To read the full report, please download PDF.

Tentative recovery underway for the USD

FX View:

The USD is on course to strengthen modestly for the third consecutive week against other major currencies lifting the dollar index back above the 100.00-level. Yet it is still around 4% lower than prior to last month’s sharp sell-off. The USD has derived support over the past week from positive trade developments which are helping to ease fears over a more disruptive outcome for the global economy, and restoring confidence in US policymaking. The Trump administration has announced the first trade deal with the UK and many more are expected to follow with other countries before the end of the reciprocal tariff delay on 9th July. The deal will lower sectoral tariffs applied to imports from the UK but the 10% universal tariff remains in place. US and China could reach an agreement as early as next week to lower current unsustainable tariff rates. Tariff reductions are not yet sufficient to trigger a bigger and more sustained rebound for the USD. At the same time, the Fed remains in “wait and see” mode to see how trade disruption impacts the US economy. Their reluctance to pre-emptively cut rates has lifted US yields and the USD.

USD STRENGTHENS AGAINST MOST G10 CURRENCIES

Source: Bloomberg, 13.20 BST, 9th May 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a long EUR/NZD trade idea.

IMM Positioning:

The latest IMM weekly positioning data covering the week to 29th April revealed that Leveraged Funds cut back long USD positions for the thirteenth consecutive week. Leveraged Funds held the largest overall short USD position since the first half of October.

FX Correlation Trees :

Stronger correlations for the CHF, JPY and gold are consistent with more risk-off trading conditions in April and the broader loss of confidence in the USD. However, we have found that the number of meaningful correlations has declined over the last week or so highlighting that the loss of confidence in the USD is becoming less evident.

FX Views

USD: Trade policy relief & on hold Fed help to provide support for USD

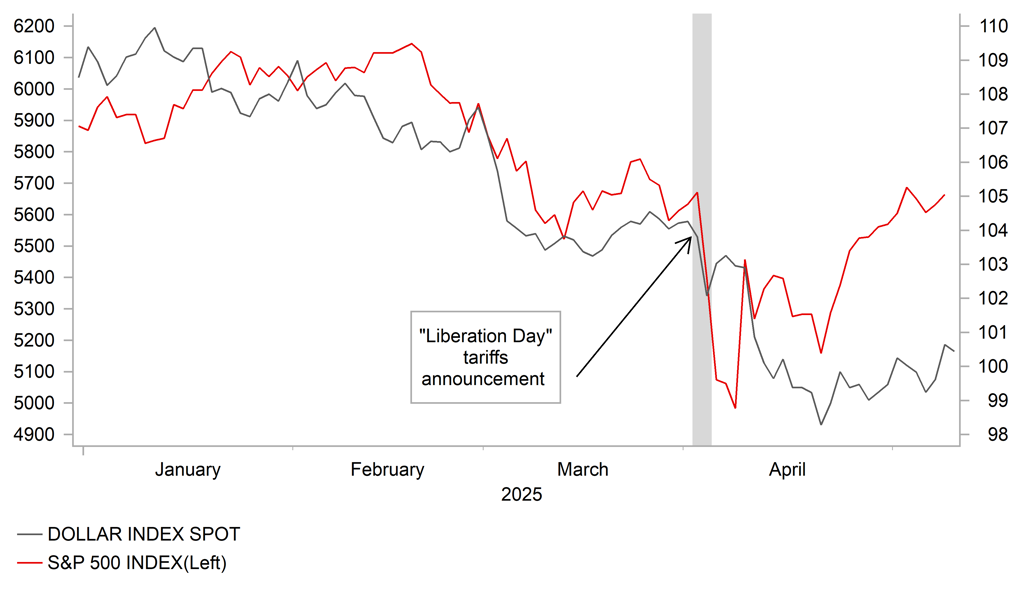

The USD is continuing to stage a modest rebound at the start of this month following last month’s heavy sell-off. After hitting a low 97.921 on 21st April, the dollar index has risen back above the 100.00-level although it is still trading around 4% below levels that were in place at the end of March. The USD rebound has coincided with US equity markets fully reversing sharp losses recorded just after President Trump’s “Liberation Day” tariffs announcement on 2nd April when the S&P500 index initially fell by almost 15%. The recovery in investor confidence towards US assets and the USD reflects an easing of fears over potential disruption from US trade policies under the Trump administration.

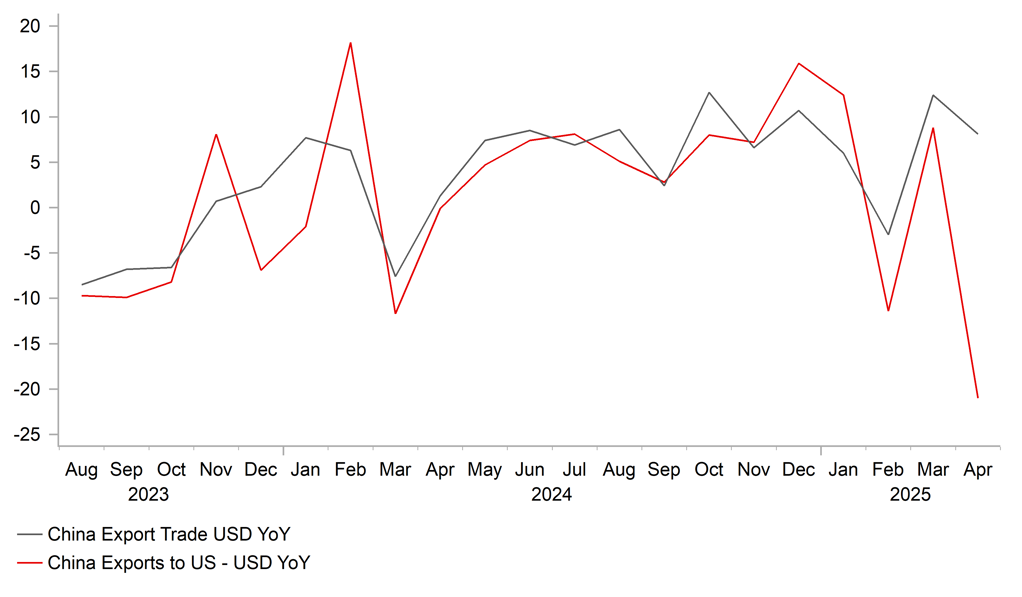

Market participants have been encouraged this week by the announcement of the first US trade agreement with the UK to begin reversing tariff hikes. The Economic Prosperity Deal (EPD) will see the tariff on car exports from the UK reduced from 27.5% to 10% for a quota of 100k UK cars which has been set at almost the same level of exports as last year. In addition, the tariff on aluminium & steel exports from the UK will be reduced from 25% to 0%. The UK may also secure preferential tariff rates on other sectoral tariffs that are applied including upcoming US plans to raise tariffs on the pharmaceuticals sector. However, the US will still apply a 10% universal tariff to imports from the UK. It highlights that the Trump administration is more flexible over reducing sectoral tariffs. President Trump warned as well that the lowest tariff rate for other countries even after trade deals “will be much higher because they have massive trade surpluses”. The Trump administration is also considering lowering tariffs on China back below 60% which could come as early as next week. It could bring the tariff rate on imports from China down from 145% closer to the 54% rate originally set on “Liberation Day” (20% for fentanyl + 34% higher reciprocal rate) before China retaliated. President Trump has since posted though that 80% tariffs on China “seem about right”. The developments support our view that trade tariffs will remain at more disruptive levels for global trade this year. A larger and more-broad-based reversal of tariff hikes would likely be needed to trigger a more sustained rebound for the USD and marked improvement in confidence in US policymaking.

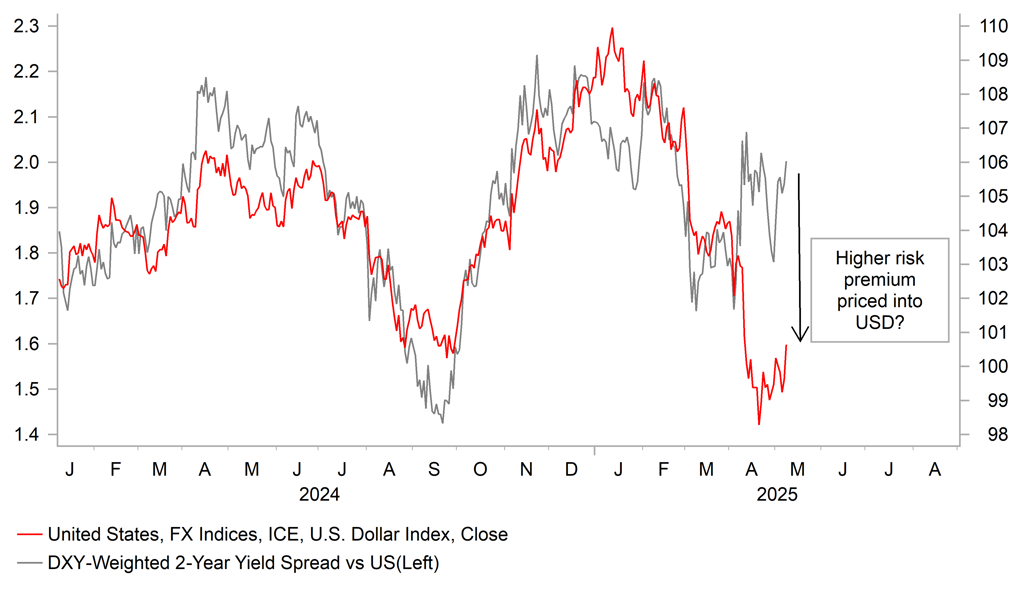

At the same time, the USD has derived some support this week from the Fed’s latest policy update which has prompted market participants to scale expectations for further Fed rate cuts. The US rate market is now only pricing in around 4bps of Fed rate cuts by the June meeting and is no longer fully (around 18bps) pricing in a rate cut by the July FOMC meeting. This week’s policy update from the Fed refrained from sending a stronger signal that they were moving closer to cutting rates. In the press conference, Fed Chair Powell reiterated that the Fed sees “no need to hurry” to lower rates, and feels like “it’s appropriate to be patient”. He believes it is “not a situation where we can be pre-emptive, because we actually don’t know what the right response to the data will be until we see more data”. The Fed has been criticized recently by President Trump for being too slow to cut rates but there has been no sign that they are giving in to political pressure. For now the Fed is in wait and see mode. We expect the Fed to resume rate cuts when evidence emerges that the US labour market is loosening in response to trade disruption and heightened policy uncertainty supporting our outlook for further USD weakness during the 2H of this year (click here). However, the bar is now higher for a rate cut as soon as at the 18th June FOMC meeting when there will have been just one more nonfarm payrolls report released, and it is still unlikely to be clear what President Trump’s plans are for the higher “reciprocal tariff” rates when the 90-day delay comes to an end on 9th July. A delay to Fed rate cuts may help to offer some much needed support for the USD in the near-term although the link with short-term yield spreads has broken down recently. An unusually wide gap has opened up between short-term yield spreads and the USD. It could be an indication that market participants have priced in a higher policy risk premium into USD and/or a larger than normal position adjustment has taken place.

RECOVERY IN US EQUITIES & USD AFTER SELL-OFF

Source: Bloomberg, Macrobond & MUFG GMR

USD HAS DIVERGED FROM YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

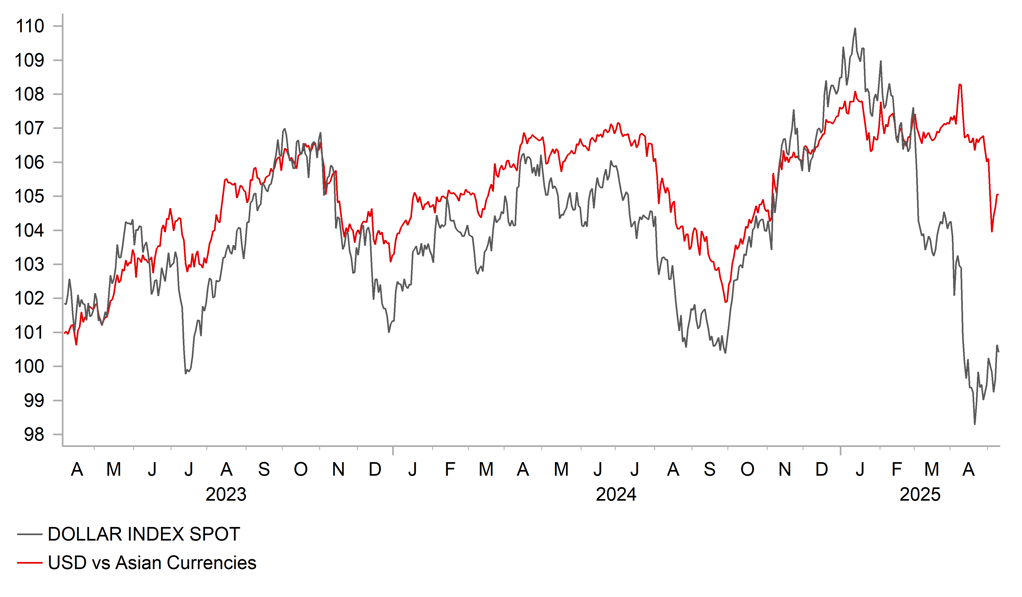

While the USD has staged a modest rebound against other G10 currencies this month, it has continued to weakened more against Asian currencies which have seen catch-up strength. After weakening alongside the US dollar at the start of this year, Asian currencies have strengthened sharply in recent weeks with the biggest gains recorded by the TWD. The TWD strengthened by almost 9% against the USD on 2nd and 5th May. The outsized gains for the TWD have fuelled speculation over a shift in FX policy in Taiwan. Trade negotiations between the US and Taiwan could be putting pressure on domestic policymakers to scale back intervention to prevent the TWD from strengthening although there has been no official confirmation that a trade agreement would include a reference to FX rates. Taiwan has been running outsized current account surpluses over the last three to four years totalling between 13-15% of GDP that have been recycled into US assets. Bloomberg has reported that Taiwanese life insurers held USD687 billion in foreign assets at the end of Q1, and stepping up FX hedging to guard against the risk of further USD weakness could have reinforced the move lower in USD/TWD. Strength in the TWD has spilled over into other Asian currencies especially the KRW and THB which have seen larger moves as well. Market participants are now watching closely to see if this is the start of a more sustained and broader shift in FX policy in the region. China’s continues to prioritize stability for USD/CNY which remains an anchor for Asian currency performance. The initial spill-over to G10 currencies has been limited. The AUD, NZD and JPY all strengthened at the start of this week but have quickly given back those gains.

CHINA EXPORT GROWTH HOLDS UP APART FROM TO US

Source: Bloomberg, Macrobond & MUFG GMR

CH-UP ASIAN CURRENCY STRENGTH

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

12/05/2025 |

00:50 |

BoP Current Account Balance |

Mar |

¥3778.9b |

¥4060.7b |

!! |

|

USD |

12/05/2025 |

15:25 |

Fed's Kugler Speaks |

!! |

|||

|

USD |

12/05/2025 |

19:00 |

Federal Budget Balance |

Apr |

-- |

-$160.5b |

!! |

|

GBP |

13/05/2025 |

07:00 |

Average Weekly Earnings 3M/YoY |

Mar |

-- |

5.6% |

!!! |

|

GBP |

13/05/2025 |

07:00 |

Employment Change 3M/3M |

Mar |

-- |

206k |

!!! |

|

EUR |

13/05/2025 |

10:00 |

Germany ZEW Survey Expectations |

May |

-- |

- 14.0 |

!! |

|

USD |

13/05/2025 |

11:00 |

NFIB Small Business Optimism |

Apr |

94.3 |

97.4 |

!! |

|

USD |

13/05/2025 |

13:30 |

CPI Ex Food and Energy MoM |

Apr |

0.3% |

0.1% |

!!! |

|

GBP |

13/05/2025 |

16:00 |

BOE's Bailey, ECB's Knot Speak |

!!! |

|||

|

SEK |

14/05/2025 |

07:00 |

CPI YoY |

Apr F |

-- |

0.3% |

!!! |

|

SEK |

14/05/2025 |

08:30 |

Riksbank Minutes |

!! |

|||

|

EUR |

14/05/2025 |

09:15 |

ECB's Nagel Speaks |

!! |

|||

|

AUD |

15/05/2025 |

02:30 |

Employment Change |

Apr |

25.0k |

32.2k |

!! |

|

GBP |

15/05/2025 |

07:00 |

GDP QoQ |

1Q P |

-- |

0.1% |

!! |

|

NOK |

15/05/2025 |

07:00 |

GDP Mainland QoQ |

1Q |

-- |

-0.4% |

!! |

|

EUR |

15/05/2025 |

07:45 |

France CPI YoY |

Apr F |

-- |

0.8% |

!! |

|

GBP |

15/05/2025 |

09:30 |

Output Per Hour YoY |

1Q |

-- |

-0.8% |

!! |

|

EUR |

15/05/2025 |

10:00 |

GDP SA QoQ |

1Q S |

-- |

0.4% |

!! |

|

EUR |

15/05/2025 |

10:00 |

Employment QoQ |

1Q P |

-- |

0.1% |

!! |

|

CAD |

15/05/2025 |

13:15 |

Housing Starts |

Apr |

-- |

214.2k |

!! |

|

USD |

15/05/2025 |

13:30 |

Retail Sales Advance MoM |

Apr |

0.0% |

1.4% |

!!! |

|

USD |

15/05/2025 |

13:30 |

PPI Ex Food and Energy MoM |

Apr |

0.2% |

-0.1% |

!! |

|

USD |

15/05/2025 |

13:30 |

Initial Jobless Claims |

-- |

228k |

!! |

|

|

USD |

15/05/2025 |

13:40 |

Fed's Powell Speaks |

!!! |

|||

|

USD |

15/05/2025 |

14:15 |

Industrial Production MoM |

Apr |

0.2% |

-0.3% |

!! |

|

JPY |

16/05/2025 |

00:50 |

GDP SA QoQ |

1Q P |

-0.1% |

0.6% |

!! |

|

EUR |

16/05/2025 |

10:00 |

Trade Balance SA |

Mar |

-- |

21.0b |

!! |

|

CHF |

16/05/2025 |

12:00 |

SNB's Schlegel Speaks |

!!! |

|||

|

USD |

16/05/2025 |

13:30 |

Housing Starts |

Apr |

1368k |

1324k |

!! |

|

EUR |

16/05/2025 |

16:00 |

ECB's Lane, BOE's Lombardelli Speak |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The releases of the latest US retail sales and CPI reports for April will be scrutinized closely for any tentative evidence of the impact from trade disruption and heightened policy uncertainty. Inflation at the start of this year has been comforting for the Fed revealing that disinflation continued but the upward pressure on prices from tariff hikes will become more evident in the coming months. The recent sharp drop in measures of consumer confidence has increased the risk of a more sustained slowdown in consumer spending after weaker growth recorded in Q1. The Fed signaled at this week’s FOMC meeting that it is not in a rush to resume rates cuts and is waiting for evidence of economic weakness especially in the labour market to open the door for cut rates.

- The BoE has indicated that it remains comfortable to stick to the current quarterly pace of rate cuts. As a result, we expect the next cut to be delivered in August. For the BoE to speed up rate cuts it would be need to have more confidence that the trade disruption will be disinflationary for the UK economy. The UK-US trade deal has helped to ease some of the downside risks to growth in the UK. Weakness in the UK labour market could be a potential trigger for the BoE to speed up rate cuts in the coming months.

- Market participants will also be watching to see if the US announces further trade deals with other countries in the week ahead. China and the US are scheduled to meet in Switzerland from 9th to 12th May to discuss trade.