FOMC minutes fail to inject fresh direction into FX market

USD: FOMC minutes have limited impact on Fed rate hike expectations

The US dollar has continued to trade at modestly stronger levels during the Asian trading session following the release of the latest FOMC minutes overnight. It has resulted in the dollar index moving up closer towards the top its recent range between 102.00 and 104.00. The major FX rates have traded within relatively narrow ranges so far this month. The release overnight of the minutes from the last FOMC meeting on 14th June revealed that there was some division amongst FOMC participants over the decision to slow down the pace of hikes by leaving rates on hold. The minutes revealed that while almost all officials deemed it “appropriate or acceptable” to keep rates on hold, some would have supported another 0.25-point hike instead. At the same time, the minutes revealed that “a strong majority of committee participants expect that it will be appropriate to raise interest rates two or more times by the end of this year”. The need for further hikes is being encouraged by the resilience of the US economy which was highlighted in the minutes. Fed participants remain more optimistic over the US growth outlook than the Fed staff who stuck to their mild recession call for later this year in Q4 2023 and Q1 2024. The probability weighted outlook was though judged to have improved slightly with the no recession scenario now viewed as “almost as likely” as the mild recession scenario. There was also division over the impact of monetary tightening going forward on the economic outlook. “Participants noted that the full effects of monetary tightening had likely yet to be observed, though several highlighted that much of the effect of past monetary tightening may have already been realized”.

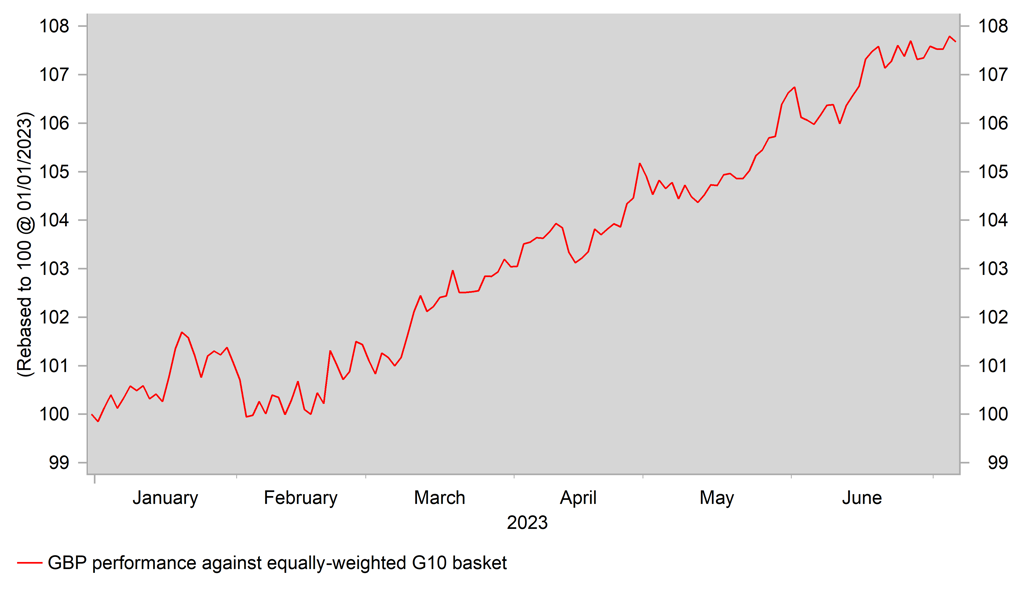

BULLISH TREND REMAINS IN PLACE FOR GBP SO FAR THIS YEAR

Source: Bloomberg, Macrobond & MUFG GMR

Overall, the minutes have not significantly altered expectations for the Fed to resume rate hikes later this month while the US rate market remains finely balanced over whether the Fed will deliver a second planned hike later this year. The US rate market pricing is currently pricing in 21bps of hikes for this month and 34bps of hikes by November which was the same as prior to the release of the FOMC minutes which helps to explain the relatively muted response to the FOMC minutes in the FX market. We continue to believe that it would take a much weaker NFP report on Friday and US CPI report next week to encourage the Fed to extend the rate pause this month. Ahead of the NFP report on Friday, the release today of the latest ADP survey for June , weekly initial claims report and JOLT job openings report for May will provide further insight into the health of the US labour market which have the potential to be bigger market movers for the USD alongside the release of the ISM services survey for June.

GBP: Hawkish repricing of BoE rate hike expectations continues

The hawkish repricing of BoE rate hike expectations has continued at the start of July extending the sell-off in the UK fixed income market that began in mid-May. The SONIA interest rate futures contracts have now moved to price in the BoE’s policy rate moving closer to a peak of 6.50%. The implied yield on the March 2024 contract rose to a fresh high yesterday of 6.39%. It has now jumped by around 182bps since the middle of May. There has been no let-up in the hawkish repricing in the UK rate market even they though we continue to believe that yields are currently overshooting to upside. The release yesterday of the latest UK PMI surveys for June signalled that growth momentum likely slowed for the second consecutive month but the composite reading of 52.8 is still consistent with modest growth. The survey is unlikely to alter significantly the BoE’s near-term outlook for the UK economy which has proven more resilient than expected at the start of this year. The recent resilience of the UK economy and still elevated inflation has been encouraging the UK rate market to price in a more extended hiking cycle for the BoE. The sharp move higher in UK yields relative to in other major fixed income markets has been encouraging a stronger pound although it has lost some upward momentum in recent weeks. EUR/GBP is currently testing support between 0.85000 and 0.8550, and cable is holding below resistance from last month’s high at around 1.2850. Evidence of weaker UK inflation and/or activity data are two of the main potential triggers for a reversal of the current upward trends for UK rates and the pound. The next important UK economic data releases are: i) the UK labour market report (11th July), ii) GDP report for May (13th July) and iii) CPI report for June (19th July). We expect softer inflation and growth to emerge later this year resulting in a correction lower for UK rates and the pound (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Jun |

228K |

278K |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

245K |

239K |

!!! |

|

US |

13:30 |

Trade Balance |

May |

-69.00B |

-74.60B |

!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Jun |

51.9 |

51.5 |

! |

|

US |

15:00 |

JOLTs Job Openings |

May |

9.935M |

10.103M |

!!! |

Source: Bloomberg