USD remains on softer footing amidst heightened US policy uncertainty

USD: Consolidating at weaker levels after last week’s heavy sell-off

The US dollar is continuing to stabilize at weaker levels following on from last week’s heavy sell-off. The dollar index has traded within a narrow range this week between 103.20 and 104.10. Downward pressure on the US dollar has eased this week as US yields have found support after their recent adjustment lower. The 10-year US Treasury attempted again but failed to break below support from the 200-day moving average that comes in just above 4.20%. Similarly at the short-end of the US curve, the 2-year US Treasury yield has risen back up to 4.00%. US yields were supported yesterday by the release of the latest US PPI report for February. The report revealed that several PPI components that feed directly in the Fed’s preferred measure of inflation, the core PCE deflator, increased sharply. These included a +0.6%M/M increase in PPI hospital prices, a 1.2% increase in PPI auto insurance prices and a 1.0% increase in PPI domestic air transportation prices. After taking both the US CPI and PPI reports into consideration, the core PCE deflator is expected to increased by +0.3%M/M or +0.4%M/M in February. It would be a strong enough reading for the Fed to stick to current guidance that that they are not in a rush to cut rates further right now. However, the latest US inflation has not prevented the US rate market from anticipating three more Fed rate cuts this year if US economic growth continues to slow in response to heightened policy uncertainty at the start of Trump’s second term.

President Trump delivered another tariff threat yesterday in response to the EU’s decision to retaliate to the US tariffs imposed on aluminium & steel imports. According to Bloomberg, US imports of targeted steel & aluminium products from the EU accounted for only 0.1% of EU GDP last year. In response the EU decided to impose its own tariffs on EUR26 billion of imports from the US including steel and aluminium products as well as textiles, agricultural products and home appliances. As was the case with Canada, President Trump has since threatened to hike tariffs further in response to retaliatory tariffs from the EU with a 200% tariff on wine, champagne and other alcoholic beverages that could impact more than EUR10 billion of imports. More disruptive tariff hikes on the EU are expected to be announced in early April. In contrast, the decisions by the Mexican and UK governments not to retaliate immediately to US tariffs have been praised by the Trump administration. It has encouraged the Mexican peso to rebound further resulting in USD/MXN falling back closer to the 20.000-level.

At the same time, market participants have been weighing up the risk of another US government shutdown from tomorrow. The risk of the US government shutting down appears to have been avoided after Senate Democratic leader Chuck Schumer decided to drop his threat to block the Republican’s bill after a day of reportedly contentious meetings between minority Democrats. Republicans likely need seven other Democrats to join Schumer who indicated that the Democrats should vote with the conscience on the legislation rather than as directed by the leadership. But as Schumer carries much influence within the caucus he is expected to amass enough support to avert a shutdown. He sated that a shutdown would be “much worse” than accepting the Republican funding package as it would give President Trump and Elon Musk “carte blanche to destroy vital government services”. The pivotal vote to advance the GOP bill to finance the government is scheduled for early Friday afternoon. Avoiding a government shutdown would help to avoid further self-inflicted harm for the US economy and the US dollar.

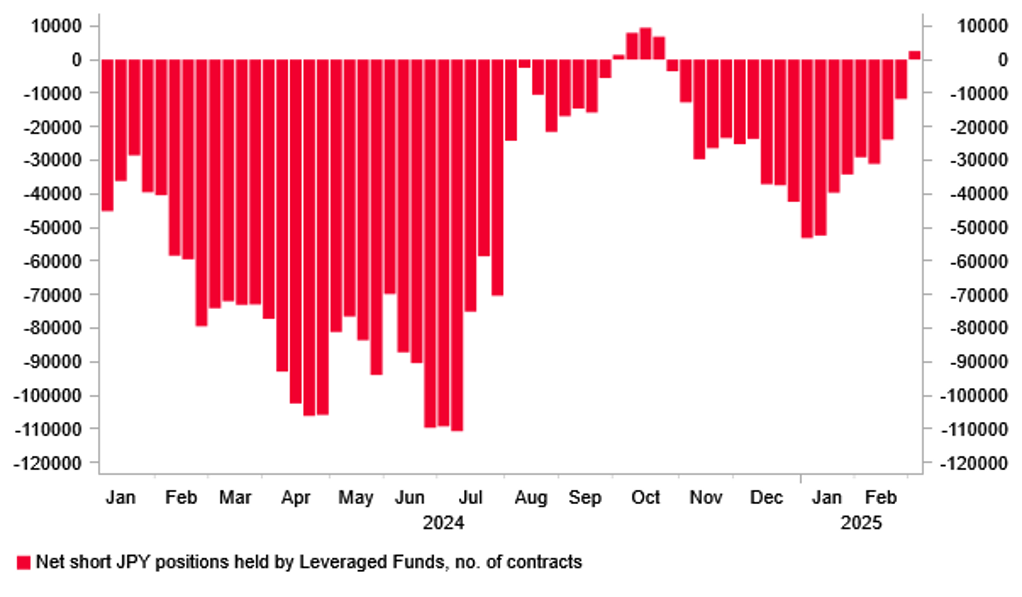

POSITIONING HAS SHIFTED TO LONG JPY AFTER STRONG GAINS THIS YEAR

Source: Bloomberg, Macrobond & MUFG GMR

CNY/JPY: China consumption measures & Japan wage agreements in focus

One of the main developments during the Asian trading session has been a strong rally for Chinese equity markets. The Shanghai composite index has strengthened by almost 2.0% following reports that officials from the finance ministry, commerce ministry, central bank and other government bodies plan to hold a press conference on Monday to boost consumption. The Chinese authorities are expected to brief the media on policies such as subsidizing a consumer trade-in program and efforts to strengthen the social safety net that include providing better child care and elderly-care services. China’s financial regulator has also vowed to develop consumer finance to boost consumption including encouraging banks to speed up issuing personal-consumption loans. It has pledged to increase financing support for services industries such as retail, accommodation, catering, tourism, education and healthcare.

At the recent NPC, China’s top leaders made boosting consumption a top priority for the first time since President Xi came to power over a decade ago. The need to roll out more support for domestic demand growth has increased recently after the President Trump raised tariffs on imports from China by a further 20 percentage points. There is also increased speculation that the PBoC could lower the reserve requirement ratio again after it repeated a pledge yesterday to cut the ratio and interest rates at an appropriate time to support growth. USD/CNY has been moving gradually lower back towards support from the 200-day moving average at just below 7.2200 alongside the broad-based US dollar sell-off. It has resulted in the renminbi weakening against the currencies of other major trading partners. The CFETS RMB index has declined by around 3.0% from the peak at the start of this year.

The other main development at the end of the Asian trading session has been the release of the preliminary wage negotiation results from Rengo, Japan’s largest labour union. The results revealed that its workers secured an average wage increase of 5.46% for the coming fiscal year. The figure is slightly higher than last year’s agreement of 5.28% which was already the highest in 30 years. The breakdown revealed an increase for base pay of 3.84% compared to last year’s agreement of 3.7%. The preliminary results from Rengo should give the BoJ more confidence that stronger wage growth will be sustained in the upcoming fiscal year. The BoJ has already indicated that it plans to raise rates further if the economy evolves in line with expectations. Market participants will closely scrutinize comments from BoJ Governor Ueda at next week’s policy meeting to better assess the likely timing of the next BoJ rate hike. We expect the next hike to be delivered in July but can’t completely rule out the possibility of an earlier hike in May or June. After recent strong gains, the Rengo wage data overnight has not been sufficient on its own to provide a fresh catalyst for further yen strength with USD/JPY rising back above the 149.00-level supported by better risk sentiment overnight.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Jan |

1.5% |

-3.1% |

! |

|

CH |

09:00 |

Chinese Total Social Financing |

Feb |

2,500.0B |

7,060.0B |

! |

|

UK |

12:00 |

NIESR Monthly GDP Tracker |

Feb |

-- |

0.3% |

!! |

|

CA |

12:30 |

Manufacturing Sales (MoM) |

Jan |

2.0% |

0.3% |

! |

|

GE |

13:00 |

German Current Account Balance n.s.a |

Jan |

-- |

24.0B |

! |

|

US |

14:00 |

Michigan 1-Year Inflation Expectations |

Mar |

-- |

4.3% |

!! |

|

US |

14:00 |

Michigan 5-Year Inflation Expectations |

Mar |

-- |

3.5% |

!! |

|

US |

14:00 |

Michigan Consumer Sentiment |

Mar |

63.1 |

64.7 |

!! |

|

US |

14:00 |

Michigan Current Conditions |

Mar |

65.0 |

65.7 |

! |

Source: Bloomberg