To read the full report, please download PDF.

USD has scope for further gains

FX View:

The FX market has finally come to life after a long lull driven by expectations of a higher than usual degree of synchronised monetary easing amongst the major central banks. That has been thrown into doubt this week with the release of the stronger than expected US CPI data. We do see scope for some clearer divergence in policy easing that in our view leaves open the path for further US dollar strength ahead. It’s very unlikely now that the Fed will cut as soon as June while the ECB and BoC meetings this week and today’s weaker CPI data in Sweden all point to an increasing number of other G10 central banks commencing easing prior to the Fed. The Riksbank could now cut in May with the ECB, SNB and BoC following in June. We doubt this divergence theme will be sustained over a sustained period and still expect the US data to turn in order to allow the Fed to commence easing, possibly by July. So while the window for USD strength is open, we doubt it will remain open longer than a month or two.

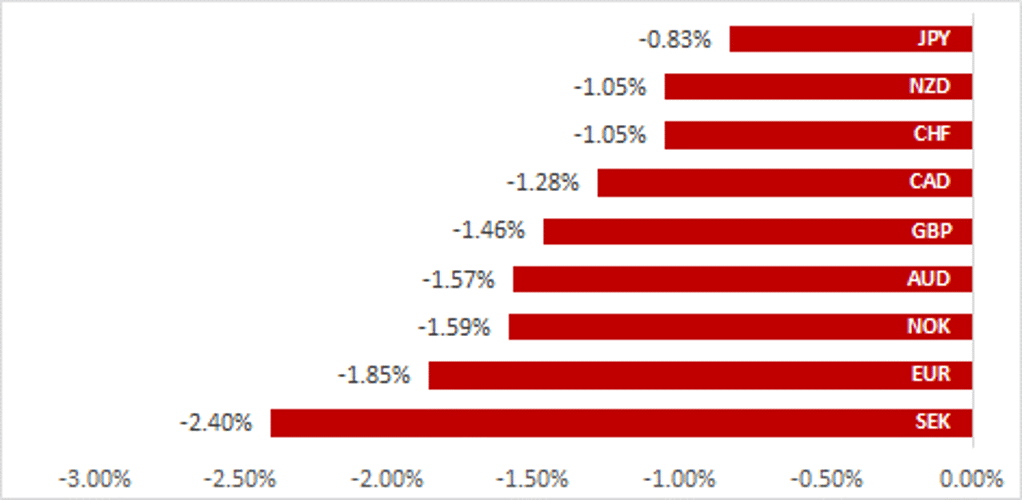

JPY TOP PERFORMING G10 CURRENCY AFTER USD THIS WEEK

Source: Bloomberg, 14:00 BST, 12th April 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our long EUR/SEK and short CHF/JPY trade ideas.

JPY Flows – Portfolio flows by investor:

Japanese investor breakdown data of foreign security purchases in March revealed continued selling of foreign bonds by Lifers and continued buying of foreign equities by Investment Trusts.

FX Momentum Indicators:

Considering performances across a 3mth period, this week EUR/USD had the strongest relative downward momentum since March 2020 where the move was 3.615 standard deviations below the average for the period. Across the same period GBP/USD also flagged distinctly strong downwards momentum where the standard deviations were calculated as -3.115.

FX Views

G10 FX: US CPI opens up further USD appreciation path

The path for further US dollar appreciation from here remains clear with the US CPI data forcing markets into a rethink on the starting time for the first rate cut from the Fed. This context and the lack of USD traction prior to the inflation print have resulted in a strong pick-up in positive momentum. The positioning data currently highlights considerable capacity for dollar buying. The IMM USD index futures positioning has seen three consecutive weeks of USD selling to Tuesday of last week with the non-commercial position now a net short for two weeks running. It’s the first net short USD position since June 2021 well before the start of the global inflation shock and the start of Fed tightening. Clearly, the FX market has positioned for the start of the cutting cycle, which now delayed, points to plenty of scope for further dollar buying.

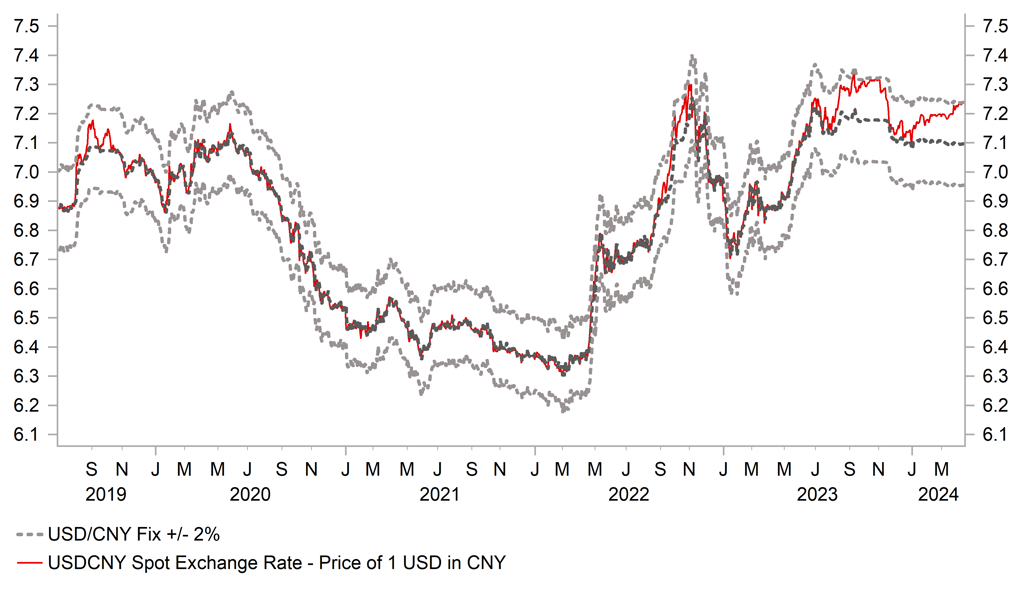

The global backdrop will also be an important input into how much the dollar can strengthen over the coming months. In that regard the information is mixed and therefore at present it is hard to argue that the global backdrop is a big impediment, at least to some further dollar strength over the near-term. Trade data released from China today certainly helped to reinforce global growth uncertainties and help reinforce dollar strength. Exports plunged 7.5% in March (expected -1.9% & -3.8% in CNY terms), much weaker than expected. When viewed in Q1 terms though the picture is somewhat different with exports up 4.9% (CNY terms). Still, we may see some upward momentum in USD/CNY. In RMB CFETS TWI terms, CNY is advancing due to USD strength and a limited USD/CNY move higher. RMB CFETS is moving higher. USD/CNY is now at the upper end of its limit and PBoC is set to adjust fixings higher.

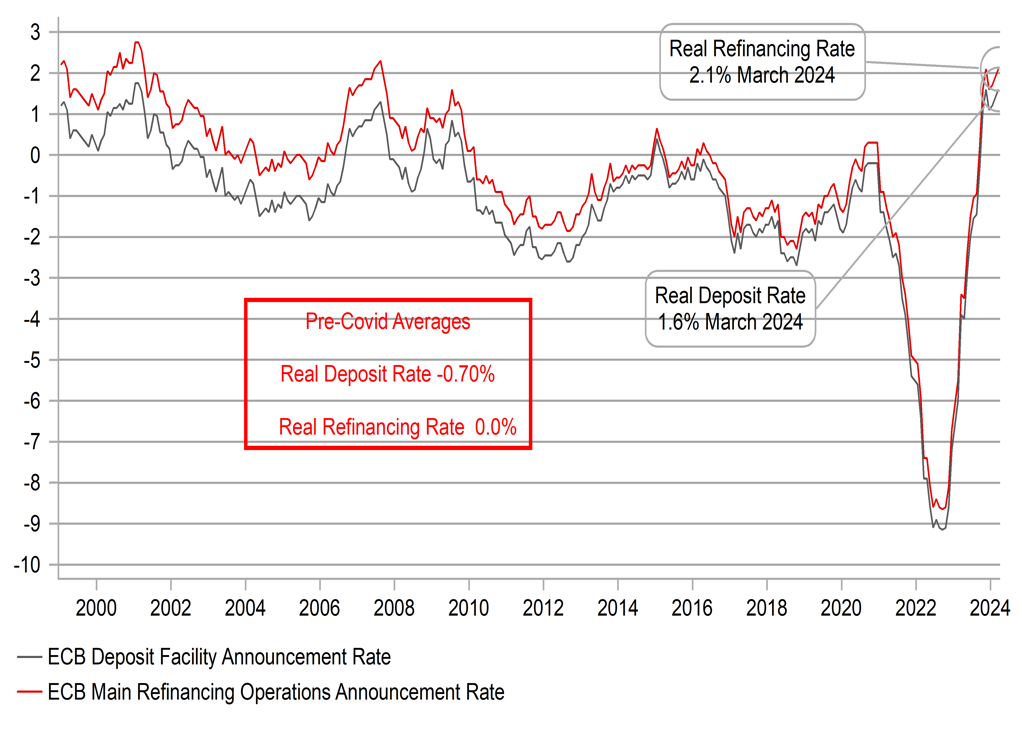

The main catalyst for dollar buying since the US CPI data release has been versus EUR after the ECB provided a more explicit message on guidance for a rate cut at the next meeting in June. We covered the ECB meeting (here) already but the more explicit message from the ECB does suggest greater concerns over the monetary stance being excessively restrictive. Indeed, the ECB should have cut yesterday and the confidence in signalling a cut in June perhaps highlights the Governing Council’s view on the balance of risks. We’ve already seen quite a sharp drop since Wednesday and our momentum indicator points to the prospect of further declines from here. Our z-score analysis of the shift in momentum over the last three trading days relative to trading over the last 3mths of trading shows the strongest shift in momentum since the outbreak of the pandemic in 2020 (19th March 2020).

PBOC CNY FIXINGS SET TO BE ADJUSTED HIGHER

Source: Bloomberg, Macrobond & MUFG GMR

REAL ECB POLICY RATES CLOSE TO RECORD HIGH

Source: Bloomberg, Macrobond & MUFG GMR

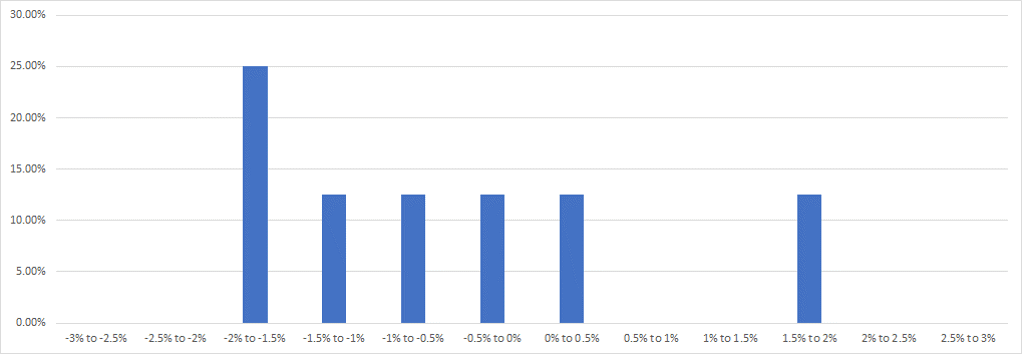

There have only been 8 occasions since EUR began trading in 1999 when we have had such a powerful shift in momentum to the downside. In March 2020 there was a reversal in the five trading days after that but when looking at the entire trading history for EUR, the probability distribution of returns in the next five-day trading period is clearly skewed to the downside. That remains our bias and looking at the trading history since 1999 is perhaps a good potential gauge of what is to come.

However, USD selling intervention remains a high risk that could, temporarily at least, disrupt dollar strength. USD/JPY has broken above the 152-level without any action to stem yen weakness. But there were a number of constraints to intervening this week. Firstly, PM Kishida has been in Washington on a state visit and yesterday addressed the joint Houses of Congress. PM Kishida would not have wanted intervention to have taken place while in Washington. He will return to Japan at the weekend. Secondly, after a period of consolidation below 152.00 (since 20th March), the move cannot yet be classed as “excessive”. Vice Finance Minister Kanda did make reference to a significant” move in JPY since the start of the year and that could be how Tokyo views the scale of moves if intervention does take place. Finally, JPY has actually been outperforming the rest of G10 since the start of trading on Wednesday. Again, not grounds for claiming speculative JPY selling. If moves accelerate next week and we see signs of underperformance that would certainly encourage intervention. But even if the move is more aligned there remains a high risk of intervention. Japanese households are suffering a cost of living crisis and furthermore “Mrs Watanabe” FX retail flows suggest increase long JPY positioning (TFX positions more than OTC) that point to Japan retailers positioned for intervention!

PROB. DISTRIUBTION OF 5-DAY AHEAD % CHANGE AFTER EUR/USD MOMENTUM SHIFT THIS WEEK

Source: Bloomberg, Macrobond & MUFG GMR

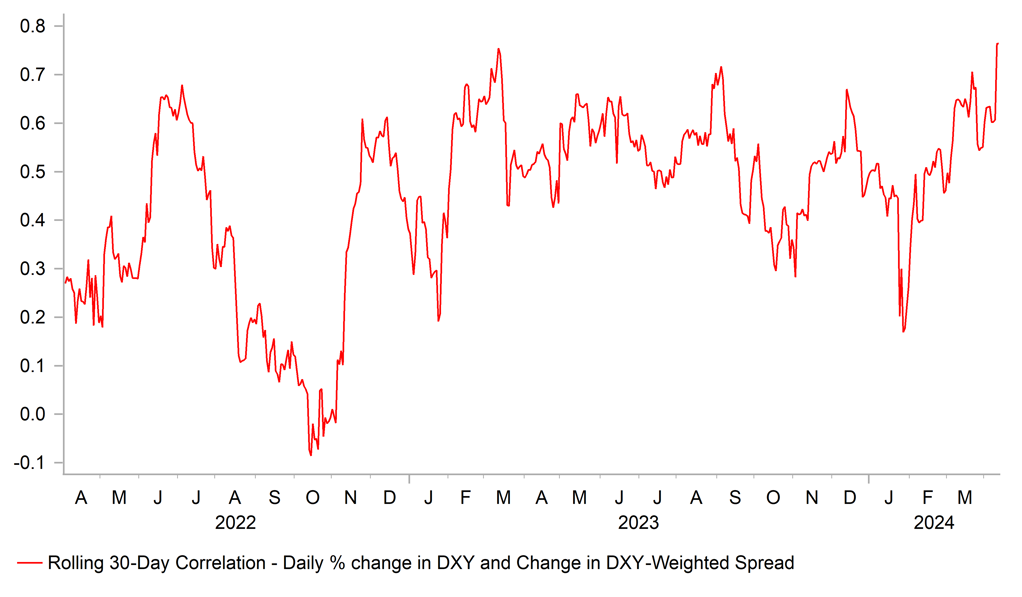

USD / 2YR YIELD SPREAD CORRELATION STRENGTHENS NOTABLY WITH YIELD SPREADS DOMINATING MOVE

Source: Bloomberg, Macrobond & MUFG GMR

We have not entirely abandoned our call for a weaker US dollar. But with a June FOMC rate cut now unlikely and with an increasing number of G10 central banks likely to ease before the Fed (ECB; BoC, SNB to all ease in June) there is a window of divergence to encourage further dollar buying. But we see the change in Fed view as only a delay and by July we will have had three further rounds of inflation data and jobs data that should be favourable enough to justify easing. Inflation upside surprises are still in large part rents-driven (47% of services CPI increase in March data was rents) and this technical feature should unwind going forward. But until we see some evidence of this the scope for US dollar strength will remain.

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

04/15/2024 |

00:50 |

Core Machine Orders MoM |

Feb |

-- |

-1.70% |

! |

|

EUR |

04/15/2024 |

10:00 |

Industrial Production SA MoM |

Feb |

-- |

-3.20% |

! |

|

USD |

04/15/2024 |

13:30 |

Empire Manufacturing |

Apr |

-7 |

-20.9 |

!! |

|

USD |

04/15/2024 |

13:30 |

Retail Sales Advance MoM |

Mar |

0.40% |

0.60% |

!!!! |

|

USD |

04/15/2024 |

13:30 |

Retail Sales Control Group |

Mar |

0.30% |

0.00% |

!!!! |

|

USD |

04/15/2024 |

15:00 |

Business Inventories |

Feb |

0.30% |

0.00% |

! |

|

GBP |

04/16/2024 |

07:00 |

Average Weekly Earnings 3M/YoY |

Feb |

-- |

5.60% |

!!!! |

|

GBP |

04/16/2024 |

07:00 |

ILO Unemployment Rate 3Mths |

Feb |

-- |

3.90% |

!! |

|

GBP |

04/16/2024 |

07:00 |

Employment Change 3M/3M |

Feb |

-- |

-21k |

!!! |

|

EUR |

04/16/2024 |

10:00 |

German ZEW Survey Expectations |

Apr |

-- |

31.7 |

!! |

|

USD |

04/16/2024 |

13:30 |

Housing Starts |

Mar |

1480k |

1521k |

!! |

|

CAD |

04/16/2024 |

13:30 |

CPI NSA MoM |

Mar |

0.70% |

0.30% |

!!! |

|

CAD |

04/16/2024 |

13:30 |

CPI YoY |

Mar |

2.90% |

2.80% |

!!! |

|

CAD |

04/16/2024 |

13:30 |

CPI Core- Median YoY% |

Mar |

-- |

3.10% |

!!! |

|

USD |

04/16/2024 |

14:00 |

Fed's Jefferson speaks |

!!!! |

|||

|

USD |

04/16/2024 |

14:15 |

Industrial Production MoM |

Mar |

0.40% |

0.10% |

!! |

|

JPY |

04/17/2024 |

00:50 |

Trade Balance Adjusted |

Mar |

-- |

-¥451.6b |

! |

|

GBP |

04/17/2024 |

07:00 |

CPI MoM |

Mar |

-- |

0.60% |

!!!! |

|

GBP |

04/17/2024 |

07:00 |

CPI YoY |

Mar |

-- |

3.40% |

!!!! |

|

GBP |

04/17/2024 |

07:00 |

CPI Core YoY |

Mar |

-- |

4.50% |

!!!! |

|

EUR |

04/17/2024 |

10:00 |

CPI YoY |

Mar F |

-- |

2.40% |

!! |

|

EUR |

04/17/2024 |

10:00 |

CPI MoM |

Mar F |

-- |

0.80% |

!! |

|

EUR |

04/17/2024 |

10:00 |

CPI Core YoY |

Mar F |

-- |

2.90% |

!! |

|

USD |

04/17/2024 |

19:00 |

Federal Reserve Releases Beige Book |

!! |

|||

|

EUR |

04/18/2024 |

09:00 |

ECB Current Account SA |

Feb |

-- |

39.4b |

! |

|

USD |

04/18/2024 |

13:30 |

Philadelphia Fed Business Outlook |

Apr |

-1.5 |

3.2 |

!! |

|

USD |

04/18/2024 |

15:00 |

Leading Index |

Mar |

-0.10% |

0.10% |

!! |

|

USD |

04/18/2024 |

15:00 |

Existing Home Sales |

Mar |

4.09m |

4.38m |

!! |

|

JPY |

04/19/2024 |

00:30 |

Natl CPI YoY |

Mar |

-- |

2.80% |

!!! |

|

JPY |

04/19/2024 |

00:30 |

Natl CPI Ex Fresh Food YoY |

Mar |

-- |

2.80% |

!!! |

|

JPY |

04/19/2024 |

00:30 |

Natl CPI Ex Fresh Food, Energy YoY |

Mar |

-- |

3.20% |

!!!! |

|

GBP |

04/19/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Mar |

-- |

0.00% |

!!! |

|

GBP |

04/19/2024 |

07:00 |

Retail Sales Ex Auto Fuel MoM |

Mar |

-- |

0.20% |

!!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The US data highlight in the data release schedule will come on Monday with the release of the retail sales report for March. There has been tentative signs of slowing consumer spending in the US with Q1-to-date retail sales down from the Q4 level. Any surprise weakness in the March data would more clearly confirm a slowdown is materializing and could therefore prompt a bigger market reaction. Control Group retail sales is expected to pick up after a 0.3% drop in January and no change in February.

- The busiest week for data releases will be in the UK with the labour market, inflation and retail sales data. All will be key for BoE policy deliberations especially the wage and inflation data. Wage growth is slowing – the 6-month annualized change in headline average weekly wages has slowed to a little over 2.0% suggesting a softening trend that should become more evident in the 3mth YoY growth rate over the coming months. Services inflation within the CPI will be important with the MPC focused on inflation persistence indicators. Japan inflation will be released at the end of the week and will be key given expectations of further BoJ rate hikes in the second half of the year – we expect a July hike.

- We have highlighted what we think could be the most important Fed speaking event – Fed Governor Jefferson on Wednesday who will speak at the Fed’s International Research Forum. There will though be 9 separate Fed speaking events next week with seven different Fed officials speaking – so a busy week for Fed speeches.