Key Points

Please click on download PDF above for full report

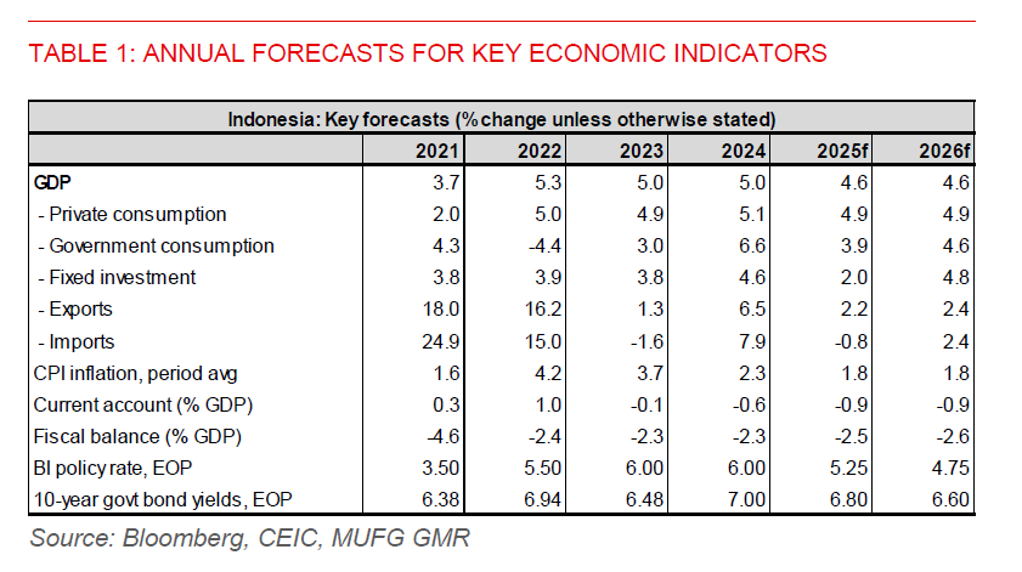

- We forecast Indonesia’s GDP growth to slow to 4.6% in 2025, from 5.0% in 2024. While it is less reliant on trade than regional peers, it is not immune to a tariff induced hit to its exports and investment. The manufacturing PMI fell into contraction in April, while Indonesian firms appear to be de-stocking. A key downside risk stems from the US imposing the full 32% reciprocal tariff on Indonesia after the 90-day pause ends on 9 July, which could cut 2025 growth by another 0.2ppt.

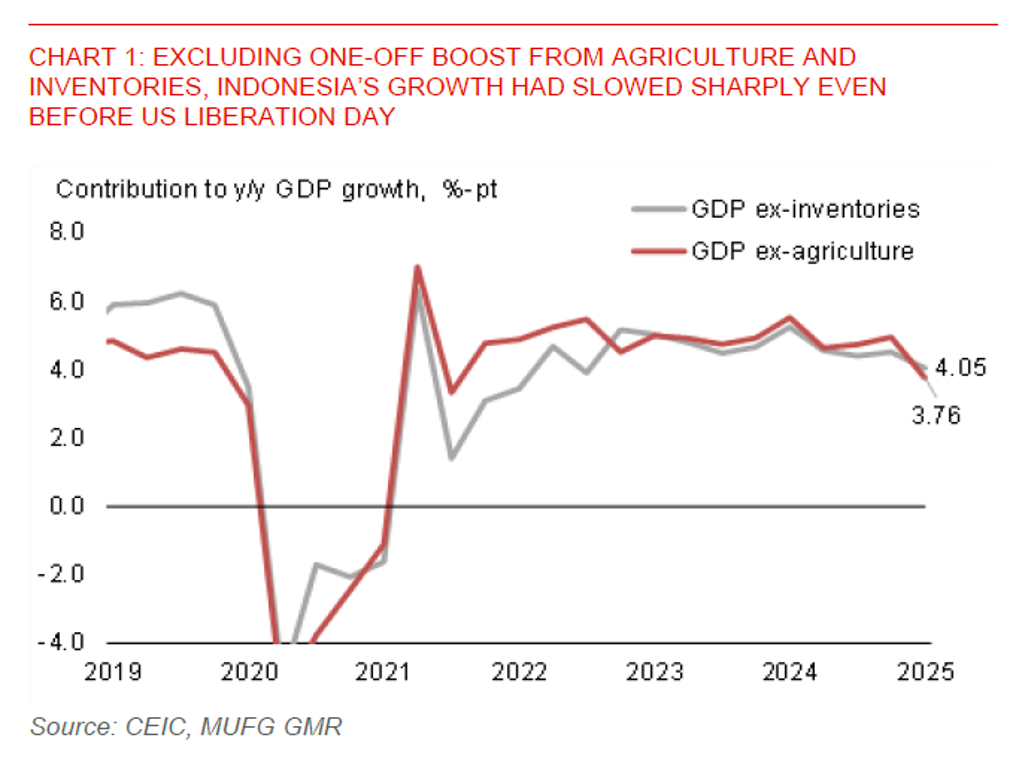

- Even before US Liberation Day on 2 April, Indonesia’s GDP growth had slowed to 4.87%yoy in Q1, from 5.02%yoy in Q4. The slowdown is sharper if we exclude the temporary boost from inventories and agriculture output. A key drag was from a pullback in fixed investment (2.1%yoy in Q1 vs. 5.0%yoy in Q4), reflecting a cautious mood among producers amid global trade uncertainties.

- There are indications of some tariff front-running, but it likely won’t provide much support for growth due to small export exposure to the US (~2% of GDP). Exports to the US grew 19.9%yoy in March, while the US share of Indonesia’s exports rose to 11.3% in March from 9.9% in Q4 2024. Tariff front-running appears to be limited to just exports of chemical and textiles to the US.

- Our analysis shows that reciprocal tariffs will pose challenges, particularly to the labour-intensive exports to the US. Sectors including textiles, plastics, rubber, and electrical machinery are more exposed, given the higher US share in the export of those products.

- We remain cautiously optimistic that Indonesia could avoid the full 32% reciprocal tariff, though the current 10% baseline US tariff imposed on 9 April will likely stay. Indonesia has engaged with the US, rather than retaliating, and we believe its small trade surplus with the US should allow room for negotiation. Beyond trade talks, Indonesia has accelerated its export diversification into ASEAN markets, with ASEAN’s share in its exports up by 2.5ppt to 21.4% in March, from 18.9% in end-2023.

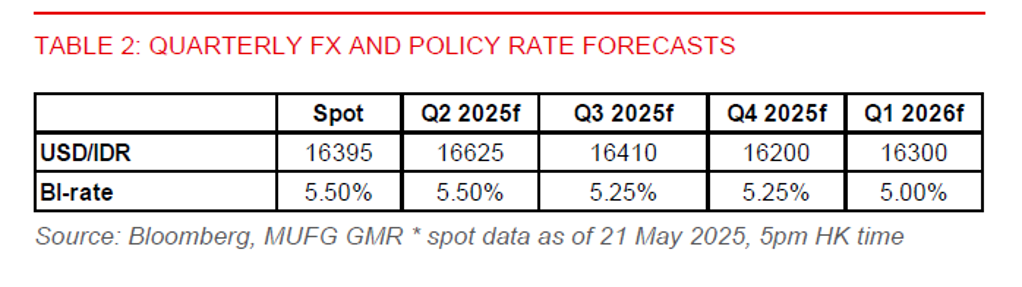

- Bank Indonesia cut the policy rate by 25bps to 5.50% in May, in line with our expectation. Rupiah’s outperformance relative to Bloomberg’s Asia Dollar index since the 23 April policy meeting could have provided the room for policy easing. BI has maintained a dovish stance, and we anticipate one more 25bps rate cut this year, possibly in Q3, bringing the policy rate down to 5.25%.

- There may still be modest rupiah weakness in the rest of this quarter due to dividend outflow pressures. But sharp IDR depreciation is unlikely, amid a weak US dollar and US-China tariff de-escalation. Indonesia’s budget surplus in April also reversed the shortfall seen in Q1, easing market concerns about the domestic fiscal outlook, while the trade surplus remains a buffer.