Will US CPI report reinforce USD sell-off?

USD/JPY: US CPI report & Japanese political developments in focus

The US dollar has traded on a softer footing overnight ahead of the release later today of the latest US CPI report for November. It has resulted in USD/JPY falling back to an intra-day low overnight of 145.23 after hitting a high yesterday at 146.59. The yen has broadly recovered some lost ground overnight as well after correctly sharply lower at the start of the week after the BoJ pushed back against recent market speculation over the possibility of an imminent exit from negative rate policy at next week’s policy meeting on 19th December. Our analysts in Tokyo are continuing to forecast the first BoJ rate hike at the following policy meeting on 23rd January when they expect an exit form negative rate policy for the first time since the start of 2016. The direction of travel for BoJ remains clear that they are moving closer to raising rates, and we expect the BoJ to have enough confidence in the outlook for stronger wage growth next year to begin rate hikes in January. As a result, it is likely that yesterday’s setback for the yen will prove short-lived.

One additional domestic uncertainty that has emerged recently has been political developments in Japan. It was reported yesterday that Prime Minister Kishida is set to replace as many as 15 ministers and junior ministers according to the Asahi newspaper as he seeks to contain the fallout from a slush fund scandal. According to media reports over the weekend, Prime Minister Kishida reportedly plans to purge officials from the LDP faction formerly headed by the late Prime Minster Shinzo Abe. The highest profile officials set to be ousted this week include Trade Minister Yasutoshi Nishimura and Chief Cabinet Secretary Hirokazu Matsuno. The negative political developments come at a time when Prime Minister Kishida popularity has fallen to its lowest level since he took office just over two years ago. An opinion poll carried out over the weekend found support for Prime Minster Kishida has fallen by 5 percentage points to 22.5%. It had been speculated earlier this year that Prime Minister Kishida could call a snap election but the likelihood of a snap elections appears to be diminishing alongside his sagging public support. He still faces the risk of being replaced as leader of the LDP. Hiis term as party leader ends in September when the LDP is set to hold a leadership election next year. We are watching domestic political developments closely, but so far are not expecting them to delay the BOJ’s plans to exit negative rate policy.

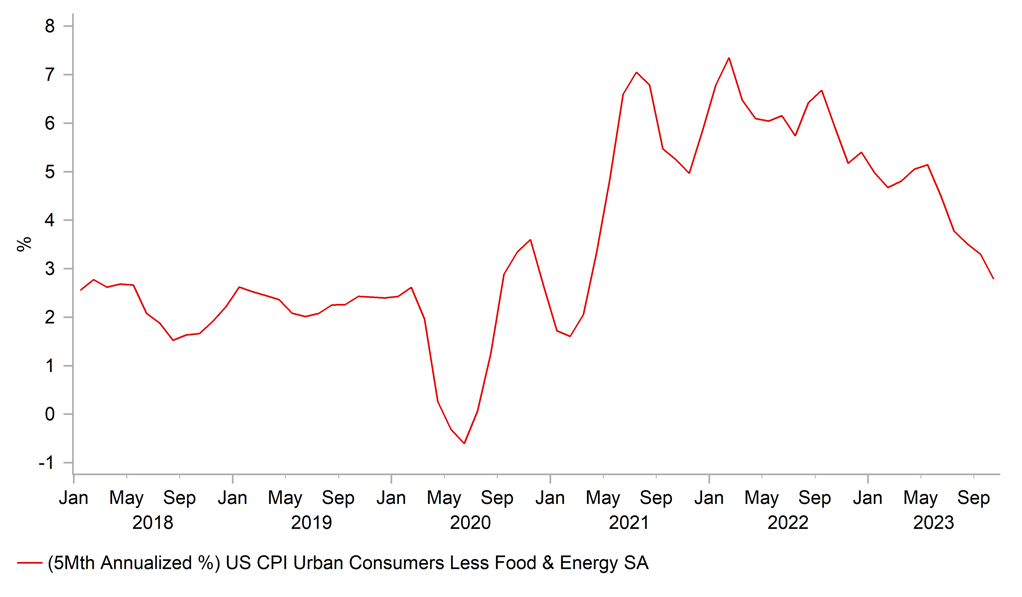

The other main catalyst for the yen’s recent rebound has been building expectations for earlier and deeper rate cuts by other the other major central banks of the Fed and ECB that are helping to narrow policy divergence with the BoJ. While the US economy has remained relatively resilient so far this year, the faster than expected slowdown in US inflation has encouraged market expectations that the Fed will be able to make policy less restrictive next year. Over the last five months the annualized rate of core inflation slowed to 2.8% in October compared to 5.9% over the same period a year ago. For the Fed to begin cutting rates next year, it will require further evidence of slowing inflation in the coming months and slower growth. The release today of the latest US CPI report for November will provide the next important test for market expectations of earlier and deeper Fed rate cuts. Recent US CPI report releases have triggered big swings in the US dollar. Last month’s CPI report release resulted in the dollar index declining by -0.8% in the first hour and the sell-off continued through the rest of November.

US INFLATION HAS BEEN SLOWING MORE QUICKLY THAN EXPECTED

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Political risks rising ahead of BoE policy update

The pound has outperformed recently against the other major currencies of the euro and US dollar. It has resulted in cable rising back up towards the 1.2600-level and EUR/GBP has fallen back below the 0.8600. The pound has strengthened in part on the back of expectations that the BoE will be slower to begin cutting rates next year than the ECB and Fed. The BoE is currently expected to begin cutting rates later from June-August of next year, and to deliver around 82bps of cuts in total for next year as a whole. The BoE has been more successful in pushing back against market expectations for even early rate cuts. The higher starting point for inflation in the UK and less evidence so far of a slowdown in core and service inflation gives the BoE’s pushback against rate cut expectations more credibility amongst market participants. The release today of the latest UK labour market report did provide some relief for the BoE policymakers showing further evidence that wage growth is beginning to slow although it remains elevated. Weekly earnings excluding bonuses slowed to 7.3% 3M/YoY as it moved further below the recent peak of 7.9%. While it is moving in the right direction, it will not be sufficient to trigger a dovish policy shift from the BoE at this week’s MPC meeting.

Political uncertainty is picking up as well in the UK ahead of the general election expected next year. Prime Minister Sunak faces an important vote today in parliament on his emergency Rwanda legislation. It has been reported that as many as 40 Tory MPs are prepared to either abstain or vote against the legislation. With Labour and other opposition parties expected to vote against it, a rebellion of just 28 Tories could see the legislation defeated. It could mark the first time that a government has failed to get legislation past a first reading since 1986, and act to further undermine confidence in Prime Minister Sunak. Recent developments are increasing the risk of an earlier election in the UK next year. However, we are not expecting an immediate impact on the pound today.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

ZEW Economic Sentiment |

Dec |

11.2 |

13.8 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Nov |

90.7 |

90.7 |

! |

|

UK |

12:00 |

NIESR GDP Estimate |

-- |

-- |

0.1% |

!! |

|

US |

13:30 |

Core CPI (YoY) |

Nov |

4.0% |

4.0% |

!! |

|

US |

13:30 |

CPI (YoY) |

Nov |

3.1% |

3.2% |

!!! |

Source: Bloomberg