BoJ signals scope for rate hike this year

JPY: Yen rebounds after dollar gains despite Trump-Powell tensions

USD/JPY advanced 150 pips from the lows yesterday morning that indicated to us that the short yen positioning that had built up leading into the upper house election last weekend had been cleared. EUR/USD did advanced following the ECB meeting that increased market doubts over an ECB cut in September but the dollar then recovered in part on relief that the Trump tour of the Fed renovations had passed without major incident. However, the tension remains very clear to see. The clip of Powell and Trump in hardhats debating whether there had been a further overspend will likely be a lasting image encapsulating their fraught relationship. The market relief was based on the fact that Trump refrained from calling for Powell to go although that was based on Trump’s view that Powell would “do the right thing”.

So the theme of Fed independence being undermined by the White House will unlikely go away and remains a downside risk for the dollar. The retracement of USD/JPY today from the 147.50 high was based on a Bloomberg report, citing “people familiar with the matter”, indicating the BoJ sees the potential for a rate hike this year. Expectations have already jumped this week following the speech from BoJ Deputy Governor Uchida who repeated in a speech the key guidance that if the BoJ’s forecasts on the economy were realised then further adjustments in the monetary stance would be required. Uchida had also then expressed greater confidence in the BoJ’s forecasts being realised following the confirmation of the US-Japan trade deal.

The Bloomberg report this morning suggests that the BoJ views the deal done as reducing the level of uncertainty for the economy and businesses and that there would be enough information on the impact on the economy that would allow for the BoJ to make a policy judgement by the end of the year. This Bloomberg article doesn’t offer much in the way of new information to the market so is unlikely to be a catalyst for this yen rebound being sustained. Deputy Governor Uchida this week already stated that the deal reduces uncertainty for the BoJ which implies the BoJ being in a better position to alter the policy stance if/when required.

We remain unconvinced over the scope for the yen to advance in current circumstances. The political uncertainty will remain high with a change in leadership likely that could then potentially lead to a general election. Front-end yields in the US should also be supportive over the near-term. The US initial claims data yesterday again suggested the labour market remains stable, albeit at weaker levels, but consistent with Powell continuing to resist the political pressure to cut.

EUR/GBP CLOSES ABOVE 0.8700 FOR FIRST TIME SINCE NOVEMBER 2023

Source: Bloomberg, Macrobond & MUFG GMR

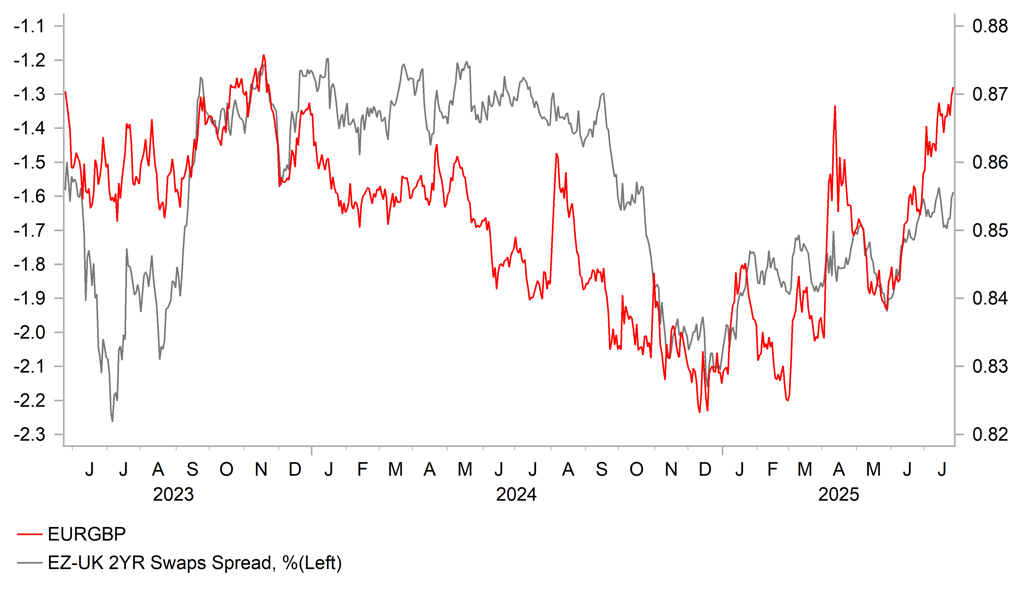

GBP: Weak data rather than India trade deal the focus

The pound was the worst performing G10 currency yesterday and is now the second worst performing on a month-to-date basis with only the Japanese yen performing worse. It was the advance PMI data that undermined performance with Gilt yields lower across key tenors in sharp contrast to the notable jump in yields in core Europe and a jump in US yields as well. We highlighted the ECB meeting in a piece released yesterday (here) which helped lift yields in Europe and provide a notable divergence with the UK that saw EUR/GBP break above the 0.8700 level for the first time since April in the immediate aftermath of the ‘Liberation Day’ tariff announcements. The close in EUR/GBP above the 0.8700-level was the first time since November 2023.

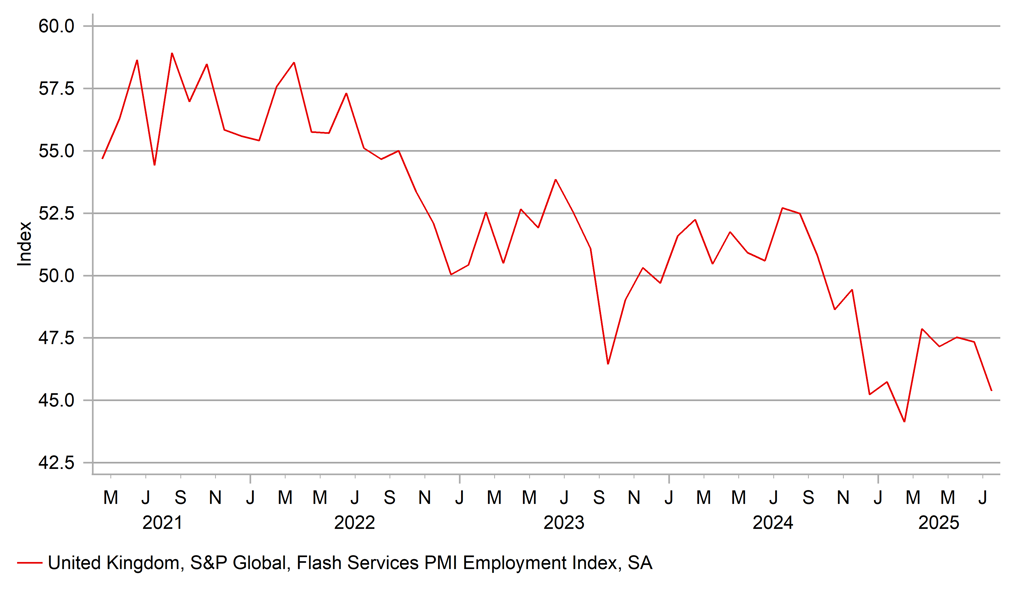

A factor in yields declining modestly is the employment components in the advance PMIs remaining weak. It is the labour market that the BoE is focused on with the MPC statement now citing the opening up of slack that will help push wage growth lower. The Flast Services PMI Employment fell from 47.3 to 45.4, the lowest level since February. The manufacturing measure also fell underlining the weakening momentum across the economy. S&P Global cited “higher staffing costs” against a backdrop of sluggish demand encouraged companies to cut employment – this an obvious reference to the NICs increase that went live in April that even now appears to still be having a negative impact on labour market conditions.

The PMI data was for July and underlines the likelihood that the UK economy has got off to a weak start in Q3 – the headline services PMI fell from 52.8 to 51.2 – the consensus had been for a modest tick higher. This PMI report doesn’t cover the retail sector but the data there is also indicative of weaker growth. ONS retail sales data this morning revealed a headline 0.6% MoM gain in June that was weaker than expected (1.2% MoM expected) and a weak rebound after a 2.9% plunge in May. GfK Consumer Confidence data earlier today also revealed the biggest appetite for saving amongst consumers since the onset of the GFC in November 2007.

This grim news was clearly more impactful than the positive news of a trade deal being confirmed between the UK and India. This news wasn’t a surprise to the market. That’s understandable given the UK government impact assessment of the deal cites a 0.13% lift to GDP, or GBP 4.8bn annually to GDP over the long-run. Still, the reduction in tariffs (GBP 400mn on UK exports into India and GBP 220mn on UK tariffs on India imports) is estimated to increase UK exports to India by nearly 60% over the long-run while UK imports from India will increase by 25%. Like with the US deal, the auto sector is a winner with Indian auto imports from the UK seeing the tariff rate drop from 110% to 10% within a quota.

The deals may well be beneficial in lifting business sentiment with the government having successes in trade deals. The US deal now looks the best Trump offered while 16,000 companies actively trade with India according to the British Chamber of Commerce.

SOFTENING TREND IN SERVICES SECTOR EMPLOYMENT IN THE UK

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Business Confidence |

Jul |

87.7 |

87.3 |

! |

|

IT |

09:00 |

Italian Consumer Confidence |

Jul |

96.0 |

96.1 |

! |

|

GE |

09:00 |

German Business Expectations |

Jul |

91.1 |

90.7 |

!! |

|

GE |

09:00 |

German Current Assessment |

Jul |

86.7 |

86.2 |

!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Jul |

89.0 |

88.4 |

!!! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Jun |

3.7% |

3.9% |

! |

|

EC |

09:00 |

Private Sector Loans (YoY) |

Jun |

1.9% |

2.0% |

! |

|

US |

13:30 |

Core Durable Goods Orders (MoM) |

Jun |

0.1% |

0.5% |

!! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Jun |

-10.4% |

16.4% |

!! |

|

US |

13:30 |

Goods Orders Non Defense Ex Air (MoM) |

Jun |

0.2% |

1.7% |

! |

|

US |

16:30 |

Atlanta Fed GDPNow |

Q2 |

2.4% |

2.4% |

! |

Source: Bloomberg & Investing.com