A setback for the USD ahead of NFP report on Friday

USD: Softer ISM services & Powell’s comments dampen upward momentum

The US dollar has continued to weaken overnight after yesterday’s sharp sell-off. It has resulted in the dollar index dropping back to towards the 104.00-level after threatening to break above the 105.00-level earlier this week. There were two main triggers responsible for the US dollar’s correction lower. Firstly, the release of the latest ISM services survey revealed that business confidence unexpectedly declined by 1.2 point to 51.4 in March. For comparison, the average reading over the last six months has been 52.0 which is the lowest reading over an equivalent period since August 2020. It highlights that business confidence in the service sector as measured by the ISM survey remains weak although that has not recently provided an accurate indicator of US economic activity. The drop in the headline ISM services reading was also mainly driven by a further plunge in the supplier delivery sub-index, whereas the business activity sub-index rose to its highest level in six months. It suggests that in the headline reading could overstate overall weakness in the service sector. The softer ISM services survey has provided some relief for market participants who were becoming less confident that the Fed will deliver multiple rate cuts this year following the release of the much strong ISM manufacturing survey earlier this week and ongoing rebound in the price of oil and commodity prices that have been lifting inflation expectations. The Fed will be mainly encouraged by the sharp pullback in the prices sub-index that dropped to its lowest level since March 2020.

Secondly, the US dollar sell-off has since been reinforced by dovish comments from Fed Chair Powell who stated that recent data on job gains and inflation have come in stronger than expected, but this data “does not materially change the overall picture, which continues to be one of solid growth, a strong but rebalancing labour market and inflation moving down toward 2% on a sometime bumpy path”. The comments provide further reassurance to market participants that the Fed remains on course to deliver three rate cuts this year with the first cut most likely to be delivered in June. Ahead of the latest nonfarm payrolls report released on Friday, Chair Powell emphasized that that the Fed is not concerned by strong growth and job gains given this reflects strong supply side growth I potential output including the labour supply. “Labour market rebalancing is evident in data on quits, job openings, surveys of employers and workers and the continued gradual decline in wage growth”. On recent higher inflation readings in January and February he did sound a note of caution by stating that “it is too soon to say whether recent readings represent more than just a bump” but continued to emphasize that “risks are on both sides”. He continues to expect rate cuts “at some point” this year. Overall, yesterday’s developments should help to dampen the US dollar’s upward momentum in the near-term.

USD/CNY MOVES UP TO TOP OF BAND WHILE DAILY FIX REMAINS STABLE

Source: Bloomberg, Macrobond & MUFG GMR

USD/CNY: Moving up to the top of the daily trading band

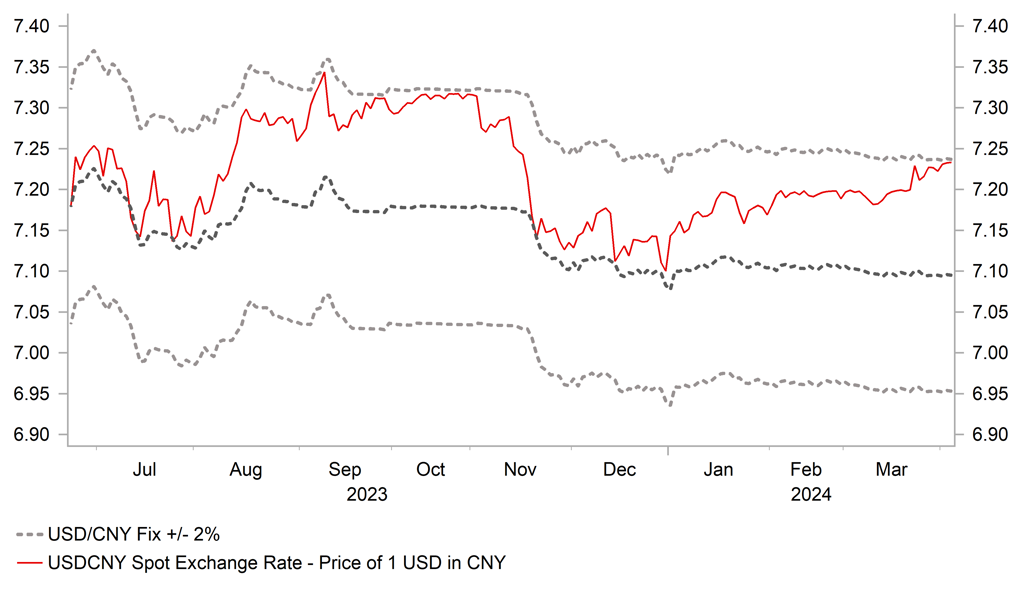

The softer US dollar has helped to lower USD/CNH during the Asian trading session. After hitting a peak at 7.2820 on 25th March, the pair has since fallen back to a low overnight at 7.2457. In contrast, the onshore USD/CNY has continued to move gradually higher at the start of this month resulting with the pair moving to within touching distance of the top of the +/- 2% daily trading band. Based on the daily fix of 7.0949, the top of the trading band is currently set at 7.2370, and USD/CNY hit a high today at 7.2362. After briefly setting the daily fix above the 7.1000-level on 22nd March, the PBoC has since set the daily fix back just below 7.1000-level. The daily fix has been set a very narrow range since December between 7.0770 and 7.1176.

Recent developments have sent mixed messages to market participants. On the one hand, it appears that policymakers in China have become more tolerant of CNY weakness in the near-term by allowing USD/CNY to break above the 7.2000-level and continue to move to the top of the daily trading band. But on the other hand, the daily fixes are sending a signal that policymakers in China want to keep the CNY stable. Now that USD/CNY has moved to the top of the daily trading band, market participants will be watching the daily fixes even more closely to see if policymakers in China allow the CNY to weaker further in the near-term against the USD.

Potential reasons for the subtle shift in current policy include: i) a reshuffle of the monetary policy committee at the PBoC, ii) allowing USD/CNY to adjust for the recent re-widening of the yield spreads in favour of the USD, and iii) attempting to dampen CNY strength against other important trading partners currencies which has resulted recently from trying to keeping USD/CNY stable while the USD has rebounded more broadly at the start of this year. The yield spread between 10-year US and Chinese government bonds has risen back to its highest level since late last year when USD/CNY was trading closer to the 7.3000-level. The CFETS CNY basket has increased by around 2.5% this year, and has reached highest level in around a year.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Services PMI |

Mar |

51.1 |

50.2 |

!! |

|

UK |

09:30 |

Services PMI |

Mar |

53.4 |

53.8 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Feb |

-8.6% |

-8.6% |

! |

|

US |

12:30 |

Challenger Job Cuts |

Mar |

-- |

84.638K |

! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

213K |

210K |

!!! |

|

US |

13:30 |

Trade Balance |

Feb |

-66.90B |

-67.40B |

!! |

|

CA |

13:30 |

Trade Balance |

Feb |

0.70B |

0.50B |

!! |

|

US |

17:15 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

19:00 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg