Activity data casts further doubt on strength of China recovery

AUD: Economic recovery losing upward momentum in China

The Australian dollar has been one of the weakest performing G10 currencies overnight resulting in the AUD/USD rate falling back below the 0.6700-level and the AUD/NZD rate has fallen back towards the 1.0700-level. It follows the release overnight of weaker than expected activity data from China for April. The renminbi has also softened in response resulting in USD/CNY moving back closer to the 7.0000-level. The latest activity data from China revealed that the strong recovery momentum for consumption has not yet spilled over to broader economic activity. Retail sales increased by an annual rate of 18.4% up from 10.6% in March although modestly below expectations. In contrast the recovery in fixed asset investment and industrial production continues to disappoint. Fixed asset investment YTD annual growth slowed to 4.7% in April down from 5.1% in March. A deeper contraction in property investment which declined by annual rate of -7.2% was the main driver of weakness. It suggests that the housing market may require further support from policymakers to help to stabilize the sector and encourage a stronger and broader economic recovery. At the same time, industrial production increased by an annual rate of 5.5% in April up from 3.9% in March although much less than consensus forecast for an increase of 10.9%.

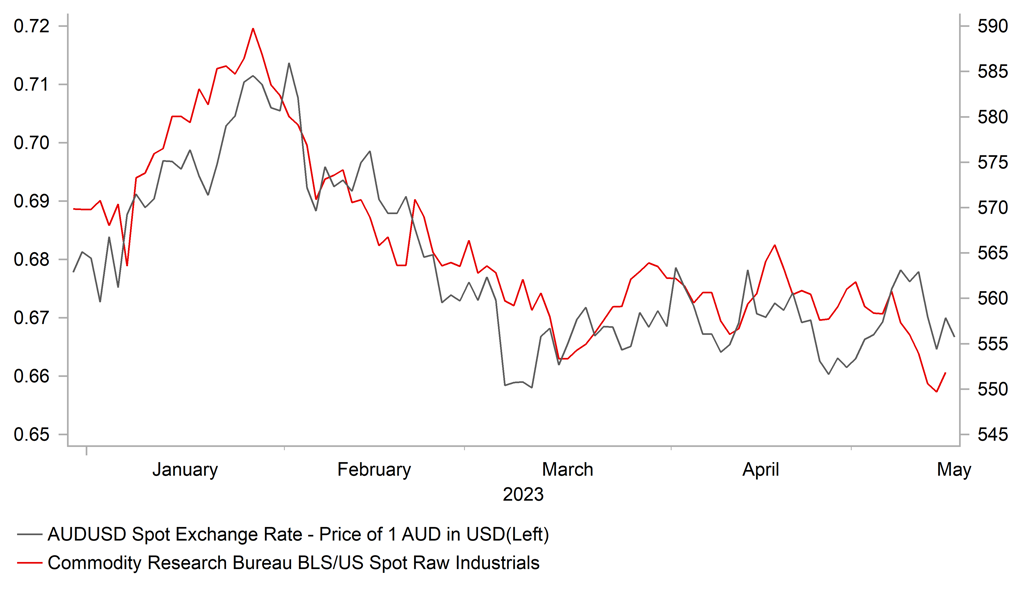

Overall the report reveals that the domestic economic recovery has lost some upward momentum at the start of Q2. It will place more pressure on policymakers to announce further stimulus/support measures to re-energise the recovery. As we have highlighted recently, the economic recovery is proving weaker in sectors of the economy which are more important for commodity demand. It was widely expected that commodity prices would rebound this year on the pick-up in China demand but so far that has not proven to be the case. CRB’s raw industrials (RIND) commodity price index has just fallen back to the lows from the end of October of last year, and has now fully reversed gains from late last year which were driven by China reopening optimism. The developments are putting a dampener on the outlook for commodity-related currencies such as the Australian dollar, although it has not prevented Latam currencies from continuing to outperform so far this year on the back of attractive carry returns. We also highlighted in our latest FX Weekly (click here) that the recent loss of growth momentum in China could be helping to support the US dollar more broadly.

AUD UNDERMINED BY COMMODITY PRICE WEAKNESS

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Domestic factors contributing to TRY & ZAR underperformance

The USD has staged a modest rebound over the past week that has resulted in a more challenging external environment for emerging market currencies. The hardest hit emerging currencies over the past week have been the ZAR (-4.1% vs. USD), RUB (-2.6%), CZK (-2.2%), PHP (-1.7%), RON (-1.6%), MYR (-1.5%) and KRW (-1.4%). However, it has not disrupted the bullish trend that has been in place for Latam currencies this year. The BRL (+2.4% vs. USD), MXN (+1.8%), CLP (+1.4%), and PEN (+1.1%) have continued to strengthen over the past week. USD/MXN and USD/PEN have both hit fresh year to date lows at 17.421 and 3.6425 respectively.

The worst performing EMEA currency over the past week was once again the ZAR as it extended the period of marked underperformance at the start of this year. The ZAR’s sell-off accelerated last week resulting in USD/ZAR breaking above the high from April 2020 in the initial aftermath of the negative COVID shock at 19.351. For the year as a whole, the ZAR has now declined by around -11% against the USD YTD. The ZAR has underperformed at the start of this year as market participants have moved to price in a much higher domestic risk premium which has more than offset favourable external developments from lower US yields and a weaker USD more broadly. The latest trigger for the deeper ZAR sell-off last week were heightened fears that geopolitical tensions between South Africa and the US could escalate significantly. It followed comments from a US ambassador stating that South Africa supplied arms to Russia. South African Finance Minister Godongwana has since claimed that the diplomatic row has been resolved, and it is unlikely to result in the US imposing penalties such as sanctions. The ZAR is attempting to stage a relief rally that could extend further in the week ahead although other domestic concerns such as ongoing energy supply disruptions and the paring back of China reopening optimism are acting as a dampener on upside potential.

The other main event for EMEA FX this week is the fallout from the elections in Turkey. The initial reaction in the FX market has been relatively modest. It is a continuation of more controlled TRY weakness ahead of the elections that has resulted in a slower pace of TRY depreciation this year (-5% vs. USD YTD). The election results revealed that President Erdogan and his AKP party are well on course to maintain their grip on power with a 2nd Presidential election to be held on 28th May. We expect TRY weakness to accelerate after the elections alongside the continuation of unconventional policy settings. We will be adjusting our USD/TRY forecasts higher. Please see our latest EMEA EM Weekly (click here) for more details.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

Apr |

8.3% |

7.6% |

! |

|

GE |

10:00 |

German ZEW Current Conditions |

May |

-37.0 |

-32.5 |

!! |

|

EC |

10:00 |

Employment Change (QoQ) |

-- |

0.3% |

0.3% |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q1 |

0.1% |

0.3% |

!! |

|

EC |

10:00 |

Trade Balance |

Mar |

-- |

4.6B |

!! |

|

US |

13:15 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Retail Sales (MoM) |

Apr |

0.8% |

-0.6% |

!!! |

|

CA |

13:30 |

CPI (YoY) |

Apr |

4.1% |

4.3% |

! |

|

US |

13:55 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

14:15 |

Industrial Production (MoM) |

Apr |

-0.1% |

0.4% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

May |

45 |

45 |

! |

|

EC |

15:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

17:15 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg