To read the full report, please download PDF.

Will markets' ‘TACO’ view prove correct?

FX View:

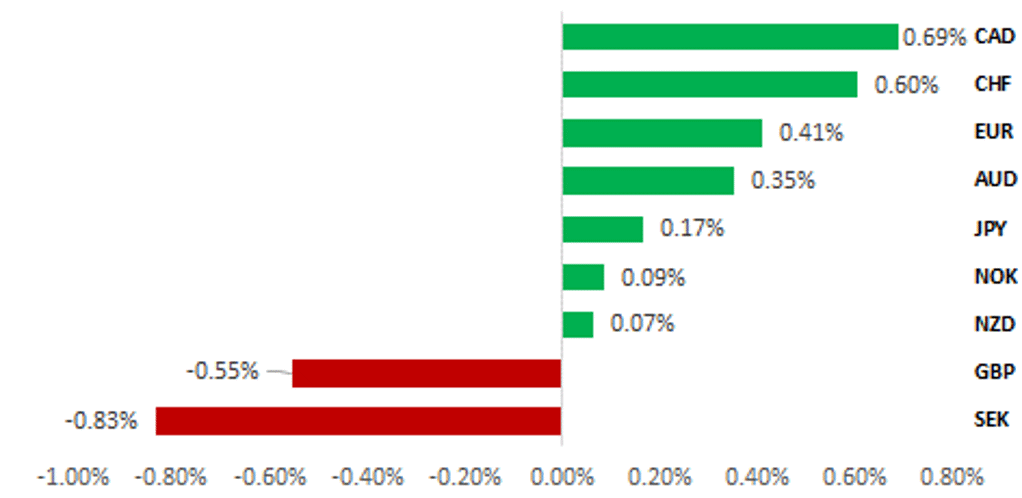

The US dollar (DXY) is close to unchanged (+0.2%) relative to last Friday’s close with markets ending the week more subdued given the US Independence Day holiday. Trump is still scheduled to sign the ‘One Big Beautiful Bill Act’ later today which has helped to support US yields this week along with the better than expected jobs report yesterday. The S&P 500 closed at another record high yesterday and has advanced by over 5% in just nine trading days. That suggests limited investor concern over the expiry of the suspension to Trump’s reciprocal tariffs on 9th July. The ‘Trump Always Chickens Out’ (TACO) theory is certainly part of why investors show limited concerns. Hence, there is a risk of surprise for the markets if over the coming days the tariffs prove more aggressive than expected. More aggressive action will likely see some milder degree of repeat of what happened in April after ‘Liberation Day’ while a more benign scenario should push US Treasury yields lower, fuel stronger speculation of Fed rate cuts that would result in moderate dollar selling. This week we assess the BoJ outlook and the yen and the outlook for SEK and NOK after a stellar H1 performance.

USD MIXED BUT MOSTLY WEAKER VERSUS G10

Source: Bloomberg, 13:35 BST, 4th July 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new long EUR/GBP trade idea in anticipation of further GBP underperformance heading into the summer, and closing our short USD/NOK trade idea.

JPY Flows:

This week we look in more detail currency by currency at OTC retail FX margin positioning data. Positions remain much smaller post-covid with the exception of ZAR and CHF.

FX Seasonality:

By examining historical monthly returns during the summer months (June, July, and August), we identify G10 currencies that exhibit strong seasonal behaviour. Specifically, we flag USD/CAD as having strong summer seasonality which is also statistically significant with the CAD strengthening.

FX Views

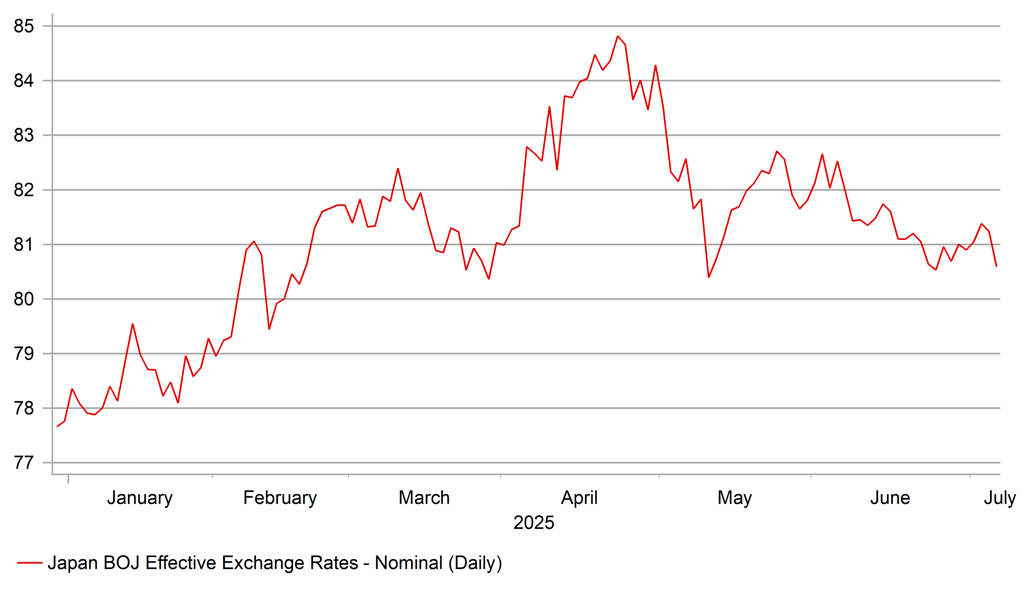

JPY: BoJ policy speculation to intensify

The third quarter is upon us and the topic of global trade and tariffs seems a theme that has lost its influence on financial markets but we will certainly see some increased focus on this topic over the coming days with the 9th July reciprocal tariff suspension expiring and President Trump promising to inform key trading partners of what tariffs will be charged going forward. The uncertainty related to trade policy has certainly had limited impact on risk appetite with the S&P 500 at new record highs. In Q2 the advance was 10.5% and that included a sell-off after ‘Liberation Day’ on 2nd April. The 2s10s UST yield curve steepened in Q2 with the 2-year down 16bps to 2.72% while the 10-year drifted 2bps higher to 4.23%. The yen gained about 4% in Q2 versus the dollar but, bar the dollar, was the worst performing G10 currency in Q2. The uncertainty created by the ‘Liberation Day’ tariffs has been one key factor that prompted the BoJ to pause its tightening cycle.

US yields have drifted higher this week – mainly in reaction to the One Big Beautiful Bill Act being passed and is due to be signed by President Trump this afternoon. The dollar is close to unchanged however despite this bill being passed and despite the better than expected jobs report yesterday. Investors remain wary due to tariff uncertainties especially following Trump’s reference to tariffs set to go live on 9th July would be in a range of 10%-70%. The top of that range is far higher than any rates revealed in April and if confirmed would likely hit confidence and see investors downgrade growth expectations and upgrade inflation expectations. How the yen responds will depend on the UST bond yield and equity market responses. Markets appear confident that most of the key major developed economies will see tariffs that are less than what were revealed in April.

Of course, it is difficult to predict what Trump will announce imminently. Trump has been critical of Japan so there is a risk of a higher than anticipated tariff being announced. The FT reported this week that “phased deals” will be announced with lower tariffs that effectively allows for further negotiations. We assume this is what happens and hence Japan avoids anything too disruptive and is closer to baseline levels with the opportunity for ongoing negotiations. While it might not be explicitly mentioned, a strengthening of the yen will likely remain an incentive for Japan given the Trump administration’s vocal complaint of an excessively weak yen that has been fuelled by inappropriately loose monetary policy.

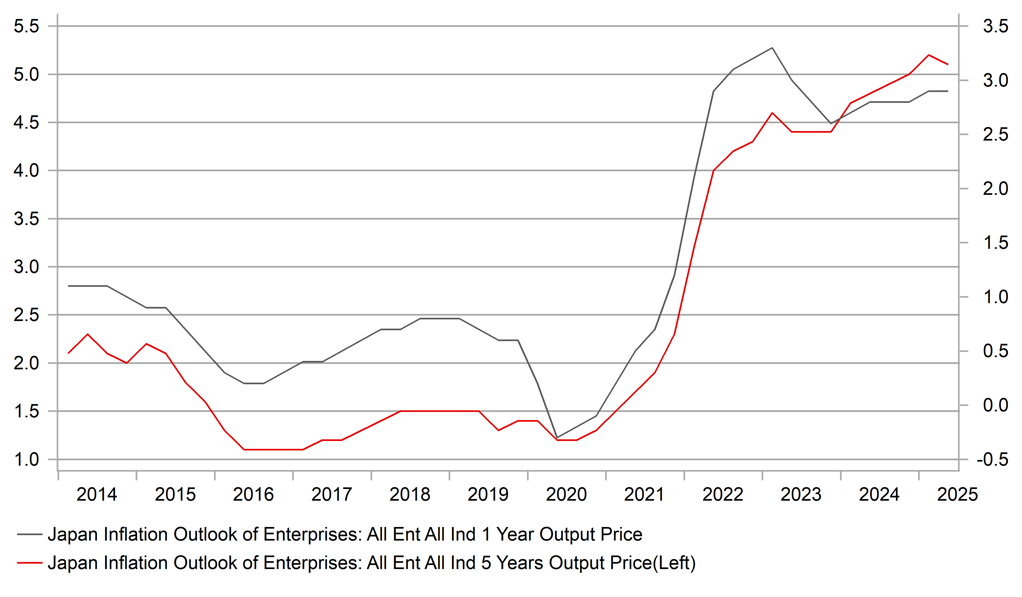

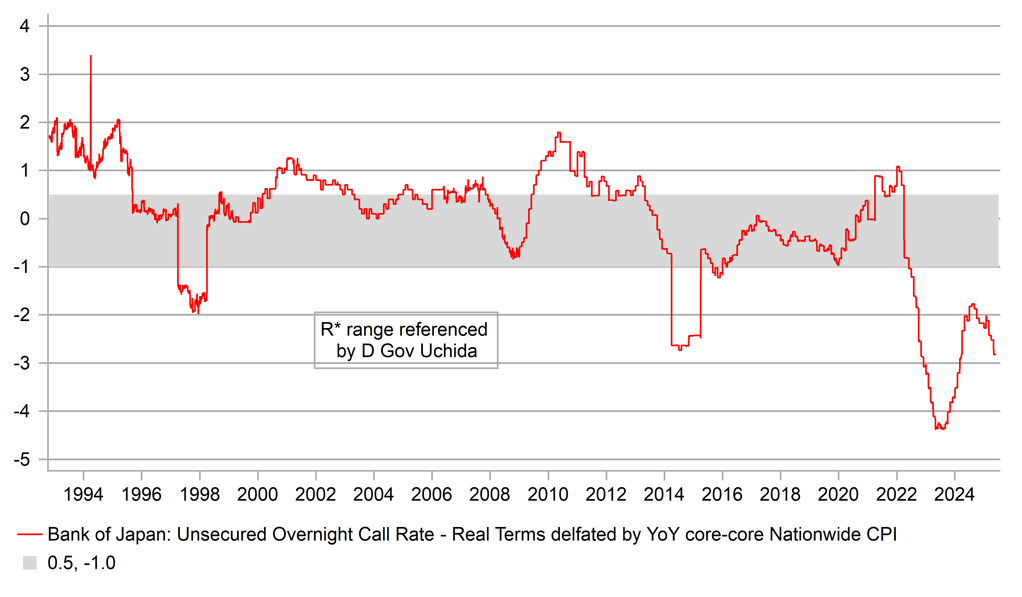

The yen weakened in NEER terms in Q2 while inflation has remained elevated with the BoJ signalling little urgency to tighten policy again. The key impediment has been the trade policy uncertainties but based on the assumption above we are likely approaching the time when the guidance communicated to the market could start to change. As can be seen in the chart above, the BoJ key policy rate in real terms is falling again and that will increase pressure on the BoJ to act. The CPI data for May released in June revealed a much stronger 3.7% core nationwide YoY rate, up from 3.3%. the core-core rate jumped 0.3ppt to 3.3%. The Tokyo data for June implies some slowdown in the nationwide data to come but still, inflation remains more elevated than expected. The BoJ is very likely to raise its inflation forecasts at the meeting on 31st July. The forecast for this year currently stands at 2.2% (down from 2.4% previously), which looks too low based on Apr-Jun data. The Tankan report released this week also points to higher levels of inflation being sustained. The 1-year inflation expected by all industries remained at 2.9% and has risen through 2024 into 2025 and is only modestly down from the global inflation shock peak of 3.3% in Q1 2023. One BoJ policy board member today (Hajime Takata) maintained his more hawkish view that the BoJ will need to resume its tightening after a “wait-and-see” period. The September market pricing for a hike is currently only 2bps, which we believe does not accurately reflect the risks of a hike by then.

TANKAN INFLATION EXPECTATIONS STILL ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR

BOJ POLICY RATE IN REAL TERMS IS DECLINING AGAIN

Source: Bloomberg, Macrobond & MUFG GMR

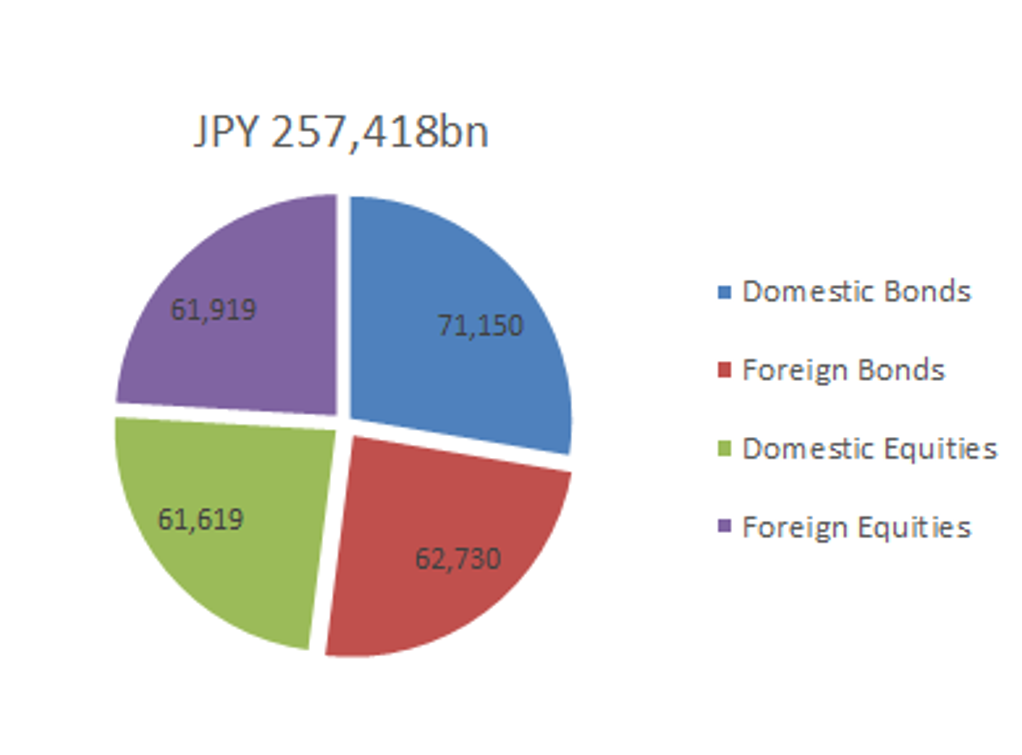

Measures have now been taken to address worsening JGB sentiment (QT slowdown by BoJ and MoF reduced issuance of super-long JGBs) which should help reduce the risk of sharp sell-offs. But yields are set to drift higher in our view and we forecast a 10-year JGB yield of 1.60% by year-end in contrast to a decline in the 10-year UST bond yield (to 4.13%). A further narrowing of the yield differential should be supportive for inflows into Japan’s bond market. The Government Pension Investment Fund (GPIF) FY results were released today which revealed an increased holding of domestic bonds relative to foreign bonds – the domestic bond holding increased from 25.51% at the end of December to 27.64% at the end of March. That’s an usually large jump in one quarter. There was of course a 5% strengthening of the yen but the GPIF can rebalance easily. The shift could be an indication of a shift to a greater home bias that would be more supportive for the yen going forward. Certainly yields are more attractive and FX risks remain high from a valuation perspective and this may be another indication of the demise of “US exceptionalism”.

Higher inflation and with the BoJ set to lift its inflation forecasts, there is certainly an increasing risk of a shift in tone from the BoJ toward signalling greater potential of a rate hike sooner than later. That will help strengthen the yen and in circumstances of broader US dollar depreciation should see USD/JPY test the 140-level over the coming months. Greater Japan investor home bias is another potential yen positive.

DOMESTIC BONDS A LARGER PART OF THE GPIF’S INVESTMENT PORTFOLIO; AS OF END MARCH 2025

Source: GPIF & MUFG GMR

BOJ’S NOMINAL EFFECTIVE YEN EXCHANGE RATE IS WEAKENING AGAIN

Source: Bloomberg, Macrobond & MUFG GMR

Scandi FX: Starting to lose some of their shine after strong start to year

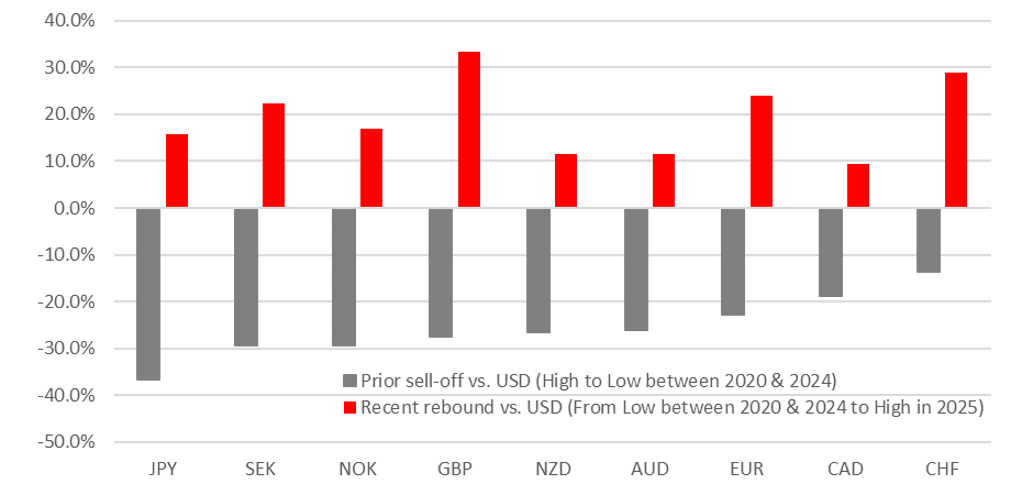

The Scandi currencies of the NOK and SEK have strengthened sharply in the first half of this year alongside the other European currencies of the CHF and EUR. The SEK was the top performing G10 currency strengthening by 17% against the USD compared to an increase of 13.8% for the EUR and 13.0% for the NOK. It marks a sharp turnaround for both Scandi which had fallen to deeply undervalued levels in recent years. From the high point in May 2021 to the low point in January this year, the NOK had fallen by 29.3% against the USD. Similarly from the high point in January 2021 to the low point in September 2022, the SEK has weakened by 29.3% against the USD. The Scandi currencies had suffered the biggest sell-offs against the USD alongside the JPY prior to the reversal of the USD’s multi-year upward trend (see chart below). It set the stage for more powerful rebounds for NOK and SEK when the tide turned. The NOK and SEK have rebounded relatively more strongly than the JPY so far but have lagged behind the rebounds for the EUR and GBP.

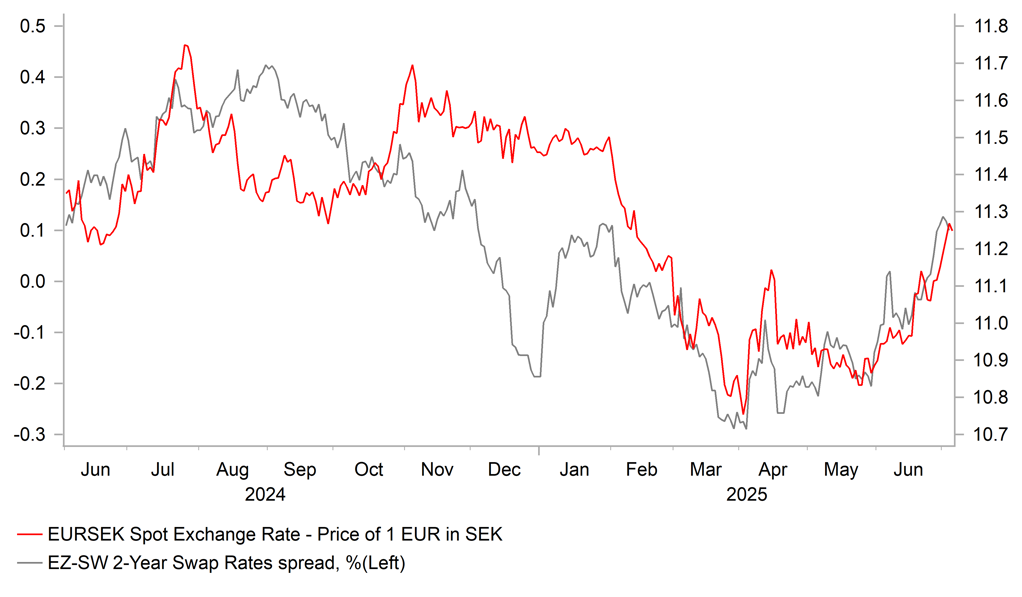

After the strong start to the year both Scandi currencies have recently lost upward momentum. Given broad-based USD weakness, the loss of upward momentum for NOK and SEK is more evident against the EUR. EUR/SEK hit a low of 11.665 in April but has just risen back above resistance from the 200-day moving average at around the 11.200-level. Similarly, EUR/NOK hit a low of 11.261 in April and has since risen back above the 11.800-level closer to where it has been trading over the past year. The turning point for both EUR/SEK and EUR/NOK was President Trump’s Liberation Day tariffs announcement in early April. Even though global investor risk sentiment has improved significantly since the worst point in April, it has been notable that both the NOK and SEK have been unable to regain their prior bullish momentum.

One of the reasons why the NOK and SEK have been unable to regain prior bullish momentum and have re-weakened against the EUR has been the recent dovish shift in monetary policies of the Riksbank and Norges Bank. The Riksbank had signalled earlier this year that it was more confident that it had done enough to lower rates to support growth and stabilize inflation around their target justifying their decision to leave rates on hold at 2.25% at the March and May policy meetings. However, the recent run of softer economic activity in Sweden prompted the Riksbank to resume rate cuts at the last policy meeting in June lowering the policy rate by a further 0.25 point to 2.00%. Additionally, the Riksbank signalled that it was likely to cut rates one more time by the end of this year. The Riksbank acknowledged that the economic recovery is proceeding more slowly than expected and economy remains weak. As a result the Riksbank lowered their forecast for GDP growth this year by 0.7 point to 1.2% which would be only a modest improvement from growth of 1.0% last year. The latest GDP report for Q1 revealed that Sweden’s economy unexpectedly contracted again modestly by -0.2% and growth in Q4 of last year was revised down to 0.5%. The unemployment rate also jumped by 0.5 point back up to 9.0% in May. The recent loss of cyclical momentum for Sweden’s economy alongside further Riksbank easing has taken some of the shine off the SEK in the near-term.

NOK & SEK REBOUND AFTER SHARP SELL-OFF

Source: Bloomberg, Macrobond & MUFG GMR

EUR/SEK TIGHTLY LINKED TO YIELD SPREADS IN 2025

Source: Bloomberg, Macrobond & MUFG GMR

At the same time the Norges Bank delivered a dovish surprise of their own by starting their easing cycle a little bit earlier than expected in June. After delaying plans for rate cuts earlier this year, the Norges bank finally started to cut rates for the first time in the current easing cycle by 0.25 point lowering the policy rate to 4.25%. Market participants including ourselves had been assuming that they would wait until autumn. However, the Norges Bank felt that the recent run of softer core inflation readings made it harder to justify holding back from cutting rates any longer. The Norges Bank noted that they gave special attention to the fact that underlying inflation has declined and been somewhat lower than projected and they are more confident wage growth is slowing notably this year. As a result, the Norge Bank has indicted that they plan to cut rates two more times by the end of this year. The current policy rate remains restrictive leaving more room for further rate cuts going forward compared to other regional central banks of the ECB and Riksbank whose policy rates have already returned to neutral territory. The Norges Bank recently raised their estimate of the neutral real rate (r*) to between 0.5% and 1.5% which after adjusting for their inflation target implies a neutral range for the policy rate between 1.5% and 3.5%.

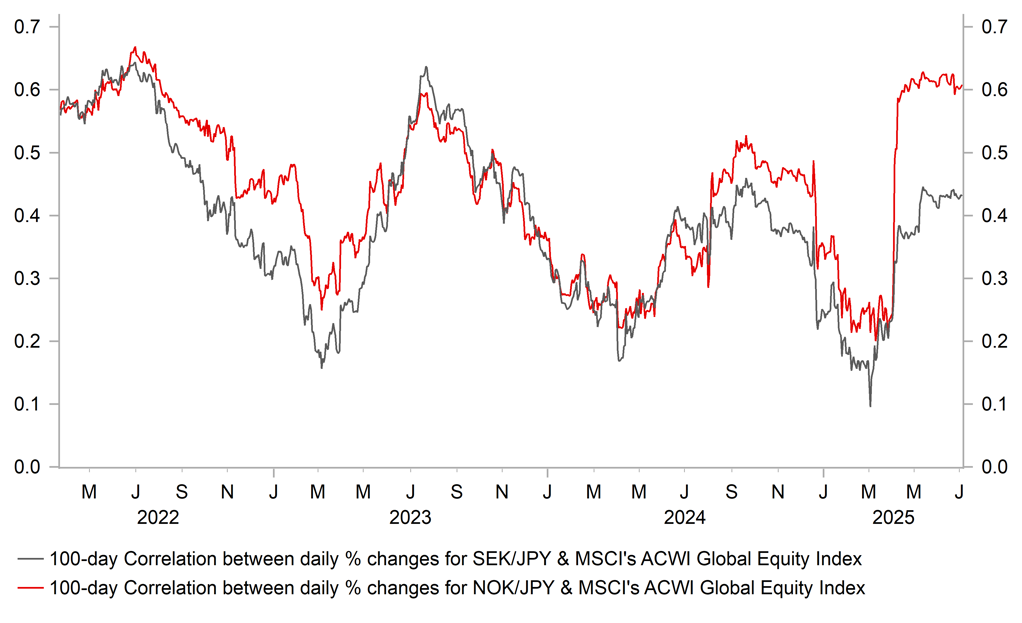

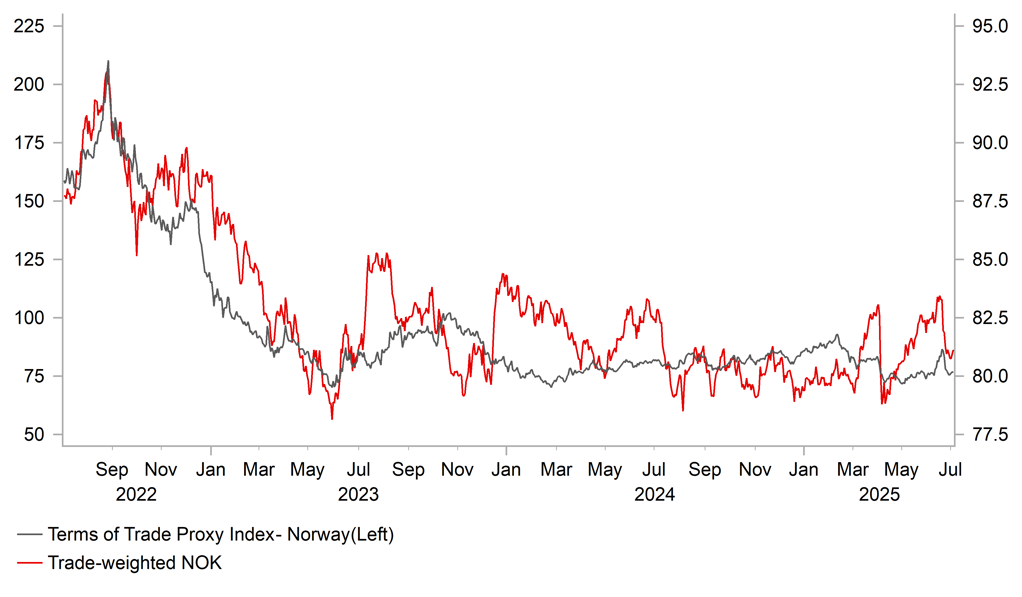

At the same time, the NOK continues to be held back by lower energy prices which helps to partly explain why it underperformed relative to the SEK in the 1H of this year. The NOK did outperform briefly last month when the price of oil initially jumped higher in response to the conflict between Israel and Iran, but those gains were quickly reversed as the price of oil dropped back towards year to date lows after a ceasefire was agreed. The price of Brent has fallen by -8.8% year to date and is down by -18.5% from last year’s highs. As we highlighted in last week’s report (click here), the balance between demand and supply in the oil market remains bearish for the price of oil and related currencies such as NOK. Over the weekend OPEC+ members are set to consider a fourth production increase of 411k barrels/day for August. Eight major OPEC+ members have already agreed to restart 411k barrels/day in May, June and July which was triple the rate of production increase initially planned. It has resulted in global oil inventories increasing by around 1 million barrels/day in recent months. Taking these factors into consideration, we expect conditions to be more challenging for the Scandi currencies of NOK and SEK. The strong gains and outperformance from 1H of this year is unlikely to be repeated through the rest of this year.

NOK HAS BEEN TRADING MORE CLOSELY WITH RISK

Source: Bloomberg, Macrobond & MUFG GMR

LOWER ENERGY PRICES REMAIN HEADWIND FOR NOK

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

07/07/2025 |

00:30 |

Labor Cash Earnings YoY |

May P |

2.4% |

2.3% |

!!! |

|

SEK |

07/07/2025 |

07:00 |

CPI YoY |

Jun |

-- |

0.2% |

!!! |

|

EUR |

07/07/2025 |

07:00 |

Germany Industrial Production SA MoM |

Jun |

-- |

-1.4% |

!! |

|

EUR |

07/07/2025 |

09:00 |

ECB's Nagel Speaks |

May |

!! |

||

|

EUR |

07/07/2025 |

09:30 |

Sentix Investor Confidence |

1Q F |

-- |

0.20 |

!! |

|

EUR |

07/07/2025 |

10:00 |

Retail Sales MoM |

Jun |

-- |

0.1% |

!! |

|

JPY |

08/07/2025 |

00:50 |

BoP Current Account Balance |

Jun |

¥2935.8b |

¥2258.0b |

!! |

|

AUD |

08/07/2025 |

05:30 |

RBA Cash Rate Target |

May |

3.60% |

3.85% |

!!! |

|

EUR |

08/07/2025 |

07:00 |

Germany Trade Balance SA |

Jun P |

-- |

14.6b |

!! |

|

USD |

08/07/2025 |

11:00 |

NFIB Small Business Optimism |

97.9 |

98.8 |

!! |

|

|

USD |

09/07/2025 |

00:00 |

"Reciprocal" tariff deadline |

2Q |

!!! |

||

|

CNY |

09/07/2025 |

02:30 |

CPI YoY |

Jun F |

0.0% |

-0.1% |

!! |

|

NZD |

09/07/2025 |

03:00 |

RBNZ Official Cash Rate |

Jun F |

3.25% |

3.25% |

!!! |

|

USD |

09/07/2025 |

19:00 |

FOMC Meeting Minutes |

Jun P |

-- |

-- |

!! |

|

GBP |

10/07/2025 |

00:01 |

RICS House Price Balance |

-- |

-8.0% |

!! |

|

|

NOK |

10/07/2025 |

07:00 |

CPI YoY |

Jun |

-- |

3.0% |

!!! |

|

SEK |

10/07/2025 |

07:00 |

Industrial Orders MoM |

May |

-- |

-6.3% |

!! |

|

SEK |

10/07/2025 |

07:00 |

GDP Indicator SA MoM |

May |

-- |

0.4% |

!! |

|

EUR |

10/07/2025 |

09:00 |

Italy Industrial Production MoM |

May |

-- |

1.0% |

!! |

|

EUR |

10/07/2025 |

09:00 |

ECB's Villeroy Speaks |

Jun |

!! |

||

|

USD |

10/07/2025 |

13:30 |

Initial Jobless Claims |

Jun |

-- |

-- |

!! |

|

GBP |

10/07/2025 |

14:00 |

Fed's Daly Speaks |

Jun F |

!! |

||

|

GBP |

11/07/2025 |

07:00 |

Monthly GDP (MoM) |

May |

-- |

-0.3% |

!!! |

|

EUR |

11/07/2025 |

07:00 |

Germany CPI YoY |

Jun F |

-- |

2.0% |

!! |

|

GBP |

11/07/2025 |

07:00 |

Trade Balance GBP/Mn |

-- |

-£7026m |

!! |

|

|

EUR |

11/07/2025 |

07:45 |

France CPI YoY |

May |

-- |

0.9% |

!! |

|

CAD |

11/07/2025 |

13:30 |

Net Change in Employment |

Jun |

-- |

8.8k |

!!! |

|

USD |

11/07/2025 |

19:00 |

Federal Budget Balance |

-- |

-$316.0b |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The 90-day delay for higher “reciprocal” tariffs is set to end on 9th The US has so far agreed trade deals with the UK and Vietnam to avoid the higher “reciprocal” tariffs from being implemented as initially planned back in early April on Liberation Day. The universal tariff of 10% will continue to apply to the UK alongside other sectoral tariffs while Vietnam will face a 20% “reciprocal” tariff. The deals signed so far suggest that a 10% tariff will be the lower bound and that countries which run larger trade surpluses with the US are likely to face higher tariffs. President Trump has even indicated that some countries could face higher tariffs of between 60-70% although we suspect those higher rates will only apply to smaller trading partners limiting the negative economic impact.

- The Antipodean central banks of the RBA and RBNZ will both hold their latest policy meetings in the week ahead. The RBA is expected to deliver another 25bps rate cut in the week ahead after cutting rates by the same amount at the last meeting in May. Market expectations for back-to-back rate cuts have been encouraged by the recent run of softer economic data from Australia including weaker Q1 GDP and the softer CPI report for May. Trade policy uncertainty remains a complication when setting policy which could argue for caution but it would be a big surprise for the RBA not to deliver a cut with 23bps already priced in. In contrast, the RBNZ is expected to temporarily pause their easing cycle by skipping a rate cut at next week’s meeting. At the last policy meeting in May the RBNZ removed an explicit easing bias and growth has since proved to be stronger than expected in Q1.

- The main economic data releases in the week ahead include: i) labour cash earnings from Japan for May, ii) the CPI reports from Norway and Sweden for June, iv) monthly GDP report for May, and v) the labour market report from Canada for June.