To read the full report, please download PDF.

USD poised for bullish break out?

FX View:

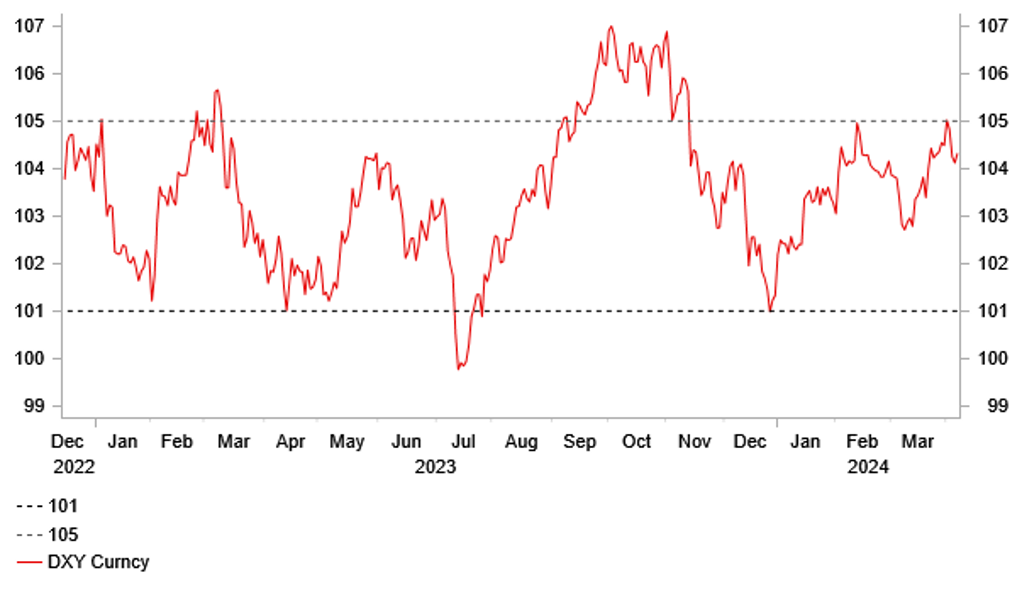

The USD has become more volatile over the past week although continues to trade in relatively narrow ranges against most other major currencies. The USD threatened to extend its advance earlier this week but the dollar failed to sustain a break above the 105.00-level. The release today of another strong US employment report for March casts fresh doubts on the need for the Fed to begin cutting rates as soon as June. The week ahead could prove pivotal for USD direction through the rest of this month with the latest US CPI and PPI reports for March scheduled to be released. In recent months, US CPI reports have proven to be key turning points for the USD. After US inflation surprised to the upside in January and February, it will be harder to look through another upside surprise in March. The week ahead will also bring the latest policy updates from the BoC, ECB and RBNZ. We expect all three central banks to signal that they are moving closer to cutting rates. A June ECB rate cut is already fully priced in which should help limit downside risks for the EUR in the week ahead.

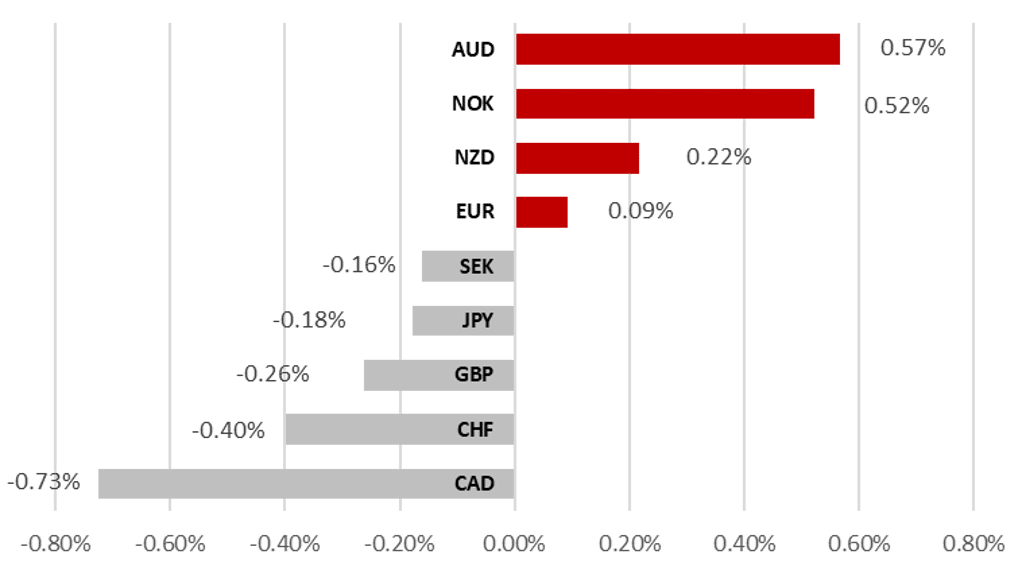

G10 COMMODITY FX OUTPERFORMS WITH EXCEPTION OF CAD

Source: Bloomberg, 15:00 BST, 5th April 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our long EUR/SEK and short CHF/JPY trade ideas.

JPY Flows – High Frequency Data:

Japanese investors turned less favourable to foreign bonds last week with selling totalling JPY1.66 trillion. It was the largest one-week selling of foreign bonds since the first week of October of 2022.

US CPI Price Action Analysis:

Recent price action highlights that US CPI reports have proven important turning points for USD especially for EUR/USD and GBP/USD compared to USD/JPY.

FX Views

G10 FX: All eyes on US inflation in week ahead

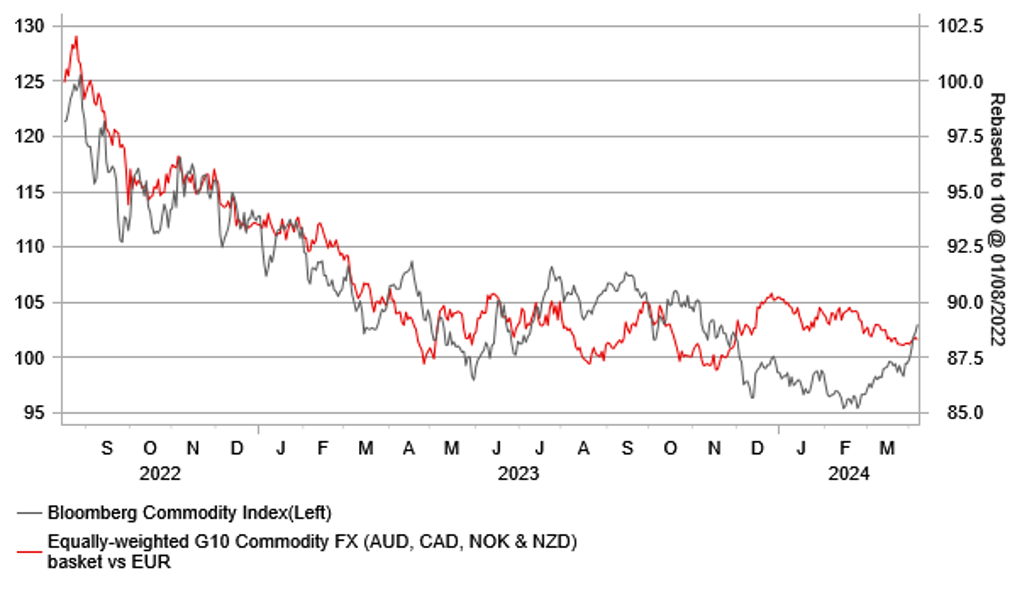

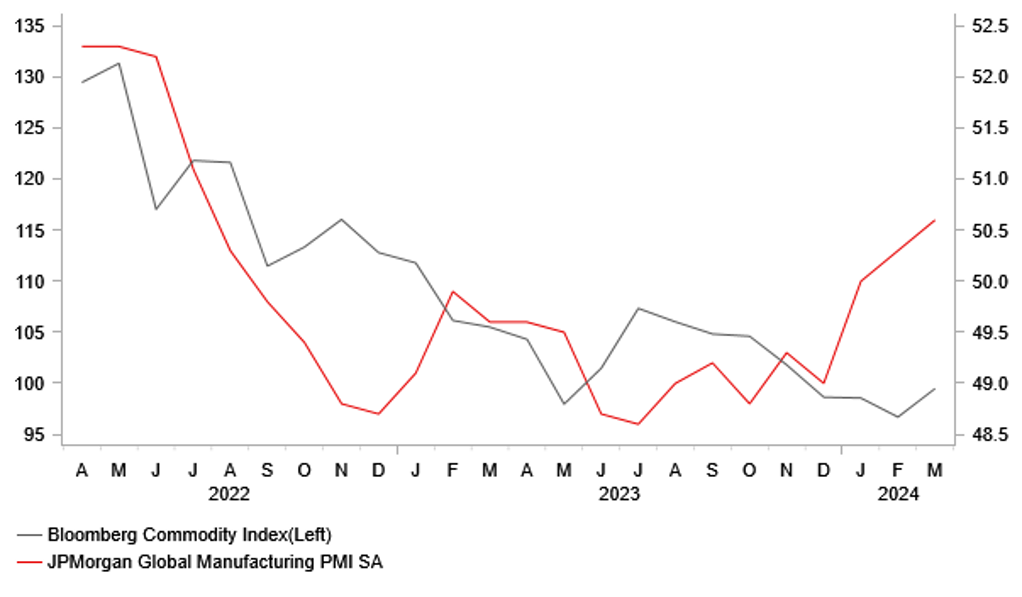

The top performing G10 currencies at the start of this month have been the commodity-related currencies of the NOK, AUD and NZD although the CAD has underperformed alongside the funding currencies of the CHF and JPY. G10 commodity currencies have derived supported from the ongoing rebound in commodity prices at the start of this year. Bloomberg’s commodity price index has climbed back its 200-day moving this week for the first time since the start of November of last year, and extended the rebound from the lows in February to just over 7%. It has been the strongest rally for commodity prices since the middle of last year. The rebound in commodity prices has been supported this week by heightened concern over geopolitical risks in the Middle East triggered by Iran’s threat to retaliate against Israel in response for an attack on one of their embassy in Syria. It has helped to lift the price of Brent back above USD90/barrel for the first time since October. At the same time, the recent rebound could reflect building optimism over a softer landing for the global economy. The release of the latest PMI surveys for March have provided further encouraging signals that the global manufacturing sector is bottoming out. Business confidence in the global manufacturing sector climbed to its highest level in March since July 2022.

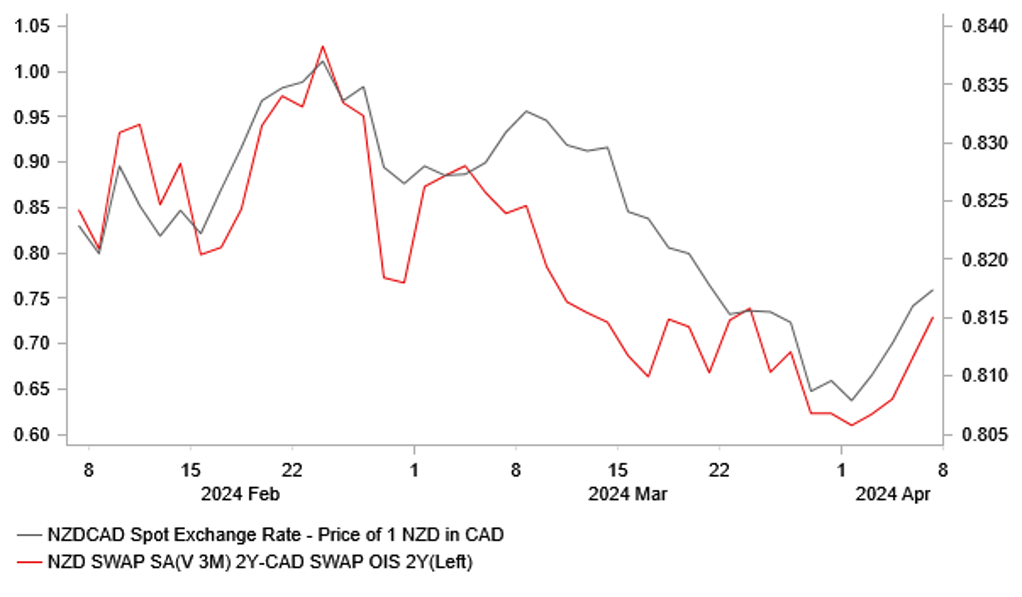

The CAD and NZD will face idiosyncratic risk in the week ahead when the BoC and RBNZ hold their latest policy meetings on Wednesday. While we expect both the BoC and RBNZ to leave their policy rates unchanged next week, market participants will be watching closely for stronger signals that they are moving closer to cutting rates. The Canadian rate market is currently pricing in around 21bps of cuts by the BoC’s June policy meeting. Anything less than a clear signal in the week ahead that the BoC is teeing up a rate cut at the following meeting in June could trigger a relief rally for the CAD. The case for the BoC to begin cutting rates in June has been strengthened by evidence of slowing core inflation at the start of this year and the ongoing adjustment higher for the unemployment rate which rose by a further 0.3ppt to 6.1% in March. The developments have been partially offset by the stronger than expected pick-up in Canadian GDP growth in January. Yield spreads have also been moving against the NZD over the past month as market participants have moved to price in more RBNZ rate cuts. The expected timing of the RBNZ’s first rate cut has been brought forward to July (roughly priced at around 50:50) or August. Since the RBNZ’s last policy meeting in late February, it was unexpectedly confirmed that New Zealand’s economy fell into a mild technical recession in Q4.

COMMODITY PRICES ARE REBOUNDING

Source: Bloomberg, Macrobond & MUFG GMR

GLOBAL MANUFACTURING IS BOTTOMING OUT

Source: Bloomberg, Macrobond & MUFG GMR

It was the fourth quarter of negative growth out of the last five during which time the economy has contracted by -0.7%. RBNZ Governor Orr also indicated in an interview in late March that “aggregate demand is slowing, core inflation pressures are coming off and inflation expectations are coming back to target, so we hope that we can see low and stable inflation on the horizon again and that would mean more normalized interest rates on the horizon”. The NZD would quickly give back gains over the past week in the week ahead if the RBNZ sends a stronger signal that rates cut be cut sooner than August.

The final G10 central bank policy meeting in the week ahead will be from the ECB on Thursday. We have become more confident that the ECB will begin to cut rates at their following policy meeting in June after the release of weaker than expected euro-zone inflation data for March. Even recent comments from ECB hawks such as Governing Council Holzmann have indicated that a strong consensus view is forming at the ECB to start cutting rates in June. It is an outcome that is already fully priced in by the euro-zone rate market which has helped to dampen the negative impact for the EUR over the past week. The updated forward guidance from the ECB at next week’s policy meeting should provide a strong signal that a June rate cut is in the offing unless there is a shock in the coming months. However it is unlikely that the ECB’s updated guidance will be sufficiently dovish to encourage the euro-zone rate market to price in more than 100bps of cuts by the end of this year and trigger a sharper EUR sell off. Elsewhere in Europe, inflation surprised to the downside again in Switzerland over the past week. With both headline and core inflation falling further below the SNB’s target to 1.0% in March. It has reinforced expectations the SNB will continue to lead the way in cutting rates by delivering another 25bp cut at their next meeting in June. While the CHF initially weakened further after the softer inflation print, EUR/CHF has failed to close above the 0.9800-level since late last month.

PRICING IN MORE RBNZ CUTS HAS WEIGHED ON NZD

Source: Bloomberg, Macrobond & MUFG GMR

USD IS ATTEMPTING A BULLISH BREAK OUT

Source: Bloomberg, Macrobond & MUFG GMR

The week ahead could prove pivotal for USD direction through the rest of this month. The USD has been more volatile over the past week as it attempted to break higher earlier this week before correcting lower towards the end of this week. After US inflation surprised to the upside in January and February, the release of the latest CPI and PPI report for March in the week ahead will be even more important in shaping Fed rate cut expectations. The leadership at the Fed have continued to signal recently that recent stronger inflation readings have not significantly changed their economic outlook in which they expect inflation to slow further albeit on a bumpy path. A third consecutive month of stronger inflation at the start of this year would push back against that view and encourage the US rate market to continue paring back Fed rate cut expectations which has been encouraging a stronger USD at the start of this year. On the other hand, market participants would breathe a sigh of relief if inflation slows in March and keeps the Fed on track to cut rates in June. A development that would initially weaken the USD, maintain supportive market conditions for FX carry trades and could encourage further near-term gains for G10 commodity-related currencies.

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

04/08/2024 |

00:30 |

Labor Cash Earnings YoY |

Feb |

2.0% |

2.0% |

!! |

|

EUR |

04/08/2024 |

07:00 |

Germany Industrial Production SA MoM |

Feb |

-- |

1.0% |

!! |

|

EUR |

04/08/2024 |

09:30 |

Sentix Investor Confidence |

Apr |

-- |

-10.5 |

!! |

|

CHF |

04/08/2024 |

16:15 |

SNB's Jordan Speaks |

!! |

|||

|

EUR |

04/09/2024 |

09:00 |

ECB Bank Lending Survey |

!! |

|||

|

USD |

04/09/2024 |

11:00 |

NFIB Small Business Optimism |

Mar |

90.0 |

89.4 |

!! |

|

NZD |

04/10/2024 |

03:00 |

RBNZ Official Cash Rate |

5.50% |

5.50% |

!!! |

|

|

NOK |

04/10/2024 |

07:00 |

CPI YoY |

Mar |

-- |

4.5% |

!! |

|

NOK |

04/10/2024 |

09:00 |

Norges Bank Governor Bache Speaks |

!! |

|||

|

USD |

04/10/2024 |

13:30 |

CPI YoY |

Mar |

3.5% |

3.2% |

!!! |

|

CAD |

04/10/2024 |

14:45 |

Bank of Canada Rate Decision |

5.0% |

5.0% |

!!! |

|

|

USD |

04/10/2024 |

19:00 |

FOMC Meeting Minutes |

Mar-20 |

-- |

-- |

!! |

|

CNY |

04/11/2024 |

02:30 |

CPI YoY |

Mar |

0.4% |

0.7% |

!! |

|

NOK |

04/11/2024 |

07:00 |

GDP Mainland MoM |

Feb |

-- |

0.4% |

!! |

|

GBP |

04/11/2024 |

09:30 |

BoE Credit Conditions Surveys |

!! |

|||

|

EUR |

04/11/2024 |

13:15 |

ECB Deposit Facility Rate |

-- |

4.0% |

!!! |

|

|

USD |

04/11/2024 |

13:30 |

PPI Ex Food and Energy MoM |

Mar |

0.2% |

0.3% |

!!! |

|

USD |

04/11/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

04/11/2024 |

13:45 |

ECB President Lagarde Press Conference |

!!! |

|||

|

USD |

04/11/2024 |

13:45 |

Fed's Williams Speaks |

!!! |

|||

|

CNY |

04/12/2024 |

Tbc |

Trade Balance |

Mar |

$72.20b |

$39.71b |

!! |

|

SEK |

04/12/2024 |

07:00 |

CPI YoY |

Mar |

-- |

4.5% |

!! |

|

EUR |

04/12/2024 |

07:00 |

Germany CPI YoY |

Mar F |

-- |

2.2% |

!! |

|

GBP |

04/12/2024 |

07:00 |

Monthly GDP (MoM) |

Feb |

-- |

0.2% |

!! |

|

GBP |

04/12/2024 |

12:00 |

BoE releases Bernanke report on forecasting |

!!! |

|||

|

USD |

04/12/2024 |

15:00 |

U. of Mich. Sentiment |

Apr P |

80.0 |

79.4 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The most important economic data releases in the week ahead will the latest US CPI and PPI reports for March. After surprising to the upside in January and February, a third upside inflation surprise in March would be harder for the Fed to look through, and would cast more doubt on the need for the Fed to begin cutting rates as soon as in June. The consensus expectations are for core inflation to slow to +0.3%M/M after stronger readings of +0.4%M/M in both January and February.

- The main economic events in the week ahead will be the latest RBNZ (Wed), BoC (Wed) and ECB (Thurs) policy meetings. We expect all three central banks to signal that they are moving closer to lowering interest rates. The New Zealand rate market has recently brought expectations for the RBNZ to begin cutting rates ahead of next week’s RBNZ meeting. A rate cut as soon as in July is currently priced at around 50:50. Market expectations for earlier RBNZ rate cuts have been encouraged by recent comments from Governor Orr who stated at the end of last month that “aggregate demand is slowing, core inflation pressures are coming off and inflation expectations are coming back to target, so we hope that we can see low and stable inflation on the horizon again and that would mean more normalized rates on the horizon”.

- Market participants will be watching closely in the week ahead to see if the updated guidance from the BoC tees up a rate cut as soon as at their following meeting in June in line with current market expectations. Inflation in Canada has softened more than expected at the start of this year opening the door for the BoC to begin cutting rates. However, the pick-up in economic growth has casts some doubt on how quickly the BoC will begin to cut rates.

- Similar to the BoC, the ECB’s updated forward guidance is expected to signal that a rate cut is likely to be delivered as early as at the following policy meeting in June. Recent communication from ECB officials has indicated that there is building support to begin cutting rates in June. Weaker than expected euro-zone inflation in March should help to give the ECB more confidence that they can start to make monetary policy less restrictive. The recent rebound in the price of oil is unlikely to be sufficient to discourage the ECB from cutting rates at the current juncture.