04/21/2023 |

14:45 |

S&P Global US Services PMI |

Apr P |

51.5 |

52.6 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main economic data release at the start of next week will be the latest GDP report from China. The report is expected to provide confirmation that China’s economy is rebounding at the start of this year as it reopens more fully. The current consensus forecast on Bloomberg is for China’s GDP to expand by 5.3% this year up from just 3.0% last year. Market participants will also be assessing whether upward growth momentum was strengthening heading into Q2.

- The release of the latest CPI reports from Canada, the UK, the euro-zone, New Zealand and Japan will also be in focus in the week ahead. The reports will provide further insights into how quickly inflation is slowing which is important in determining how much further the BoE, ECB and RBNZ will keep hiking rates. We remain of the view that all three central banks are moving closer to pausing their hiking cycles although there appears more room to for the ECB to keep hiking for longer.

- The release of the latest PMI surveys from Europe and the US in the week ahead will attract more attention as market participants continue to weigh up the scale of the dampening impact on growth from the recent loss of confidence in the banking system. The US rates market in particular has moved to price in a much higher risk of sharper slowdown/recession in the US driven by tighter credit conditions.