Ahead Today

G3: US ISM Services Index

Asia: Indonesia GDP, Singapore Retail sales

Market Highlights

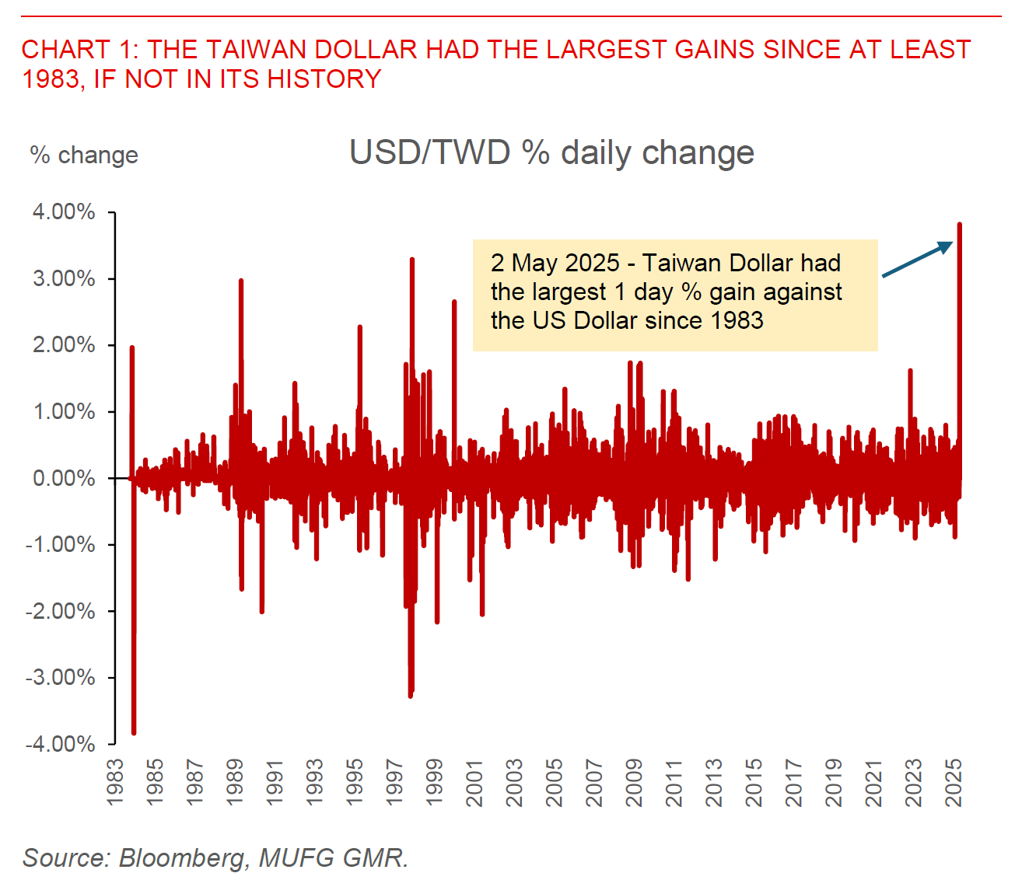

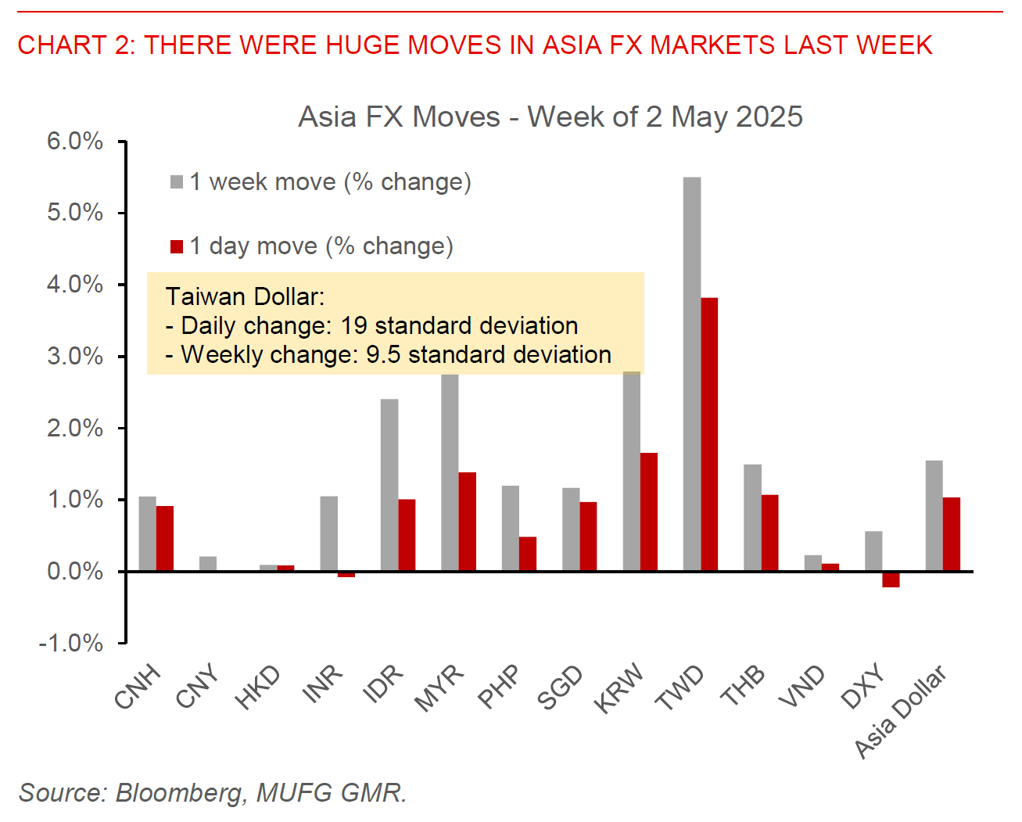

The moves in Asia’s FX markets last Friday (2 May 2025) were certainly one for the history books, led by strength in the typically out-of-the-radar Taiwan Dollar. In particular, the Taiwan Dollar jumped by 3.8% on the day, while rising 5.5% during the week, and the whole Asian FX complex appreciated significantly during the day as well, with KRW (+1.7%), MYR (+1.4%), SGD (+1%), IDR (+1%) and CNH (+0.9%) outperforming. To put these moves into perspective, the daily gain by the Taiwan Dollar was the largest move since at least 1983, if not in its history, and as a corollary is equivalent to a 19 standard deviation move on the day and 10 standard deviation change on the week.

What are the key drivers behind these sizeable moves in Asia FX? The prospect of US-China trade talks, especially the hopes on US-China tariffs talks was likely one key contributor, together with stronger than expected US tech earnings and robust Taiwan GDP numbers may have been catalysts for these moves. This is also reflected in a sharp US$1.2bn foreign equity inflows into Taiwan on Friday. In addition, there are likely also Taiwan-specific drivers such as increased hedging demand due to a weakening dollar and the significant asset-liability mismatches of Taiwan’s life insurance companies (large share of assets in US dollar while large share of liability in local TWD). Together with a bunching up of exporter conversion, all of which were probably exacerbated by thin FX liquidity during the holiday season for many Asian markets. Additionally, Executive Yuan of Taiwan issued a statement on 3 May that Taiwan has completed the first round of the tariff consultation with the US on May 1.

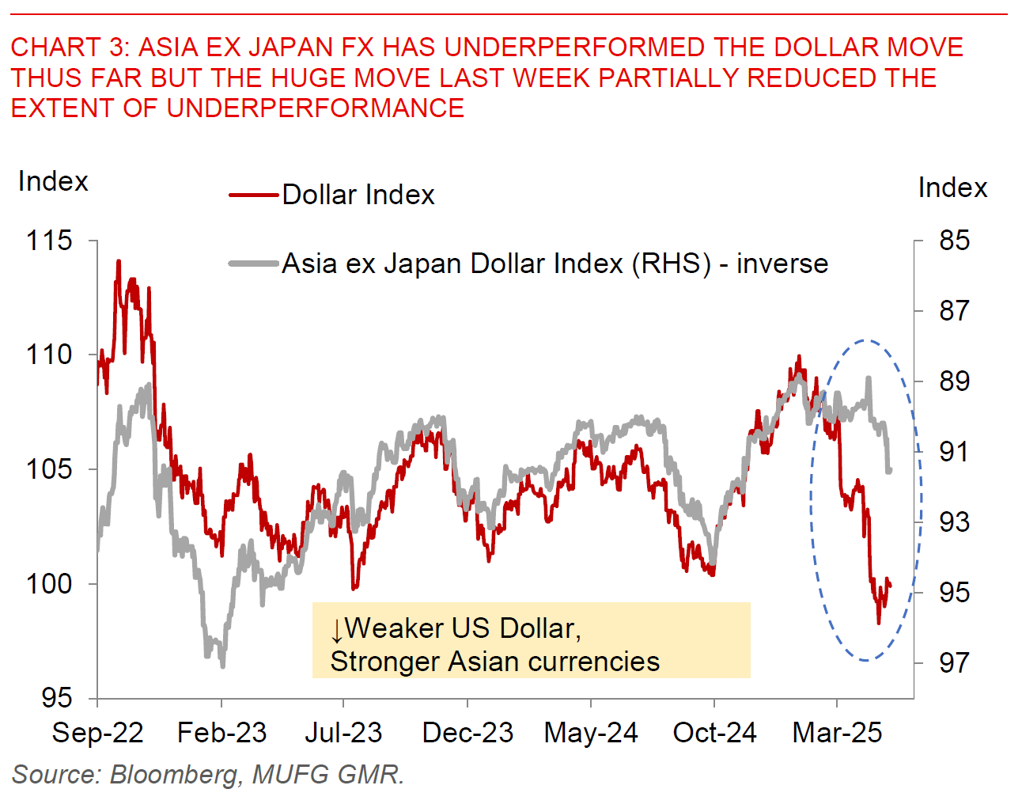

The key question is of course whether these huge Asian FX gains can continue moving forward, or whether this is just a technical blip. In making our Asia FX forecasts in our latest Global FX Monthly (see link), we were forecasting the Asia FX complex to underperform core G10 (such as EUR and JPY) through our forecast horizon. We think this view continues to make sense from a fundamental perspective. This is because Asia and in particular China is likely to bear the brunt of the negative tariff impact and export slowdown to the US, and also because Asia is likely to be much more negatively impacted by the indirect impact of China’s growth moderation notwithstanding possible stimulus measures by China moving forward. We were as such forecasting greater outperformance and strength in the likes of INR, PHP, IDR (partly for local reasons), and greatest underperformance in the China linked currencies such as KRW, CNY and VND. On that front, the latest Asia PMI indicators released were indicative of softening export momentum out of many Asian exporters.

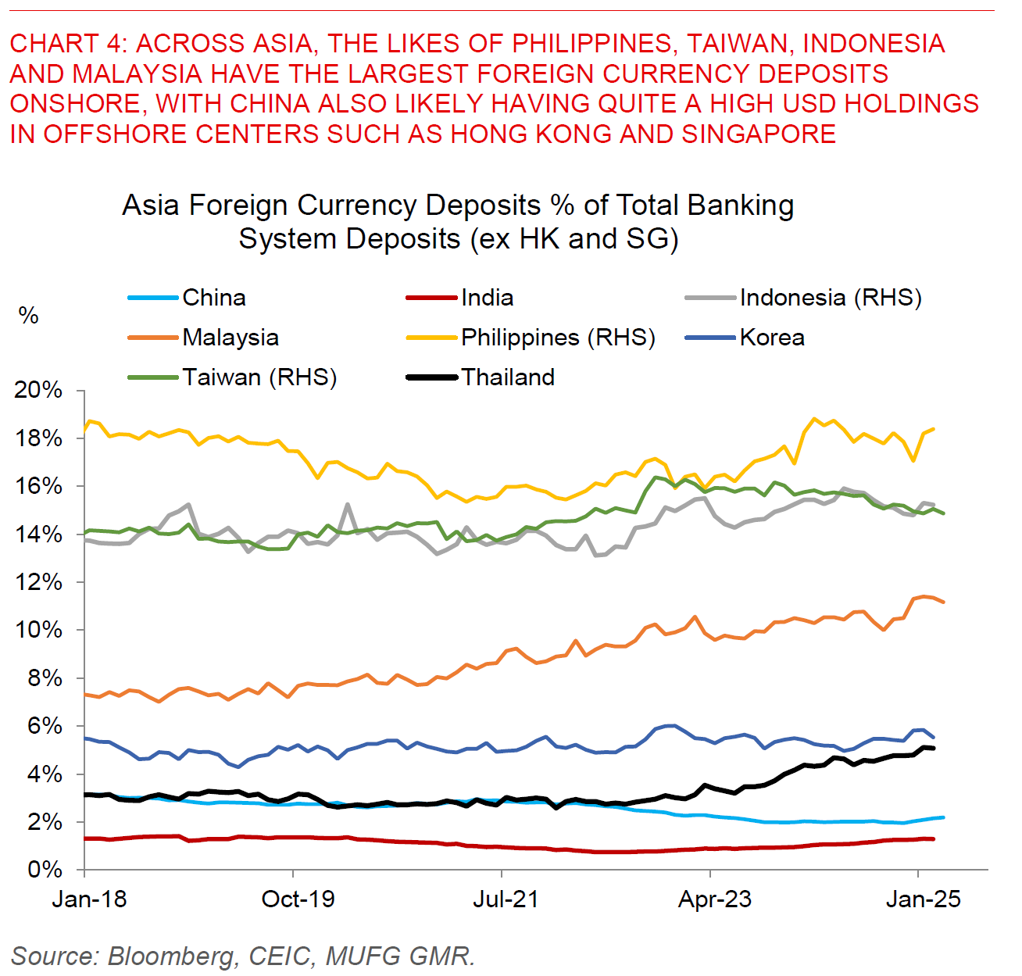

Nonetheless, the big picture as well is that the Dollar is also expected to weaken quite meaningfully moving forward (by another 5% as per our G10 team), together with a decline in US rates, and as such this may also fundamentally change the calculus of many Asian corporates, households and central banks. Exporter USD hoarding has been rising over the past 5 years and FX hedge ratios have likely been coming down due to higher implicit costs due to higher US rates. All this means that we have to also be cognizant of a structural change in the environment for Asian FX moving forward as well.

Regional FX

Beyond the sizeable Asian FX moves, the other key development was the rise of the incumbents in key Elections in Singapore and Australia, with Trump and his disruptive tariff policies seemingly a key driver behind voters’ intentions across the world. In particular, Singapore’s People’s Action Party (PAP) won 87 of 97 seats, with the opposition holding onto 10 seats, while the ruling PAP party also increased its vote share to around 66% from 61% the previous Election in 2020 in what it termed a strong mandate. Meanwhile, Australia’s Prime Minister Anthony Albanese has won a historic election and a very strong showing as well, winning the election with 56% of the vote with the Labour party projected to win at least 86 of the parliament’s 150 seats.