Heightened intervention threat helps to put dampener on USD strength

JPY: Japan moves another step closer to intervention to support the yen

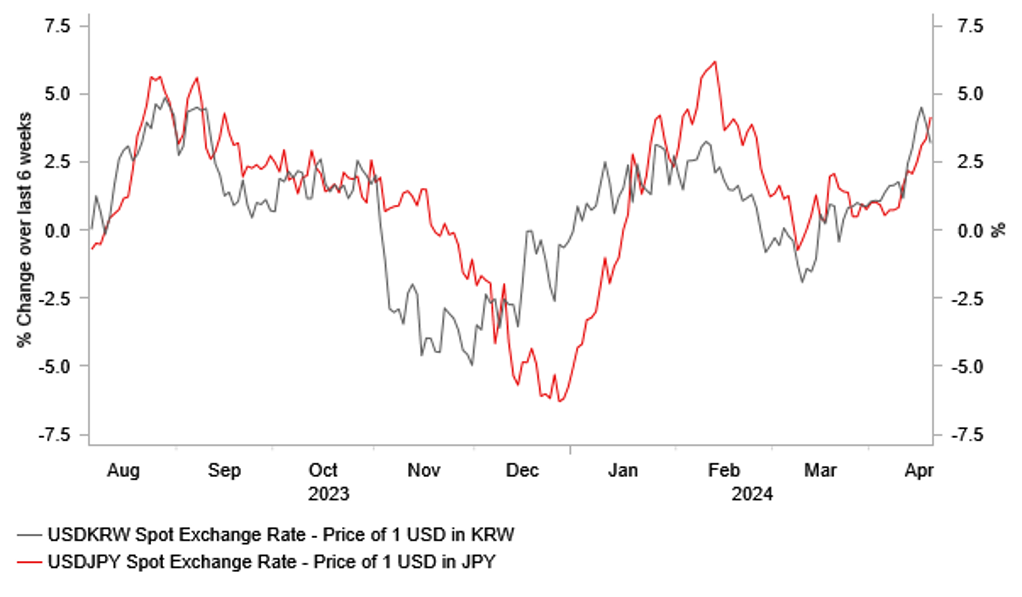

The US dollar has lost some upward momentum over the last couple of days. After hitting an intra-day high of 106.52 on 16th April, the dollar index has fallen back modestly to an intra-day low of 105.84 overnight. The South Korean won has staged the biggest rebound against the US dollar over this period falling from an intra-day high of 1,400.0 on 16th April to an intra-day low overnight of 1,371.7. In contrast, the yen’s rebound has been more modest. After threatening to break above the 155.00-level earlier this week, USD/JPY has fallen back to an intra-day low of 153.96. The won and the yen have both been supported in recent days by actions taken by domestic policymakers that have increased the risk of intervention to support their currencies. In a joint statement released overnight following the first trilateral meeting in Washington of the Finance Ministers from Japan, the Republic of Korea and the US, they agreed to “continue to consult closely on foreign exchange market developments in line with our existing G20 commitments, while acknowledging serious concerns of Japan and the Republic of Korea about the recent sharp depreciation of the Japanese yen and the Korean won”.

The statement suggests that Japan and Korea have been the green light by the US to intervene to support their currencies should the yen and won continue to weaken sharply. It sends another strong signal to market participants that Japan and Korea are moving closing to stepping into the FX market while at the same time officials from Japan and Korea will be hoping that the joint statement with the US helps to strengthen the credibility of verbal intervention as well. It has even encouraged some speculation that the US could join Japan and Korea to help support the yen and won through selling the US dollar. However, joint intervention involving the US still appears unlikely at the current juncture. The stronger US dollar remains fundamentally consistent with the Fed’s desire to maintain tight monetary policy to bring inflation back to their 2.0% target. Taking action to significantly weaken the US dollar would be be inflationary. As a result, if joint intervention takes place it is more likely to involve Korea and Japan.

However, market participants would still be sceptical whether it would prove effective at turning around weakness in both the yen and won while US yields continue to march higher in response to the recent run of stronger US activity and inflation data. The US rate market is not even fully confident now that the Fed will deliver just two rate cuts by the end of this year. It is likely for this reason that officials from Japan in particular have been reluctant to intervene over the past week even as USD/JPY has continued to move sharply higher up towards the 155.00-level. The joint statements do though show their patience for tolerating currency weakness is wearing thin thereby further increasing the imminent risk of intervention. After the joint statement was released Japan’s top currency official Masato Kanda stated that “it is serious concerns rather ordinary concerns”. He said that the agreement on language about currency weakness itself was an achievement, as that hasn’t been done in recent years.

US ACKNOWLEDGES CONCERNS OVER RECENT JPY & KRW WEAKNESS

Source: Bloomberg, Macrobond & MUFG GMR

AUD/CAD: RBA and BoC are on different rate cut paths

The other main development overnight has been the release of the latest labour market report from Australia. The report revealed further evidence that Australia’s labour market is holding up better than expected. After the blowout employment increase of 117.6k jobs in February, the pullback in March was relatively small as employment declined by only -6.6k jobs. Monthly employment growth has been more volatile since late last year. The Australian economy has added on average 29.2k jobs/month over the last six months which compares to an average of 24.3k/month over the past year. The small decline in employment in March helped to lift the unemployment rate by 0.1ppt to 3.8% although that was a smaller increase than the consensus forecast of 3.9%. the unemployment rate has increased only marginally by 0.3ppt from the cyclical low set in October 2022 providing further evidence of the resilience of the Australian labour market. It will support expectations that the RBA will wait longer than other G10 central banks to begin cutting rates. The Australian rate market is not expecting the RBA to begin cutting rates until later this year in Q4. While it is a supportive development for the Australian dollar it has not been sufficient on its own to drive outperformance so far this year.

In contrast, economic conditions continue to fall into place for the BoC to begin cutting rates sooner. The release earlier this week of the latest CPI report from Canada for March revealed that core inflation continues to surprise to the downside at the start of this year. The BoC’s preferred measure of core CPI which is an average of the median and trimmed measures slowed further to 3.0% in Mach. The lowest reading since July 2021. The favourable development keeps the BoC on track to cut rates as soon as at their next policy meeting in June. Expectations for widening policy divergence between the BoC and Fed are lifting USD/CAD up closer to the 1.4000-level.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Feb |

45.2B |

39.4B |

! |

|

EC |

10:00 |

Construction Output (MoM) |

Feb |

-- |

0.48% |

! |

|

EC |

11:00 |

EU Leaders Summit |

-- |

-- |

-- |

!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

GE |

13:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

215K |

211K |

!!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Apr |

1.5 |

3.2 |

!!! |

|

US |

14:05 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

14:15 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Existing Home Sales |

Mar |

4.20M |

4.38M |

!!! |

|

US |

15:00 |

US Leading Index (MoM) |

Mar |

-0.1% |

0.1% |

!! |

|

US |

16:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

EC |

18:30 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg