Key Points

- Official vote counts could take up to 35 days. But based on ‘quick count’ polling results, current Defence Minister Prabowo Subianto (age 72) has won the 2024 presidential election in the first round. He has secured nearly 60% of the votes, trumping former Central Java governor Ganjar Pranowo and former Jakarta governor Anies Baswedan. Prabowo’s inauguration is set for October this year, while his running mate, Gibran (son of President Jokowi), will assume the vice president position.

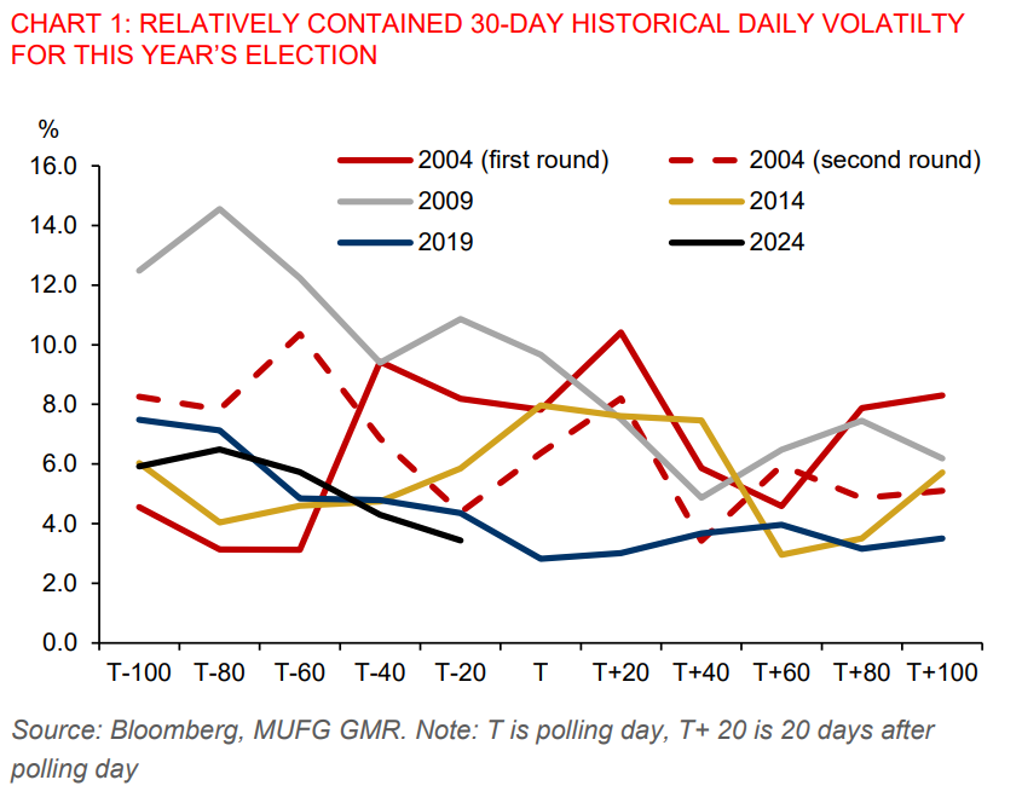

- A presidential election run-off is thus likely not needed, helping to ease political uncertainty and contain rupiah volatility. Compared to past presidential elections, currency volatility this time round has been relatively contained in the 100 days prior to election date (Chart 1). We don’t expect significant post-election volatility in the rupiah.

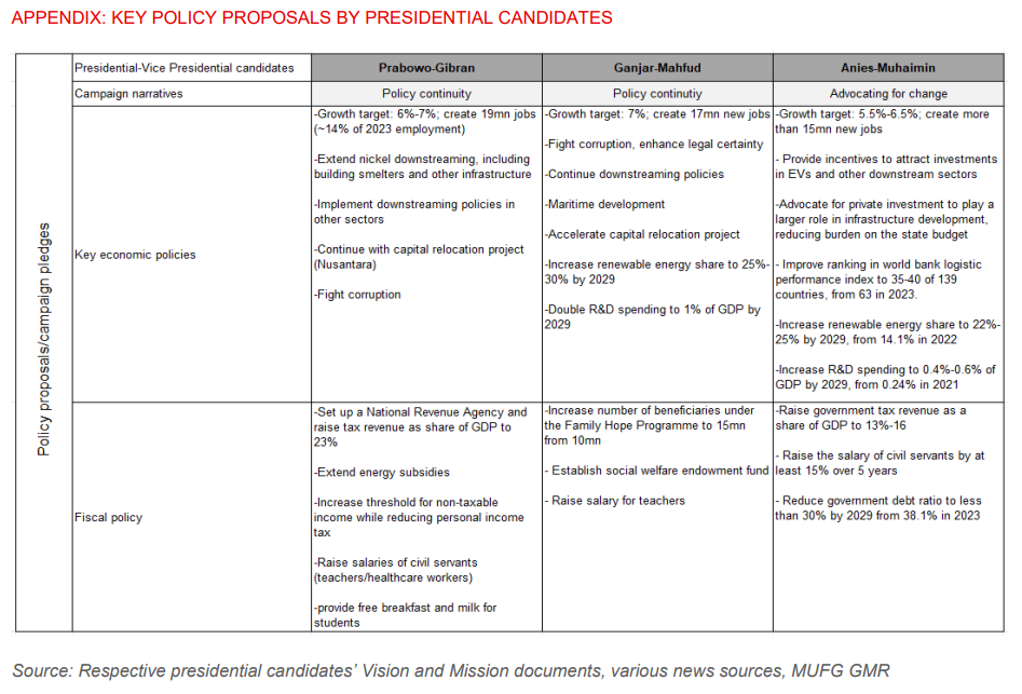

- We expect economic policy continuity under a Prabowo government. During the campaign, Prabowo has pledged to continue implementing the key economic policies started by Jokowi, including downstreaming the commodity sector to increase exports value-add, accelerating infrastructure development, and developing the US$34bn new capital city Nusantara.

- We still think Prabowo’s goal of achieving 6%-7% growth during his five-year term (2024-2029) is ambitious, though. His growth target is 1-2 percentage points higher than the average 5% pre-Covid pace of growth seen in Jokowi’s first presidential term (2014-2019). Reaching this pace of growth is not impossible, but it will entail a massive ramp-up of local and foreign investment, tech know-how, and productivity growth, all of which will take time.

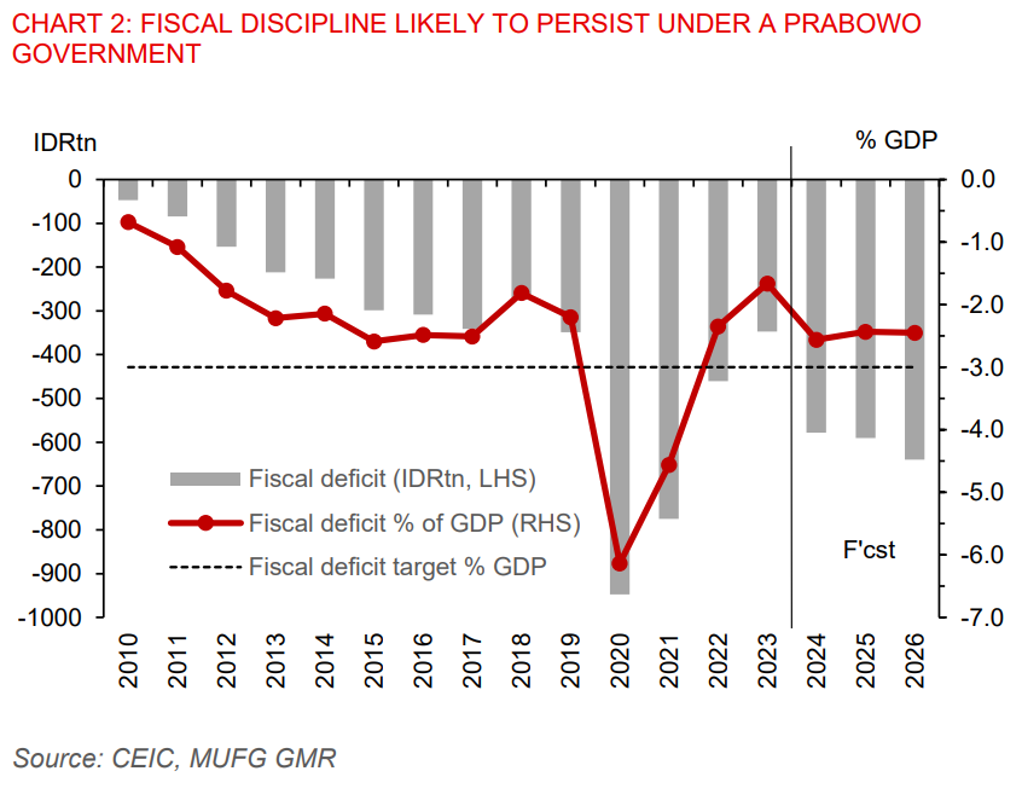

- There remains an element of uncertainty for investors regarding the composition of Prabowo’s cabinet, particularly over who will be the next finance minister. Indeed, current finance minister Sri Mulyani has been a seasoned hand in managing government finances and keeping the budget deficits within the fiscal deficit cap of 3% of GDP, barring during the Covid years in 2020 (-6.1%) and 2021 (-4.6%). A steady hand at the Ministry of Finance will be crucial to maintain investor confidence. For now, it remains uncertain whether Mulyani will remain in her position under a Prabowo government. Rumors have recently circled around about her intention to resign due to Jokowi’s backing of Prabowo for the presidency.

- Prabowo plans to push up the tax ratio to 23% of GDP to finance his proposed fiscal spending plans, which include extending energy subsidies, increasing civil servant wages, and reducing personal income tax rates. While we are not optimistic about his fiscal revenue goals, we think fiscal risks will still be contained and forecast Indonesia’s budget deficit to average 2.5% of GDP in 2024-2029 (Chart 2). There are several reasons for this. First, Indonesia has a fiscal rule that caps the annual budget deficit at 3% of GDP, which should act as a backstop. Second, we believe the new government will not want to jeopardize Indonesia’s sovereign credit rating, currently at BBB (stable) by S&P and Fitch, and Baa2 (stable) by Moody’s.

- In terms of foreign policy, we think Prabowo will continue Jokowi’s policy of striking a balance between US and China, while maintaining foreign policy neutrality. As such, Prabowo will likely continue to deepen bilateral economic ties with China, maintain a comprehensive strategic partnership with the US in areas of trade and defense cooperation, while ensuring a stable relationship with other member countries in ASEAN.

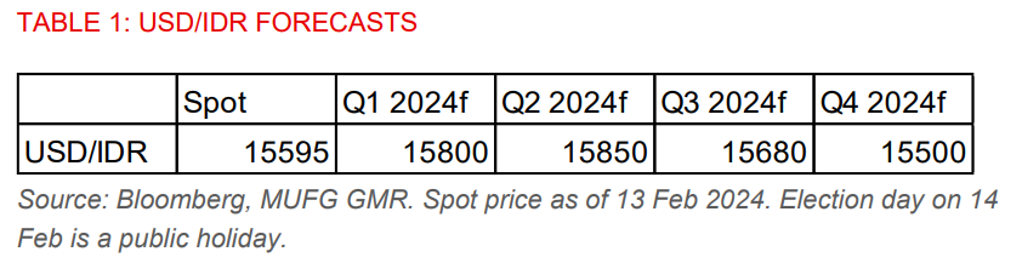

- We remain cautious on the USD/IDR, keeping our forecast at 15,800 in Q1 2024 and 15,850 in Q2 2024 (Table 1). With Prabowo winning the presidential election in the first round, election uncertainty has somewhat eased. Still, we remain mindful of potential political transition risks stemming from the forming of a governing coalition among the different political parties and the appointment of key cabinet members. Moreover, markets have further pared back expectations for US rate cuts this year following a higher-than-expected US CPI data for January. Policy rate cuts by Bank Indonesia and sustained rupiah strength against the US dollar are likely to have to wait till external pressures recede.