JPY the best pick as banking sector concerns persist

USD: US bank stocks remain weak

The US dollar is mixed today but the notable move is versus the Japanese yen as yields in the US remain near recent lows and risk aversion persists given the ongoing concerns over the US banking sector. As highlighted here yesterday, the Euro Stoxx 600 Bank Index remains in positive territory year-to-date whereas the S&P 500 equivalent 22%, and yesterday closed at a new year-to-date low, and the lowest level since just prior to the covid-vaccine spurred global rally in risk in November 2020.

Sentiment could have been worse perhaps given the Fed balance sheet data last night was not as bad as some had feared. The balance sheet data as of Wednesday showed that usage of the main Primary Credit Facility (Discount window) totalled USD 110.2bn, down from USD 152.9bn last week. The newly created Bank Term Funding Program did see an increase in usage from USD 11.9bn last week to USD 53.7bn. So combining the two there was a marginal drop from USD 164.8bn to USD 163.9bn. Loans to the FDIC – the other entry that has jumped notably increased as well from USD 142.8bn to USD 179.8bn. What must be concerning for investors at this juncture is that we have

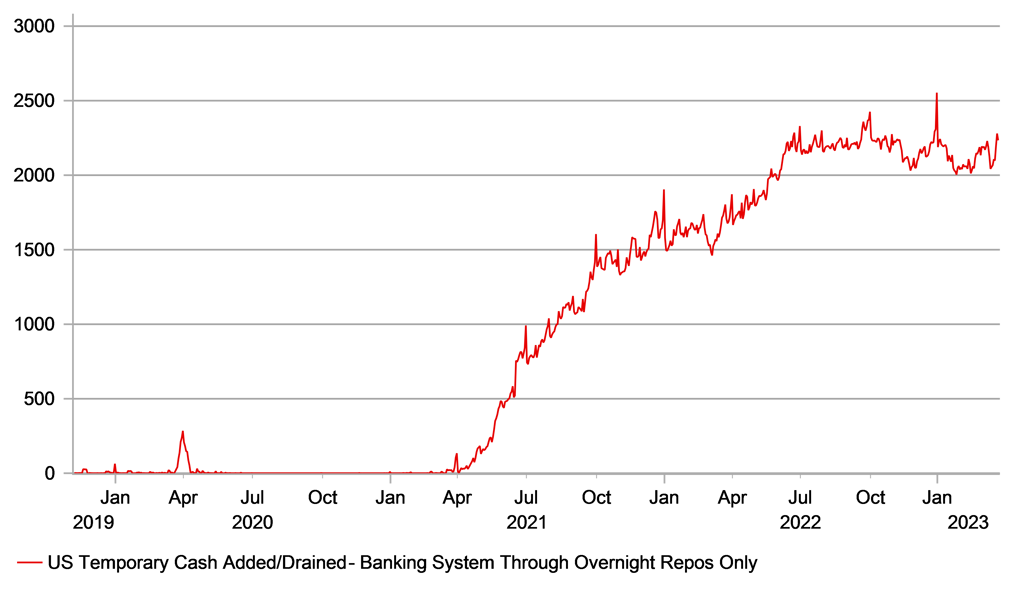

had the Fed balance sheet data which we would suggest was not as bad as feared and then yesterday US Treasury Secretary Yellen tried to clarify her remarks from Wednesday by stating the government was prepared to take further steps to protect bank deposits if required. Banking sector risks look unlikely to fade especially with the Fed continuing with its key policy of QT. The Reserve Repurchase Program has not diminished in size since QT began meaning commercial bank reserves are coming down on the liability side as assets run off the balance sheet. This increases the risks of further disruptions as we move forward.

We continue to see a lower USD/JPY as the most likely scenario as we move forward from here. The scale of easing now priced for this year (Dec ’23 fed funds future at 4.10%) leaves the US dollar vulnerable and we are likely to see USD/JPY trading down to the ytd lows between 127-128 relatively quickly. (other factor see below).

FED’S REVERSE REPURCHASE PROGRAM NOT COMING DOWN THRU QT

Source: Macrobond & Bloomberg

JPY: Strength will be more than just about the Fed

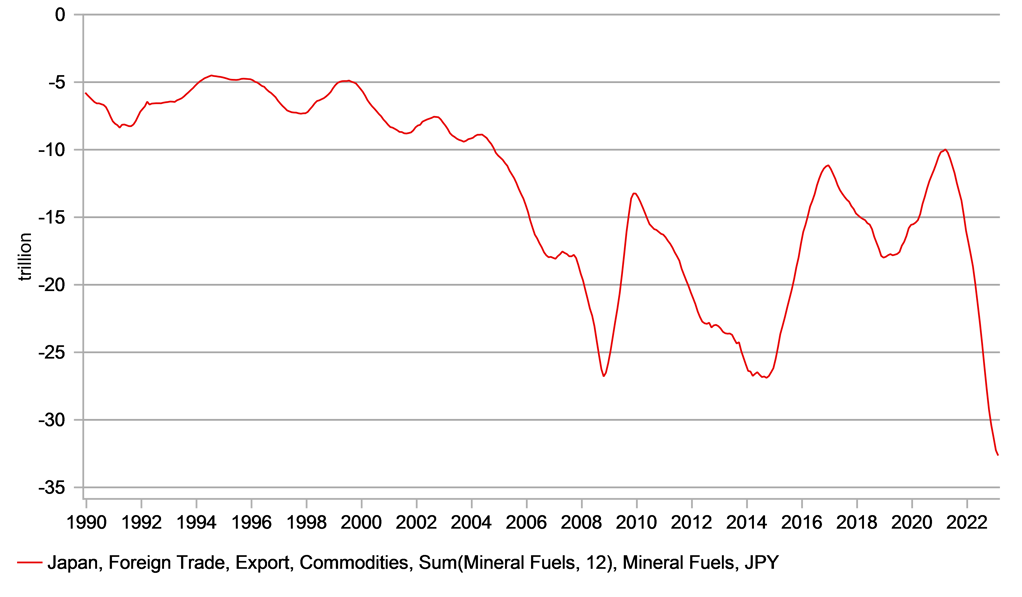

Following our FX Daily Snapshot yesterday when we highlighted the terms of trade improvement evident in the euro-zone current account data we were asked to look at the same details for Japan. Like we stated yesterday, the more favourable backdrop is there not just for EUR but also many other countries with large energy import bills, like JPY for example.

The monthly trade data in Japan released on 15th March for the month of February indicated the reversal of that negative terms of trade shock is well under way in Japan. The February import bill for fuel and minerals totalled JPY 2,577bn. The peak total for imports was back in August when natural gas prices peaked with the total import bill at JPY 3,423bn. The 12mth sum of this deficit stands at JPY 32trn as of February but natural gas and crude oil prices are trading back around levels from summer 2021. If these prices were to persist over time and the 12mth energy deficit was to revert to the 2021 levels, it would imply a JPY 20trn narrowing of Japan’s energy deficit (USD 150bn). Of course prices may drift higher, so the scale of improvement would be less but Japan, like the euro-zone and the UK is set for a marked improvement in its energy deficit this year. Understandably, the Fed and the drop in yields in the US is getting the attention as a key factor in pushing USD/JPY lower but the energy story will certainly add to positive JPY momentum this year.

GBP: BoE hiked but the reasoning was less than clear

We published an FX Focus piece (here) yesterday on the outcome of the BoE meeting. In short summary, the BoE provided a carbon-copy of the policy guidance from February even though the minutes of the meeting indicated an acknowledgement that wage growth was slightly weaker than the BoE expected and that services inflation was also weaker than expected in February, although overall inflation was higher but due to the volatile clothing and footwear segment. The statement also did not refer to the inflation risks “skewed significantly to the upside” like in February. Given the MPC guidance in February repeated yesterday that “if there were to be evidence of more persistent (inflation) pressures, then further tightening in monetary policy would be required” the decision to hike is from those perspective difficult to explain.

However, the BoE did highlight stronger than expected labour demand and due in part to the budget GDP growth was also going to be stronger. But clearly the case for tightening wasn’t compelling but the stronger CPI data overall probably forced the BoE’s hand. We see a good chance now that yesterday’s hike was the last. BoE Governor Bailey yesterday stated that the BoE needs to see the inflation fall actually happen. The March CPI data in April will be important.

There was not enough in the details for any abrupt shift in market expectations and there’s been minimal impact on GBP. Hence the positive momentum in GBP/USD could continue and we see scope for further gains to the upside from here given the broader less favourable backdrop for the dollar.

JAPAN RECORD ENERGY DEFICIT – THIS IS NOW REVERSING ON A MONTHLY BASIS & COULD AMOUNT TO JPY 20TRN DEFICIT REDUCTION

Source: Macrobond

GBP: BoE hiked but the reasoning was less than clear

We published an FX Focus piece (here) yesterday on the outcome of the BoE meeting. In short summary, the BoE provided a carbon-copy of the policy guidance from February even though the minutes of the meeting indicated an acknowledgement that wage growth was slightly weaker than the BoE expected and that services inflation was also weaker than expected in February, although overall inflation was higher but due to the volatile clothing and footwear segment. The statement also did not refer to the inflation risks “skewed significantly to the upside” like in February. Given the MPC guidance in February repeated yesterday that “if there were to be evidence of more persistent (inflation) pressures, then further tightening in monetary policy would be required” the decision to hike is from those perspective difficult to explain.

However, the BoE did highlight stronger than expected labour demand and due in part to the budget GDP growth was also going to be stronger. But clearly the case for tightening wasn’t compelling but the stronger CPI data overall probably forced the BoE’s hand. We see a good chance now that yesterday’s hike was the last. BoE Governor Bailey yesterday stated that the BoE needs to see the inflation fall actually happen. The March CPI data in April will be important.

There was not enough in the details for any abrupt shift in market expectations and there’s been minimal impact on GBP. Hence the positive momentum in GBP/USD could continue and we see scope for further gains to the upside from here given the broader less favourable backdrop for the dollar.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:15 |

French Manufacturing PMI |

Mar |

48.0 |

47.4 |

!! |

|

FR |

08:15 |

French S&P Global Composite PMI |

Mar |

51.8 |

51.7 |

!! |

|

FR |

08:15 |

French Services PMI |

Mar |

52.5 |

53.1 |

!! |

|

GE |

08:30 |

German Composite PMI |

Mar |

51.0 |

50.7 |

!!! |

|

GE |

08:30 |

German Manufacturing PMI |

Mar |

47.0 |

46.3 |

!!! |

|

GE |

08:30 |

German Services PMI |

Mar |

51.0 |

50.9 |

!!! |

|

EC |

09:00 |

Manufacturing PMI |

Mar |

49.0 |

48.5 |

!!!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Mar |

51.9 |

52.0 |

!!!! |

|

EC |

09:00 |

Services PMI |

Mar |

52.5 |

52.7 |

!!!! |

|

UK |

09:30 |

Composite PMI |

-- |

52.7 |

53.1 |

!!! |

|

UK |

09:30 |

Manufacturing PMI |

-- |

50.0 |

49.3 |

!!! |

|

UK |

09:30 |

Services PMI |

-- |

53.0 |

53.5 |

!!! |

|

GE |

09:30 |

ECB's President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

Core Durable Goods Orders (MoM) |

Feb |

0.2% |

0.8% |

!! |

|

US |

12:30 |

Goods Orders Non Defense Ex Air (MoM) |

Feb |

0.1% |

0.8% |

!! |

|

CA |

12:30 |

Core Retail Sales (MoM) |

Jan |

0.6% |

-0.6% |

!!! |

|

CA |

12:30 |

Retail Sales (MoM) |

Jan |

0.7% |

0.5% |

!! |

|

US |

13:30 |

FOMC Member Bullard Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:45 |

Manufacturing PMI |

Mar |

47.0 |

47.3 |

!! |

|

US |

13:45 |

S&P Global Composite PMI |

Mar |

47.5 |

50.1 |

!! |

|

US |

13:45 |

Services PMI |

Mar |

50.5 |

50.6 |

!! |

|

UK |

15:00 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!! |

|

UK |

16:00 |

BoE MPC Member Mann |

-- |

-- |

-- |

!!! |

Source: Bloomberg