Ahead Today

G3: US initial jobless claims, Germany industrial production

Asia: Philippines GDP, BNM policy rate decision

Market Highlights

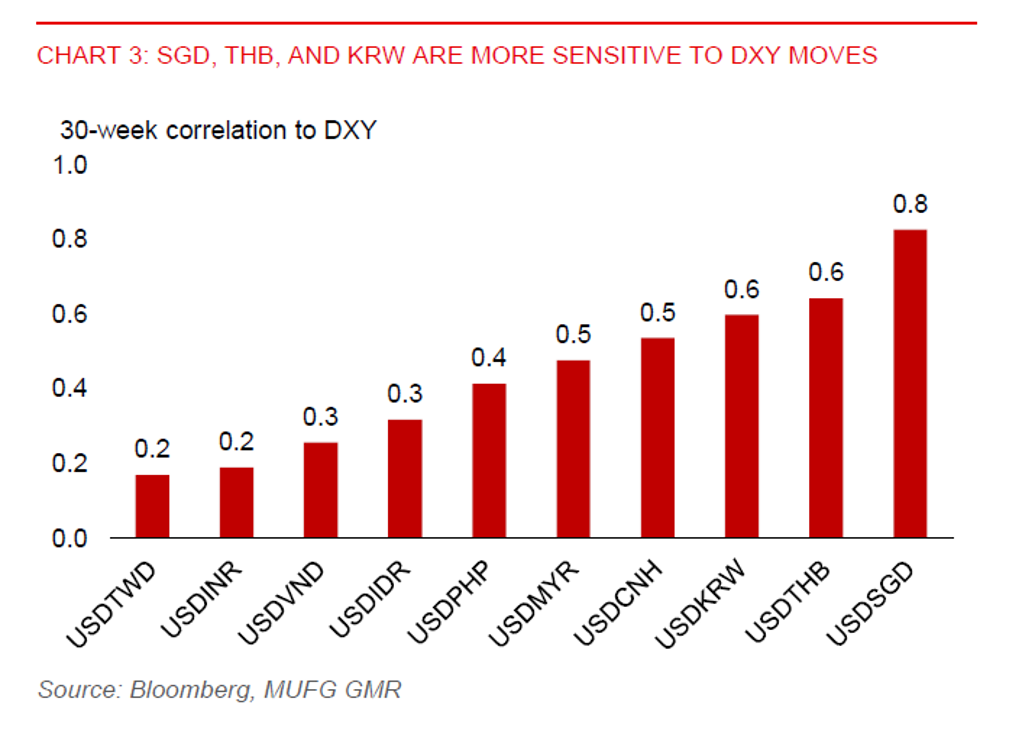

The Fed unanimously held the benchmark policy rate at 4.25%-4.50% as widely expected, defying pressure from US President Trump for a lower policy rate. Fed Chair Powell said that Trump’s comments don’t impact their jobs. The Fed is also in no hurry to adjust rates and that the costs of waiting for more clarity about the impact of Trump’s tariff policy are fairly low. Uncertainty about the US economic outlook has risen and stayed elevated (Chart 1). This is not a backdrop where the Fed can act preemptively. But Powell said the Fed can react quickly if needed. Meanwhile, policymakers have flagged an increased risk of higher unemployment and higher inflation. There will be policy trade-offs if both unemployment and inflation rise, putting the Fed in a difficult predicament.

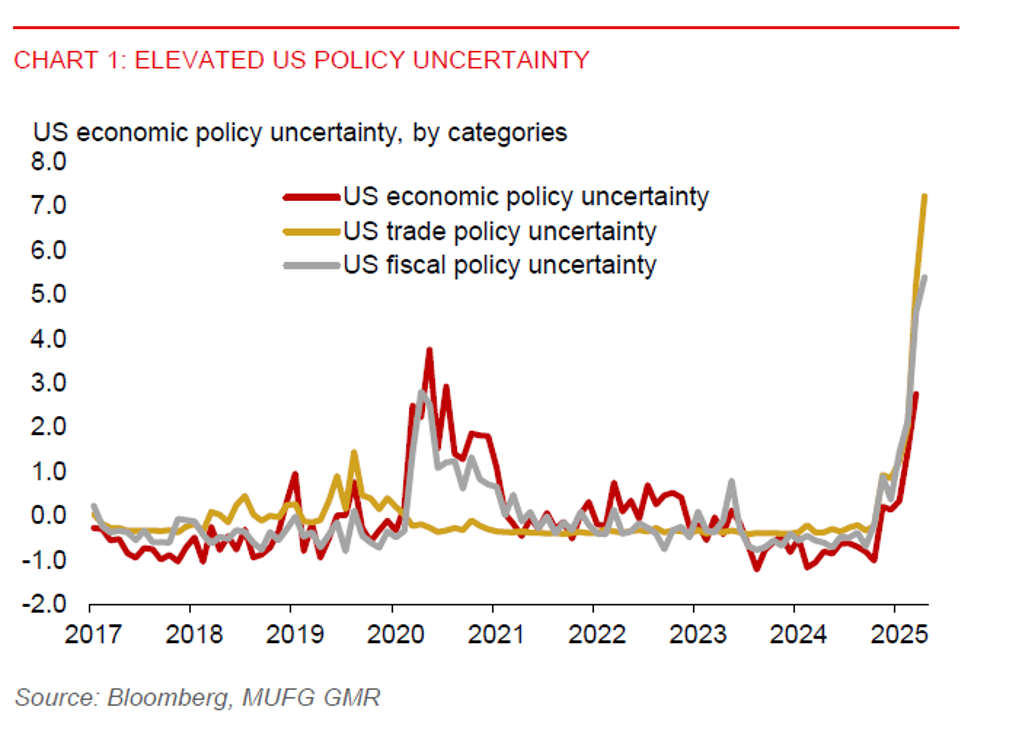

Near-term inflation expectations have moved up, with surveys suggesting that tariffs are driving this increase. Powell said the Fed is obligated to keep inflation expectations anchored, and that current policy stance is appropriate and modestly restrictive. For now, tariff impact has yet to show up in the hard economic data, though. Powell said that the US economy still looks solid, despite the negative Q1 GDP print. We note that the 0.3%qoq annualized drop in Q1 US GDP growth was primarily due to an import surge as firms sought to front-run tariffs. The front-running of tariffs appears to be fading, which should reduce a drag on the US economy in Q2. Meanwhile, Powell said that labour market dynamics are broadly balanced and no longer a source of significant inflation. The somewhat hawkish tone by the Fed has supported a rebound in the US dollar, but it has not changed the pre-FOMC market expectation of 3 US rate cuts this year (Chart 2).

Regional FX

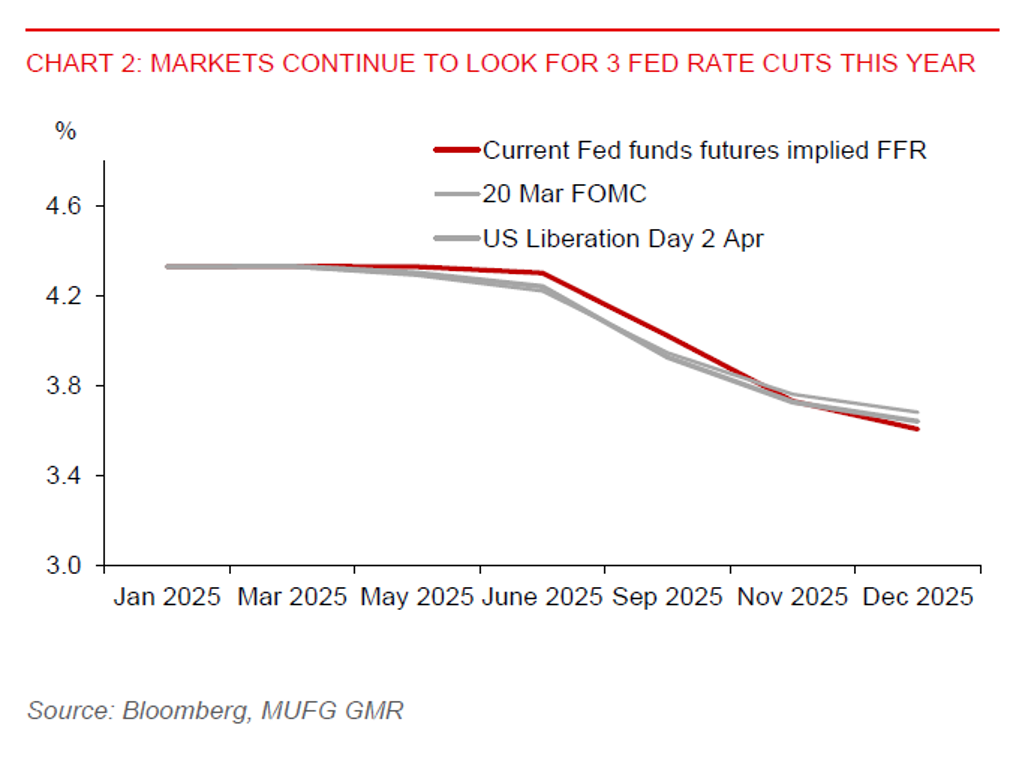

The broad US dollar index (DXY) has rebounded after Fed Chair Powell sent a hawkish signal to markets. Signs of potential de-escalation in the US-China trade war have also likely eased the downward pressure on the US dollar.. Asian currencies that are highly sensitive to DXY movements could pare back more of their recent gains against the US dollar, which has found a temporary floor (Chart 3). For instance, we think recent SGD strength may not be sustained (see Singapore: SGD strength may not be durable amid trade tensions).

The key highlight today is the BNM policy rate decision. We hold an out-of-consensus call for BNM to cut rates by 25bps to 2.75% to support growth, amid modest inflation and recent ringgit strength. Despite some possible frontloading of exports ahead of tariffs, advance estimates show Malaysia’s Q1 GDP growth still slowed to 4.4%yoy, from 5.0% in Q4 2024. Malaysia’s manufacturing PMI also eased to 48.8 in March, from 49.7 in February. Along with subdued inflation, at just 1.4%yoy in March, there’s room for BNM to cut rates by 25bps to cushion domestic demand.

Meanwhile, China’s monetary easing yesterday could also be followed by the PBOC allowing for a weaker CNY to cushion the tariff impact. The PBOC cut the 7-day reverse repo rate by 10bps to 1.40%, while the reserve requirement ratio was lowered by 0.5% to ramp up banking liquidity (see China: Incremental financial policies announced).

Elsewhere, the recent sharp pace of appreciation in the Taiwan dollar has stalled at around the 30.00-level against the US dollar. But the 1-month volatility remains at a historic high. Headline inflation eased to 2%yoy in April from 2.3% in March, but this may not be enough for a policy pivot by Taiwan’s central bank. CBC governor Yang Chin-long has said that policy easing would most likely come only when inflation moderates below 1.5%yoy.

The Indonesian rupiah led losses in the region yesterday, down 0.5% against the US dollar. The new sovereign wealth fund, Danantara, is seeking ways to raise debt funding, while President Prabowo has pledged to keep fiscal deficit below the constitutional limit of 3% GDP.