Downward revisions on GDP growth and CNY for 2023 and 2024

Key Points

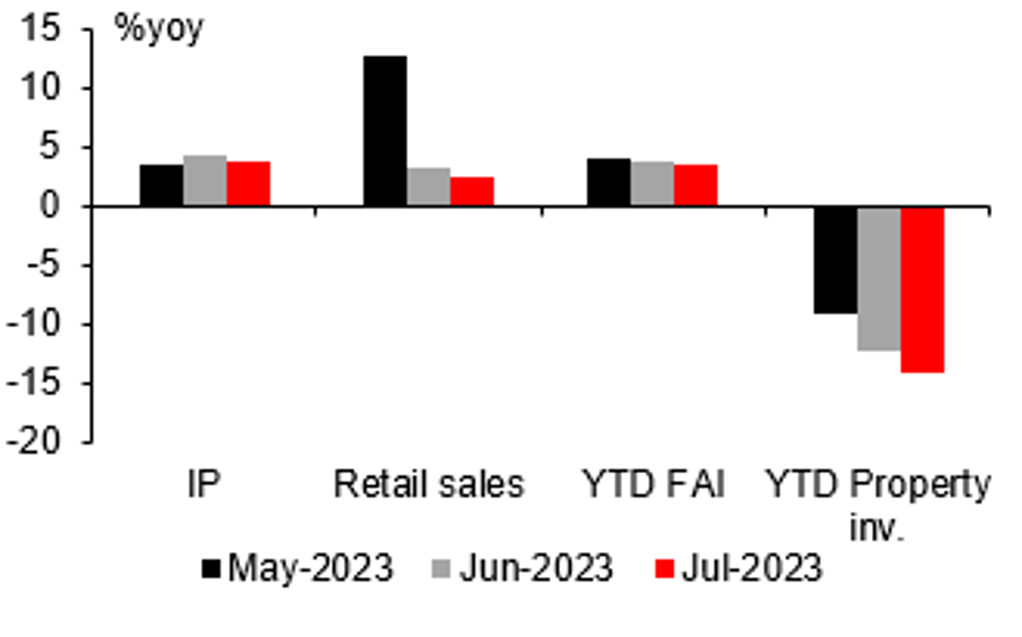

- July key macro numbers surprised market to the downside. Both year-over-year and month-on-month changes of indicators including IP, FAI, retail sales and property indicators, decelerated. In fact, retail sales, FAI and property sector’s main activity indicators contracted sequentially in July.

- July data indicated that the pressure on Chinese economy is broad based, and the challenge property sector faces is particularly strong. As the sector has not yet bottomed out, we see the risk of more defaults on developers’ bonds and persisting negative ripple effects due to financial market and economy’s direct and indirect linkages to the sector, these require government to take a more forceful approach to stabilize the sector and whole economy.

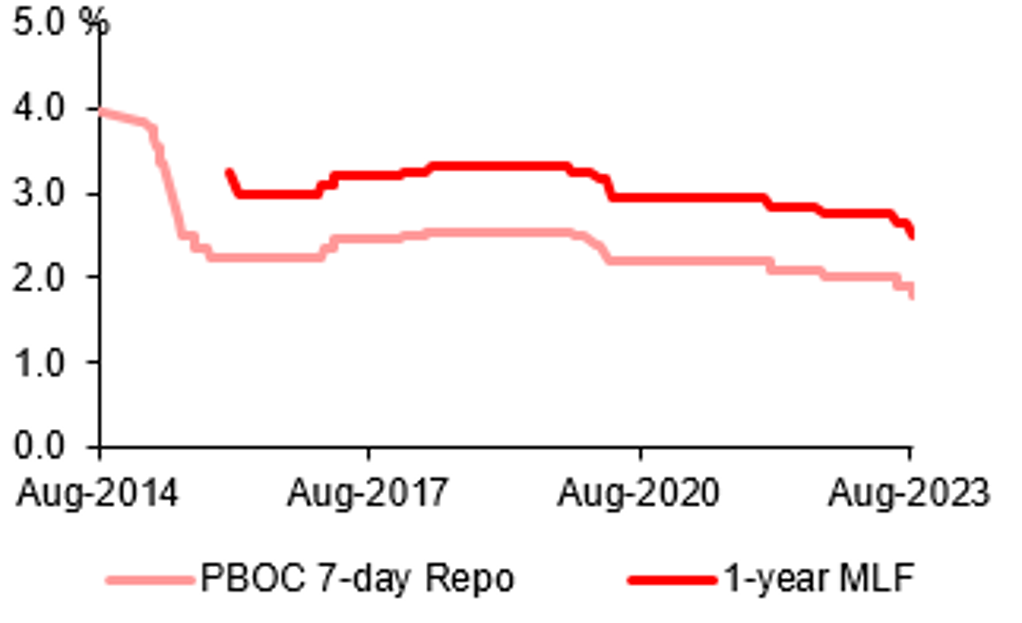

- PBOC’s asymmetric policy rate cuts this Morning came as a surprise, indicating PBOC’s easing stance and government’s support for economy. We expect additional 10bps policy rate cut and a 25bps RRR cut ahead in rest of this year.

- We expect fiscal spending to behave in a more counter-cyclical manner. Fiscal stimulus could focus on supporting infrastructure, household consumption, providing more social and public goods and social warfare and etc.

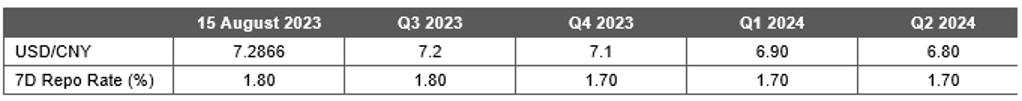

- In light of recent weaker-than-expected numbers, we revise our China real GDP growths to 5.1% for 2023 (from previous 5.5%), 5.0% for 2024.

- We still expect USD/CNY to strengthen by the end of this year on improving economic fundamental and sentiment. However, due to our downward revisions on China’s real GDP growths, recently widened negative yield spread between China and US bonds, and potential more gradual pace of narrowing of the negative yield spread compared with our prior views, we expect USD/CNY to reach 7.1 by the end of 2023, up from prior forecast of 6.8 for the end of 2023.

WEAKER YEARLY GROWTHS OF KEY INDICATORS WERE SEEN IN JULY

Source: CEIC, MUFG GMR

PBOC CUT ITS 1-YEAR MLF RATE AND 7-DAY REPO RATE ON 15TH AUGUST

Source: Bloomberg, MUFG GMR

MUFG PERIOD-END FORECASTS

Source: Bloomberg, MUFG GMR