To read the full report, please download PDF.

Yen depreciation still limited from here

FX View:

The very cautious tone of BoJ Governor Ueda on Tuesday after announcing an unwind of the QQE framework put in place in 2013 by former Governor Kuroda has helped encourage renewed yen selling. The lack of strong guidance on further rate increases could continue to weigh on the yen over the short-term but any move higher in USD/JPY is likely to be halted in any case by intervention by the MoF and BoJ. Allowing the yen to weaken much from here would only serve to damage the Kishida government further given its unpopularity due to higher inflation. We see scope for yields in Japan to move higher given the potential for inflation to be higher than expected and due to the ongoing evidence of strong wage growth. That said, for a sustained period of yen appreciation to unfold, we will need to see G10 central banks commence cutting rates. That looks much more plausible after the SNB cut rates and the Fed and BoE provided communications suggesting rate cuts are coming, probably in June.

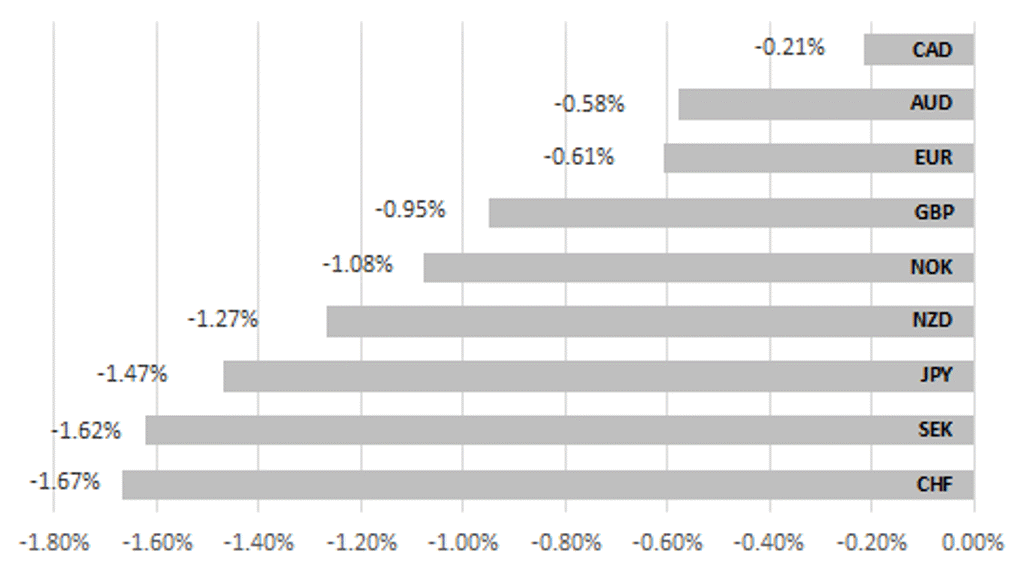

USD RECORDS BROAD-BASED STRENGTH WITH CHF SUFFERING MOST

Source: Bloomberg, 13:15 GMT, 22nd March 2024 (Weekly % Change vs. USD)

Trade Ideas:

We have cut our short EUR/GBP trade idea but have maintained our short CHF/JPY trade idea and added a long EUR/SEK trade view.

JPY Flows – Balance of Payments:

The MoF monthly Balance of Payments data for January was released earlier this month and revealed a clear pick-up in appetite for US bonds. US bond purchases by Japanese investors totalled JPY 3,368bn in January, the largest total since September.

FX Positioning:

Our two-year rolling z-scores signal that short JPY positions were the most stretched amongst Leveraged Funds. Short JPY positions recently reached their highest level since 2018 ahead of the BoJ’s latest policy meeting.

FX Views

USD/JPY: BoJ caution……for now

Tuesday’s BoJ monetary policy announcement was largely in line with our expectations as had been laid out here last week and we also emphasised the importance of the tone of communication and guidance by the BoJ in determining market reaction. The very well-telegraphed communications ahead of the announcement meant communication and guidance were the only unknown variables given the lack of surprise in the policy announcements. The guidance was certainly cautious with a lack of conviction in signalling the scale of future moves and that predictably led to renewed yen selling. But the lack of JPY demand post meeting has not altered our view that the BoJ decision is an important one and opens up the scope for yields to become more responsive to market forces that will over time lead to greater rates and FX swings which coupled with declining global yields sets the yen up for a move stronger over time.

Given the monetary policy changes announced were in line with our expectations, we are maintaining our view on the BoJ hiking again, by 20bps to 0.30% in Q4 (probably October). The risk to that view remains that the hike takes place in Q3 (July) and opens up the scope for a further hike in Q4. That scenario is as much linked to global conditions as it is domestic inflation and wage conditions. The FOMC this week through its updated Summary of Economic Projections revealed a ‘-no-landing’ scenario with GDP growth of 2.1%, 2.0%, and 2.0% from 2024 to 2026. We are unconvinced by those projections and see growth and inflation coming in weaker than the FOMC expects. But if the Fed projections did prove accurate for this year and into next year, the scope for the BoJ to hike more is certainly greater.

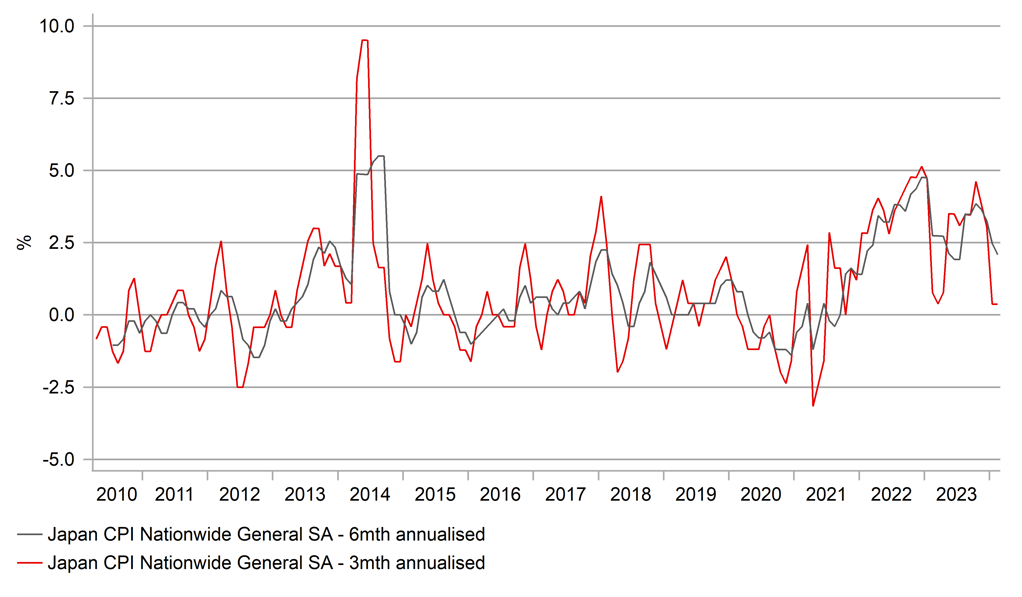

Nationwide CPI data from Japan was released today for February and the data revealed a rebound in the YoY rates for headline and core rates which reflects the base effects from the introduction of energy price subsidies falling out of the annual equation. In February 2023, electricity prices plunged by nearly 20% m/m. In order to look through this base-effect impact, assessing the CPI data on a 3mth or 6mth annualised basis can give us a better picture of momentum. That analysis confirms a trend of disinflation continues. The 3mth and 6mth annualised (NSA) rates show a sharp slowdown to just 0.4% and 2.1% respectively. On these recent trends you could certainly argue the limited need for additional rate hikes going forward.

3 & 6MTH ANNUALISED CPI SHOWS SLOWDOWN

Source: Bloomberg, Macrobond & MUFG GMR

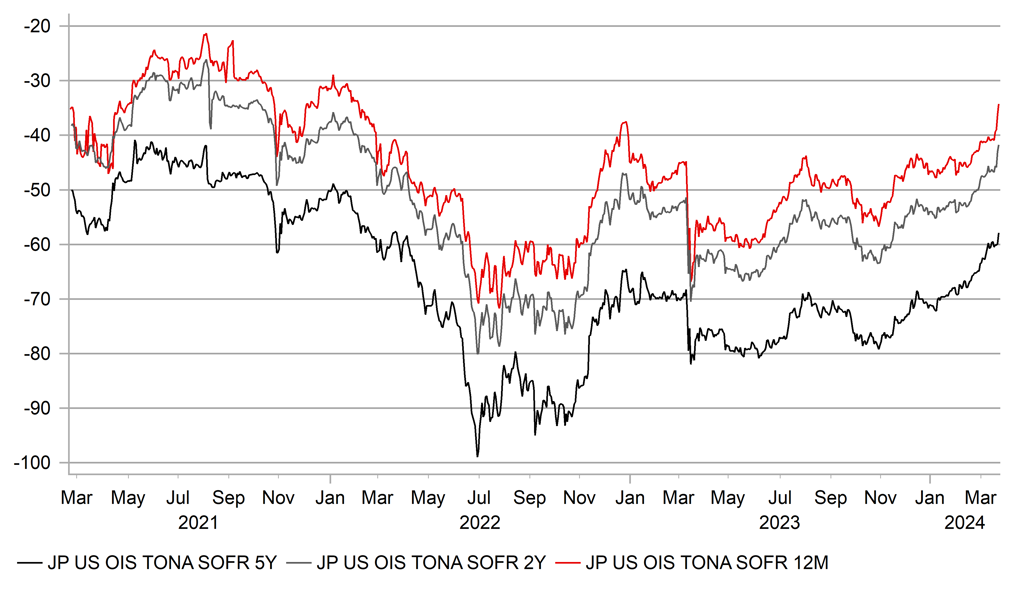

X-CURRENCY BASIS NARROWS ON BOJ POLICY SHIFT

Source: Bloomberg, Macrobond & MUFG GMR

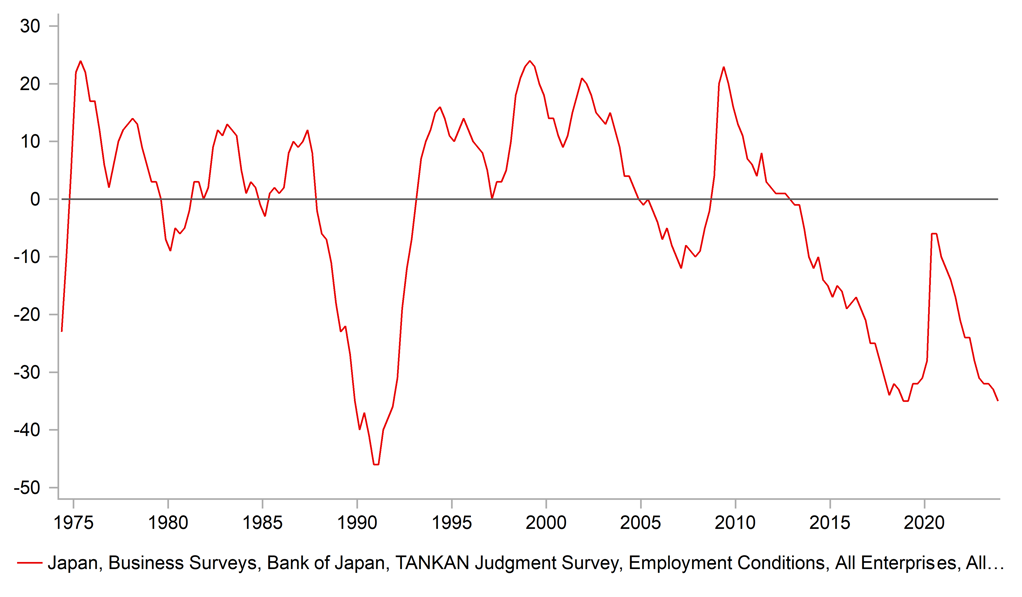

However, the key of course is the outlook ahead and there are certain factors pointing to the potential for a pick-up in the underlying inflation trend. Firstly, imported inflation is turning higher again after a sustained period of disinflation and then deflation. That will feed into CPI levels gradually going forward. Japan’s import prices fell from 48.7% in September 2022 to -14.7% in July 2023 and have since turned higher to +0.2% in February. Secondly, the energy price subsidy currently in place is set to expire on 30th April pointing to a big m/m increase in May which will reinforce inflation expectations. This subsidy could be extended but has not been confirmed. In addition, the wage data is likely to continue to reinforce the confidence of the BoJ that inflation can become more sustainable. The Rengo 2nd round estimate was announced today and the wage estimate was close to unchanged at 5.25% (5.28% 1st estimate). In the context of wage pressures going forward, the Tankan data, released on 1st April will be important and we will be looking closely at labour market conditions. The Q4 Employment diffusion index in the last report showed the tightest labour market conditions since 1991.

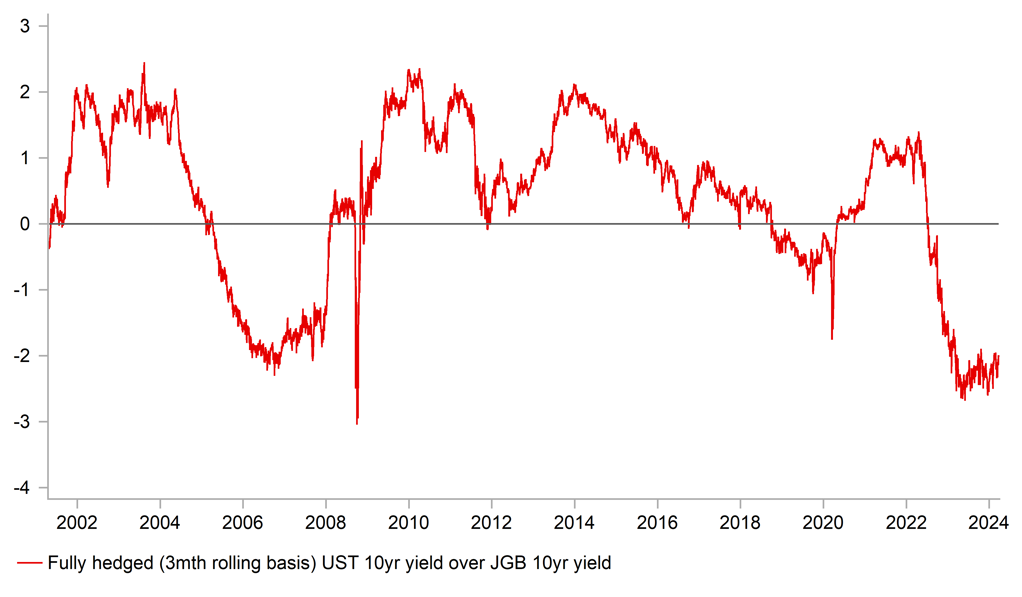

There has been a lot of speculation over the potential for a large-scale shift in flows with repatriation flows back to Japan putting upward pressure on the yen. We believe it would take a considerable move higher in JGB yields for that scenario to unfold. A more realistic scenario is a change in hedging behaviour. Returns abroad net of hedging have been poor given the elevated cost of hedging due to monetary tightening abroad. The lifting of rates in Japan we believe is important from a medium-term perspective in altering expectations about potential yen strength in the future and will likely encourage domestic investors to reconsider hedge ratios. Those ratios have likely drifted lower due to the elevated cost and once the Fed and other central banks commence cutting, the risk-reward balance will increasingly favour increased hedging. One-quarter of Life Insurance companies’ assets are in foreign markets totalling JPY 103trn as of December. A 10ppt increase in the hedge ratio equates to between USD 50-60bn worth of foreign currency sales versus the yen. But we will need to see a clear momentum in bull-steepening in the US curve for that scenario to potentially unfold. Lifers sold a record JPY 11.5trn worth of foreign bonds in 2022 and a further JPY 2.8trn in 2023. Clearly currency-hedged fixed income investments remain unattractive.

So, from an FX perspective it is difficult to argue BoJ action alone both this week and going forward will be enough to change the JPY direction. But when global yields do start to move lower, the stance of the BoJ will certainly reinforce the scale of yen appreciation. We still see scope for USD/JPY to drop to at least 140.00 by year-end with risks of a move to the mid-130’s. We also expect intervention quite quickly after any break of 152.00 with the government clearly opposed to yen depreciation that would only serve to reinforce voter dissatisfaction with the Kishida government.

TANKAN SURVEY – EMPLOYMENT CONDITIONS INDEX

Source: Macrobond & Bloomberg

JAPAN INVESTOR FULLY HEDGED UST BOND YIELD

Source: Macrobond & Bloomberg

USD: Will European central banks continue to lead rate cut cycle ahead of Fed?

The USD is on course to strengthen for the second consecutive week after a volatile couple of trading days. USD weakness after this week’s FOMC meeting has proven to be short-lived. The dollar index initially declined sharply by around -0.7% but it has since quickly recovered all of those losses and is now trading at the highest level in almost a month. While the Fed’s more dovish than expected policy update this week has helped to dampen upside risk for the USD in the near-term, it is clearly not sufficient on its own tor trigger a sustained weakening of the USD. The Fed’s policy update has made market participants more confident that the Fed will begin to cut rates in June and deliver at least three rate cuts this year. The Fed is not yet overly concerned by two consecutive months of higher US inflation.

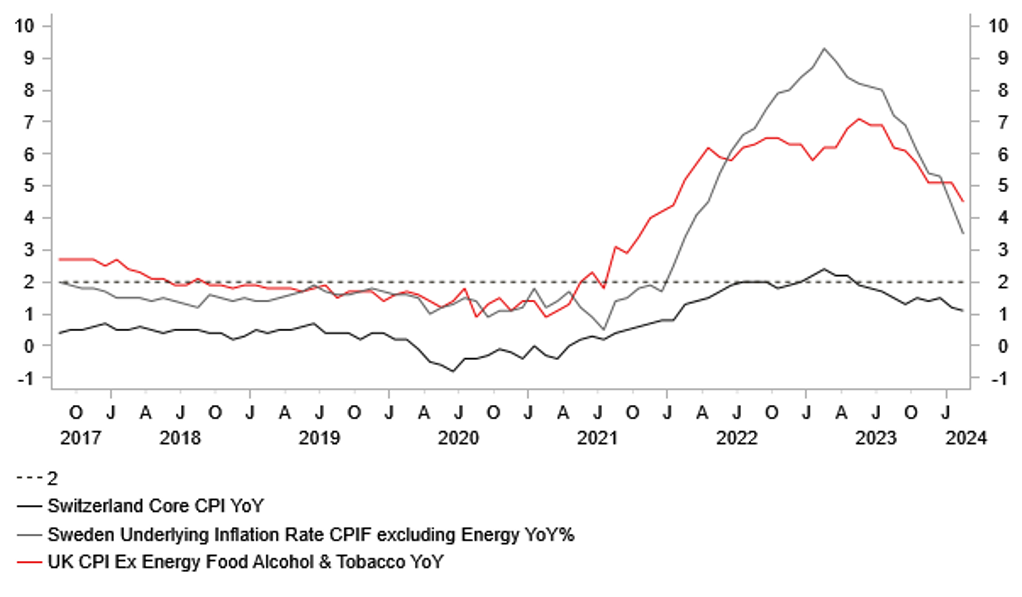

However, the negative impact on the USD from the dovish repricing of the Fed policy outlook has been quickly overshadowed by intensified speculation over earlier rate cuts from European central banks. It follows the surprise decision by the SNB lower rates yesterday by 25bps, and in doing so becoming the first G10 central bank to kick off monetary easing cycles. The SNB’s decision to deliver an earlier rate cut was justified by the significant downward revisions to their inflation forecasts while they continuing to express concern over the stronger CHF over the past year. The SNB’s first mover rate cut has reinforced the CHF’s position as one of the worst performing G10 currencies so far this year alongside the other low yielding funding currency of the JPY. A large part of the move higher for the CHF over the past year has already been reversed with EUR/CHF moving back to closer to parity where it was trading a year ago. We expect the SNB to cut rates again in June when they will be joined by the ECB starting their own easing cycle. A development which should then begin to ease downward pressure on the CHF.

At the same time, the BoE’s updated policy communication since yesterday’s MPC meeting has encouraged expectations that they will also will join a more synchronized easing cycle from Q2. In media interviews carried out since yesterday’s MPC meeting, Governor Bailey has indicated that rate cuts are “in play” at future policy meetings, and highlighted that there would be a reappraisal in the May Monetary Policy Report of their forecast for inflation to pick back up again over the summer after falling below target temporarily in Q2 when the Ofgem energy price cap is set lower. The comments suggest that a rate cut from the BoE can’t be ruled out as early as at the next MPC meeting in May if there is a significant downward revision to the inflation forecasts.

INFLATION SURPRISING TO DOWNSIDE IN SW, SZ & UK

Source: Bloomberg, Macrobond & MUFG

USD/CNY BREAKS ABOVE RESISTANCE AT 7.2000-LEVEL

Source: Bloomberg, Macrobond & MUFG

We have brought forward our forecast for the first BoE rate cut to June from August. After outperforming at the start of this year on the back of expectations that the BoE will lag behind the ECB and Fed when beginning to cut rates, this week’s dovish BoE policy guidance could now trigger a correction lower for the GBP in the coming months. We have decided to close our short EUR/GBP trade idea after it failed to break below support at the 0.8500-level, and the pair is now threatening to break back above resistance from the 200-day moving average at around 0.8610 for the first time since the end of last year.

The next European central bank to provide a policy update will be the Riksbank when they meet next week on 27th March. The Riksbank is expected to leave their policy rate unchanged at 4.00% for the third consecutive meeting. We expect the updated policy guidance to signal a more dovish outlook that could tee up the first rate cut from the Riksbank as early as at the following policy meeting in May. Similar to in Switzerland and the UK, inflation in Sweden has surprised to the downside at the start of this year which is encouraging a dovish policy shift. The CPIF excluding energy measure of core inflation in Sweden has continued to slow sharply to 3.5% in February down from 5.3% at the end of last year. Deputy Governor Floden stated recently that it is “increasingly clear inflation is moving toward target”. A development that is creating room for the Riksbank to make the monetary policy less restrictive for Sweden’s economy that has fallen into recession. Unlike the SNB though, the Riksbank remains concerned by SEK weakness which may make it relatively more reluctant to cut rates ahead of the ECB. Ahead of next week’s Riskbank meeting, EUR/SEK is threatening to break higher above year to date highs at around 11.400 in anticipation that a dovish policy update could lift the pair back up closer to the 200-day moving average at around 11.500.

The final trigger for the USD’s rebound at the end of this week has been the adjustment lower for the CNY overnight. USD/CNY has finally climbed decisively above the 7.2000-level which has provided strong resistance since mid-January even though it has not been the top of the daily trading band. The daily fix was adjusted higher overnight from 7.0942 to 7.1004 in what was the biggest daily move in the fix since 5th February. It has lifted the top of the daily trading band to 7.2424. USD/CNY is still trading just below the top of the band leaving some room for the pair to keep moving higher. As the pair approaches the top of the daily trading band, market attention will intensify on the daily fixings for an indication of whether domestic policymakers in China are becoming more tolerant of allowing the CNY to weaken further. The weaker CNY has already had a negative spill-over impact on the performance of other Asian currencies and the G10 commodity currencies of the AUD and NZD. A further weakening of the CNY would cast some doubt on our assumption that China will continue to support the CNY as it prioritizes currency stability.

In summary, this week’s developments have increased downside risks for European currencies against the USD. The biggest dovish shift in expectations has been for BoE rate cut expectations which threatens to trigger a reversal of GBP outperformance at the start of this year. Nevertheless, the start of easing cycles for the major central banks of the BoE, ECB and Fed still appear synchronized which continues to favour relative stability for the major FX pairs of EUR/USD, GBP/USD and EUR/GBP. The SEK is next in the firing line with the Riksbank set to deliver a dovish policy update in the week ahead.

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GBP |

03/25/2024 |

11:00 |

CBI Retailing Reported Sales |

Mar |

-- |

-7.0 |

! |

|

USD |

03/25/2024 |

14:00 |

New Home Sales |

Feb |

675k |

661k |

! |

|

GBP |

03/25/2024 |

14:15 |

BoE's Mann speaks |

!!! |

|||

|

CAD |

03/26/2024 |

12:15 |

BoC Senior Deputy Governor Rogers speaks |

!!! |

|||

|

USD |

03/26/2024 |

12:30 |

Durable Goods Orders |

Feb P |

0.8% |

-6.2% |

!! |

|

USD |

03/26/2024 |

14:00 |

Conf. Board Consumer Confidence |

Mar |

107.0 |

106.7 |

!! |

|

NZD |

03/26/2024 |

Tbc |

NZ Government Budget Policy Statement |

!! |

|||

|

AUD |

03/27/2024 |

00:30 |

CPI YoY |

Feb |

3.5% |

3.4% |

!!! |

|

SEK |

03/27/2024 |

08:30 |

Riksbank Policy Rate |

-- |

4.0% |

!!! |

|

|

EUR |

03/27/2024 |

10:00 |

Consumer Confidence |

Mar F |

-- |

-14.9 |

!! |

|

AUD |

03/28/2024 |

00:30 |

Retail Sales MoM |

Feb |

0.5% |

1.1% |

!! |

|

GBP |

03/28/2024 |

07:00 |

GDP QoQ |

4Q F |

-- |

-0.3% |

!! |

|

GBP |

03/28/2024 |

07:00 |

Current Account Balance |

4Q |

-- |

-17.2b |

!! |

|

SEK |

03/28/2024 |

07:00 |

Retail Sales MoM |

Feb |

-- |

0.4% |

!! |

|

CHF |

03/28/2024 |

08:00 |

KOF Leading Indicator |

Mar |

-- |

101.6 |

!! |

|

EUR |

03/28/2024 |

08:55 |

Germany Unemployment Change (000's) |

Mar |

-- |

11.0k |

!! |

|

EUR |

03/28/2024 |

09:00 |

M3 Money Supply YoY |

Feb |

-- |

0.1% |

!! |

|

CAD |

03/28/2024 |

12:30 |

GDP MoM |

Jan |

0.2% |

0.0% |

!! |

|

USD |

03/28/2024 |

12:30 |

GDP Annualized QoQ |

4Q T |

3.2% |

3.2% |

!! |

|

USD |

03/28/2024 |

12:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

03/28/2024 |

14:00 |

U. of Mich. Sentiment |

Mar F |

76.5 |

76.5 |

!! |

|

EUR |

03/28/2024 |

17:30 |

ECB's Villeroy speaks |

!!! |

|||

|

JPY |

03/28/2024 |

23:30 |

Tokyo CPI YoY |

Mar |

2.5% |

2.6% |

!! |

|

JPY |

03/28/2024 |

23:30 |

Jobless Rate |

Feb |

2.5% |

2.4% |

!! |

|

JPY |

03/28/2024 |

23:50 |

Retail Sales YoY |

Feb |

2.3% |

2.3% |

!! |

|

EUR |

03/29/2024 |

07:45 |

France CPI YoY |

Mar P |

-- |

3.0% |

!!! |

|

EUR |

03/29/2024 |

10:00 |

Italy CPI EU Harmonized YoY |

Mar P |

-- |

0.8% |

!!! |

|

USD |

03/29/2024 |

12:30 |

PCE Deflator YoY |

Feb |

2.5% |

2.4% |

!!! |

|

USD |

03/29/2024 |

12:30 |

Advance Goods Trade Balance |

Feb |

-$89.9b |

-$90.2b |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- There is a quieter schedule of economic events and data releases for the week ahead following the busy week of G10 central bank updates over the past week. The Riksbank is the next G10 central bank to provide a policy update in the week ahead. We expect the Riksbank to indicate that they are moving closer to cutting rates at upcoming policy meeting in either May or June. There has been a significant improvement in inflation outlook at the start of this year in Sweden. The CPIF excluding energy measure of inflation has slowed more sharply than expected to 3.5% in February from 5.3% at the end of last year.

- The main economic data release in the week ahead will be the US PCE deflator report for February. After the stronger than expected US CPI and PPI reports for February, the PCE deflator report is expected to provide further confirmation that inflation remained firmer than desired in February. The core PCE deflator is expected to have increased by 0.3%M/M in February following the +0.4%M/M jump in January. It compares to an average monthly increase of +0.2%M/M during the 2H of last year. Fed Chair Powell’s comments at the latest FOMC meeting have indicated that they are not yet overly concerned by the pick-up in inflation at the start of this year which should help dampen the market impact of the upcoming PCE deflator release for February.

- Other economic data releases and events to watch out for in the week ahead include: i) a speech from BoC Senior Deputy Governor Rogers (Tues), ii) the New Zealand government’s budget statement, iii) the Australia CPI report for February, and iii) France and Italy CPI report for March. Market participants will be watching closely for any signal from the BoC that they are closer to cutting rates at their upcoming policy meetings in April or June in response to slowing core inflation at the start of this year. The recent sharp inflation slowdown in Australia has made the RBA more confident that they have raised rates sufficiently. However, they are not yet at the point where they are considering rate cuts. The latest blow out Australian labour market report for February even if the strength proves temporary supports the RBA’s caution over cutting rates too soon. The releases of the latest CPI reports from France and Italy for March will be watched closely to further assess how quickly the ECB is likely to cut rates in Q2.