To read the full report, please download PDF.

JPY corrects lower after dovish BoJ shift

FX View:

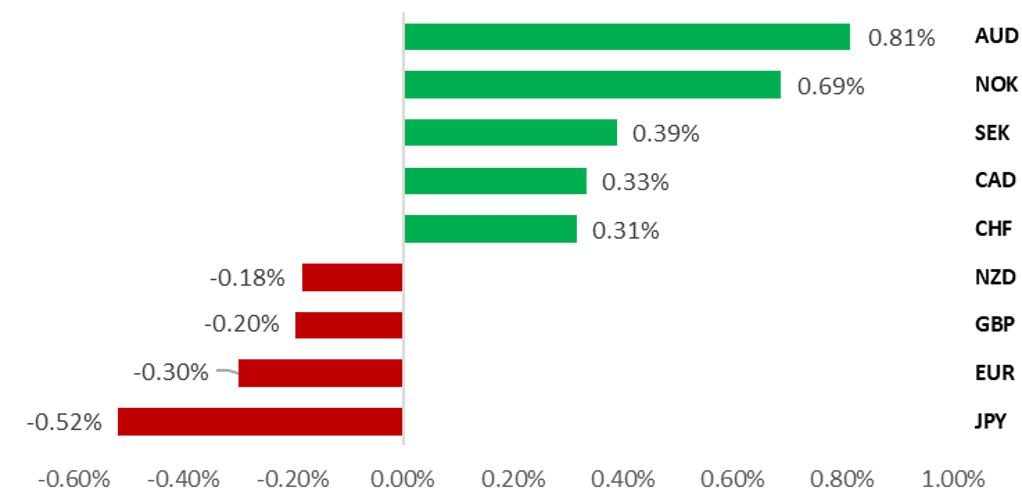

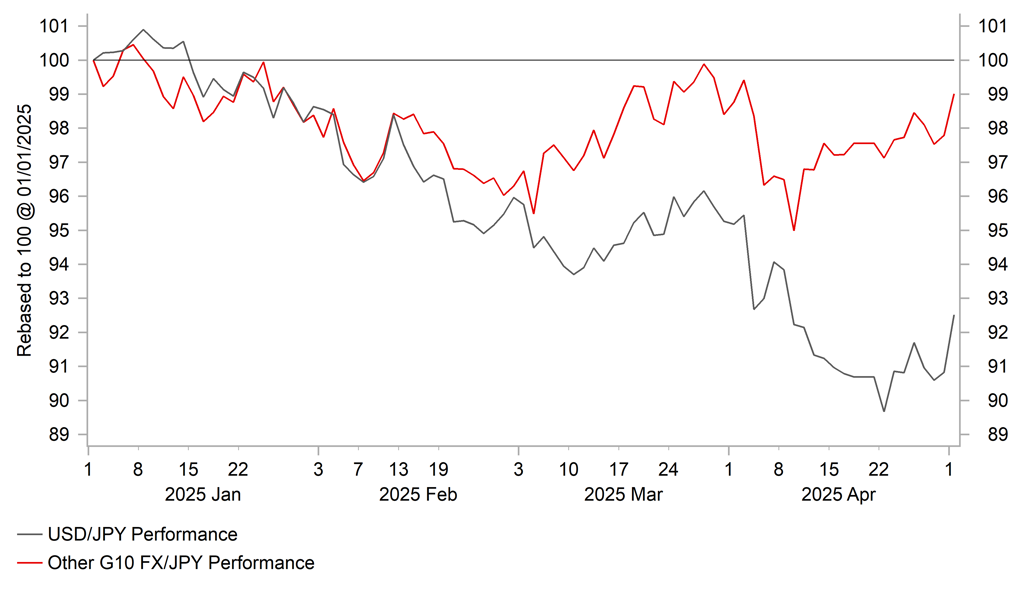

The JPY weakened sharply yesterday after the BoJ delivered a bigger than expected dovish policy shift at this week’s policy meeting. The updated guidance from the BoJ sent a stronger signal that they are unlikely to have confidence to deliver another rate hike while heightened trade policy uncertainty clouds the economic outlook. It has further pushed back expectations for the timing of the next BoJ hike until later this year at the earliest. A slower pace of BoJ policy normalization has encouraged a lightening of record long JPY positions. However, we are not convinced the dovish BoJ policy shift is sufficient on its own to trigger a more sustained reversal lower for the JPY. Slowing global growth and policy easing outside of Japan should further narrow yield spreads and boost demand for the JPY. Market participants will be watching policy updates from the Fed and BoE in the week ahead to see if they indicate a faster pace of easing going forward posing downside risks for the USD and GBP.

MAJOR G10 CURRENCIES HAVE UNDERPERFORMED OVER PAST WEEK

Source: Bloomberg, 13.45 GMT, 2nd May 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a short EUR/NZD trade idea.

IMM Positioning:

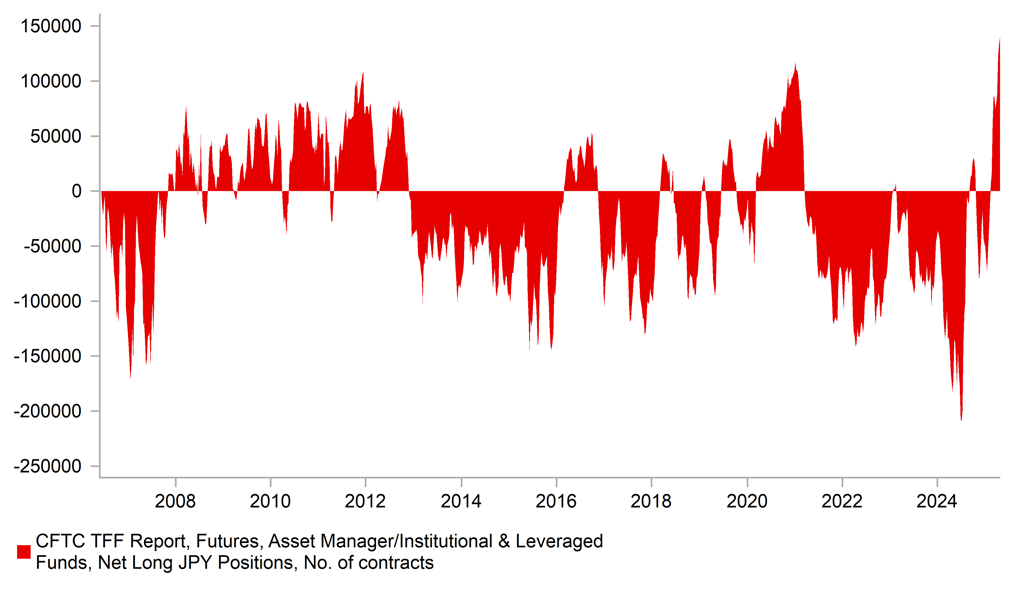

Leveraged Funds held a small overall short USD position for the first time since October of last year. Our two-year rolling z-scores signal revealed that long JPY positions were the most stretched amongst Leveraged Funds.

Sentiment Analysis on the BoJ Outlook for Economic Activity and Prices: :

A sentiment analysis of the BoJ's latest quarterly Outlook for Economic Activity and Prices report revealed a downward shift in sentiment across all broad topics (Inflation, Commodities, Demand, Economy, Housing, Labour, Manufacturing), with sentiment falling to lows not seen since April 2023.

FX Views

JPY: BoJ triggers lightening up of JPY longs ahead of FOMC meeting

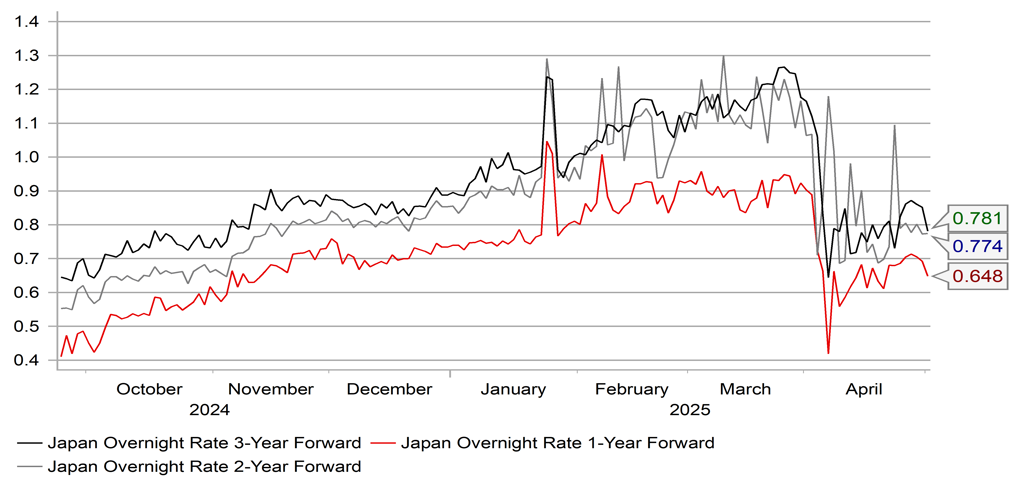

The JPY has been the worst performing G10 currency this week resulting in USD/JPY rising back up towards the 145.00-level as it moves further above the low of 139.89 on 22nd April. The pullback for the JPY leaves the CHF as the clear outperformer amongst safe haven currencies over the past month. The main trigger for the reversal of JPY gains has been this week’s dovish policy update from the BoJ which has reinforced expectations that the BoJ may not raise rates further this year in response to trade policy disruption. The yields on 2-year and 10-year JGBs have both fallen sharply by around 30bps to 35bps from the highs in late March prior to President Trump’s “Liberation Day” tariffs. After yesterday’s dovish BoJ policy update the Japanese rate market is now pricing in around 9bps of hikes by the October or December policy meetings and only around 3bps by the July meeting.

At the current juncture, the dovish repricing of BoJ expectations appears appropriate although one can’t rule out another rate hike later this year if downside risks to the economic outlook from trade disruption ease. It has been reported overnight that Japan’s chief negotiator Akazawa expressed hopes of reaching a trade agreement with the US in June following further talks with US officials this week. The next round of trade talks could come from mid-May onwards. The Nikkei newspaper has reported that Japan wants trade negotiations to be more comprehensive including a review on non-tariff barriers and expanding imports of US farm products. In contrast, the Nikkei reported that the US sought to keep talks focused on “reciprocal tariffs” and plans to maintain tariffs on autos as well as steel and aluminium. The 90-day delay for higher reciprocal tariffs is set to expire on 9th July when a 24% rate would be applied to imports from Japan up from the current 10% universal rate. Even if a trade agreement is reached in the coming months to ease the direct hit to Japan from higher tariffs, the BoJ would still be wary of the negative indirect impact from slower global growth.

The BoJ clearly indicated that they have become more cautious over delivering further rate hikes in the near-term. Governor Ueda stated that he judged that the likelihood of the updated economic outlook materializing is not as high as before. Additionally, he stated that it was hard to say when they will have more confidence in the outlook. So while the BoJ reiterated guidance that they are likely to raise rates further if the economy evolves in line with their outlook, it will take longer now to regain confidence in the outlook. It means that another rate hike is unlikely until September at the earliest point and more likely later now. The dovish comments from Governor Ueda were backed up as well by updated economic projections and risk assessment. The BoJ’s first updated economic projections since President Trump’s “Liberation Day” tariffs announcement revealed that the forecast for GDP growth in Japan for the current fiscal year was revised lower by 0.6ppts to 0.5% and for the next fiscal year by 0.3ppts to 0.7% before growth is expected to pick back up to 1.0% in FY2027. At the same time, the BoJ’s updated projections for core inflation (excluding fresh food) were revised lowered by 0.2ppts to 2.2% for the current fiscal year and 0.3ppts for the next fiscal year after which it is expected to be close to the BoJ’s target at 1.9% in FY2027. The BoJ judges now that risks are skewed to the downside for both growth and inflation for the current and following fiscal years.

RECORD LONG JPY POSITIONS AHEAD OF BOJ UPDATE

Source: Bloomberg, Macrobond & MUFG GMR

BOJ RATE HIKE EXPECTATIONS SCALED BACK

Source: Bloomberg, Macrobond & MUFG GMR

The sharp sell-off for the JPY in response to dovish BoJ policy update reflects in part that positioning. The latest IMM positioning data has revealed recently that long JPY positions built up by Leveraged Funds and Asset Managers had reached their highest level on record encouraged by expectations for further BoJ policy normalization. It is likely that long JPY positions have been lightened after the BoJ indicated that they will take more time to raise rates further depending on how trade risks develop going forward. However, we are not convinced that the dovish shift in BoJ policy will trigger a sustainable reversal lower for the JPY even after USD/JPY has once again failed to break back below the 140.00-level similar to in September of last year and December 2023 providing important technical support.

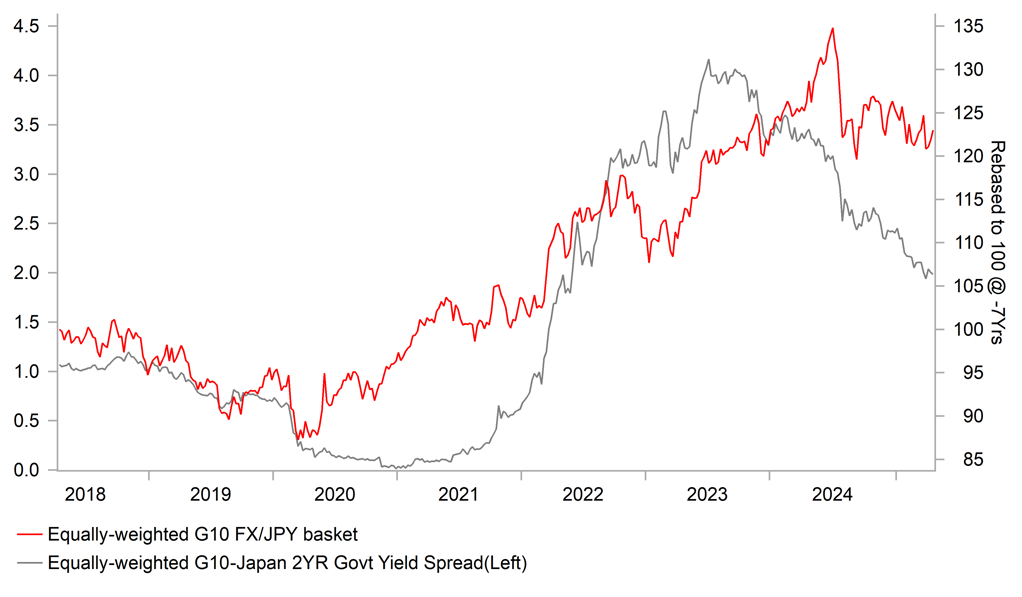

Our forecast for further JPY gains (click here) is built more on external factors. We expect the yield spread between Japan and other major economies to narrow further as the Fed, ECB, BoE and PBoC continue to cut rates in response to the negative hit to global growth from trade disruption and heightened policy uncertainty. Market participants will be watching closely next week’s FOMC meeting to see if the Fed provides a stronger signal that it is considering resuming rate cuts at the following FOMC meeting in June. After today’s solid nonfarm payrolls report for April, it is less likely that the Fed will set up a cut in June which is now more dependent on the incoming US economic data rolling over in the month ahead. Additionally, the JPY remains deeply undervalued against the USD which will remain an area of concern for the Trump administration in ongoing trade talks with Japan. It should continue to encourage speculation that the Trump administration will keep pressure on Japan to stay on the path of monetary policy normalization and strengthen the JPY to avoid the risk of greater trade conflict.

YIELD SPREADS STILL MOVING IN FAVOUR OF JPY

Source: Bloomberg, Macrobond & MUFG GMR

LOWER USD/JPY HAS BEEN DRIVEN BY USD LEG

Source: Bloomberg, Macrobond & MUFG GMR

GBP: BoE policy update could deliver setback for GBP after recent rebound

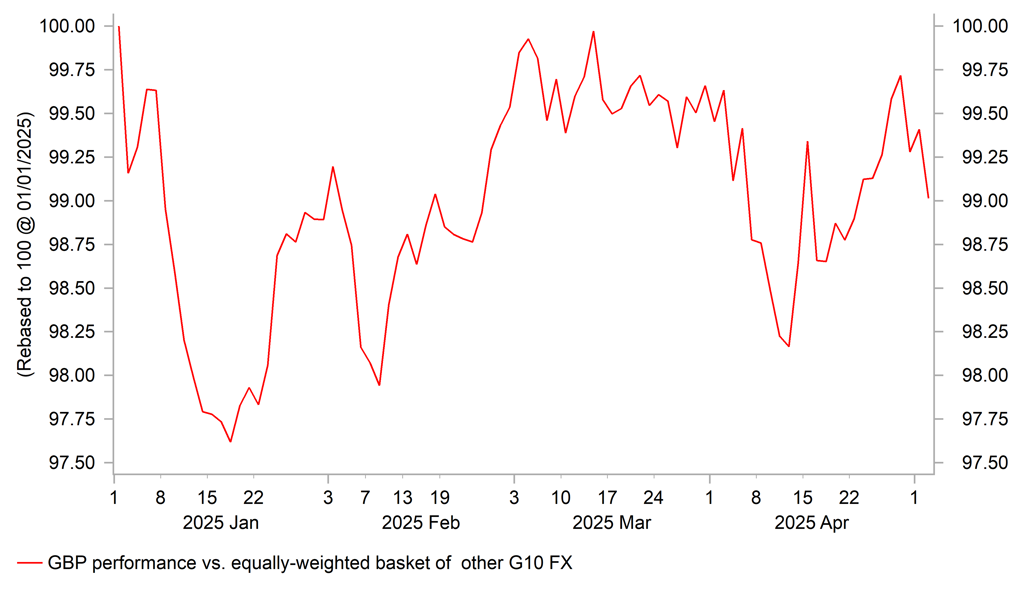

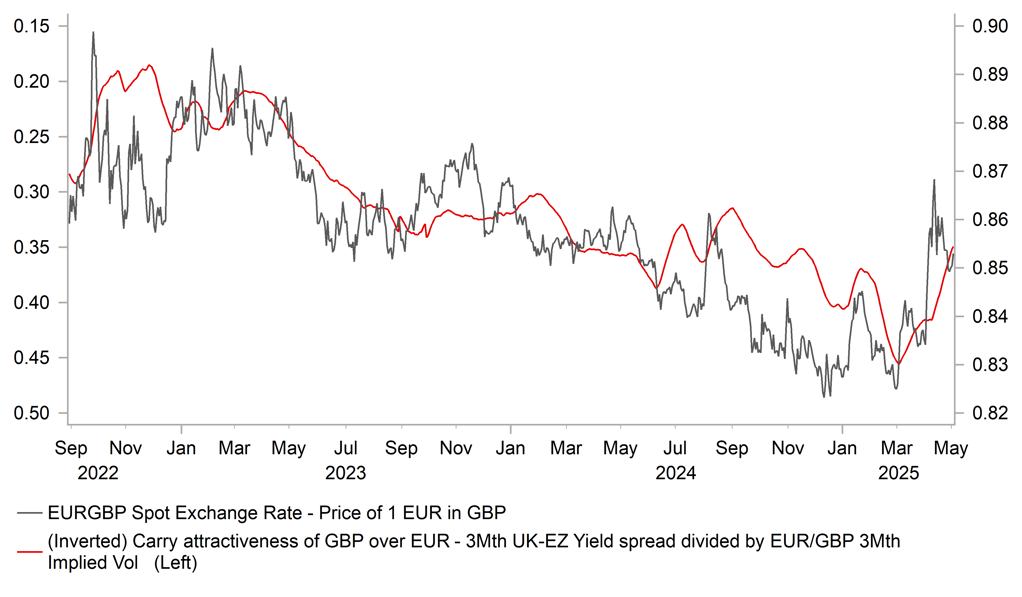

The GBP has continued to recover lost ground over the past week following the sell-off in the first half of last month triggered by President Trump’s “Liberation Day” tariffs announcement. At the worst point, EUR/GBP hit a high of 0.8738 on 11th April but has briefly dropped back below the 0.8500-level this week. The GBP has underperformed over the past month alongside the other high beta G10 currencies of the NOK and AUD. The broad-based loss of confidence in the USD has still resulted in cable rising back to the highs from last September at just over the 1.3400-level which currently represents an important resistance level standing in the way of further upside.

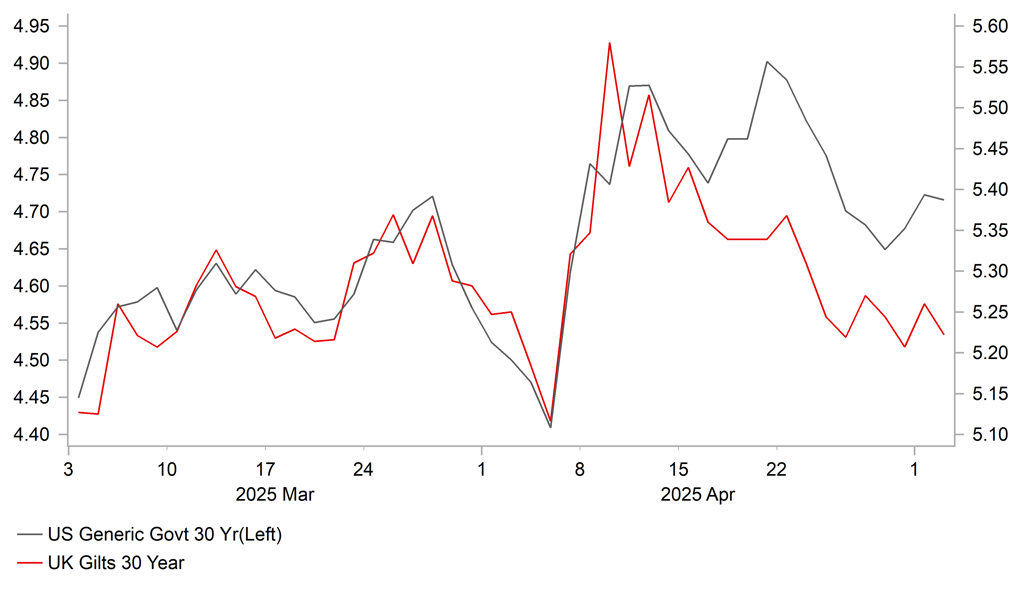

The GBP has been hit harder recently by the sharp jump in financial market volatility triggered by the initial fallout from President Trump’s tariff plans. It has triggered an unwind of carry trades that reinforced the sell-off in higher yielding currencies such as the GBP. At the same time, unfavourable external conditions have made it more challenging for countries that rely more on external financing such as the UK whose current account deficit totalled just under 3% of GDP last year. Negative sentiment towards the GBP was reinforced as well last month by the renewed sell-off in the Gilt market which was hit by negative spill-overs from the sell-off in the US Treasury market. The 30-year Gilt yield temporarily jumped by around 60bps between 7th and 9th April which was similar in size to the move higher in the 30-year US Treasury yield. After peaking at 5.66% on 9th April, the 30-year Gilt yield has since dropped back towards 5.20% alongside an easing of financial market volatility helping the GBP to rebound.

GBP REBOUNDS AFTER SELL-OFF IN 1H APRIL

Source: Bloomberg, Macrobond & MUFG GMR

NEGATIVE SPILL-OVERS FROM UST SELL-OFF

Source: Bloomberg, Macrobond & MUFG GMR

The more challenging external background will be taken into consideration in more detail in the week ahead when the BoE’s holds their first policy meeting since President Trump’s “Liberation Day” tariffs were announced. Recent comments from BoE officials ahead of next week’s MPC meeting have struck a more dovish tone. Governor Bailey indicated that the BoE is focused on the potential negative growth shock for the UK economy from tariffs if there is a slowdown in global trade. After rebounding more strongly than expected at the start of this year, trade disruption has reinforced expectations that stronger growth will not be sustained. The release of updated GDP forecasts next week are expected to show an upward revision to growth this year but offset by a downward revision to growth next year. In contrast, he described the impact of tariffs on the inflation as harder to assess noting there’s a number of forces that can pull it into either direction including: i) retaliation, ii) redirection of trade into other markets, and iii) the exchange rate effect. With no retaliation so far from the UK government who are seeking a quick trade deal/agreement to reverse tariff hikes, and with energy prices falling alongside the weaker outlook for growth, we expect the updated inflation projections to be lowered for the coming years. It should create more room for the BoE to keep lowering rates. It has encouraged expectations that the BoE will signal it is more open to speeding up the pace of rate hikes at next week’s MPC meeting. A bigger dovish surprise would be if the voting pattern reveals more dissenting MPC members voting in favour of a larger 50bps cut next week. One way for the BoE to signal that they are more open to the possibility of cutting rates again sooner perhaps at the following MPC meeting in June would be to drop guidance that “gradual” further withdrawal of monetary policy restraint is appropriate. The BoE could also indicate that that risk assessment to meeting their inflation target has shifted to the downside although they are likely to be wary of providing strong guidance while uncertainty over the outlook remains so elevated.

A more dovish policy update from the BoE in the week ahead poses downside risks for the GBP in the week ahead, and could deliver a setback after the recent rebound. The UK rate market has already moved to price in around 40bps of BoE cuts by the June MPC meeting highlighting that there is already a strong expectation that the BoE will signal a faster pace of easing going forward. The dovish repricing that has already taken place should help to dampen a GBP sell-off on the back of a change in guidance next week form the BoE unless those expectations are reinforced further by discussions over delivering a larger 50bps cut if needed. One can’t completely rule out a larger 50bps as early as next week either although that appears unlikely to us. On the other hand, the GBP will derive support if financial market volatility continues to ease encouraged by building investor optimism over trade deals/agreements to reverse President Trump’s tariff plans especially involving China and the UK.

HIGHER VOL UNDERMINED CARRY APPEAL OF GBP

Source: Bloomberg, Macrobond & MUFG GMR

UK ECONOMY STRONGER PRIOR TO TRADE DISRUPTION

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CHF |

05/05/2025 |

07:30 |

CPI YoY |

Apr |

0.2% |

0.3% |

!! |

|

EUR |

05/05/2025 |

09:30 |

Sentix Investor Confidence |

May |

- 15.0 |

- 19.5 |

!! |

|

USD |

05/05/2025 |

14:45 |

S&P Global US Composite PMI |

Apr F |

-- |

51.2 |

!! |

|

USD |

05/05/2025 |

15:00 |

ISM Services Index |

Apr |

50.1 |

50.8 |

!!! |

|

EUR |

06/05/2025 |

07:45 |

France Industrial Production MoM |

Mar |

0.3% |

0.7% |

!! |

|

CHF |

06/05/2025 |

08:35 |

SNB's Schlegel Speaks |

!!! |

|||

|

EUR |

06/05/2025 |

09:00 |

HCOB Eurozone Services PMI |

Apr F |

49.7 |

49.7 |

!! |

|

GBP |

06/05/2025 |

09:30 |

S&P Global UK Services PMI |

Apr F |

-- |

48.9 |

!! |

|

EUR |

06/05/2025 |

10:00 |

PPI YoY |

Mar |

2.6% |

3% |

!! |

|

USD |

06/05/2025 |

13:30 |

Trade Balance |

Mar |

-$119.5b |

-$122.7b |

!! |

|

CAD |

06/05/2025 |

13:30 |

Int'l Merchandise Trade |

Mar |

-- |

-1.52b |

!! |

|

NZD |

06/05/2025 |

23:45 |

Employment Change QoQ |

1Q |

-- |

-0.1% |

!! |

|

SEK |

07/05/2025 |

07:00 |

CPI YoY |

Apr P |

0.5% |

0.5% |

!! |

|

EUR |

07/05/2025 |

07:00 |

Germany Factory Orders MoM |

Mar |

2.1% |

0.0% |

!! |

|

EUR |

07/05/2025 |

10:00 |

Retail Sales MoM |

Mar |

-0.1% |

0.3% |

!! |

|

USD |

07/05/2025 |

19:00 |

FOMC Rate Decision (Lower Bound) |

4.25% |

4.25% |

!!! |

|

|

GBP |

08/05/2025 |

00:01 |

RICS House Price Balance |

Apr |

-- |

2.0% |

!! |

|

EUR |

08/05/2025 |

07:00 |

Germany Trade Balance SA |

Mar |

19.1b |

17.7b |

!! |

|

SEK |

08/05/2025 |

08:30 |

Riksbank Policy Rate |

2.25% |

2.25% |

!!! |

|

|

NOK |

08/05/2025 |

09:00 |

Norges Bank Deposit Rate |

4.50% |

4.50% |

!!! |

|

|

GBP |

08/05/2025 |

12:00 |

Bank of England Bank Rate |

4.25% |

4.50% |

!!! |

|

|

USD |

08/05/2025 |

13:30 |

Nonfarm Productivity |

1Q P |

-0.5% |

1.5% |

!! |

|

USD |

08/05/2025 |

13:30 |

Unit Labor Costs |

1Q P |

5.4% |

2.2% |

!! |

|

USD |

08/05/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

GBP |

09/05/2025 |

00:01 |

KPMG and REC UK Report on Jobs |

!! |

|||

|

JPY |

09/05/2025 |

00:30 |

Labor Cash Earnings YoY |

Mar |

-- |

2.7% |

!!! |

|

CNY |

09/05/2025 |

Tbc |

Trade Balance |

Apr |

-- |

$102.64b |

!! |

|

CAD |

09/05/2025 |

13:30 |

Net Change in Employment |

Apr |

25.0k |

-32.6k |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- There is a busy schedule of G10 central bank policy updates in the week ahead. The Fed are expected to leave their policy rate on hold in the week but all eyes will be on the updated policy guidance. With the US rate market pricing in a close to a 50:50 probability of a rate hike at the following meeting in June (11bps currently priced in), market participants will be looking for a stronger signal from the Fed that they are moving closer to cutting rates again. However, the high level of uncertainty may discourage the Fed from providing stronger policy guidance as soon as next week’s FOMC meeting and instead the Fed may emphasize that it is highly data dependent as it continues to assess the impact of changes in US trade policy on the economy. A decision to leave rates on hold is likely to garner more criticism from President Trump.

- The BoE is expected to deliver another 25bps rate cut in the week ahead lowering the policy rate to 4.25%. It would be fourth rate cut in the current easing cycle. Market participants will be watching closely to see if the BoE sticks to the current guidance for further “gradual” quarterly rate cuts. Recent comments from BoE officials have indicated that they are viewing trade disruption as more of a negative hit to demand in UK than an inflation shock which could open up the door for the BoE to speed up the pace of rate cuts this year. The UK rate market has already moved to price in an additional rate cut this year on top of the current quarterly pace.

- The Norges Bank and Riksbank are both expected to leave rates on hold in the week ahead. The Riksbank recently paused their easing cycle after inflation picked up at the start of this year in Sweden and the economy was recovering. However, trade disruption will increase pressure on the lower rates further if growth slows again in the coming months. Similarly, the Norges Bank recently delayed plans to begin cutting rates after stronger inflation in Norway at the start of this year. The Norges Bank could signal it cut rates as soon as at the following meeting in June if downside risks from trade materialize in the near-term.