Ahead Today

G3: US JOLTS Jobs Opening

Asia: Indonesia GDP

Market Highlights

Trump delayed the 25% tariffs on Canada and Mexico by at least 30 days, after a call with leaders from both countries. Mexico said that they will send 10,000 troops to the border to stem the flow of fentanyl and migration into the US. Meanwhile, Canada said that it is appointing a new fentanyl czar and will also go ahead with a plan to add more border security resources including helicopters. There was no sign yet of any deal with China, but Trump said the US will be speaking to China probably over the next 24 hours. The Dollar trimmed its gains with these delays in tariff imposition. Nonetheless, we think it remains too early to tell, with tariffs likely to remain a significant tool moving forward in achieving Trump 2.0’s policy agenda for both trade and non-trade purposes. The upcoming review on trade on 1 April is also a key date to watch, on top of whether these deals on border issues are ultimately resolved.

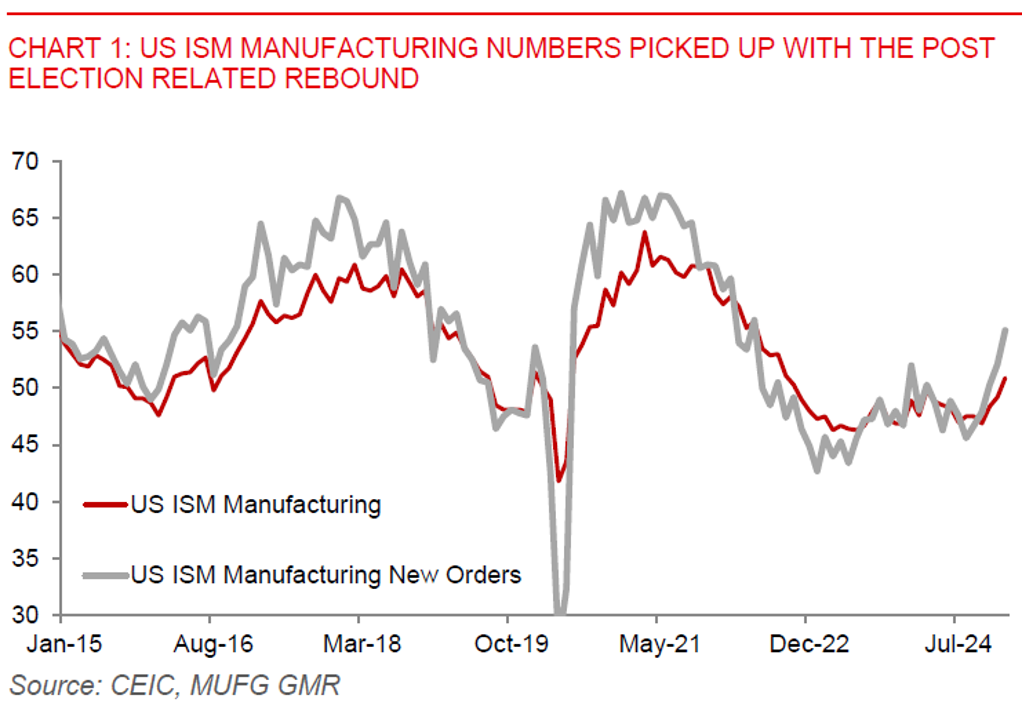

Meanwhile, US ISM Manufacturing was stronger than expected at 50.9 up from 49.3 previously. The new orders sub component was also very strong at 55.1 from 52.5. These numbers follow from the broader set of data suggesting a post election rebound in the US, but nonetheless, we think this growth should moderate moving forward if only due to the uncertainty generated by possible tariffs under the new administration.

Regional FX

Asian currencies were weaker before paring back some losses on the day on the back of the postponement of tariffs. Indonesia’s headline CPI inflation numbers came in much lower than expected at 0.8%yoy, although we saw a tick up in core inflation. The lower headline inflation print was due to weaker utilities prices, which helped to offset volatile food inflation. Overall, Bank Indonesia likely has space to cut rates just from inflation alone, but the key binding constraint is certainly the volatile IDR, with BI saying that it intervened to cap Rupiah volatility yesterday on the back of Trump induced moves. Meanwhile, China’s Caixin PMI came in softer than expected at 50.1 from 50.5 previously, adding to some urgency regarding stimulus measures to help support the economy. Overall, Asia’s PMI numbers out yesterday were mixed, with weak prints out of Vietnam, Thailand, and Malaysia, and domestic oriented markets such as Philippines being more robust.