FOMC minutes provide little steer on rate cut timing

USD: Little reaction to minutes as QT policy gets some focus

The US dollar has seem limited reaction to the release of the minutes from the December FOMC meeting that had helped add to the decline in yields and further weakening of the dollar. These minutes were all about seeing whether there would be much validation of the current market pricing with currently an 80% probability that the first rate cut will be delivered by the Fed in March.

There was plenty of evidence of increased confidence that progress is being made in bringing inflation back under control. All members of the FOMC saw “clear progress” in bringing inflation back to the 2.0% goal. In regard to the outlook, the FOMC viewed the current policy rate as “at or near the peak” highlighting that some still believe further rate hikes may be required. The description on the timing of a possible change in policy was vague with a “restrictive stance” required “for some time”. That’s very subjective and could feasibly be associated with any number of months and certainly leaves open the prospect of a rate cut in March. However, “several” FOMC members did state they believed rates would have to remain higher for longer than the FOMC currently expects. Balance sheet policy plans also got a mention and that’s probably the surprise element of the minutes. The reference was more about talking about when to start talking about it but nonetheless it’s an indication perhaps that the Fed do not want to see a repetition of what happened in 2019 when balance sheet shrinkage perhaps went on for too long and created notable volatility in the repo market and in front-end rates. This reference is perhaps the clearest sign that the Fed is confident it has done enough and that the focus going forward is on reversing policy tightening.

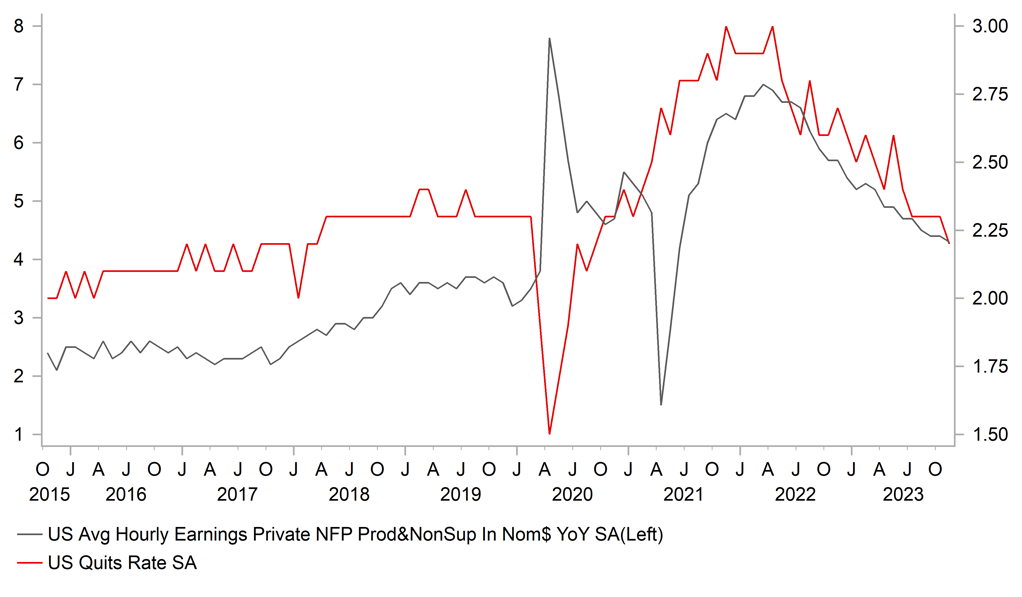

The minutes were always going to highlight the importance of incoming data and today we have the ADP jobs data before the NFP tomorrow. The JOLTS data yesterday certainly confirmed the continued easing of labour demand. Job openings fell from 8.85mn to 8.79mn with hiring hitting its lowest level since April 2020. The quit rate fell to 2.2% underlining the diminishing confidence within the labour market.

Given yields have now drifted back a little higher and the probability of a March rate cut has come down, the hurdle for rates and the dollar to decline is a little lower now. Still, we believe a modestly stronger than expected jobs report will certainly have a bigger rates and FX impact than a modestly weaker than expected report.

JOLTS QUIT RATE FALLS TO 2.2% - A LEVEL NOT SEEN SINCE EARLY 2018 WHEN COVID PERIOD IS EXCLUDED

Source: Macrobond

USD: Middle East tensions lift crude oil prices

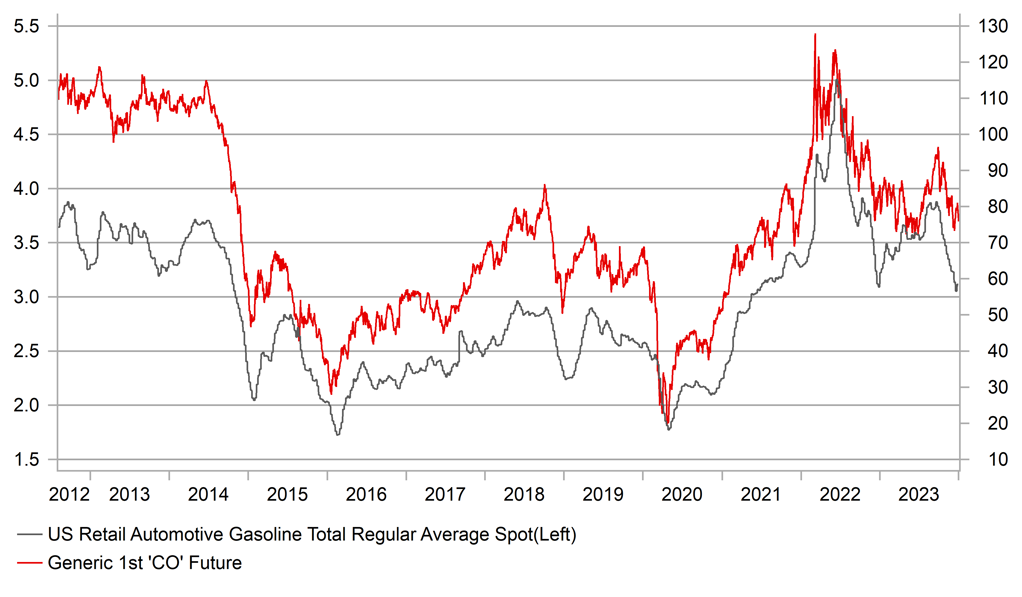

With much of the focus on the Fed minutes and the US labour market data, the building tensions in the Middle East have continued with crude oil prices rallying over 3.0% yesterday with further gains today. Developments helped reinforce the risk-off sentiment in global markets and added impetus to G10 FX selling versus the US dollar. Crude oil supply concerns are escalating with Libya shutting its largest oil field following protests that disrupted production. Another Houthi militant attack in the Red Sea yesterday coincided with two bombings in Iran, which was reported as being a terrorist attack. These events followed Israel’s killing of a senior Hamas leader in Lebanon. OPEC+ also released a statement committing to “unity, full cohesion and market stability”. The statement came ahead of fresh production cuts that many are sceptical will be delivered. That plus surging crude oil production in the US and weak global growth conditions have helped keep crude oil prices under downward pressure despite the Middle East tensions and OPEC+ supply cuts.

We remain at a price level that is far from raising concerns over global inflation risks. Prior to yesterday’s rally, Brent crude fell below USD 75 p/bl, down from USD 97 p/bl at the end of September. The annual change in crude prices is currently in negative territory. Still, if Middle East tensions escalate further and we see increased conflict incorporating Iran, then we may see some larger spikes higher that may prompt some increased central bank caution. The link between crude oil prices and US retail gasoline prices are tight and a sustained move higher would possibly prompt caution from the Fed. The yen was the big underperformer in FX yesterday and higher energy prices certainly could well have been a factor in the scale of underperformance. Japan’s trade position has improved notably since the easing of the global energy price shock and any re-emergence of energy price volatility could weigh on yen performance although it will be of secondary importance to Fed policy and global inflation developments.

CRUDE OIL VERSUS US RETAIL GASOLINE PRICE

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:50 |

French S&P Global Composite PMI |

Dec |

43.7 |

44.6 |

! |

|

FR |

08:50 |

French Services PMI |

Dec |

44.3 |

45.4 |

!! |

|

GE |

08:55 |

German Composite PMI |

Dec |

46.7 |

47.8 |

! |

|

GE |

08:55 |

German Services PMI |

Dec |

48.4 |

49.6 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Dec |

47.0 |

47.6 |

!! |

|

EC |

09:00 |

Services PMI |

Dec |

48.1 |

48.7 |

!! |

|

UK |

09:30 |

BoE Consumer Credit |

Nov |

1.400B |

1.289B |

! |

|

UK |

09:30 |

Composite PMI |

Dec |

51.7 |

50.7 |

!!! |

|

UK |

09:30 |

Mortgage Approvals |

Nov |

48.50K |

47.38K |

! |

|

UK |

09:30 |

Net Lending to Individuals |

-- |

1.6B |

1.2B |

! |

|

UK |

09:30 |

Services PMI |

Dec |

52.7 |

50.9 |

!!! |

|

US |

12:30 |

Challenger Job Cuts |

Dec |

-- |

45.510K |

! |

|

GE |

13:00 |

German CPI (MoM) |

Dec |

0.1% |

-0.4% |

!! |

|

GE |

13:00 |

German CPI (YoY) |

Dec |

3.7% |

3.2% |

!! |

|

GE |

13:00 |

German HICP (MoM) |

Dec |

0.3% |

-0.7% |

!!! |

|

GE |

13:00 |

German HICP (YoY) |

Dec |

3.8% |

2.3% |

!!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Dec |

115K |

103K |

!!! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,883K |

1,875K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

216K |

218K |

!! |

|

US |

14:45 |

S&P Global Composite PMI |

Dec |

51.0 |

50.7 |

!! |

|

US |

14:45 |

Services PMI |

Dec |

51.3 |

50.8 |

!!! |

Source: Bloomberg