Takaichi driven JPY weakness has been refuelled

JPY: Shift in expectations for fiscal & BoJ policies weigh on yen

The yen has continued to weaken at the start of this week resulting in USD/JPY hitting a high overnight at 151.61. The recent yen weakening trend has been reinforced by confirmation that Sanae Takaichi won a vote in the Diet to be confirmed as Japan’s new prime minster after winning 237 votes in the lower house. At the same time, it has been reported that she is poised to appoint Satsuki Katayama as the country’s first female finance minister. Satsuki Katayama is currently a member of the LDP’s Fiscal Policy Review Committee which is a proactive fiscal policy thinktank. Our colleagues in Tokyo have noted that while she is currently a member of this committee as a proponent of active fiscal policy, she previously had a strong image of being in favour of fiscal austerity. It may contribute to some doubts about her stance as a proponent of active fiscal policy. Our colleagues noted that at her core she is aligned with the Ministry of Finance and fundamentally does not favour a significant rise in interest rates. However, she has also been involved in expansionary fiscal policies in line with the administration at the time. Her appointment as the new finance minister will at least initially refuel expectations that Prime Minister Takaichi is preparing to implement looser fiscal policies. A view backed up by Bloomberg who reported today that Satsuki Katayama is generally known for her support for expansionary fiscal policy. In the report, it was highlighted that she argued that bond issuance should not be viewed as debt, but as future-focused investment on a LDP panel last year. It comes just after the LDP and new partner Japan Innovation Party have announced a coalition agreement. The two sides have agreed to “promote effective public and private investment based on responsible and active fiscal policy”.

Despite renewed concerns over looser fiscal policy overnight, the JGB market has been well-behaved with long-term yields remaining relatively stable. Downward pressure on JGB yields and the yen overnight have been encouraged by reports that BoJ officials are of the view that there’s no urgency to hike rates next week even if the economy is making progress towards achieving their inflation target according to people familiar with the matter. The report notes that while officials aren’t ruling out the chance of another hike by year-end, there has so far been no conclusive factor that would convince them they must raise the policy rate when they next set policy on 30th October. The officials judge though that the likelihood has continued to rise gradually for their outlook to be achieved as the economy and inflation develop more or less in line with their expectations. The report added that the BoJ would take into account developments in financial markets into account including the weaker yen. Some officials noted as well that it may be possible to decide on a rate hike with just an initial assessment of the economic and fiscal policies likely to be undertaken by the new government. After the report was released the Japanese rate market has moved to further scale back expectations for a hike week, and is currently pricing in only 3bps. Overall, the latest developments will continue to encourage a weaker yen in the near-term although we still expect initial investor optimism over a bigger policy shift in Japan to be left disappointed over time helping the yen to recover lost ground.

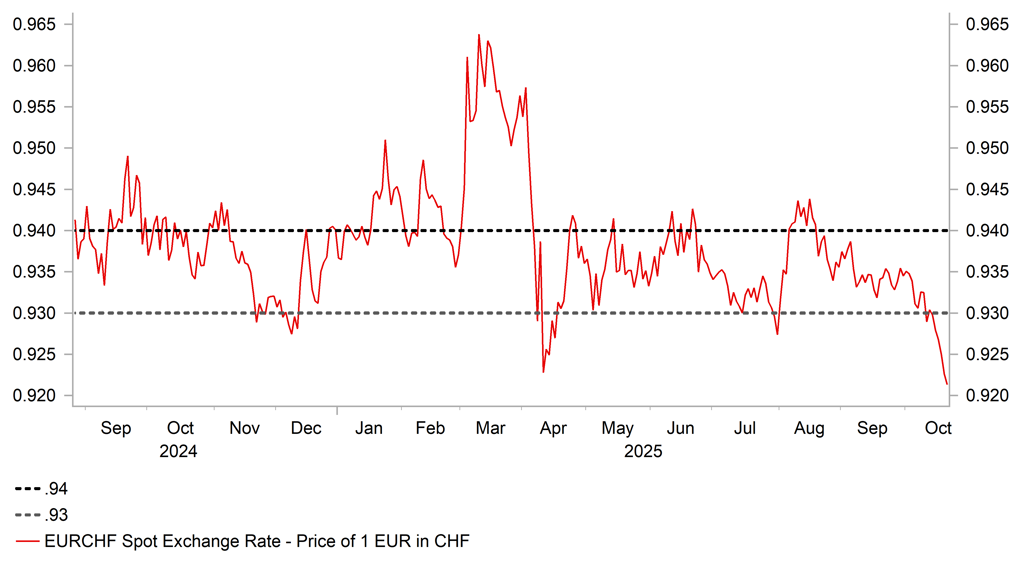

CHF IS ATTEMPTING TO BREAK LOWER AGAINST EUR

Source: Bloomberg, Macrobond & MUFG GMR

CAD/CHF: CHF is threatening to break to upside while CAD remains weak

The euro has softened alongside the yen at the start of this week resulting in EUR/USD falling back towards the 1.1600-level after briefly rising back above the 1.1700-level at the end of last week. Euro weakness has been most evident against the Swiss franc amongst the major currencies as the Swiss franc is outperforming more broadly. EUR/CHF is currently threatening to break out to the downside from the trading range that has been in place for most of the last year between 0.9300 and 0.9400, and is moving closer to lows just above the 0.9200-level. The price action supports our short CAD/CHF trade recommendation. Demand for the Swiss franc has picked up this month alongside the sharp rise in the price of gold (click here). While the Canadian dollar has been undermined by the price of oil dropping back towards year to date lows closer to USD60/barrel. The Canadian dollar has been hit recently as well by the Canadian rate market moving to price back in a higher probability of another BoC rate cut this month. There are currently around 21bps of cuts priced in for the 29th October BoC policy meeting ahead of the release today of the latest Canadian CPI report for September. The stronger rebound in Canadian employment (+60.4k) in September only briefly triggered a scaling back of BoC rate cut expectations.

At the same time, the Swiss franc has been supported recently by the renewed upturn in political uncertainty in France. While French Prime Minister Lecornu was able to survive two votes of no confidence last week, he still faces a difficult challenge to secure enough support to pass his budget plans for next year through parliament. The deteriorating fiscal outlook was highlighted by the decision late last week from S&P to downgrade France’ credit rating by one notch to A+. It follows a similar decision last month from Fitch. The initial negative impact from the credit rating downgrade on the French government bond market and the euro has been relatively muted.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

UK |

11:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

EC |

12:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

Business Inventories (MoM) |

Aug |

0.1% |

0.2% |

!! |

|

US |

12:30 |

US Leading Index (MoM) |

Sep |

0.1% |

-0.5% |

!! |

|

CA |

13:30 |

CPI (YoY) |

Sep |

2.3% |

1.9% |

! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.9% |

! |

|

US |

14:00 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

22:00 |

Overall Net Capital Flow |

Aug |

-- |

2.10B |

! |

Source: Bloomberg & Investing.com