Inflation focus this week as global growth concerns persist

USD: Inflation and global growth concerns key for dollar

Weak PMI data last Friday in Europe has reinforced the expectations that global growth is set to remain fragile and this in turn is likely to help provide the dollar with ongoing support over the near-term. The brief mutiny in Russia over the weekend has not had much initial financial market impact but that will be watched closely by investors – the unseating of President Putin may fuel speculation of a sooner end to the invasion of Ukraine but that might not be the case depending on how that would unfold and needless to say, a period of elevated uncertainty could potentially undermine investor confidence further in Europe, which could reinforce US dollar strength.

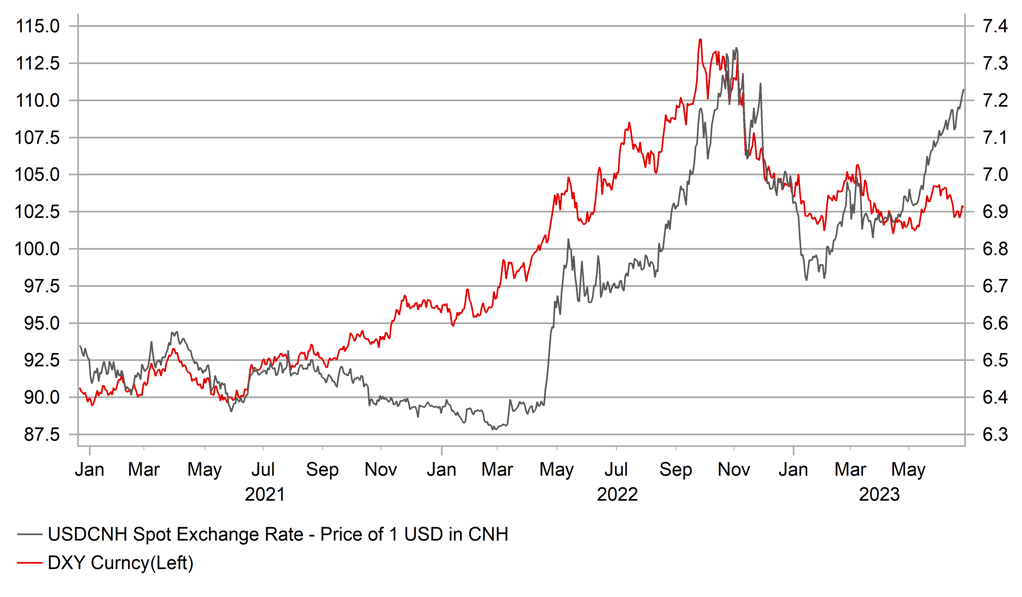

The global growth uncertainty is also apparent this morning after data released in China revealed weaker travel spending during the dragon boat festival that will reinforce the weaker recovery overall in consumer spending. Domestic tourism revenues over this specific period hit 94.9% of the level recorded in 2019 suggesting the post-pandemic re-opening momentum remains more muted than expected China stocks have underperformed in part due to the data and in part catching up after the holiday close. USD/CNY also jumped 0.5% today reflecting the broader US dollar move at the end of last week. The CSI 300 is now down 4.0% over the last four trading days.

The focus this week will again be on inflation. Inflation data will be released in Canada, Australia, the euro-zone and the US and will be key in driving policy rate expectations. The key data will be Friday with the euro-zone advance CPI and the US PCE inflation data. The advance euro-zone CPI data will likely see the headline CPI rate come down sharply again (5.6% from 6.1%) but the data on core CPI will be less favourable. The 5.3% May reading is likely to be followed by an increase to 5.5%. While the energy base-effect from a year ago will help headline inflation, a discounted rail fare deal last year in Germany will have the opposite base effect on services inflation, resulting in the increase. Other tourist related prices may also lift services inflation with prices generally higher than a year ago as we enter the summer tourism season.

The US inflation data may be quite similar with the overall PCE inflation slowing notably (3.8% from 4.4%) but the core measure remaining unchanged at 4.7%. The markets will be watching the super-core measure which gained 0.42% MoM last month and remained unchanged at 4.6% YoY.

Any surprises in the inflation data will be where we see potential FX volatility this week but as we outlined in the FX Weekly (here), we are approaching the peak in the monetary policy cycle and that means we will likely see increased sensitivity to the incoming data and potentially with it short-term swings back and forth as investors try and determine the timing of the turn in tightening cycles to pauses and then easings. The ECB Annual Forum in Sintra may help shape these expectations and prompt some volatility and the Policy Panel discussion with Powell, Lagarde, Ueda and Bailey on Wednesday at 14:30 (BST) will be the key event in focus.

CNY SHARPLY WEAKER VERSUS USD RELATIVE TO DXY CURRENCIES

Source: Macrobond

GBP: Surge in speculative buying

The Leveraged Fund sector has clearly taken the view that aggressive monetary tightening by the BoE is currency positive focusing on the yield driver and ignoring for now at least the potential negative growth consequences that will inevitably come from further aggressive rate hikes from here. The IMM data on Friday revealed an increase in speculative long GBP positions from just 168 contracts to 37,114 – an unusually large swing in just one week. It was the largest net long position held by Leveraged Funds since August 2022. In terms of the one-week change, it was the largest one-week increase since March 2016.

The IMM data is to last Tuesday, so didn’t even capture the reaction to the CPI data but the G10 performance in the week to 20th June covering the same period as the IMM data does show GBP was the best performing G10 currency over that period – although it only just outperformed EUR. What was covered in that period was the UK jobs data and the very strong wage data that fuelled a sharp increase in rate hike expectations. We can understand the logic here and we are not surprised that the initial response is to focus on yields as being FX positive although that could quickly turn if the economic data was to weaken suddenly. The 2s10s UK Gilt curve has inverted sharply of late and this is the strongest indication that investors now, for the first time in this tightening cycle, believe the BoE are acting aggressively enough to hit growth and potentially bring inflation lower. The much weaker than expected PMIs from Europe last week may mean there is better scope for GBP gains versus EUR than versus the dollar given the broader global growth concerns remain elevated.

LEVERAGED FUNDS’ BUYING OF GBP SURGES

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

IFO Business Climate |

Jun |

90.7 |

91.7 |

!! |

|

GE |

09:00 |

IFO Current Assessment |

Jun |

93.5 |

94.8 |

!! |

|

GE |

09:00 |

IFO Expectations |

Jun |

88.1 |

88.6 |

!! |

|

UK |

11:00 |

CBI Reported Sales |

JUn |

-10 |

!! |

|

|

UK |

11:00 |

CPI Retailing Reported Sales |

Jun |

-8 |

-10 |

!! |

|

US |

15:30 |

Dallas Manufacturing Activity |

Jun |

-20.0 |

-0.3 |

! |

|

EC |

18:30 |

ECB's Lagarde Opens Annual Forum |

!! |

Source: Bloomberg