Key Points

- Bank Indonesia surprised markets by delivering a 25bps rate hike, bringing its key reverse repo rate to 6.00% from 5.75% previously.

- The post policy-statements suggest that the rate hike was a pre-emptive and forward-looking move to strengthen the central bank’s ability to stabilise the Rupiah, and as such to also mitigate potential imported inflation. BI also said that the current financial market uncertainty required a stronger policy response.

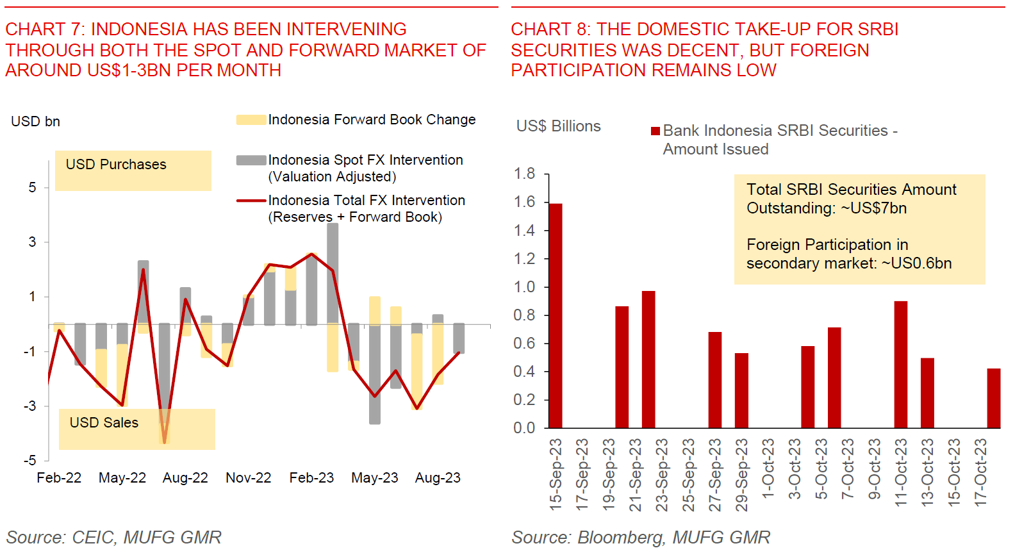

- While the weakness in IDR over the past few months was certainly a concern for BI, we were expecting the central bank to focus more on capital flow measures such as export repatriation and FX conversion rules as a first line of defence, rather than rate hikes, in order to maintain support to growth and especially with the inflation trajectory still manageable right now.

- We think the underlying assumption by Bank Indonesia is that US rates will remain higher for longer into 2024, and that keeping a decent interest differential between Indonesia and US is one important factor in achieving Rupiah stability, especially with US 10-year yields hovering around 5% (vs 6.8% in Indonesia).

- More broadly, Indonesia’s and IDR’s macro fundamentals look quite strong in our view, even as it is buffeted by some external factors outside of its control.

- As such, we continue to think sharp USDIDR spikes like we saw in 2020 and during the 2013 taper tantrum period are unlikely, barring further significant rises in US rates and the US Dollar, which is not our base case.

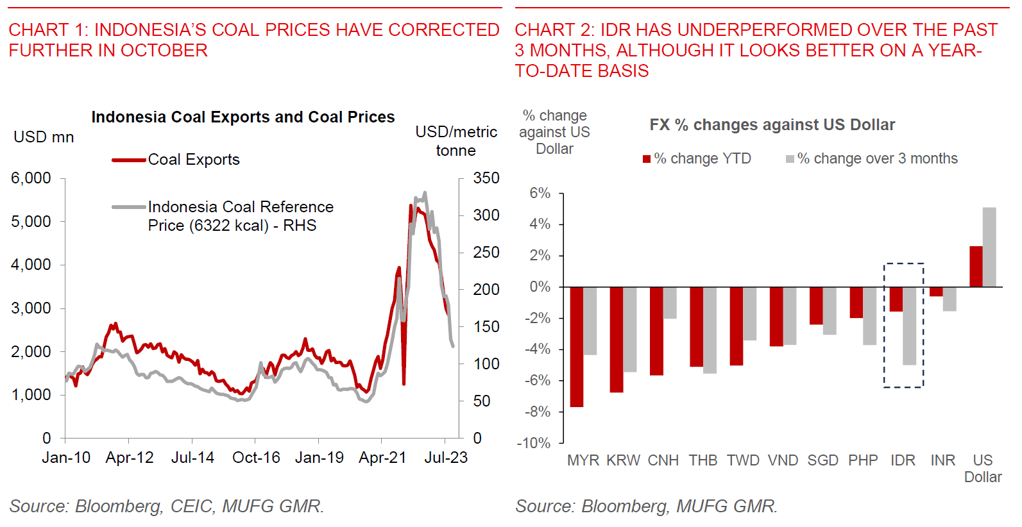

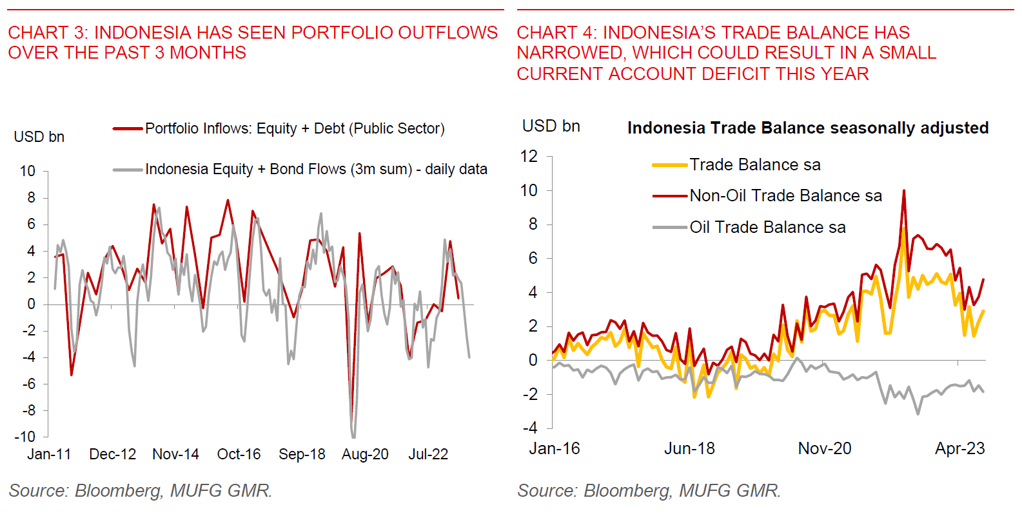

- On the negative front for IDR, coal and palm prices remain depressed, with latest data showing that prices for both commodities corrected further in October (Chart 1). Meanwhile, Indonesia continues to see foreign portfolio outflows to the tune of US$4bn over the past 3 months, and more so in bonds recently. This in part reflects compression in yield differentials between Indonesia and the US.

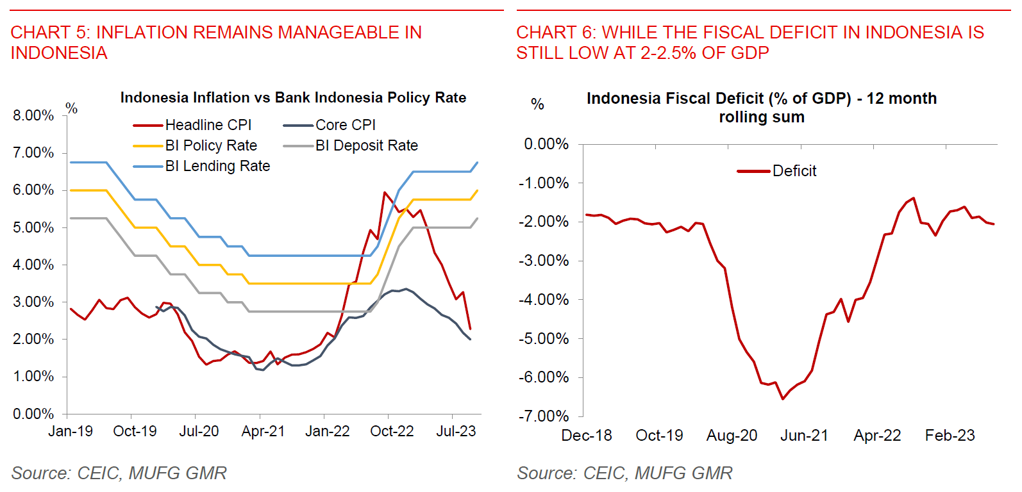

- On the positive front, inflation remains very manageable at less than 3%yoy for both headline and core. The fiscal deficit is also low at around 2-2.5% of GDP and as such financing needs are not that high, notwithstanding the recent upsized auction by the government.

- We forecast USDIDR at 15,600 in 3 months and 15,200 in 12 months, balancing these different push and pull factors, and with the assumption of a weaker Dollar, lower US yields, and a contained Middle East conflict for 2024. Admittedly, US rates have continued to rise higher than our global forecasts, and if they do push and sustain higher, we will have to raise our USDIDR forecast.

- Moving forward, we expect Bank Indonesia to be on a prolonged pause at 6%, with cuts likely to come only with better clarity on the Fed’s rate trajectory. We have pencilled in 25bps cuts per quarter from 3Q2024, which would bring the BI rate to 5.50% by the end of next year. Risks to our policy rate forecast would come from further weakness in IDR.

Bank Indonesia also provided several other policy updates:

- Issuance of new FX-denominated securities and Sukuk to attract portfolio inflows to support currency stability, and deepen the money market: These new notes, called SVBI and SUVBI respectively, will use the foreign assets held by Bank Indonesia as the underlying securities, for example US Treasuries. The first auction will start on 17 November, with tenors ranging from 1 to 12 months. The pricing could be based on SOFR with some risk premium embedded in our view, in order to make it attractive for foreign investors. We think this may also be Bank Indonesia’s attempt to better utilise of its FX reserves, without being forced to sell its underlying securities outright especially during periods of stress.

- Issuance of rupiah-denominated short-term securities (SRBI) strong, but foreign transactions still low: According to BI, issuance of the new SRBI securities reached around US$7bn (IDR113.7 trillion). However, purchases by foreign investors in the secondary market remains low at just US$0.6bn (IDR9.81 trillion). Part of the low attractiveness for foreign investors could reflect higher withholding taxes paid relative to IndoGBs. During the press conference, Bank Indonesia said they are aware of this concern and is in discussion with the Ministry of Finance on this issue.

- FX Term Deposits placed with BI by exporters reached US$1.9bn: This was an increase of US$0.6bn from the last meeting in September of US$1.3bn. To our mind, this seems quite low relative to the potential inflows that could be obtained from mining, plantation and forestry exporters. We were thinking that it could reach US$6-7bn at its run rate.