The USD continues to trade on softer footing since banking fears emerged

USD: Tentative improvement in risk sentiment weighs on US dollar

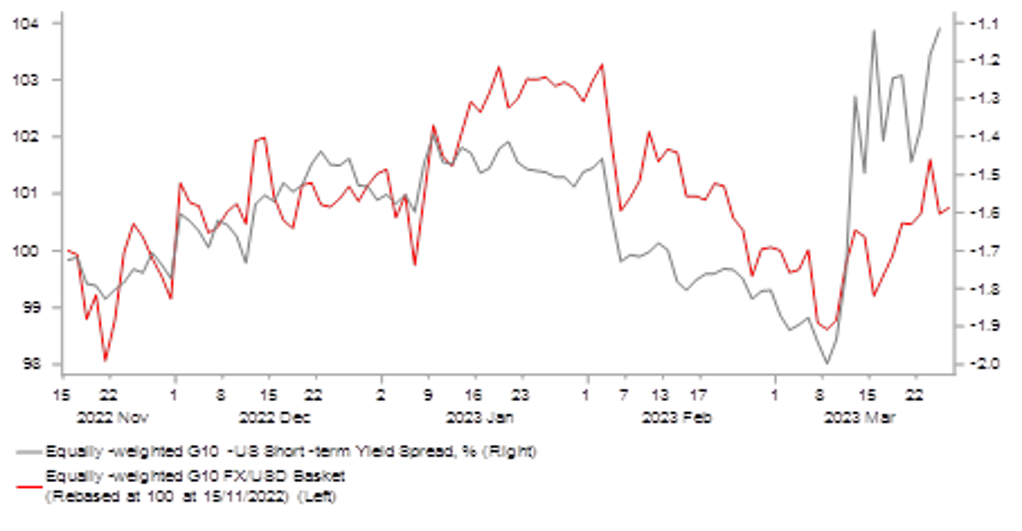

The US dollar has softened at the start of this week resulting in the dollar index dropping back towards last week’s intra-day low of 101.92. US dollar selling has coincided with a tentative improvement in global investor risk sentiment. It follows some relief yesterday for European banks and US regional banks. It followed the news that First Citizens Bank will buy much of the failed Silicon Valley Bank in a deal brokered by the Federal Deposit Insurance Corporation. The Fed’s vice chair for supervision, Michael Barr, has criticised SVB’s “concentrated business model” and proposed a possible tightening of banking rules for midsized banks. The FT has reported that the Fed is reviewing the capital and liquidity requirements it imposes on banks, especially those with between USD100 billion and USD250 billion of assets. In a separate testimony, the chair of the Federal Deposit Insurance Corporation (FDIC) also called for “special attention” to be paid to the regulation of banks with more than USD100 billion in assets. Furthermore, he stated that it would propose policy options for changing the USD250k limit for insured deposits by 1st May. While he noted that there had been a “moderation” in deposit outflows since earlier this month, banks were still reporting that corporate depositors were shifting money to “diversify their exposure and increase their insured deposit cover”. The developments still point towards US regional banks having to pay more to attract and maintain deposits which alongside the implementation of tougher regulations should lead to a tightening in credit conditions. Regional and community banks play an important role in the American economy, and do about half the country’s commercial lending. Smaller banks are particularly dominant in commercial property. The expected tightening in credit conditions has been the main trigger behind the dovish repricing of Fed rate hike expectations. The US rate market remains much more confident now that the Fed is close to ending their hiking cycle with only 12bps of further hikes priced in for this year, and then expects around 60bps of cuts in anticipation that the US economy will slow sharply/fall into recession later this year. The tentative improvement in global investor risk sentiment at the start of this week leaves the US dollar vulnerable to further weakness on the back of the recent sharp adjustment lower in US yields.

YIELD SPREADS HAVE MOVED AGAINST THE USD THIS MONTH

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Pessimism over UK economy & pound continue to ease

The pound has continued to hold up well during the emergence of fears over the health of the global banking system. It is currently the third best performing G10 currency this month after the traditional safe haven currencies of the yen and Swiss franc, and it leaves the pound as the best performing G10 currency year to date alongside the other European currencies of the euro, Swiss franc and Swedish krona. The pound has clearly benefitted from a reversal of some of the investor pessimism towards the UK economy that had been in place last year when the pound was one of the worst performing G10 currencies. The sharp ongoing decline in energy prices is helping to ease one of the main headwinds to growth, and the incoming economic data has already revealed that the UK economy is slowing less than feared. It may even avoid a recession although the BoE is still forecasting a mild recession for this year. Retail sales increased more strongly than expected for the 2nd consecutive month in February and the latest UK PMI surveys for March continued to signal modest growth in Q1.

The more resilient UK economy is keeping pressure on the BoE to tighten policy, and was one of the reasons why the BoE decided to hike rates by a further 25bps last week despite recent weaker than expected wage growth and inflation. In his first speech since last week’s MPC meeting, Governor Bailey provided reassurance that UK banks were “well placed” to support the economy while acknowledging “big strains” in parts of the global banking system. The BoE believes that the UK banking system is resilient, with robust capital and liquidity positions. Future policy decisions will remain dependent on the incoming economic data without any discussion of the prospect of a tightening in domestic credit conditions as a result of the loss of confidence in the health of banks. The comments leave open the possibility of one further 25bps hike at the next MPC meeting on 11th May. The UK rate market is currently priced at around 50:50 for another hike then. However, Governor Bailey did also signal that “interest rates will not necessarily have to return fully to, and remain around, the higher levels they once had”. He believes that the long-run neutral interest rate may remain low. Once the BoE brings inflation under control, it would then open the door for the BoE to begin cutting rates which should help to anchor long-term UK yields at lower levels. Overall, the developments do not immediately challenge the pound’s recent outperformance.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:45 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

UK |

09:45 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

EC |

14:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg