Please download PDF using the link above for the full report

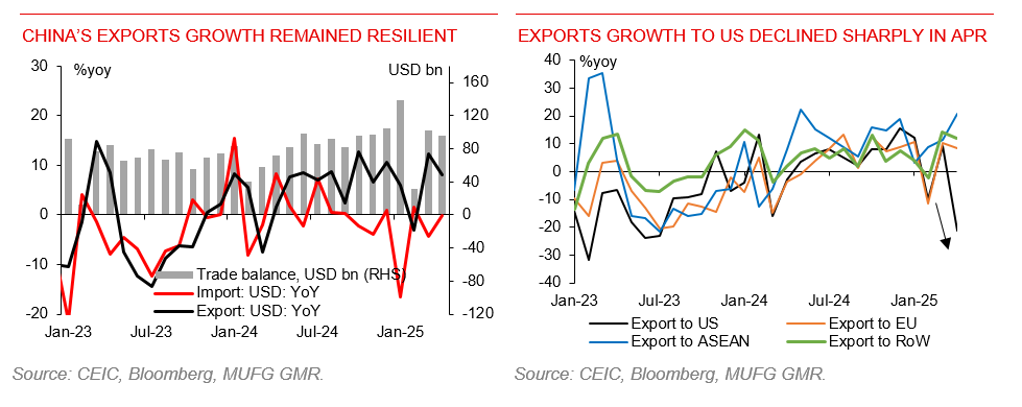

China released its April exports data today. China exports (in US dollar) expanded by 8.1%yoy, stronger than the 2.0%yoy Bloomberg consensus expectation. China imports (in US dollar) grew -0.2%yoy, better than a -6%yoy consensus expectation as well.

April trade numbers of China are watched by many, for gauging the impact of Trump tariffs. Details of April trade numbers did show certain positive exports pattern shifting:

- Impact of US’s tariffs on China was evident. China’s exports to the US fell by 21%yoy in April, compared with a 9%yoy rise in March.

- US’s tariffs on China also fostered Chinese exporters to seek alternative markets and re-route shipments through a third country. We see a strong 20.8%yoy growth of China’s exports to ASEAN, improving from March’s 11.6% and February’s 8.8%yoy, among which, exports to Vietnam increased by 22.5 %yoy this April. Exports to the European Union rose by 8.3%yoy, lower than March’s 10.3%yoy.

- Decoupling of trades continued between China and the US. This April, shares of exports to US, EU, Japan, and ASEAN were 10.5%, 14.8%, 4.2% and 19.1% respectively. ASEAN is the largest export destination of China and its share of China total exports remained on the rising trend.

- Strong and accelerated exports growth was seen in products like ships (36%yoy), electronic integrated circuit (20.2%yoy); while mobile phone exports contracted by 21.4%yoy. Large exports growth was reported for toy (-11.6ppts), furniture (-14.9ppts), textile (-12.9ppts) and etc., while high-tech exports growth remained largely stable at 6.5%yoy in April.

- Details of products exports indicated a resilient intermediate goods exports. This may reflect that Chinese subsidiary companies outside of China were taking advantages of the 90-day pause of tariffs and were ramping up productions locally, which in turn generated stronger demand for China intermediate goods.

- April’s better-than-expected exports number and the rerouting activities did reflect the resilience and sophistication of Chinese supply-chain and its strong ability to adapt to the environment.

- Having said it, we are concerned on the prospects of China’s exports, as April exports number may not yet fully reflect the impact of US tariffs, and potential less support from re-routing trades to the US through other countries including ASEAN. European Union actually set up a task force to determine whether Trump’s tariffs will cause Chinese shipments to be rerouted to Europe.

- Senior officials from both sides are preparing for tariffs talks this weekend, we expect a deal some time down the road and the time to reach a deal could take months. We expect US’s average weighted tariffs on imports from China to increase to about 40% during Trump’s second term, up from 11% before Trump took the office in this January.

- The experience of first US tariffs on China during 2018-2019 suggests that every 10% US tariffs increase could shrink China’s exports to US by about 10%. We expect a growth deceleration in China exports in near term, and expect China exports growth turns negative in second half of 2025.