USD continues to correct lower ahead of release of latest US CPI report

USD: US rates continue to correct lower after weaker NFP report

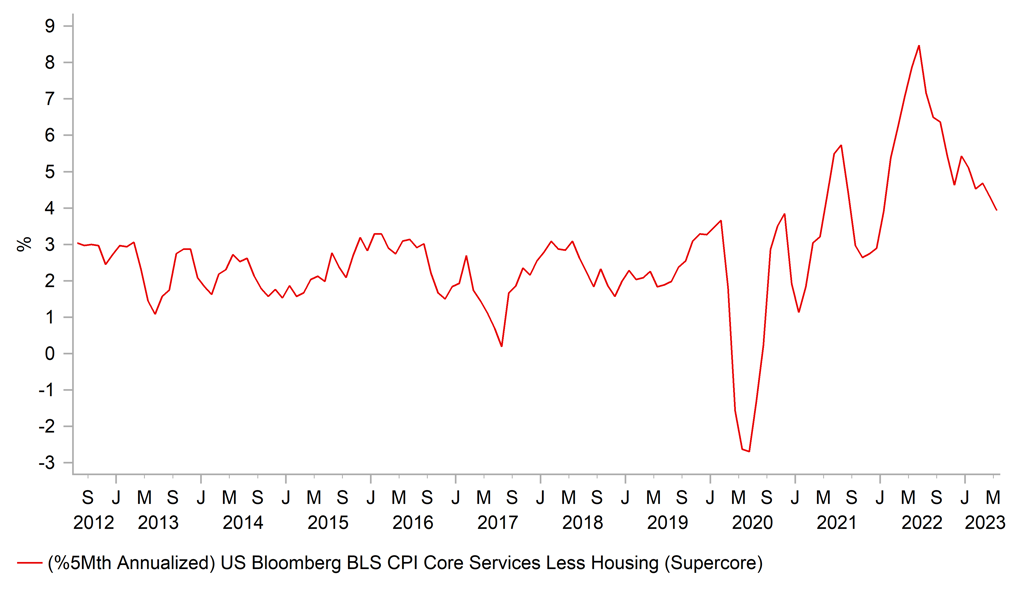

The US dollar has continued to weaken at the start of this week extending the sell-off since the release of the weaker than expected non-farm payrolls report on Friday. It has resulted in EUR/USD climbing back above the 1.1000-level and USD/JPY has fallen back closer to the 140.00. The sell-off for the US dollar has coincided with US yields peaking out in the near-term. After hitting an intra-day high of 5.12% on Thursday, the 2-year US Treasury yield has dropped back to 4.84% and the 10-year US Treasury yield has dropped back below 4.00%. The weaker non-farm payrolls report has helped dampen speculation that the Fed will have deliver further rate hikes this year. The US rate market has moved to scale back expectations for a second rate hike later this year and is currently pricing in around 34bps of hikes by November. However, US rate market participants remains confident that the Fed will deliver another 25bps hike later this month. Unless there is significant downside surprise in tomorrow’s US CPI report for June, the Fed is highly likely to hike rates one more time but we continue to believe that a second hike won’t be necessary later this year when there should be more evidence that inflation and the labour market have weakened. It supports our outlook for the US dollar to weaken in the 2H of this year (click here). In our latest FX Weekly, we recommended a new short USD/JPY trade idea (click here) which increases our short US dollar exposure alongside our long EUR/USD trade idea. The main downside risks to those trade recommendations would be if the release tomorrow of the US CPI report for June reveals a pick-up in the super core measure of inflation which would add to the Fed’s concerns over the risk of more persistent inflation.

WILL US SUPER CORE INFLATION SLOW FURTHER?

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Elevated wage growth keeps the BoE under pressure to raise rates

The pound has strengthened further against the US dollar amidst the broad-based sell-off for the US dollar overnight. It has resulted in cable rising to a fresh year to date high at 1.2913 as the pair moves to within touching distance of the 1.3000-level for the first time since April of last year. The pound’s upward momentum has been reinforced this morning by the release of the latest UK labour market report. It revealed that wage growth surprised to the upside again in May supporting market expectations for the BoE to keep hiking rates to dampen the risk of more persistent inflation. Growth in regular pay (excluding bonuses) was at 7.3% in March to May 2023 which equals the highest growth rate in the data series. The breakdown revealed that average regular pay growth was 7.7% for the private sector and 5.8% for the public sector. It will keep pressure on the BoE to deliver another larger 50bp hike at their next policy meeting in August. The UK rate market was already pricing in a high probability of another 50bps hike in August and the policy rate to reach a peak early next year at 6.50%.

The hawkish repricing of BoE rate hike expectations and resilience of UK economy at the start of this year have contributed to the pound outperforming against other major currencies. However, the labour market report was not all bad news for the BoE. The report revealed that the economic inactivity rate fell by 0.4ppt as more people re-entered the labour force, and the unemployment rate increased by 0.2ppt to 4.0%. At the same time, the number of vacancies fell by -85k on the quarter. The unemployment rate has now increased by 0.5ppt since last year’s low of 3.5% providing some reassurance that the labour market is not as tight as first feared although employment growth like economic activity is proving more resilient than expected.

Overall, it is unlikely to significantly alter the view expressed by Governor Bailey last night that “the interaction of above-target headline inflation with labour market tightness and demand pressure in the economy has made underlying developments in goods and services price inflation more sticky than previously expected”. The pound should continue to benefit from higher UK rates in the near-term until evidence begins to emerge that the UK economy is slowing more in response to much higher rates. Cable is poised to move into the low 1.3000’s.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

May |

0.7% |

-1.9% |

! |

|

GE |

10:00 |

German ZEW Current Conditions |

Jul |

-60.0 |

-56.5 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Jun |

89.9 |

89.4 |

! |

|

UK |

12:15 |

NIESR GDP Estimate |

-- |

-- |

-0.1% |

!! |

|

US |

14:00 |

FOMC Member Bullard Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg