Week Ahead: Asian FX markets have been on tenterhooks with higher US yields and a strong Dollar. In addition, the rise in Middle East tensions including last week’s strike on Iran by Israel has led to an increase in risk aversion amid fears of a much sharper oil price spike. The good news for now is that Iranian officials seem to be downplaying the Israeli response, but the situation is fluid and tensions can rachet up quickly.

As FX weakness accelerated and EM carry trades unwound, Asian authorities have not stood still. Japan and South Korea issued a joint statement on concerns against JPY and KRW weakness, while BI intervened last week to support the IDR after it weakened past 16000 per dollar for the first time in four years. Some including the BSP have highlighted the possibility of delaying rate cuts.

We have already highlighted downside risks to our Asian FX forecasts in part stemming from these global trends (see Asia FX Weekly), even as we continue to acknowledge green shoots from improving electronic exports, resilient domestic demand, improving tourism and contained inflation pressures (see Asia FX Outlook 2Q2024 – Light at the end of the tunnel). For now, the dominant FX driver in Asia continues to be the high level of US rates relative to Asia, exacerbated by bouts of risk aversion, and we’ll likely have to see these factors change to witness a sustained turn in Asian currencies.

On that front, our global team thinks Dollar strength should still continue over the next one to two months, but they stress the window for Dollar strength is likely to close in 2H24 with markets already meaningfully pricing out Fed rate cuts (see FX Weekly here and here). A wider geopolitical conflict could push oil prices up by US$5-20/bbl, but elevated OPEC+ spare capacity provides some buffer (see Commodities – Geopolitical risk). Next week, markets will focus on US PCE deflator estimates, coupled with Bank of Japan and Bank Indonesia policy meetings. We see a risk that BI hikes rates this week to support the rupiah, but stress it is not our base case.

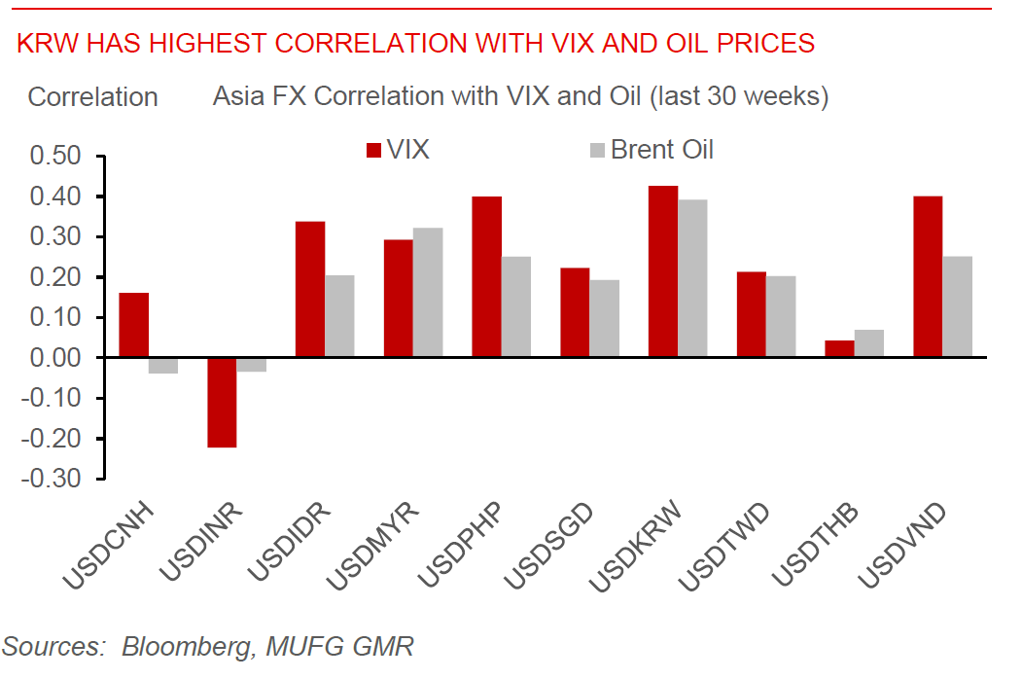

KRW has highest correlation with VIX and Oil prices