Week In Review: The US Dollar weakened by more than 1% last week, as Fed Chair Powell signalled some degree of confidence over rate cuts this year, and also amidst an ambiguous US non-farm payrolls report. Asian currencies strengthened, and risk sentiment was generally stronger, with Taiwan’s equity markets rising more than 4% amidst continued optimism over AI chip stocks and a turn in the tech cycle. From the 2024 Work Report delivered by Premier Li on March 5th, targets including an “around 5%” GDP target, with high-level commitments on supporting consumption and science and technology advancement, was announced. We have revised our USDCNY up modestly for 1H due to the gap between the moderately aggressive GDP growth target and only slightly more expansionary fiscal targets for 2024 compared with 2023, but maintain our view for CNY appreciation in 2H2024 with the belief of more stimulus policies and moderately improving fundamentals later this year.

Capital Flows: Capital inflows into Asia’s equity markets continued, led by more than US$3bn of inflows into Taiwan’s stock markets amidst optimism over the AI chip boom, and to a smaller extent, South Korea and India. We also saw decent foreign inflows into Korea’s and India’s bond markets.

Week ahead: This week, US February CPI estimates will be key to see if the price spikes seen in January reverse, and ultimately support our view of disinflation and Fed rate cuts starting this year. Other key market moving releases would include Japan’s 1st tabulation of wage negotiations from the Rengo labour union, coupled with China’s MLF policy rate decision. We think that the PBOC should lower the MLF rate through this year to lower bank funding costs to help support NIMs and economic activity.

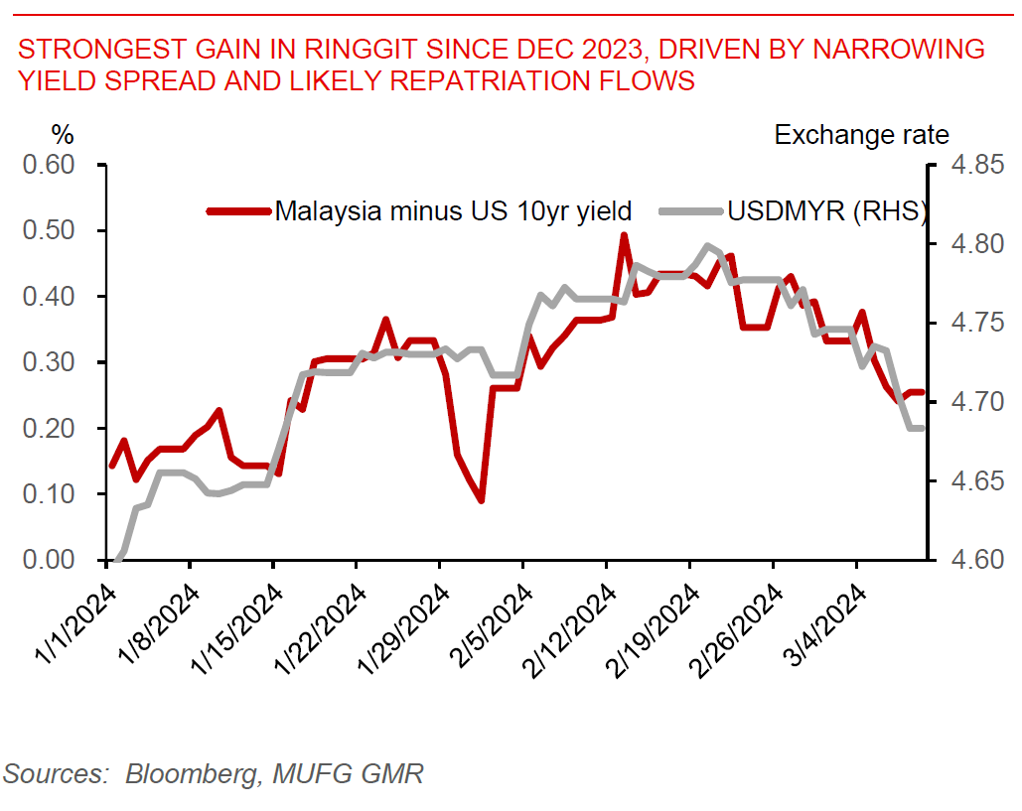

Gain in Ringgit driven by narrowing yield spread and likely repatriation flows