Consolidation ahead of US jobs data

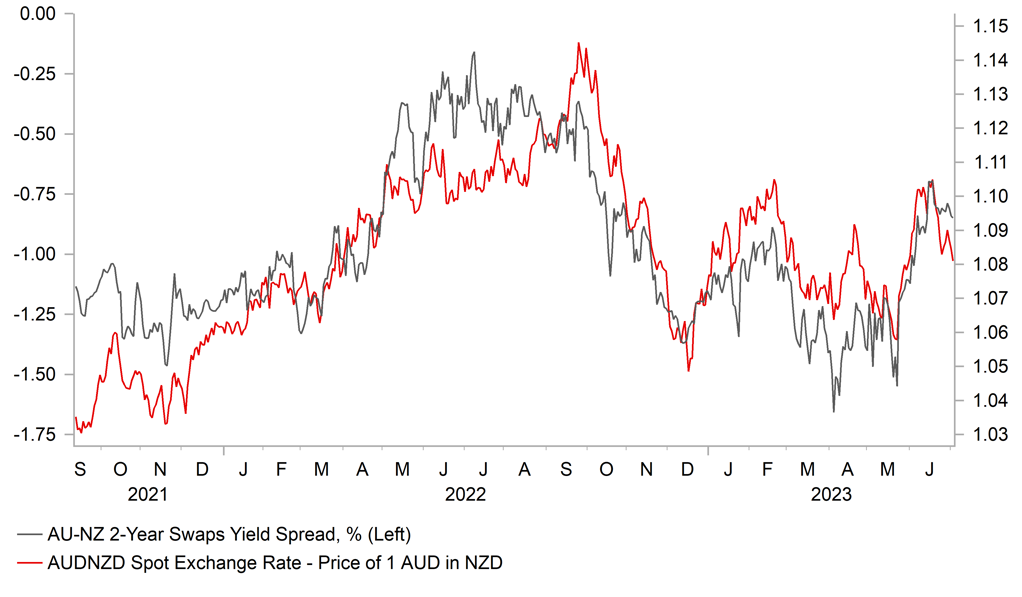

USD: Quiet holiday trading unlikely to change ahead of NFP

The major currencies versus the US dollar remained in relatively predictable narrow trading ranges yesterday in honour of the 4th July US vacation with NZD the top performing G10 currency, which likely reflected the liquidation of long AUD/NZD positions established on the view of divergence in central bank policy driving the pair higher. We continue to run a long AUD/NZD trade idea in our FX Weekly (here) and while this has now corrected further lower after the RBA decision to keep the policy rate unchanged, we see scope for renewed AUD support ahead. The RBA’s guidance was unchanged, signalling the potential for a further rate hike and we see greater economic damage from RBNZ rate hikes coming to the fore that will ultimately see renewed AUD outperformance versus NZD.

Ahead of the key US jobs report on Friday, there is little in the way of potential market movers apart from the release of the FOMC minutes this evening covering the last meeting on 13th/14th June. That of course was the meeting at which the FOMC provided individual forecasts on the policy rate that provided a median of two further rate increases being delivered this year.

AUD/NZD VERSUS 2YR AU-NZ SWAP SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

So the market will be well braced for further hawkish headlines summarising the FOMC meeting this evening. As always context and tone will be important and whether the details of the minutes tally with the hawkish dots profile will be key – anything that questions the hawkish message built into the dots profile could prompt a move. But is that likely? Given that there were only two FOMC members who saw no need for further rate increases, it seems unlikely to us that the details of the minutes will be inconsistent with the hawkish messages of late.

One aspect of Powell’s commentary since the last FOMC meeting relates to speed of tightening. Powell stated in his semi-annual testimony to Congress that speed is no longer important given the hikes already undertaken and if there are more comments in that regard it could play into speculation that the FOMC could pause in July also. However, with the jobs report on Friday, the minutes could play more into the reaction on Friday to the jobs data than a reaction to the minutes themselves as the markets are unlikely to move much now ahead of Friday.

The market is priced at about 20bps for the hike on 26th July, a level that has existed throughout most of the last month. We doubt the FOMC minutes will change that much tonight and the NFP and CPI data remain key. We’d expect EUR/USD to remain in a relatively narrow trading range too with the final estimates for PMI in Europe today unlikely to move the market much either. Although it will be notable to see euro-zone YoY PPI fall into deflation in the data for May. YoY PPI took 20mths to advance higher once the YoY rate turned positive in January 2021 to the peak of 43.4% (Aug 2022) and a fall back into negative YoY territory today will mean it took in only nine months to decline back below zero again!

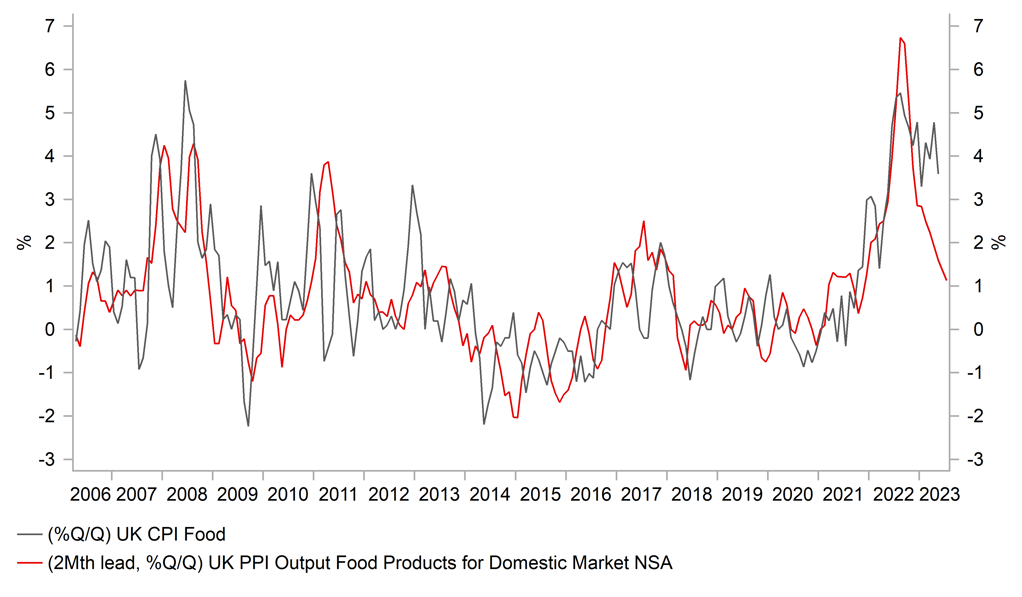

UK FOOD PPI POINTS TO SHARPER CPI DROP AHEAD

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Inflation declines becoming more evident

The OIS UK curve remains excessive in our view with still a large 130bps of tightening priced through to the turn of the year. With that likely to adjust lower as the markets see inflation come down and the BoE not needing to be so aggressive, the scope for further GBP strength could be limited. The Citigroup / YouGov inflation expectations for 5yr and 10yr declined further to 3.3% in June from 3.5% in May in data released yesterday. However, short-term inflation expectations increased from 4.7% to 5.0%. Short-term expectations are more shaped by actual inflation data and the disappointing data over the last two months undoubtedly influenced expectations.

However, shorter-term expectations should be set for a fall judging from other news of late. Firstly, Ocado & M&S announced that it was cutting food prices on more than 100 products with an average decline in price of about 10%. Sainsbury’s and Aldi also recently announced plans to implement price cuts. Sainsbury Plc yesterday announced results that showed a 9.8% gain in revenue and confirmed it had spent GBP 60mn lowering prices on 120 products. The CPI data shows that food inflation has peaked with a fall for the second consecutive month in June. PPI data strongly indicates more substantial declines are on the way.

Falling food prices will have the biggest impact on short-term inflation expectations and the drop in food inflation will coincide with the 17% cut in utility bills with the OFGEM price cap reduction effective 1st July. The developments should mean we see more meaningful declines in inflation over the coming months that leads the market to question the extent of BoE rate hikes required going forward. We continue to see two more hikes rather than the five priced which will remove some of the current yield support for the pound.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

FR |

08:50 |

French S&P Global Composite PMI |

Jun |

47.3 |

51.2 |

! |

|

FR |

08:50 |

French Services PMI |

Jun |

48.0 |

52.5 |

!! |

|

GE |

08:55 |

German Composite PMI |

Jun |

50.8 |

53.9 |

! |

|

GE |

08:55 |

German Services PMI |

Jun |

54.1 |

57.2 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Jun |

50.3 |

52.8 |

!! |

|

EC |

09:00 |

Services PMI |

Jun |

52.4 |

55.1 |

!! |

|

UK |

09:30 |

Composite PMI |

Jun |

52.8 |

54.0 |

!!! |

|

UK |

09:30 |

Services PMI |

Jun |

53.7 |

55.2 |

!!! |

|

NO |

10:00 |

House Price Index (YoY) |

Jun |

1.30% |

0.10% |

! |

|

EC |

10:00 |

PPI (MoM) |

May |

-1.8% |

-3.2% |

! |

|

EC |

10:00 |

PPI (YoY) |

May |

-1.3% |

1.0% |

! |

|

CA |

12:00 |

Leading Index (MoM) |

Jun |

-- |

-0.08% |

! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

May |

-- |

3.0% |

! |

|

US |

15:00 |

Durables Excluding Transport (MoM) |

May |

-- |

-0.3% |

! |

|

US |

15:00 |

Factory Orders (MoM) |

May |

0.8% |

0.4% |

!! |

|

US |

15:00 |

Factory orders ex transportation (MoM) |

May |

0.5% |

-0.2% |

! |

|

US |

15:00 |

IBD/TIPP Economic Optimism |

-- |

45.3 |

41.7 |

! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!!! |

|

US |

21:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg