Key Points

- Elections tend to create one thing that markets dislike – uncertainty. With President Jokowi constitutionally barred for running a third term, Indonesia will elect a new president on 14 February. The presidential election will be a three-horse race between Defence Minister Prabowo Subianto (age 72), former Central Java governor Ganjar Pranowo (age 55), and former Jakarta governor Anies Baswedan (age 54). Markets have priced in higher country risk premium, with the USD/IDR trading near the highs seen in October 2023.

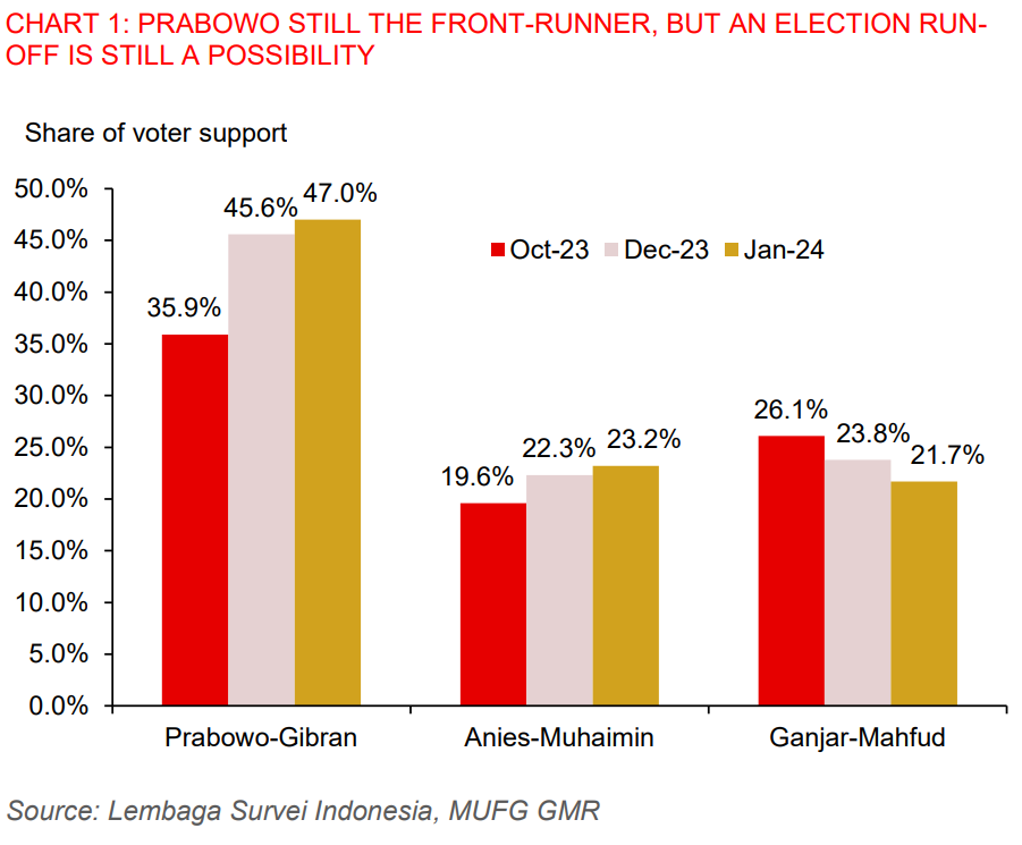

- A presidential election run-off in June remains a possibility. A run-off vote will happen if no candidates get majority of the electoral votes (>50%) on 14 February. This would lead to extended election uncertainty. Opinion polls in January showed Prabowo, along with his running mate Gibran (President Jokowi’s eldest son), are frontrunners, but only garnering 47% of voter support in January (Chart 1), while Anies and Ganjar had 23.2% and 21.7% of voter support respectively.

- We are mindful of potential sources of uncertainty stemming from bitter disputes over election results in a close contest, an election run-off, and cabinet appointments following the presidential elections.

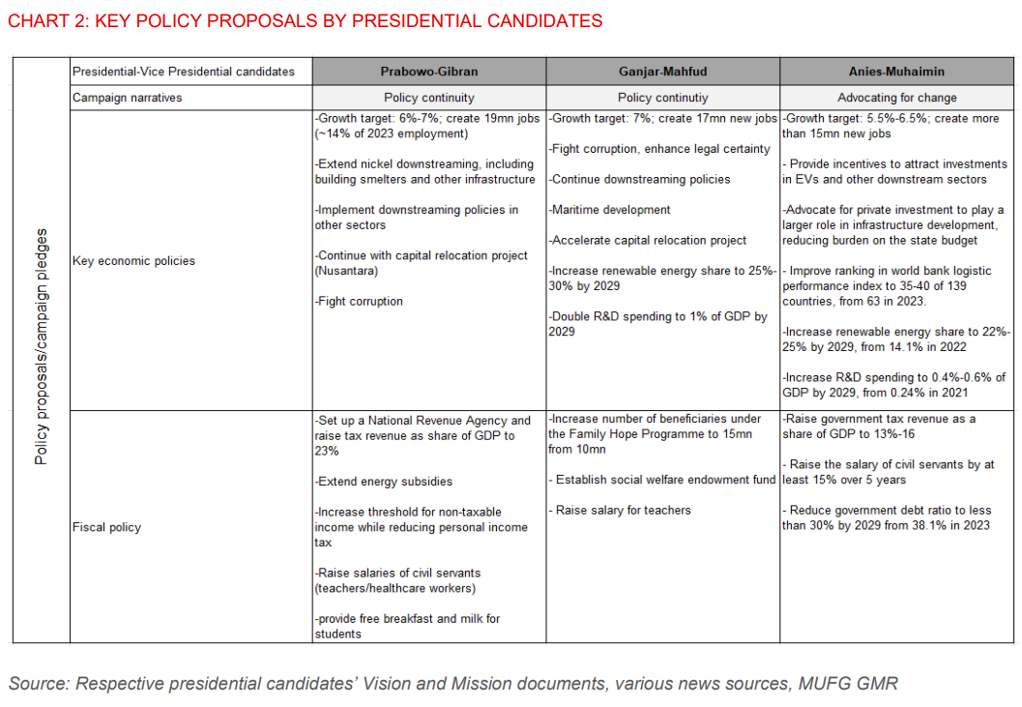

- Economic policies proposed by the three candidates are broadly indicative of their intention to make further socio-economic progress, though there will be some nuances/differences in their respective approaches (Chart 2).

- No major departure from Jokowi’s key policies is expected under either a Prabowo or Ganjar presidency. Both Prabowo and Ganjar are widely seen as continuity candidates, as they have pledged to continue implementing Jokowi’s key economic policies including nickel downstreaming, infrastructure development, and capital relocation to Nusantara. Moreover, Jokowi remains popular among the electorate and will likely retain his political influence especially under a Prabowo government where his son Gibran would be holding the VP post.

- The biggest change to economic policies will come if Anies is elected. He has cast doubts about President Jokowi’s export ban on minerals and the capital relocation plan. Anies and his running-mate Muhaimin are proposing to provide incentives to lure foreign investors and private investment into downstream industries and infrastructure development.

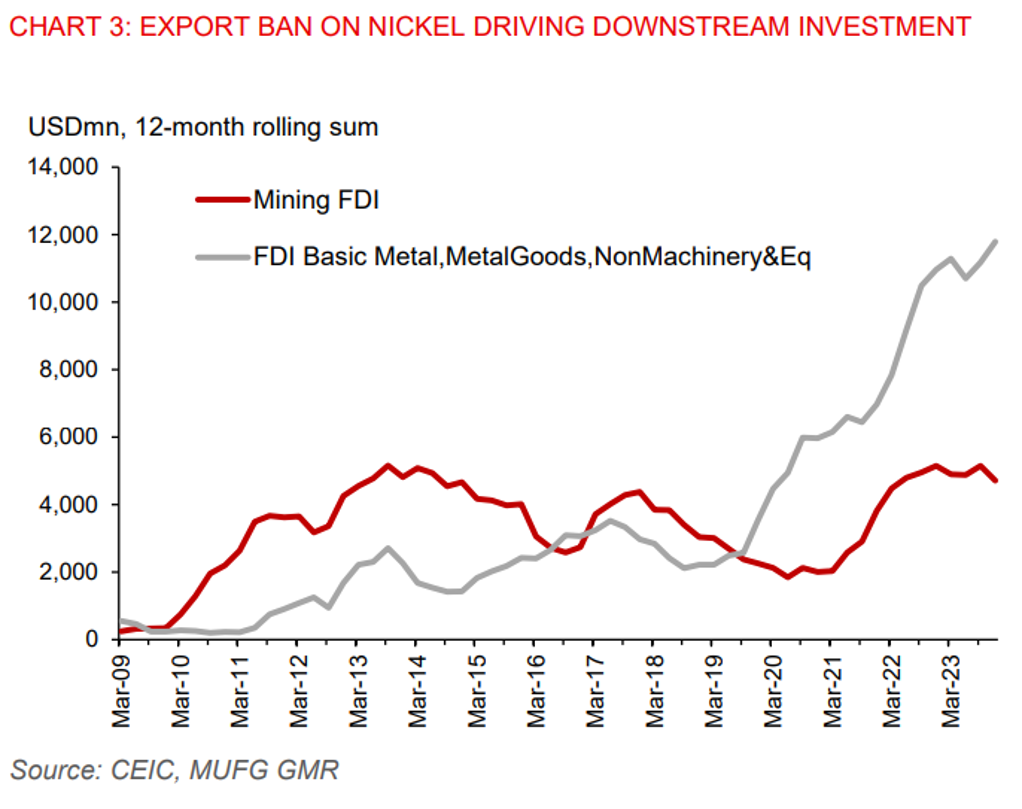

- Nonetheless, downstreaming policies (in whatever form they take under a new government) are set to stay, as Indonesia aims to move up the value chain, particularly via strengthening its position in the electric vehicle supply chain. We believe downstreaming will help Indonesia to stay relatively more resilient against commodity boom-bust cycles and volatility in portfolio financing flows. The export ban on nickel and other minerals has led to a notable rise in realized FDI in smelting and refined metals, increasing the export value-add of these products (Chart 3).

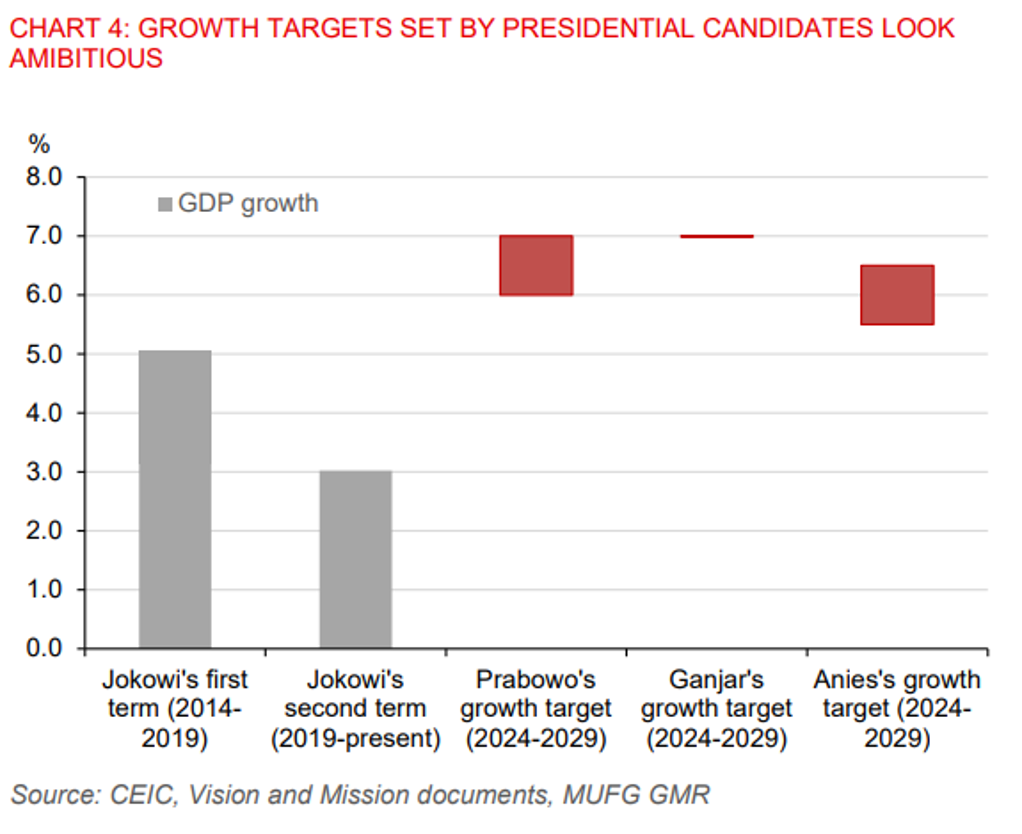

- Growth targets set by the three candidates are ambitious versus average 5% growth during Jokowi’s first term in office (2014-2019) and 3% in his second term (which includes the Covid impact).

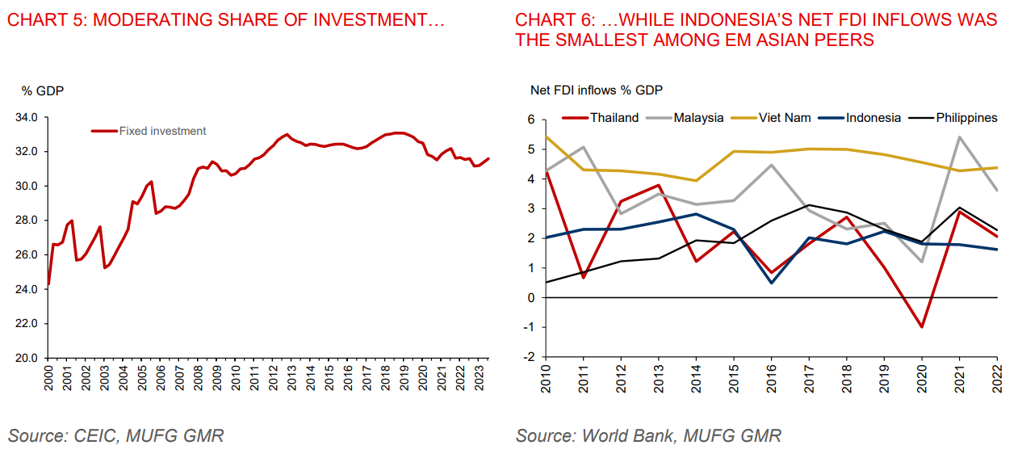

- To reach those growth targets will require a massive ramp-up of investment and total factor productivity growth, which generally takes time. Having said that, overall investment as a share of GDP has moderated in the last decade while FDI remains a small portion of the economy (Charts 5 and 6). The ability of the new government to push up FDI and private sector investment will rest on further improvement in the business environment, incentives, and a continuation of the prudent monetary and fiscal policy framework.

- We forecast the USD/IDR at 15,800 in Q1 2024 and 15,500 in end-2024. Markets are pricing for the US Fed to only cut rates in May, after Fed Chair Powell pushed back on a March rate cut. Along with ongoing domestic election uncertainty, which will weigh on capital inflows, we are cautious on the USD/IDR. The BI will be in no rush to cut rates in H1 2024 or front-run the Fed in the rate cutting cycle to avoid inviting unnecessary rupiah volatility.

- Indonesia’s current account has also returned to modest deficits since Q2 of last year amid further softening of coal and nickel prices. Notably, BI has been buying bonds in the secondary market to sterilise its FX intervention. However, once external pressures from US rates ease and domestic political uncertainty abates, the rupiah is expected to regain modest strength against the US dollar.