Ahead Today

G3: US Factory and Durable Goods Orders, Eurozone July PPI, RBA Cash Rate

Asia: China Caixin Services PMI, Philippines CPI, Thailand CPI, India Services PMI, Singapore Retail Sales

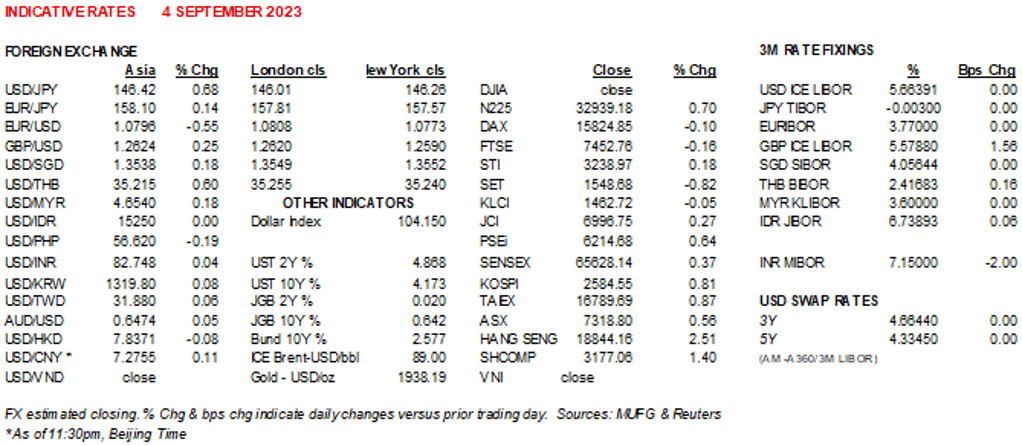

Market Highlights

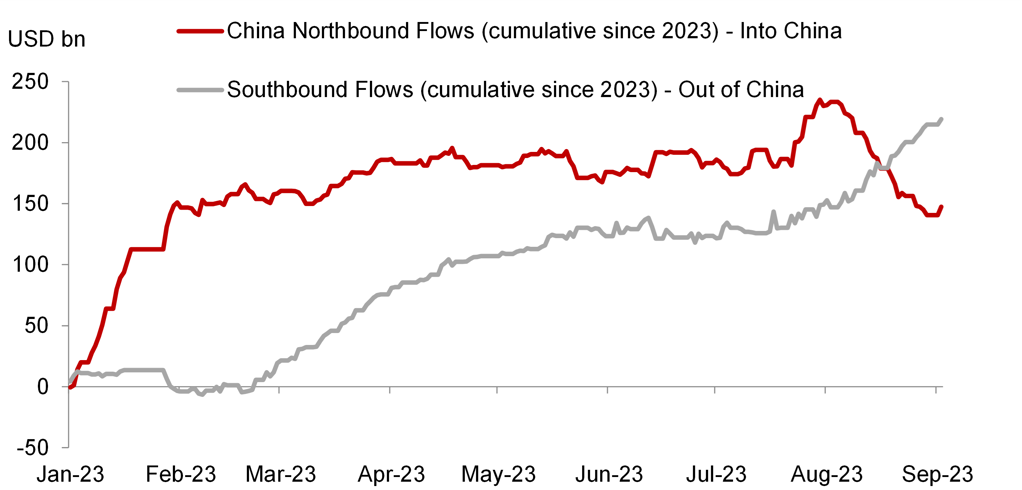

Chinese stocks rose on Monday after the country rolled out property support measures last week. These include lowering the minimum downpayment, cutting mortgage rates, and redefining 1st time homebuyers. Home sales in China’s biggest cities rose, with existing home sales doubling over the weekend from the previous according to one report, while new home sales also saw spikes in key cities such as Beijing and Shanghai. Foreign investors bought US$6.9bn in Northbound flows on Monday, but this still pales in comparison to the US$90bn of Northbound outflows and US$76bn of Southbound flows in August. USDCNH stabilized at 7.27.

Brent oil prices rose further on Monday to US$89/bbl, as markets digested news about extension of Russia’s supply cuts, while waiting for announcements from Saudi Arabia around its next steps. Looking ahead, we have Reserve Bank of Australia’s policy decision, together with China’s Caixin Services PMI, and US Durable goods orders. The RBA is expected to remain on hold due to softer inflation and higher unemployment seen last month, but markets will also focus on the commentary and rhetoric in what is Governor Lowe’s last policy meeting.

FOREIGN INVESTORS BOUGHT US$7BN IN NORTHBOUND FLOWS ON MONDAY, BUT THIS PALES IN COMPARISON TO THE OUTFLOWS SEEN IN AUGUST

Source: Bloomberg

Regional FX

Overall, Asian currencies were mixed against the Dollar, given the tug of war between CNH, the broader Dollar and higher oil prices. Korea’s August CPI was higher than expected at 3.4%yoy (vs consensus 2.9%yoy), driven by higher food and energy prices. Looking ahead, we will also have inflation datapoints from the Philippines and Thailand. For the Philippines, markets expect some pickup in inflation pressures by 0.5%mom sa, due in part to higher oil prices while Thailand’s inflation should remain contained at 0.6%yoy. The Philippines recently announced a price cap on rice prices below prevailing market prices, on the back of rice export bans from India. This may ultimately exacerbate rice shortages down the road.