Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

KHANG SEK LEE

Associate

Global Markets Research

Global Markets Division for Asia

E: khangsek_lee@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

SOOJIN KIM

Analyst, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

June 2025

KEY EVENTS IN THE MONTH AHEAD

1) US TRADE & ECONOMIC POLICIES

The US dollar was close to unchanged in May, down a mere 0.1% (DXY basis) but that consolidation of the dollar followed a 7.6% drop over March and April and the lack of rebound in May underlines the ongoing poor investor sentiment toward the dollar. At the root of the problem are a number of factors including the flip-flopping on trade tariff polices that is creating ongoing uncertainty that will likely impair economic growth as companies and households delay decision-making. Admittedly that isn’t entirely clear from the incoming economic data and equity investor sentiment remains positive with the S&P 500 up 22% from the intra-day low after the reciprocal tariff announcement in early April to the closing level at the end of May. But the renewed accusations by both the US and China over keeping to the terms of the de-escalation deal reached in Geneva on 12th May points to the potential for renewed trade conflicts in June. A call between President Trump and Xi looks like being required although we have no date confirmed for that. The doubling of the steel & aluminium tariffs to 50% will go live on 4th June which will likely spark retaliations. Separately, the ‘Big Beautiful Bill’ is now with the Senate with the markets expecting some changes given the opposition of certain Senators already expressed. But the essence of the bill adding to the US debt profile will only reinforce the risks to the long-end of the yield curve, with the potential to add to US dollar negative sentiment. The aim remains to have the bill on President Trump’s desk on 4th July for signing. We continue to expect broad US dollar depreciation ahead.

2) ACTIVE MONTH FOR CENTRAL BANKS

June always is a busy month for central banks ahead of the quieter summer period through July and August. Eight of the ten G10 central banks will meet this month starting with the BoC and ECB in the first week. We fully expect, along with the market, for the ECB to cut a further 25bps, taking the policy rate to the deemed 2.0% neutral rate. There is a high likelihood of the SNB also cutting by 25bps, which is fully priced, taking the policy rate back to zero percent. Moving back into negative rates is also partially priced. A cut by the Riksbank is priced at 50-50 while the other central banks, including the Federal Reserve are expected to keep their policy rates unchanged.

3) “A BIT STALLED US-CHINA TALKS” MAY REQUIRE A CALL BETWEEN PRESIDENTS

Lately, the US administration decided to target Chinese students and revoke some Chinese student’s visa, and US has reportedly ordered companies that offer software used to design semiconductors to obtain an export license prior to selling to China. These developments indicate that tariff negotiations between US and China are fraught with difficulties, and could ultimately require a call between Presidents of both countries to break the deadlock.

Forecast rates against the US dollar - End-Q2 2025 to End-Q1 2026

|

Spot close 30.05.25 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

JPY |

144.10 |

144.00 |

142.00 |

140.00 |

138.00 |

|

EUR |

1.1351 |

1.1200 |

1.1500 |

1.1800 |

1.2000 |

|

GBP |

1.3477 |

1.3330 |

1.3530 |

1.3640 |

1.3790 |

|

CNY |

7.1975 |

7.2000 |

7.2500 |

7.3000 |

7.3000 |

|

AUD |

0.6434 |

0.6300 |

0.6400 |

0.6500 |

0.6600 |

|

NZD |

0.5971 |

0.5800 |

0.5900 |

0.6000 |

0.6200 |

|

CAD |

1.3744 |

1.3800 |

1.3700 |

1.3500 |

1.3400 |

|

NOK |

10.211 |

10.357 |

10.174 |

9.8310 |

9.5830 |

|

SEK |

9.5868 |

9.7320 |

9.3910 |

9.0680 |

8.9170 |

|

CHF |

0.8221 |

0.8300 |

0.8170 |

0.8050 |

0.7920 |

|

|

|

|

|

|

|

|

CZK |

21.966 |

22.230 |

21.570 |

20.930 |

20.500 |

|

HUF |

355.87 |

361.60 |

356.50 |

351.70 |

345.80 |

|

PLN |

3.7438 |

3.7950 |

3.6960 |

3.6440 |

3.5830 |

|

RON |

4.4560 |

4.5180 |

4.4170 |

4.3220 |

4.2670 |

|

RUB |

78.350 |

80.650 |

80.560 |

80.480 |

82.570 |

|

ZAR |

18.030 |

18.000 |

17.750 |

17.500 |

17.250 |

|

TRY |

39.235 |

40.000 |

42.500 |

45.000 |

47.000 |

|

|

|

|

|

|

|

|

INR |

85.573 |

85.000 |

84.500 |

84.000 |

83.500 |

|

IDR |

16320 |

16350 |

16410 |

16300 |

16100 |

|

MYR |

4.2530 |

4.2000 |

4.2300 |

4.1900 |

4.1500 |

|

PHP |

55.730 |

55.600 |

55.000 |

54.500 |

54.500 |

|

SGD |

1.2897 |

1.3000 |

1.3150 |

1.3350 |

1.3200 |

|

KRW |

1379.4 |

1375.0 |

1390.0 |

1390.0 |

1400.0 |

|

TWD |

29.866 |

30.000 |

30.500 |

30.300 |

30.100 |

|

THB |

32.807 |

32.900 |

33.200 |

33.500 |

33.100 |

|

VND |

26019 |

26200 |

26300 |

26300 |

26300 |

|

|

|

|

|

|

|

|

ARS |

1200.5 |

1225.0 |

1275.0 |

1325.0 |

1400.0 |

|

BRL |

5.7217 |

5.7000 |

5.7000 |

5.8000 |

5.8000 |

|

CLP |

942.50 |

950.00 |

960.00 |

970.00 |

980.00 |

|

MXN |

19.409 |

19.750 |

19.500 |

19.250 |

19.250 |

|

|

|||||

|

SAR |

3.7513 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

49.695 |

50.800 |

51.000 |

51.200 |

51.400 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 30.05.25 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

USD/JPY |

144.10 |

144.00 |

142.00 |

140.00 |

138.00 |

|

EUR/USD |

1.1351 |

1.1200 |

1.1500 |

1.1800 |

1.2000 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

135.00-150.00 |

133.00-148.00 |

131.00-146.00 |

129.00-144.00 |

|

|

EUR/USD |

1.0800-1.1700 |

1.1000-1.1900 |

1.1200-1.2100 |

1.1300-1.2200 |

MARKET UPDATE

In May the US dollar weakened marginally against the euro in terms of London closing rates, from 1.1325 to 1.1351. However, the dollar strengthened against the yen, from 142.85 to 144.10. The FOMC at its meeting in May maintained the range for the federal funds rate at 4.25% to 4.50%, the level reached following 100bps of cuts last year. The FOMC is reducing its securities holdings with the pace of QT via the cap of UST bonds allowed to roll off the balance sheet now at just USD 5bn. The pace of reduction in the holdings of MBS is running at around USD 15bn per month.

OUTLOOK

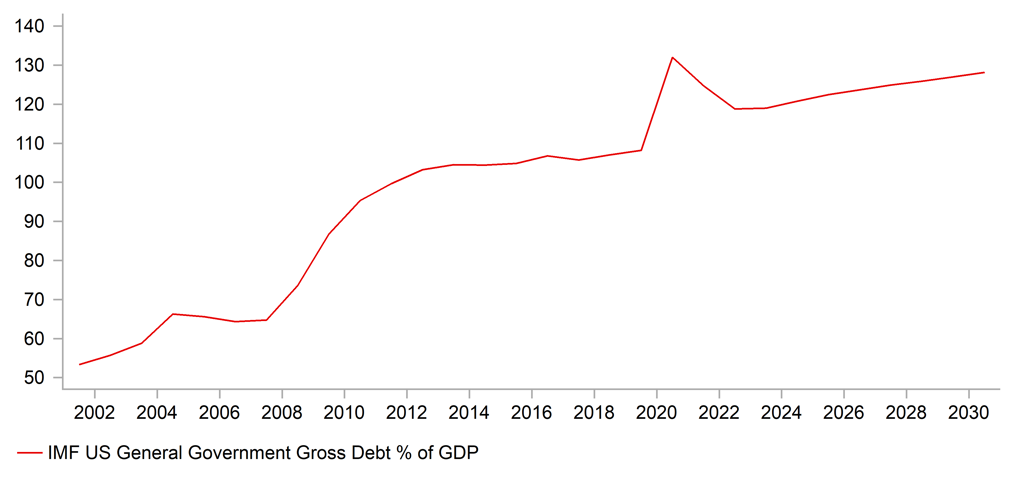

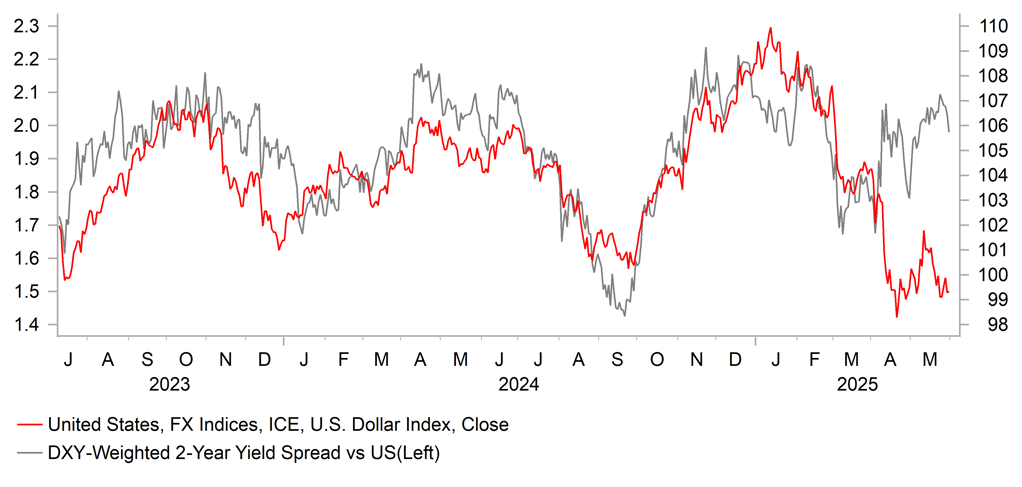

After a sharp drop of 7.6% (DXY) in March and April, the dollar was more stable in May and on a DXY basis was close to unchanged, with dollar sentiment remaining poor. The near-term horizon remains uncertain and hence we see limited scope for any notable improvement in sentiment. Moody’s downgraded its US sovereign rating, which wasn’t a big surprise but certainly reinforced concerns over the outlook for the US deficit. President Trump’s ‘Big Beautiful Bill’ is set to add approximately USD 3.5trn to US debt over a 10yr period and Section 899 of the bill allows for the taxing of income received by foreign investors on their US portfolio assets. The tax would be retaliatory on investors in countries with ‘discriminatory’ taxes on US entities like the digital services tax. Such a tax, if ever implemented, would be hugely damaging to confidence and investors’ appetite for US securities. The Court of International Trade’s ruling that reciprocal tariffs under IEEPA was illegal has created further uncertainties after a court of appeal granted a stay until the case is heard by the Supreme Court. Whichever way this goes it will not halt Trump’s trade strategy and could simply just cause more disruptive, unpredictable actions that undermine investor confidence even further. Lost revenues if the ruling is confirmed would further undermine investor concerns over the tax bill and long-term debt sustainability.

The FOMC minutes for the May meeting revealed that Fed staff believe the chance of a recession is now “nearly as high” as the baseline assumption of no recession. Still, despite that, the FOMC continues to signal caution on cutting rates which has fuelled further criticism from President Trump. Continuing claims in May hit a new high not seen since November 2021 suggesting new claimants are finding it more difficult to find new employment. A cut by July remains feasible and we see the delay in cutting as likely leading to the Fed doing more. We now see the FOMC cutting by 100bps in the second half of the year – a key assumption in this view is that the labour market will soon show clearer signs of deterioration.

The dollar is consolidating and as we move into the second half of the year we see renewed trade policy turmoil, a clearer weakening of the labour market and a shift from the Fed to more dovish communications. That will be the catalyst for further dollar depreciation in H2 2025 and into 2026.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

Policy Rate |

4.33% |

4.33% |

3.88% |

3.38% |

3.38% |

|

3-Month T-Bill |

4.33% |

4.13% |

3.63% |

3.38% |

3.38% |

|

10-Year Yield |

4.40% |

4.25% |

4.38% |

4.25% |

4.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

We believe the longer the Fed waits, the more they are passively tightening conditions, yet as with all things, it’s not what they should do but what they will do. So, we have pushed back our next cut to July (from June) but increased the total amount of 25bp cuts to 4 in 2025.

We still believe that the neutral rate is somewhere in the range of 3.00-3.50%, where the longer the Fed waits, the more they need to do. If the Fed delievers on our cuts for 2025, they likely go on a more permanent hold at the neutral rate. However if we are wrong and they postpone cuts and allow weakness to set in, they may need to catch up and deliver 50bp cuts at some point later on. For now, the bond market is under pressure due to fiscal and foreign capital outflow fears. However, if the Fed has another policy error by waiting too long, the bond market will sniff that out as the economy weakens, and rates will start to rally over the course of the summer (especially in the front-end). Given that we have had a bull/bear steepener stance since post-election, we only made minor tweaks to our long-term forecasts (see link) and continue to advocate buying dips in 2s while expecting the backend of the curve to lag in any front-end rally due to inflationary/debt dynamic concerns.

(George Goncalves)

IMF US GOVT. GROSS DEBT (% GDP)

Source: Bloomberg, Macrobond

ICE DOLLAR INDEX VS. DXY WEIGHTED 2YR YIELD SPREAD

Source: Bloomberg, Macrobond

Japanese yen

|

Spot close 30.05.25 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

USD/JPY |

144.10 |

144.00 |

142.00 |

140.00 |

138.00 |

|

EUR/JPY |

163.57 |

161.30 |

163.30 |

165.20 |

165.60 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

135.00-150.00 |

133.00-148.00 |

131.00-146.00 |

129.00-144.00 |

|

|

EUR/JPY |

154.00-168.00 |

155.00-170.00 |

156.00-171.00 |

156.50-171.50 |

MARKET UPDATE

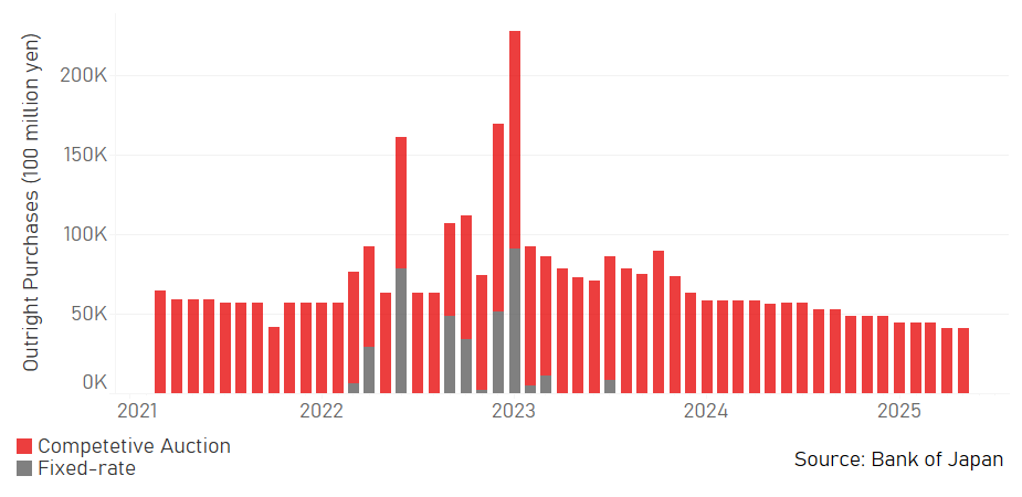

In May the yen weakened versus the US dollar in terms of London closing rates from 142.85 to 144.10. In addition, the yen weakened versus the euro from 161.78 to 163.57. The BoJ at its meeting in May maintained the key policy rate at 0.50%, following the 25bp hike in January, the first 25bp rate hike since before the GFC in 2007. The BoJ is also continuing with the policy of cutting JGB purchases that was announced last July with monthly purchases cut by JPY 400bn each quarter, resulting in the BoJ’s balance sheet set to decline by 7-8% by Q1 2026.

OUTLOOK

The yen was the worst performing G10 currency in May with the main period of sell-off triggered by the announced de-escalation of the US-China trade conflict on 12th May. The decision prompted a pick-up in risk appetite and modestly higher yields. The yen strengthened again before weakening with the back-and-forth on trade policy playing its part. Ultimately though we remain yen bullish and see the global backdrop as consistent with a continued gradual decline in USD/JPY. We can’t be sure, but the weakening of the yen toward month-end could have been fuelled in part by the announced deal for Nippon Steel to purchase US Steel Corp following agreement with the Trump administration to incorporate a “golden share” giving the US government some control. The deal is a USD 14.1bn cash purchase with a possible further USD 14bn of investment. The initial purchase amount equates to around JPY 2trn of yen selling that may have helped support USD/JPY.

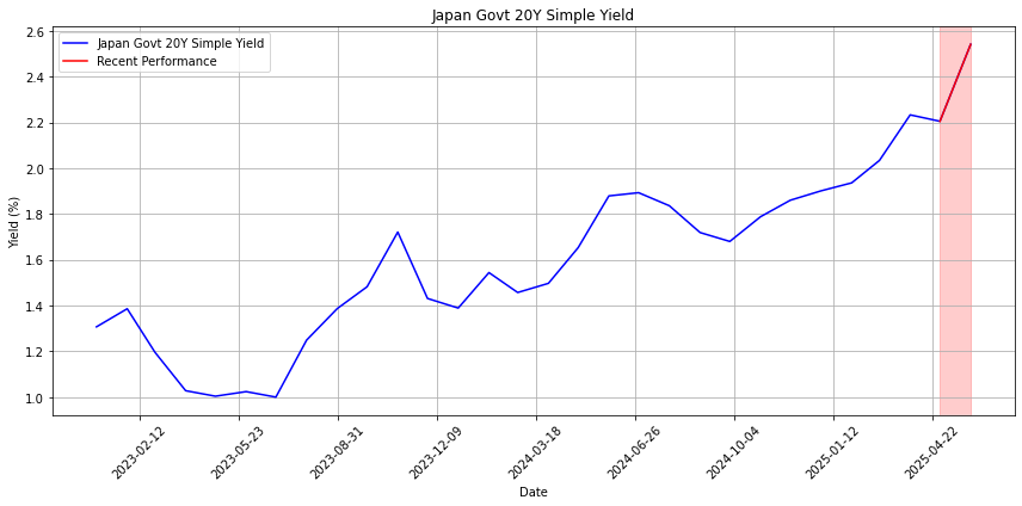

Another key influence for the yen in May and potentially going forward was the volatility in super-long JGB yields. The 30-year JGB yield initially surged 50bps in May but then reversed sharply when the MoF sought feedback by market participants on issuance plans. The 30-year yield dropped sharply although still closed 26bps higher in May. Flow data highlights record JGB super-long selling by Japan banks and Lifers in the 3mths to April but this was offset by record buying by foreign investors. However, weekly data points to foreigners turning to selling in May that could have been a key factor in the sell-off. Renewed instability in JGBs could potentially influence the monetary policy stance of the BoJ. It may persuade the BoJ to slow the pace of passive QT now under way – a review takes place in June. In addition, it could persuade the BoJ to shift its communication to more dovish that could eliminate pricing for further hikes. However, there is also a strong argument that the BoJ will want to be seen to act tough against the inflation threat in order to avoid any renewed notable sell-off of the yen. That is our current expectation and we do not expect JGB volatility to prompt a shift in BoJ policy.

Trade conflict de-escalation is not in our view reason to alter our forecasts for yen strength ahead. Uncertainties are set to persist while we expect the US economy to slow and for global central bank policy rates to go further lower. Even a modest shift away from US portfolio investments would reinforce USD/JPY downside pressure.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

Policy Rate |

0.50% |

0.50% |

0.75% |

0.75% |

1.00% |

|

3-Month Bill |

0.40% |

0.50% |

0.70% |

0.80% |

0.90% |

|

10-Year Yield |

1.50% |

1.50% |

1.60% |

1.70% |

1.80% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield jumped notably in May, by 18bps to close at 1.50%. There were a number of factors but there was certainly an influence from abroad with the Moodys downgrade of its US sovereign credit rating one factor that sparked a jump in US yields that had a global impact. A contraction in Q1 real GDP in Japan prompted calls from some LDP members for renewed fiscal stimulus. This prompted investor concerns over increased JGB supply which reinforced selling. PM Ishiba has ruled out any deficit-financed government spending. The BoJ at the end of March had also announced a cut to super-long JGB monthly purchases in Q2 (from JPY 450bn to JPY 405bn) which undermined sentiment in the long-end. We doubt the BoJ will actively get involved in curtailing longer-term yields with MoF action through tweaking issuance plans more likely. The BoJ may well see the best course of action being keeping its strong message of hiking further if the economy evolves as expected. That will keep the yen from weakening again and help curtail inflation expectations and hence longer-term yields. We expect a modest rise in 10yr yields.

JAPAN 20-YEAR GOVERNMENT BOND YIELD, %

Source: Bloomberg, Macrobond

BOJ OUTRIGHT PURCHASES OF JGBS

Euro

|

Spot close 30.05.25 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

EUR/USD |

1.1351 |

1.1200 |

1.1500 |

1.1800 |

1.2000 |

|

EUR/JPY |

163.57 |

161.30 |

163.30 |

165.20 |

165.60 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0800-1.1700 |

1.1000-1.1900 |

1.1200-1.2100 |

1.1300-1.2200 |

|

|

EUR/JPY |

154.00-168.00 |

155.00-170.00 |

156.00-171.00 |

156.50-171.50 |

MARKET UPDATE

In May the euro strengthened marginally versus the US dollar in terms of London closing rates, moving from 1.1325 to 1.1351. The ECB did not meet in May and hence the key policy rate remained at 2.25%, following 175bp of cuts since last year. The ECB is running down APP securities and started PEPP run-off in July last year with about EUR 425bn of securities estimated to roll off the balance sheet in 2025.

OUTLOOK

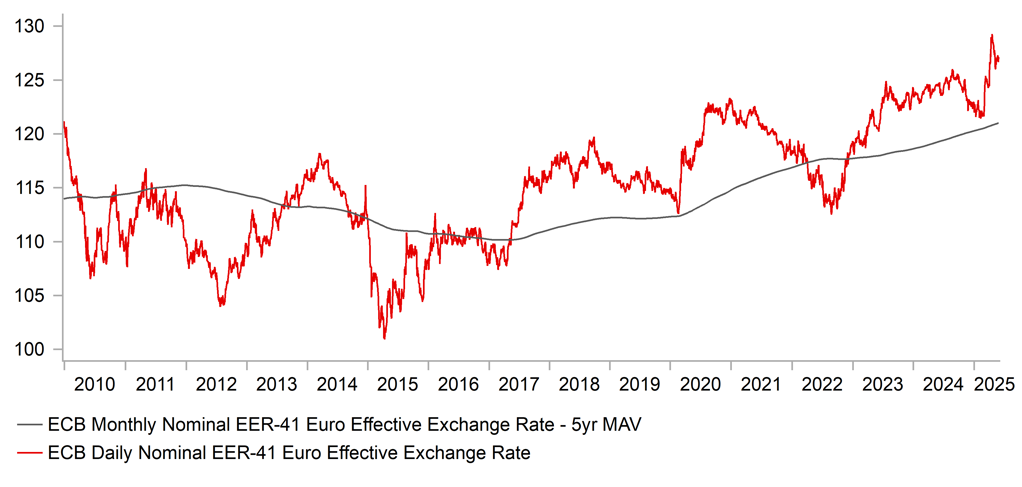

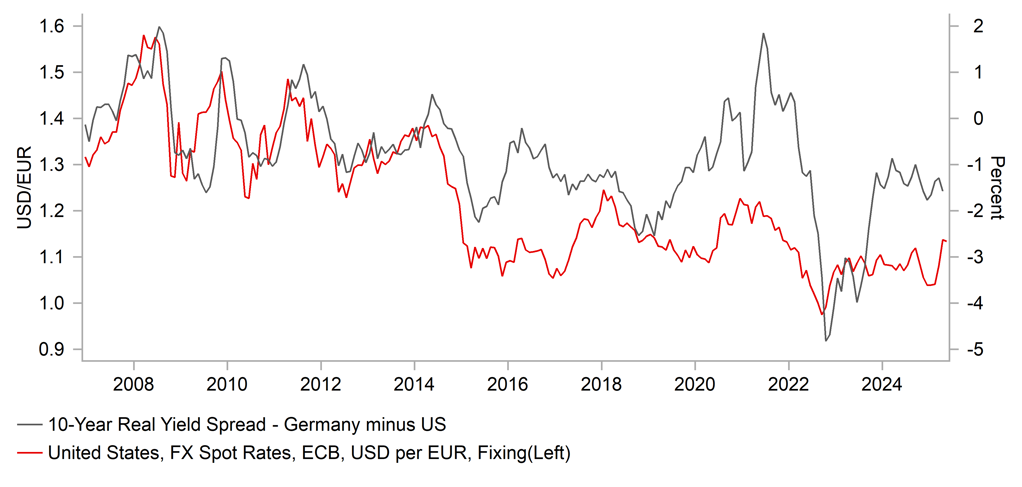

The euro initially weakened in May and hit the low-point of the month on the day of the announcement of a de-escalation in the US-China trade conflict on 12th May. But the de-escalation did not benefit the US dollar for long and EUR/USD rebounded. Some of the movement in EUR/USD certainly reflected the commonly cited fact that the euro is the “anti-dollar” but overall was there some EUR underperformance in May. The EUR EER-41 index fell 0.9% and EUR was the second worst performing G10 currency in May. We believe that in part is a mere reflection of the scale of the move in March/April when EUR/USD advanced 9.2%. But increased uncertainty over the outlook for growth in the euro-zone was an influence as well given President Trump is now threatening a 50% tariff in the EU due to his frustrations with a lack of progress in trade negotiations. Progress is reportedly now taking place but that uncertainty will likely persist ahead of the reciprocal suspension expiry date of 9th July. While yield spreads have been less influential of late, the 2-year swap spread moved nearly 30bps in favour of the US which likely played a role in EUR underperformance.

A stronger euro and lower energy prices likely provide plenty of scope for the ECB to cut rates at its meeting on 5th June. The EUR EER-41 is 4% stronger than the ECB assumed in projections in March and Brent crude oil closed USD 10 p/bl lower than level assumed in March. We still see scope for the ECB to cut three times by year-end which is not fully priced but equally we see the FOMC doing more as well – so see little negative repercussions for the euro. Indeed, the euro in our view looks set for potentially taking on a greater reserve currency role and ECB President Lagarde in a speech in May described the current period as a “window of opportunity” for Europe to grasp that role, which would see reserve managers who move away from the US dollar switching to the euro. We see euro as best placed for this. The EUR composition in global reserves peaked at 28% in 2009 so there is no reason why composition can’t increase from the current 19.8%. The end of negative rates could mark the start of better conditions after the GFC, the EZ debt crisis and negative rates saw EUR reserve compositions continually decline.

After a gain of over 9% in April and May, the euro is set for a period of consolidation. While we still expect the EU to be hit with a higher tariff rate (we assume 20%) we doubt that will translate into a lower euro. A larger 50% tariff increase could see the euro underperform to some degree the forecasts above.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

Policy Rate |

2.25% |

2.00% |

1.75% |

1.50% |

1.50% |

|

3-Month Bill |

2.00% |

1.95% |

1.70% |

1.50% |

1.55% |

|

10-Year Yield |

2.50% |

2.40% |

2.30% |

2.50% |

2.65% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year bund yield increased in May, by 6bps to close at 2.50%. Bunds outperformed UST bonds in May as debt sustainability and inflation risks are seen as much lower in Germany. If we are correct and global investors increase their appetite for the euro, this outperformance of German bunds could continue. Still, we suspect that outperformance would be more evident when yields are rising. If UST bond yields decline (due to weaker growth) bund yields may decline by less if the US move relates to weaker US growth. Given the large US trade deficit with the euro-zone it seems more likely than not that the 20% rate will go live in July and hence some degree of retaliation against the US is likely. Most ECB officials seem to view the tariff uncertainty as disinflationary and with growth set to remain weak and with China and Asia goods potentially set to boost supply into the euro-zone, we see the ECB delivering further easing. Last month we added an additional 50bps of easing for this year. The risk to this view is that retaliation from the EU is more aggressive than expected, leading to greater ECB caution. Still, based on our view and modest declines in UST yields, we expect only a modest rise in bund yields.

EUR EER-41 INDEX VS. MAVG

Source: Bloomberg, Macrobond

EUR/USD VS. LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond

Pound Sterling

|

Spot close 30.05.25 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

EUR/GBP |

0.8422 |

0.8400 |

0.8500 |

0.8650 |

0.8700 |

|

GBP/USD |

1.3477 |

1.3330 |

1.3530 |

1.3640 |

1.3790 |

|

GBP/JPY |

194.20 |

192.00 |

192.10 |

191.00 |

190.30 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2900-1.3850 |

1.2950-1.3900 |

1.2950-1.3950 |

1.3000-1.4100 |

MARKET UPDATE

In May the pound strengthened further against the US dollar in terms of London closing rates from 1.3330 to 1.3477. In addition, the pound strengthened against the euro from 0.8496 to 0.8422. The MPC, at its meeting in May, cut the key policy rate by 25bps to 4.25% which followed three previous 25bp cuts – in February and August of this year, and November of last year.

OUTLOOK

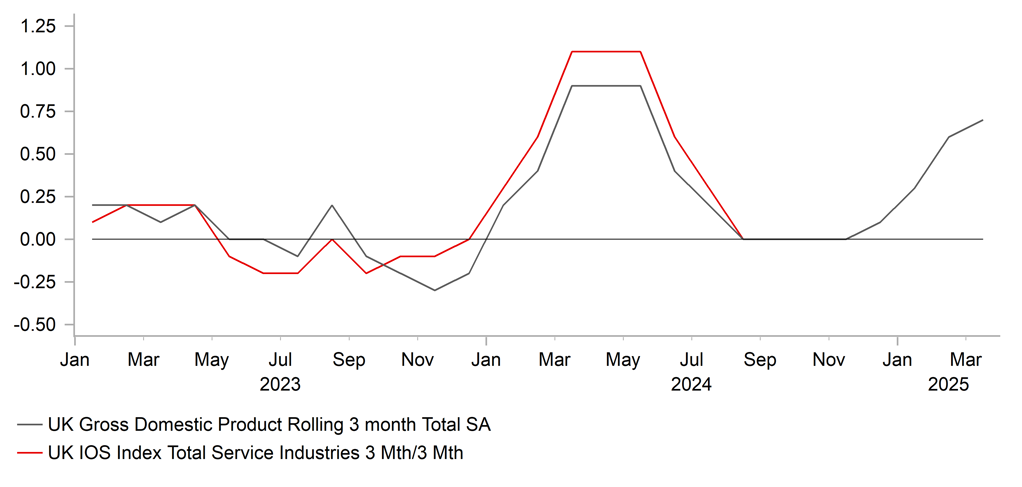

The pound was the second best performing G10 currency in May with just NOK outperforming. In BoE TWI terms, the pound advanced 0.9% and hit levels not seen since the Brexit referendum in 2016. The pound was certainly helped by the better trade outlook that was triggered by the trade deal announced between the US and the UK – the first country in which the US has reached any kind of deal. The deal was not particularly detailed but the key aspects were opening up the beef market to each other, allowing duty free US ethanol to the UK, Section 232 tariffs on UK autos being lowered from 25% to 10% up to a quota of 100k vehicles. The deal was announced on 8th May and then the US and China announced a de-escalation of its trade conflict on 12th May. How sustained better financial market conditions we believe is open to question. A legal challenge against reciprocal tariffs in the US now creates greater uncertainty over tariff policy approach in the US and hence the improved sentiment in May could quickly evaporate if the US is seen to use other trade acts to implement tariffs. This risk points to the potential for the pound to underperform if investor risk appetite worsens once again.

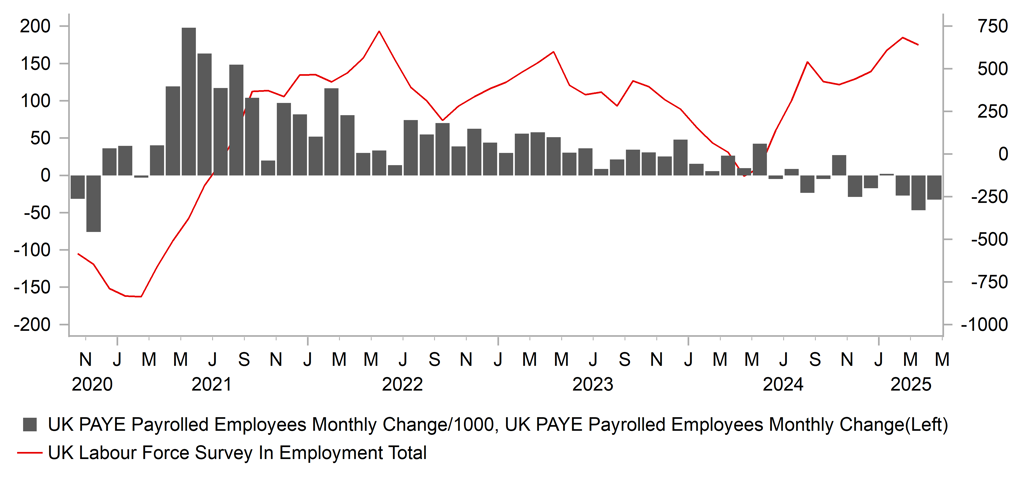

The pound also benefitted from economic data that indicated UK economic resilience with GDP in Q1 expanding by 0.7% Q/Q, more than expected. While wage growth rates slowed, the inflation data for April was stronger than expected with the YoY services CPI jumping from 4.7% to 5.4% - the BoE expected just 5.0%. Given the EU-UK trade deal and general tariff de-escalation, business sentiment is improving. The Lloyds Business Barometer jumped to 50.0, matching the high from last year, which was the highest level since before Brexit in 2016. Retail sales in April were also stronger than expected while consumer confidence rebounded in May, which all points to a more resilient economy. This means increased caution from the BoE ahead. The BoE’s 25bp cut in May came with a divided vote 5-2-2 with Huw Pill and Catherine Mann voting for no change and two others (Swati Dhingra and Alan Taylor) for a 50bp cut. The labour market remains key in determining the path for the economy ahead but the trade deals done (US, EU and India) if coupled with better financial market conditions could see the UK economy outperform expectations.

We have maintained our view of pound appreciation versus the dollar but depreciation versus the euro. We do however, see greater risks than a month ago that the pound could outperform our forecasts given the signs in May that the UK economy could prove stronger than expected and hence the MPC cuts by less.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

Policy Rate |

4.25% |

4.25% |

4.00% |

3.75% |

3.50% |

|

3-Month Bill |

4.31% |

4.30% |

3.95% |

3.70% |

3.55% |

|

10-Year Yield |

4.65% |

4.50% |

4.40% |

4.30% |

4.30% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield jumped in May, by 21bps to close at 4.65%, reflecting in part a global influence with UST bond yields higher following a US sovereign ratings downgrade by Moodys and increased concerns over the US fiscal outlook. JGB yields also jumped notably higher. For the UK, as above, there were clear signs of the UK economy proving more resilient and the April inflation data was stronger than expected, which throws some doubt on the prospect of a 25bp policy rate cut at the next MPR MPC meeting in August. For now we are maintaining our view of a 25bp cut at each MPR meeting over the forecast profile but our conviction of a cut in August has certainly come down – hence the risks to the above forecast profile is that rates are higher. Nonetheless, there are still grounds for believing the BoE can cut in August. The meeting will follow possible reciprocal tariff increases globally and possibly an imminent increase for China as well. The US economy could then be showing clearer signs of a slowdown and UK sentiment could be worsening based on a renewed increased in global trade uncertainty. We expect longer-term yields to remain elevated given the fiscal uncertainties ahead.

UK GDP YOY, % ROLLING 3M VS. SERVICES ACTIVITY

Source: Bloomberg, Macrobond

UK PAYE EMPLOYEES VS. UK LABOUR FORCE SURVEY

Source: Bloomberg, Macrobond

Chinese renminbi

|

Spot close 30.05.25 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

USD/CNY |

7.1975 |

7.2000 |

7.2500 |

7.3000 |

7.3000 |

|

USD/HKD |

7.8412 |

7.8400 |

7.8400 |

7.8400 |

7.8400 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

6.9500-7.3500 |

7.0000-7.4000 |

7.0000-7.4000 |

7.0000-7.4000 |

|

|

USD/HKD |

7.8000-7.8500 |

7.8000-7.8500 |

7.8000-7.8500 |

7.8000-7.8500 |

MARKET UPDATE

In May, USD/CNY moved from 7.2698 to 7.1975. On 7th May, the PBoC announced monetary easing on multiple fronts, from quantity (50bps RRR cut) to price (7-day reverse repo rate lowered by 10bps to 1.40% & 25bps cut for special structured instrument interest rates) and structural policies. On 20th May, 1Y LPR and 5 LPR were lowered by 10bps to 3.00% and 3.50% respectively.

OUTLOOK

April’s economic data highlights the challenges that China’s economy faces, namely a fragile housing recovery, a lack of endogenous demand with both consumption and financing activity being weak, among others (China: Endogenous financing demand still in a need to be restored, ChinaPulse: A thorny housing market amid trade ructions). That said, the details of April’s macro data highlighted the positive effects of government policies particularly the consumer goods trade-in program and large-scale equipment upgrade program in supporting retail sales growth and consumption.

The recent resilience in CNY against the dollar has not reflected much of China’s weak economic fundamentals in our view. Instead, we think it has been mostly driven by external factors including the dollar movement and global sentiment. Better-than-expected April exports for China might nonetheless have helped CNY a little, with China’s total exports managing a decent growth of 8.1%yoy. Strong exports to ASEAN for instance helped to offset a 21%yoy drop in China’s exports to the US.

On the tariffs front, latest indications are that Trump’s tariffs are still in place with the Court of Appeal temporarily pausing the recent ruling of the US International Trade Court. Looking forward, we do not expect any tariff relief for China from the recent legal developments, given the various alternative legal ways that Trump can use to implement his tariffs, although we would certainly acknowledge increased uncertainty on the path of tariffs. Additionally, China’s rerouting of trade through third countries to avoid US tariffs may not be able to persist in the future as Trump aims to close those trade loopholes. As such, China’s total export growth is likely to decline and may turn negative in the second half of this year, as efforts in finding alternative final-demand markets are unlikely to fully offset the US tariffs in the short-term. US Treasury Secretary Bessent said that US-China talks are “a bit stalled” and it may require a call between Trump and President Xi to reach a deal. However, the US administration has lately decided to target Chinese students and revoke Chinese students’ visa, with the US also ordering companies that offer software used to design semiconductors to stop selling to China prior to obtaining an export license. The “sanctions” from US on China continued to escalate although the reciprocal tariff level was temporarily set lower for the 90-day pause period. Such actions do not create a good atmosphere for tariff negotiations. We see downside risks for CNY but this will be partially offset by a weaker US dollar and continuation of Fed easing going forward. We expect USD/CNY to reach 7.2000 by Q2, 7.2500 by Q3 and 7.3000 by Q4.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2025 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

|

|

LPR 1Y |

3.00% |

3.00% |

2.80% |

2.80% |

2.80% |

|

7-Day Repo Rate |

1.40% |

1.30% |

1.10% |

1.10% |

1.10% |

|

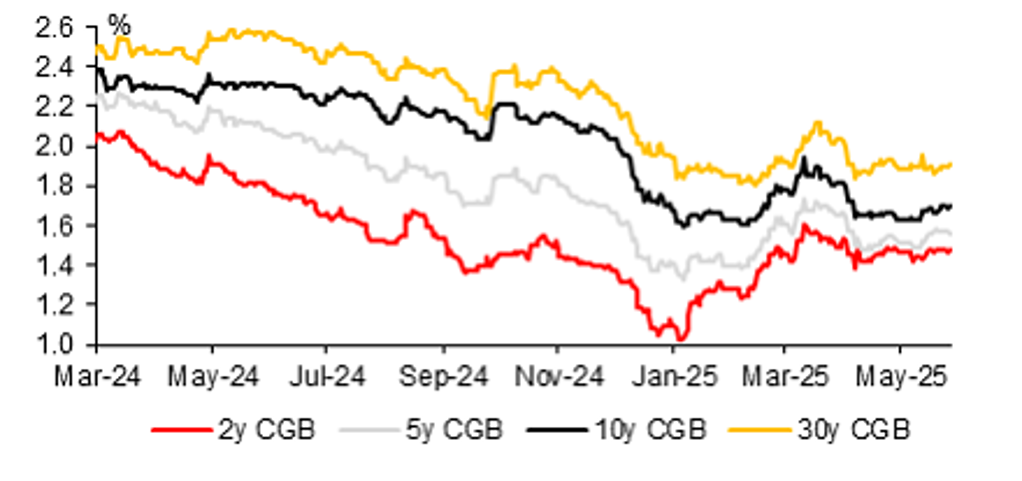

10-Year Yield |

1.71% |

1.65% |

1.65% |

1.70% |

1.80% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The PBoC decisively announced various rate cuts to support the economy on 7th May, to stabilise growth. The timing seemed good as CNY has been relatively resilient, while the problem of insufficient effective credit demand is still prominent. When facing the tariff challenges and the potential decline in exports, from the perspective of stabilizing the exchange rate, moderately relaxing domestic financial conditions will help prevent the CNY from appreciating too much. Deposit rates were lowered by major banks on 20th May right after a 10bps cut on 1Y and 5Y LPRs, specifically, 15bps rate cut for 1Y and 2Y deposits, 25bps cut for 3Y and 5Y tenors deposits. The larger cut in deposit rates than the LPR rates reflects PBOC’s intention to protect the banking sector’s net interest margin which reached a new low of 1.43% in Q1 2025 and to protect the profitability of banks. It also opens up space for further downward movement of interest rates, so as to better achieve the ultimate goal of guiding the downward trend of financing costs for the real economy.

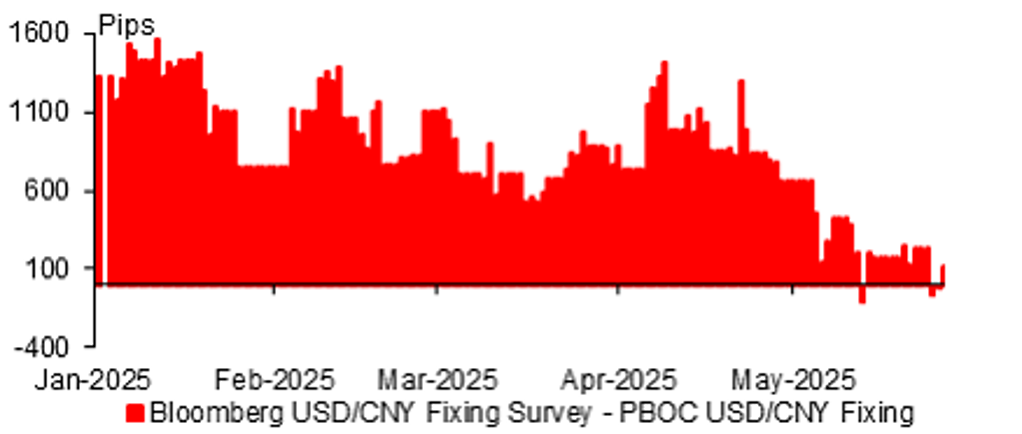

THE GAP BETWEEN FIXING SURVEY AND PBOC FIXING NARROWED IN MAY

Source: : Bloomberg, MUFG GMR

CGB BOND YIELDS ACROSS THE CURVE STABILIZED LATELY

Source: : Bloomberg, MUFG GMR