USD/JPY hits year to date high as mood music from debt ceiling talks improves

USD/JPY: US debt ceiling optimism & rising US yields lift pair to YTD high

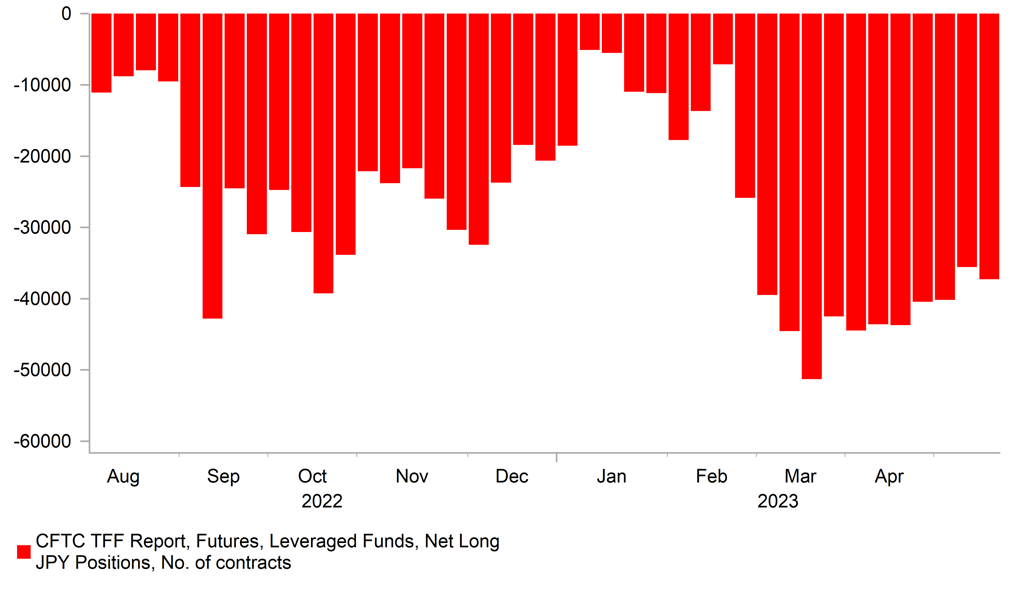

The US dollar has hit a fresh year to date high overnight against the yen at 138.87 as it continues to extend its advance from the low of 133.75 recorded on 11th May. Over that period the yen has been the worst performing G10 currency alongside the Scandi currencies of the Swedish krona and Norwegian krone which have declined by over 2% against the US dollar. The recent move higher in USD/JPY has coincided with the ongoing adjustment higher in US rates. 2-year and 10-year US government bond yields have closed higher for seven consecutive days which is the longest run of higher closing prices since September of last year. It was also a period of yen weakness when USD/JPY was breaking above the 140.00-level for the first time since the middle of 1998. According to the latest CFTC report, leveraged funds have been paring back the size of their short yen positions this month although they still remain close to levels from back in autumn of last year when USD/JPY hit its current cycle high. The BoJ’s ongoing reluctance to tighten monetary policy further in the near-term combined with recent adjustment higher in US rates has triggered renewed upward momentum for USD/JPY. The move higher in US rates was encouraged yesterday by reassuring comments following a meeting between President Biden and House speaker McCarthy on the debt ceiling. After the talks, House speaker McCarthy stated that “the tone was better than any other time we have had discussions”. Both President Biden and House leader McCarthy acknowledged that the talks had been productive although they have not yet reached an agreement. President Biden stated that “we reiterated once again that default is off the table and the only way to move forward is in good faith toward a bipartisan agreement”. House leader McCarthy expects to speak with President Biden on a daily basis until a deal has been reached. The developments support market expectations that a compromise agreement will be reached to raise the debt ceiling before the so-called “X-date”. If those expectations are seriously challenged in the coming weeks then it could trigger a squeeze of short yen positions and a sharp move lower in USD/JPY.

At the same time, the move higher in US rates was encouraged yesterday by comments from Fed officials. St Louis Fed President Bullard stated that he is “thinking two more moves this year” to put enough downward pressure on inflation. He is a well-known hawk and a non-voter on the FOMC this year. The hawkish comments from St Louis Fed President Bullard were partially offset by relatively more cautious comments from Minneapolis Fed President Kashkari who stated “we may have to go higher from here, but we may not raise rates quite as aggressively and as quickly as we have over the course of the past year”. He also believes it’s a close call as to whether the Fed raises rates further in June or skips that meeting. We would place more weight on his comments as he is a voter on the FOMC this year. June rate hike expectations have since edged higher again with the US rate market pricing in around 5bps of hikes.

JPY SHORTS REMAIN POPULAR

Source: Bloomberg, Macrobond & MUFG Research

EM FX: Giving back gains as US debt ceiling moves into greater focus

The USD has continued to rebound against emerging market currencies over the past week. The only emerging market currencies that bucked the broader weakening trend have been the KRW (+1.9% vs. USD), PHP (+0.8% and TWD (+0.3%). At the other end of the spectrum the THB (-2.6% vs . USD), MXN (-2.6%), HUF (-2.0%), BRL (-1.5%), MYR (-1.4%), CNY (-1.4%) and CLP (-1.2%) have been the worst performing currencies. It marks a reversal for the MXN (+9.0% vs. USD YTD), HUF (+7.8%), CLP (+6.9%), and BRL (+6.3%) which are still amongst the best performing EM currencies so far this year.

The reversal has been triggered by the ongoing correction higher in US yields and paring back of optimism over the strength of the economic recovery in China. US yields have risen back to their highest levels since mid-March just after the collapse of Silicon Valley Bank. Fears over a further loss of confidence in US regional banks has eased somewhat in recent weeks as bank share prices have stabilized at significantly lower levels. The US economic data flow has surprised to the upside as well encouraging the US rate market to scale back expectations for rate cuts later this year from around 75bps back towards 50bps. Fed Chair Powell did though dampen expectations for another hike at the next FOMC meeting on 14th June. With the policy rate already in restrictive territory and credit conditions tightening, Fed Chair Powell is more cautious over the need for further hikes. Expectations for further Fed hikes will be held back in the near-term until a deal is reached to raise the debt ceiling. The more last minute the deal, the greater the risk of disruption to financial markets. A jump in market volatility poses downside risks for popular carry trades, and could trigger a further reversal of year to date gains for the MXN, HUF, CLP and BRL.

The outperformance of Latam currencies at the start of this year could also be tested by the paring back of optimism over the strength of economic recovery in China. The latest activity data from China for April revealed a loss of growth momentum at the start of Q2 with industrial production and property investment remaining weak. The prices of raw industrial metal prices have fallen back to the lows from last autumn which is leading to deterioration in terms of trade for Latam commodity exporters.

In EMEA, HUF carry trades have been hit by comments from Hungarian Foreign Minister Szijjarto pledging to block further aid to Ukraine. The confrontational stance from the Hungarian government could further delay the release of EU funds, and may deter the NBH from easing policy further at today’s policy meeting. The consensus forecast is for the NBH to begin lowering the overnight policy rate by 1 percentage point from 18.00% after lowering the top end of the corridor by 4.5 percentage points to 20.5% at their last meeting in response to the improvement in the risk perception for Hungary that has created more leeway to loosen policy. We still expect the forint to remain an attractive carry currency in the near-term. Please see our latest EM EMEA Weekly (click here) for more details.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Mar |

20.2B |

24.3B |

! |

|

EC |

09:00 |

Manufacturing PMI |

May |

46.2 |

45.8 |

!! |

|

EC |

09:00 |

Services PMI |

May |

55.6 |

56.2 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

-- |

48.0 |

47.8 |

!!! |

|

UK |

09:30 |

Services PMI |

-- |

55.5 |

55.9 |

!!! |

|

UK |

10:15 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

UK |

10:15 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

UK |

10:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

UK |

10:15 |

MPC Member Tenreyro Speaks |

-- |

-- |

-- |

!! |

|

US |

13:00 |

Building Permits |

-- |

1.416M |

1.430M |

!!! |

|

US |

14:45 |

Manufacturing PMI |

May |

50.0 |

50.2 |

!! |

|

US |

14:45 |

Services PMI |

May |

52.6 |

53.6 |

!!! |

|

US |

15:00 |

New Home Sales |

Apr |

663K |

683K |

!!! |

|

UK |

15:35 |

MPC Member Haskel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg