China’s NPC targets disappoint supporting the USD

CNY: Hopes for bigger fiscal stimulus in China are disappointed

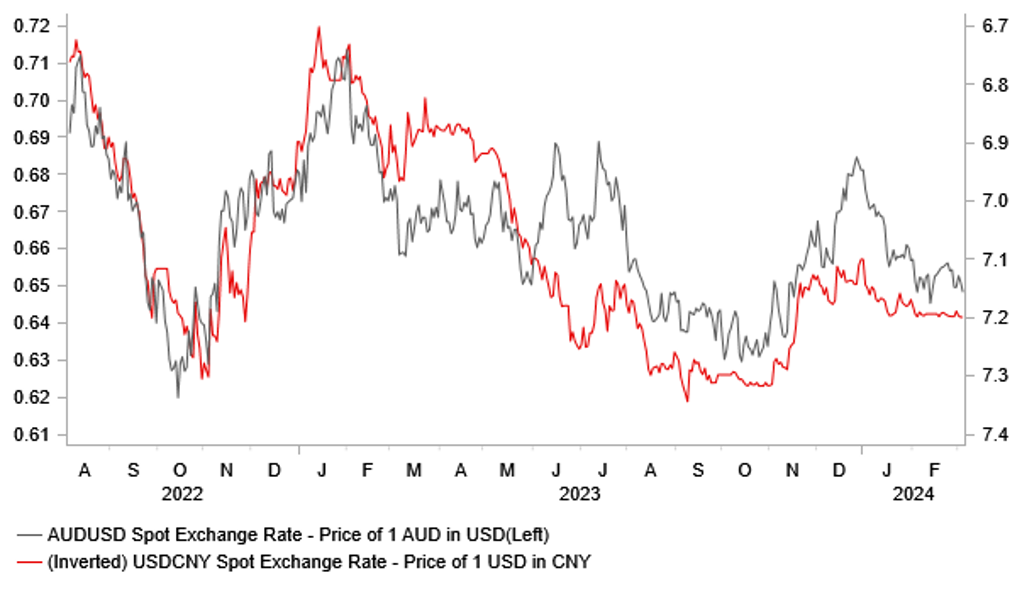

The US dollar has strengthened overnight amidst more risk-averse trading conditions. US dollar strength has been most evident against the G10 commodity-related currencies of the Australian and New Zealand while Asian currencies have also weakened. The main trigger has been the announcement of the Chinese government’s targets for the current calendar year at the annual National People’s Congress (NPC) . It was announced overnight that China’s government has set a similar target to last year for economic growth of “around 5%” for 2024. While the target is relatively ambitious and compares to the current Bloomberg consensus forecast for growth of 4.6%, market participants are not convinced it can be achieved without more forceful fiscal stimulus to support growth alongside looser monetary policy. However, the government target for the fiscal deficit and debt issuance have disappointed market expectations suggesting that the government’s plans for additional fiscal support are unlikely to prove sufficient to ease negative investor sentiment over the cyclical outlook for China’s economy in the year ahead. The fiscal deficit target was set at 3.0% of GDP which was similar to last year, although the government did adjust it higher later last year in October to 3.8% of GDP to create more room for stimulus. In addition, China has set issuance targets for special treasury bonds at CNY1.0 trillion and special local government bonds at CNY3.9 trillion which are again largely the same as last year.

The announcements have understandably been met with an initial sense of disappointment from market participants who have been hoping that policymakers in China would set the stage for a more forceful fiscal policy response in the coming months to boost growth momentum. Premier Li Qiang acknowledged that “it is not easy for us to realize these targets”, and stated that “we need policy support and joint efforts from all fronts”. Bloomberg did note though that China did unveil plans to issue CNY1 trillion of ultra-long special central government bonds in 2024. It would mark only the fourth such sale in the past 26 years with the most recent one in 2020 when the bonds were issued to finance pandemic response measures. Overall, the developments leave risks titled to the downside for Asian and G10 commodity-related currencies that have already underperformed at the start of this year.

NEGATIVE SPILLOVERS FROM CHINA GROWTH CONCERNS

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Weighing up risks for EM FX after weak start to the year

Emerging market currencies have on the whole staged a modest rebound over the past week encouraged by the recent loss of upward momentum for US yields and the USD. The 2-year US Treasury yield has corrected lower after failing to break above resistance from the 200-day moving average at just above 4.70%. It has been the biggest correction lower for US yields since they started adjusting higher again in early February. The top performing EM currencies since the start of last week have been the CLP (+1.4% vs. USD), ZAR (+1.1%), RUB (+1.1%), and MYR (+1.0%). While the HUF (-1.6% vs. USD), TRY (-1.5%) and IDR (-0.9%) continued to weaken against the USD.

The hawkish repricing in the US rate market has lost momentum over the past week indicating that market participants are becoming more comfortable that rate cut expectations have been scaled backed sufficiently at the current juncture. The timing of the first Fed rate cut has already been pushed back until June, and the total number of cuts priced in by year end is more closely aligned with the Fed’s plans from December for three cuts. As a result, we are not expecting Fed Chair Powell to rock the boat in the week ahead when he delivers the semi-annual testimony on monetary policy to Congress. Fed officials have already indicated that they view stronger inflation data at the start of this year as more likely a bump in the road and as such it is likely too early to expect Chair Powell to strongly signal that the Fed is already considering scaling back rate cut plans. Instead the main hawkish risk for the US rate market that could trigger renewed selling for EM FX in the week ahead is the release of the latest nonfarm payrolls report for February. After the blowout report last month, Fed rate cut expectations would be challenged if employment growth remains strong in February. While a softer NFP report would be supportive for our favoured EM carry currencies of the BRL COP, INR, MXN and ZAR.

The two EM EMEA currencies of the HUF and TRY have been amongst the weakest performing currencies over the past week. It has resulted in EUR/HUF rising back above the 395.00-level for the first time in just under a year. The HUF has been undermined by the NBH’s decision to lower their policy rate more quickly in Hungary which is making the HUF less attractive as a carry currency. It is notable that the HUF has underperformed at the start of this year when market conditions have been favourable for carry trade performance. At the same time, the HUF has been undermined by the recent confrontation between the government and NBH that is encouraging market participants to price back in a higher risk premium into the HUF. NBH Governor Matolcsy warned that the government is planning a “significant attack” against central bank independence with a proposed modification of the law regulating the institution. In response the government has stated that it respects the central bank’s independence and only aims to boost transparency and prudent financial management in areas of unrelated to monetary policy. If the forint continues to weaken to price in a bigger risk premium, it will put pressure on the NBH to slow back down the pace of rate cuts after a delivering a larger 100bps cut last month to 9.00%.

There were also negative economic developments in Turkey at the start of this week with inflation surprising to the upside again in February when it rose to 67.1%. It poses upside risks to the CBRT’s outlook for inflation to continue increasing in the 1H of this year before falling back to 36.0% by the end of this year. At their last policy meeting under new Governor Karahan, the CBRT added that “we stand ready to act in case of any deterioration in the inflation outlook” indicating that the policy rate could still be raised further from 45.00%. However, Treasury and Finance Minister Simsek remains confident that “we think we have done enough in tightening”, and that it is important to be “patient and committed going forward”. The pace of TRY weakness has sped up at the start of March after it weakened by an annualized rate of around -28% against the USD in the first two months of this year. Please see our latest EM EMEA Weekly (click here) for more details.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:50 |

French Services PMI |

Feb |

48.0 |

45.4 |

!! |

|

GE |

08:55 |

German Services PMI |

Feb |

48.2 |

47.7 |

!! |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q4 |

0.2% |

0.1% |

! |

|

EC |

09:00 |

Services PMI |

Feb |

50.0 |

48.4 |

!! |

|

UK |

09:30 |

Services PMI |

Feb |

54.3 |

54.3 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Jan |

-8.1% |

-10.6% |

! |

|

US |

14:45 |

Services PMI |

Feb |

51.3 |

52.5 |

!!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Feb |

-- |

55.8 |

! |

Source: Bloomberg