US yields grind higher & to support dollar in low vol conditions

USD: PPI adds to concerns with FOMC minutes in focus this week

At the start of this week optimism over receding inflation certainly isn’t as high as it was at the start of last week with both the CPI and PPI prints coming in stronger than expected last week. The PPI services increase of 0.6% spooked the market and gave credence to services inflation continuing to be sticky as was evident in the CPI data as well. The higher PPI has lifted expectations of a stronger PCE print too with the consensus in the market seeming to be in a range of 0.3% - 0.5% m/m. The data last week will certainly encourage the Fed to continue with its cautious rhetoric that has seen the push-back on rate cuts leave the total priced for this year at 86bps. At the end of January, the expected total for rate cuts this year was 148bps. If 148bps can be described as excessive we would also argue now that the removal of 60bps of easing to leave the total between 3-4 25bp cuts are also starting to look excessive the other way. The FOMC minutes will be released on Wednesday evening and will be interesting to see how much consensus there was for pushing back on market pricing – the minutes may reveal that the extent of the reduction in rate cuts priced is starting to look excessive. The January FOMC meeting marked the end of the tightening bias in the statement but was also when Powell in the press conference basically dismissed the idea of a March rate cut. A QT discussion took place according to Powell at the meeting and signalled a more “in-depth discussion” would take place at the at the March meeting. This week it will be Thursday when we get the next wave of Fed speakers with Vice Chair Jefferson, Governors Bowman, Cook and Waller and President Harker (non-voter) all speaking.

But the risk over the short-term must be that the inflation information last week will linger which could provide further upside scope for bond yields. It wasn’t just the CPI and PPI data. The NY Empire Manufacturing report revealed increases in both prices paid and prices received while 91% of the firms surveyed reported input prices as the same or higher. The prices paid in the NY Fed Business Activity report also showed a jump while the Michigan Consumer Sentiment report on Friday showed the 1yr inflation expectations reading ticking up from 2.9% to 3.0% while the 5-10yr expectations remained at 2.9%, but was expected to drop to 2.8%.

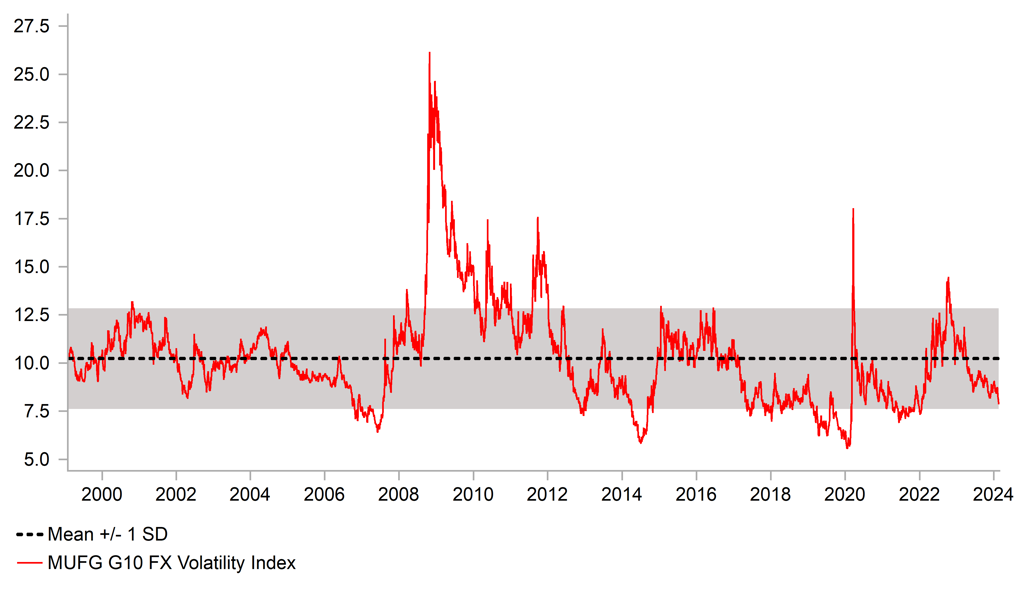

Momentum last week did fade somewhat for the dollar. In a week in which the 2yr UST note yield jumped around 20bps, the dollar (DXY) barely moved, up just 0.2%. The 2yr yield in core Europe did also gain by about 15bps but the 2yr Gilt yield gained just 2bps. The 2yr JGB yield advanced by 5bps. Last week also saw recessions confirmed in the UK and Japan while growth in the euro-zone was flat. That had limited impact in fuelling divergence trades as the outlook for growth is improving in Europe and Japan. In that regard the advance PMI data on Thursday will be potentially crucial for rates and FX. If we don’t see the expected further improvements in PMIs in Europe, the dollar could make more notable gains if inflation concerns continue to provide support for US bond yields, which seems likely over the short-term. Still, there is a lack of top tier data releases this week and today is a US holiday so it seems likely that low FX volatility conditions are likely to continue.

MANUFACTURING PMIS IN EUROPE HAVE BIGGEST SCOPE FOR REBOUND

Source: Bloomberg, Macrobond & MUFG GMR

CNY: China reopens on signs of consumer revival

China’s New Year holiday officially ended on Saturday with data emerging showing a strengthening of consumer demand. Chinese travellers made 474mn journeys across the country during the 8-day vacation, up 34% on a YoY basis and up 19% from the level in 2019. Domestic spending on tourism came in at CNY 633bn, up 47% on a YoY basis and up 7.7% from the level in 2019. China officials also reported that domestic box office receipts for live performances surged by 80% on a YoY basis. However, the flow of good economic data suggesting a revival in consumer spending has not translated into renewed equity buying. The Hang Seng China Enterprise Index is trading down close to 1.0% although the CSI 300 Index is up about 1.0%. There had been speculation of a PBoC rate cut to start the return from the New Year holiday period but that did not happen.

However, the authorities continue to fuel expectations that more policy action will be taken. Premier Li Qiang yesterday called for “pragmatic and forceful” action to lift confidence in the economy adding that policy decision-making needed to be “consistent and stable”. Steps to increase support for the real estate sector continue with China’s state banks increasing loans available for property projects eligible for support and consistent with calls from government for loans to be made available.

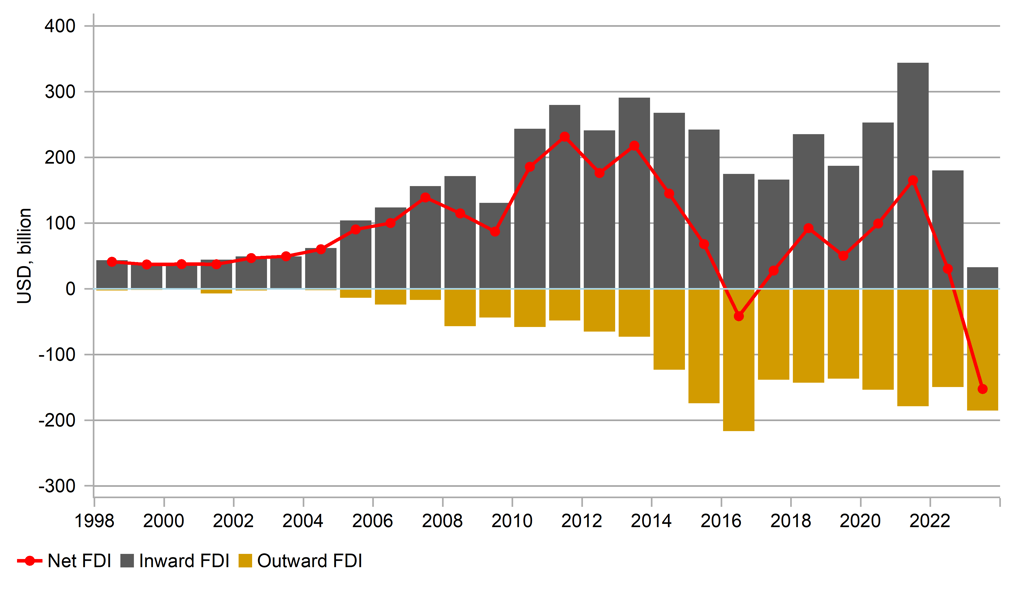

While there was no PBoC rate cut yesterday, CNY 1bn of liquidity was injected and bank lending rates are expected to come down over the coming weeks. The PBoC continues to be cautious given the desire for CNY to remain stable. Scope for easing is being constrained by the worsening cross-border flow picture. China’s current account surplus remains substantial but is shrinking. The Q4 data was released over the weekend and for 2023 as a whole the surplus totalled USD 264bn, down from USD 402bn in 2022. China’s FDI inflow last year was just USD 33bn, 82% down on 2022 and the smallest inflow since 1993. The PBoC will continue to thread carefully with rate cuts given the worsening cross-border flow backdrop.

CHINA INWARD FDI IN 2023 COLLAPSES TO WEAKEST SINCE 1993

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

13:30 |

Ind Prod Price Index (YoY) |

Jan |

-- |

-2.7% |

! |

|

CA |

13:30 |

IPPI (MoM) |

Jan |

-0.1% |

-1.5% |

! |

|

CA |

13:30 |

Raw Material Price Index (YoY) |

Jan |

-- |

-7.9% |

! |

|

CA |

13:30 |

RMPI (MoM) |

Jan |

0.7% |

-4.9% |

!! |

Source: Bloomberg